February 6, 2020 – For hundreds or perhaps even thousands of years, humans have been enamoured with betting.

Whether it be on sports, horse racing, stocks or commodities, nothing captivates the mind like an exciting bet. Case in point, an estimated 26 million Americans will have bet on this year’s Super Bowl, wagering around $6.8 billion on the game. Wagering is so ingrained in the human psyche that it is perhaps instinctual. I wouldn’t be surprised if early cavemen were betting on which Neanderthal would land the kill shot on a woolly mammoth.

I also wouldn’t be the least surprised to see early betting systems, likely offering “guaranteed” results, scrawled on a cave wall tens of thousands of years ago. As long as betting has been around, betting systems, which are purported to lead to bounteous profits, have existed.

Just Bet the Favourite

The most simplistic and tempting wagering system is to always bet on the favourite.

Mike Tyson to beat Buster Douglas? Easy money.

New England Patriots to triumph over the New York Giants? Practically guaranteed.

Serena Williams to crush Bianca Andreescu? Just give me the money now.

Wagering on the favourite is a consensus bet. Most people expect the favorite to come out on top. Intellectually, this strategy is very tempting: everyone expects them to win, so why not just do what’s easiest? Plus, your brain will get the pleasurable dopamine hit that accompanies the resulting confirmation bias when you hear that most other people agree with your consensus view.

The problem with betting on the favourite is that it doesn’t work. Here’s why.

Betting on the favourite doesn’t work because the betting odds, or payout, adjust for the market implied probability that the favorite will win. The favourite to win in a popular bet encompasses the market participant’s combined knowledge and is typically efficiently priced.

The Stock Market’s Favourites – Growth Stocks

The stock market equivalent of betting on the favourite is investing in growth stocks. This is the easiest and most straight-forward strategy. Ask any amateur investor if they’d rather bet on a company in a hot new growth industry or a company in a stable, old-economy industry, and that unsophisticated investor would likely choose the growth company every time (irrespective of price). It’s appealing to the human psyche.

The most simplistic and tempting stock market investing system is to bet on the market’s favourite growth stocks.

Are electric vehicles taking over the world? Acquire at any price.

Is cannabis a replay of the end of prohibition? Load the boat.

Are all humans going to change their diets to fake meat? Buy buy buy!

The reason these new economy industries seem as if they would make good investments is because of their ostensibly limitless revenue growth potential.

What if I told you that companies with the highest revenue growth had on average the worst share price performance?

It is counter-intuitive, but true.

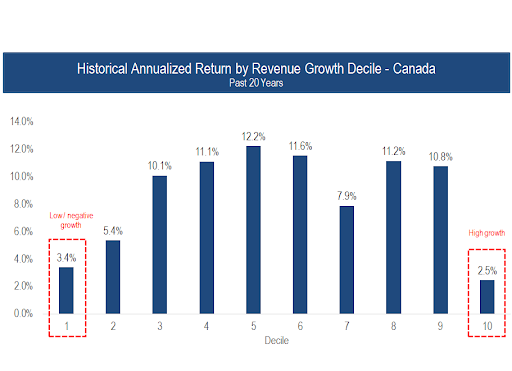

An analysis was run on both Canadian and US stocks over the past 20 years. Each month, the portfolios were segmented into deciles depending on their level of year-over-year revenue growth. The top decile portfolio contained stocks of companies with the highest year-over-year growth in sales, while the bottom decile portfolio had stocks exhibiting the lowest sales growth (or highest revenue decline for that matter).

The results are surprising.

Source: Accelerate, Compustat, S&P Capital IQ

Over the past two decades, Canadian stocks with the highest revenue growth performed the worst on average, with a 2.5% annualized return. Not only did they underperform the average stock return of about 8%, but they also underperformed the stocks with the lowest or negative revenue growth over that period by nearly 1% per annum.

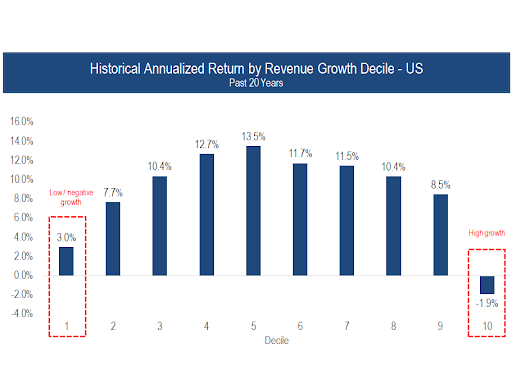

The results for the market’s favourites, growth stocks, were even worse in the US.

Source: Accelerate, Compustat, S&P Capital IQ

Over the past 20 years, a portfolio of the fastest growing stocks returned -1.9% per year, the only decile portfolio of stocks with a negative return since 2000. Stocks of companies with the highest revenue growth underperformed stocks with the lowest (or even negative) revenue growth by nearly 5% per year.

Not Too Hot, Not Too Cold, Just Right

The Goldilocks principle is derived from the children’s story “The Three Bears”. The crux of the story is the protagonist, Goldilocks, prefers her porridge neither too hot nor too cold but “just right”.

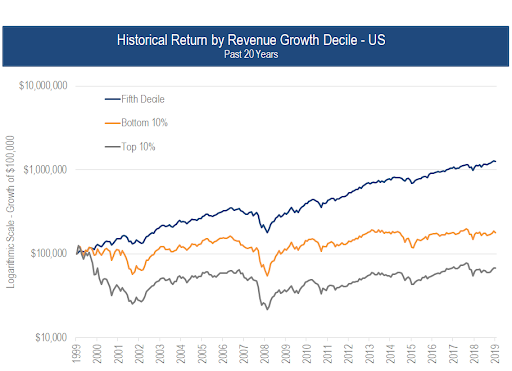

Growth investors should seek out companies with the “just right” amount of revenue growth – neither too high nor too low – in order to maximize their investment results.

Historically, companies with middle-of-the-pack revenue growth exhibited the top performing stock prices.

Source: Accelerate, Compustat, S&P Capital IQ

Over the past two decades, $100,000 invested in the portfolio of stocks with the highest growth declined to less than $70,000, while the same amount invested into stocks with the lowest revenue growth increased to nearly $180,000. A portfolio of stocks with average sales growth, the fifth decile, grew to well over $1,000,000.

In the Stock Market, Never Bet the Favourite

In sports, the favourite is always the consensus choice in which competitor or team will win.

In the stock market, the favourite is the most popular stock with a good “new economy” story and high revenue growth potential.

Given that these growth stocks seem so appealing to the human psyche, with their seemingly limitless potential and front-page newspaper coverage, investors and speculators have an intellectually easy time buying them.

However, like the favourites in sports, the market’s favourite growth stocks don’t offer great odds as they tend to be priced to perfection. And since they are priced very richly, investors tend to overpay and therefore go on to underperform. It’s hard to exceed expectations when expectations are already set extremely high.

When investing in growth stocks, don’t seek out companies exhibiting the highest growth in sales. Be like Goldilocks and buy stocks in which sales growth is just right.

-Julian