February 10, 2020— December’s Santa Claus rally, which led to a significant bounce back in low quality “junk” stocks, came and went. It’s back to business for evidence-based investing as we saw positive net alpha generated in both Canadian and U.S multi-factor long-short portfolios.

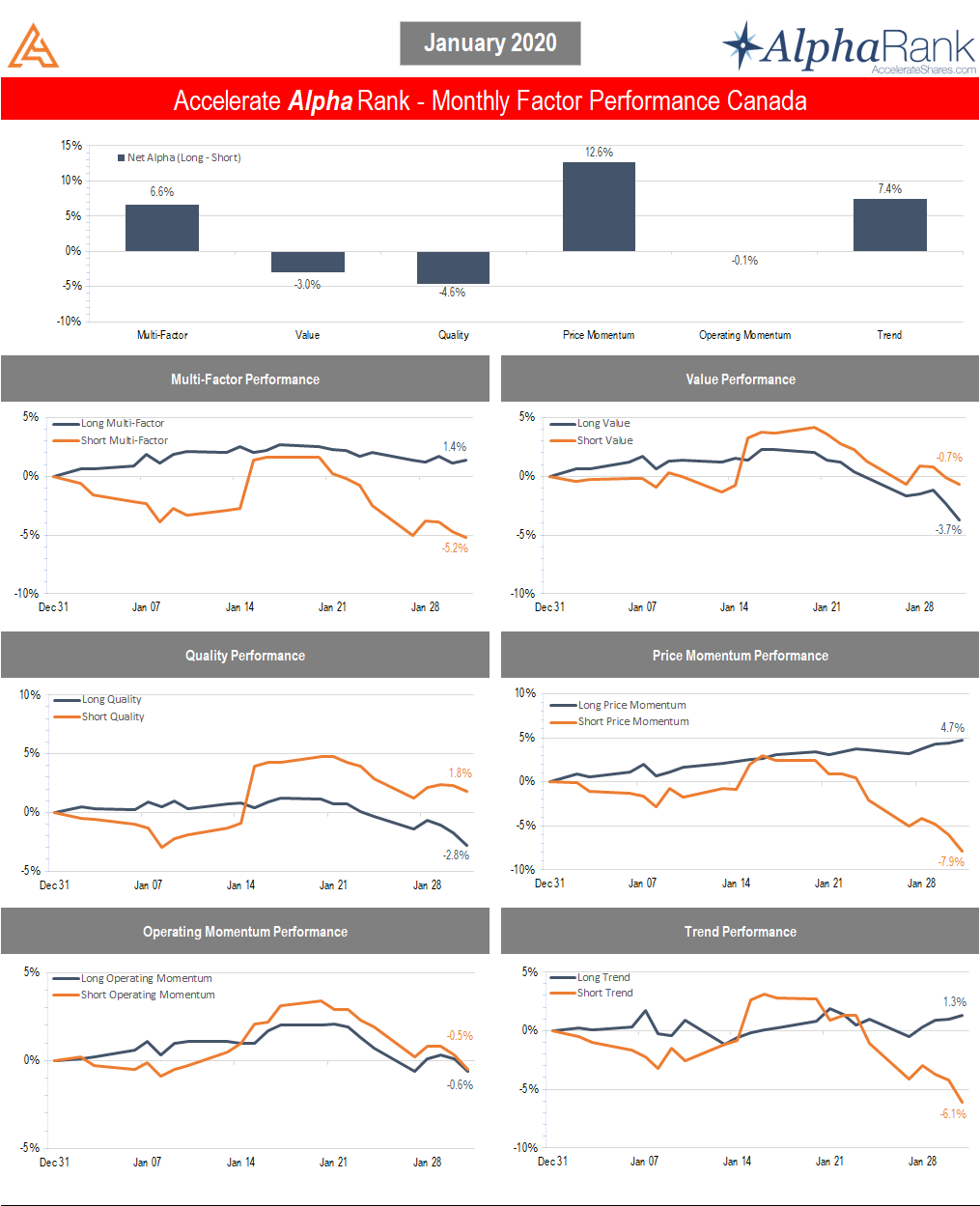

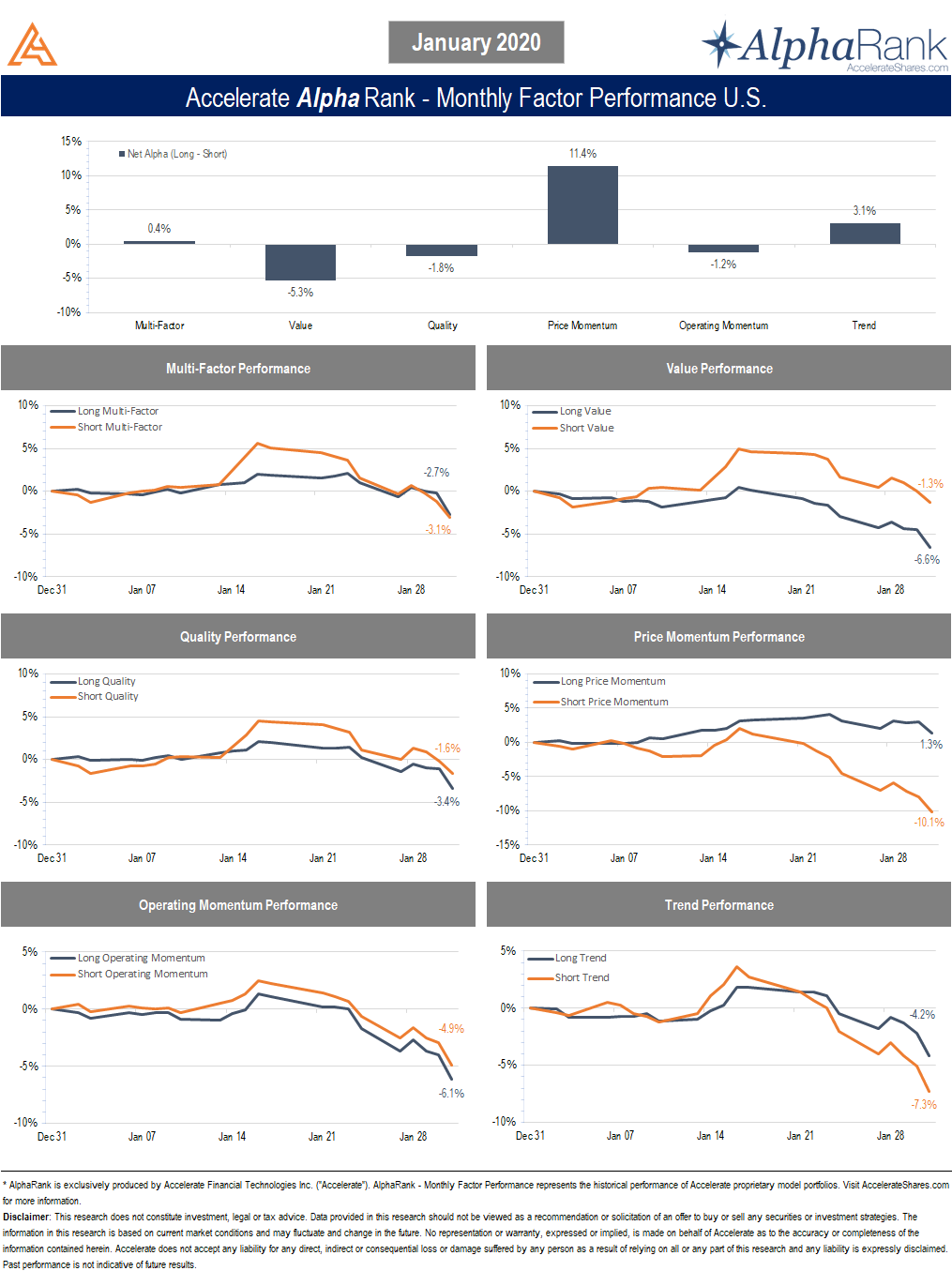

The Canadian multi-factor long-short portfolio was up 6.6% in January as the long book rose 1.4% while the short book fell -5.2%. The U.S. multi-factor long-short portfolio barely eked out a gain last month, but finished up 0.4% nonetheless, with the long portfolio dropping -2.7% and the short portfolio falling slightly more at -3.1%.

Momentum was the big winner in January, up 12.6% in Canada and 11.4% in the U.S. The momentum factor performance was largely driven by the short side, as stocks with poor momentum continued their decent downward.

The value and quality portfolios performed poorly over the month, with much of the weakness from the long book. Portfolios that were long cheap, high-quality stocks did poorly in January.

AlphaRank Factor Performance represents the daily historical performance of Accelerate’s proprietary model factor portfolios.