Accelerate Absolute Return Fund

Portfolio Protector.

The Accelerate Absolute Return Fund (TSX:HDGE, HDGE.U) is a quantitative long-short equity hedge fund that seeks to achieve attractive risk-adjusted returns with low correlation to the broad equity markets.

About the Fund

The Accelerate Absolute Return Fund (TSX: HDGE, HDGE.U) is a quantitative long-short equity hedge fund that seeks to achieve attractive risk-adjusted returns with low correlation to the broad equity markets.

Investment Objectives

- Target 10-15% annualized returns

- Generate positive returns irrespective of market direction

- Hedge downside risk

- Manage volatility

- Provide uncorrelated returns

Accelerate Absolute Return Fund Explained:

HDGE TRADING DATA

SUBSCRIBE TO OUR DISTRIBUTION LIST TO STAY UPDATED ON HDGE

QUICK FACTS

Type:

Long-short equity

Structure:

Alternative ETF

Date Started:

May 10, 2019

Management Fee:

0.00%

Performance Fee:

20% of outperformance over high water mark

Investment Manager:

Accelerate Financial Technologies Inc.

Distribution:

$0.10 per quarter

Exchange:

TSX

Currency:

CAD/USD

Risk Rating:

Medium

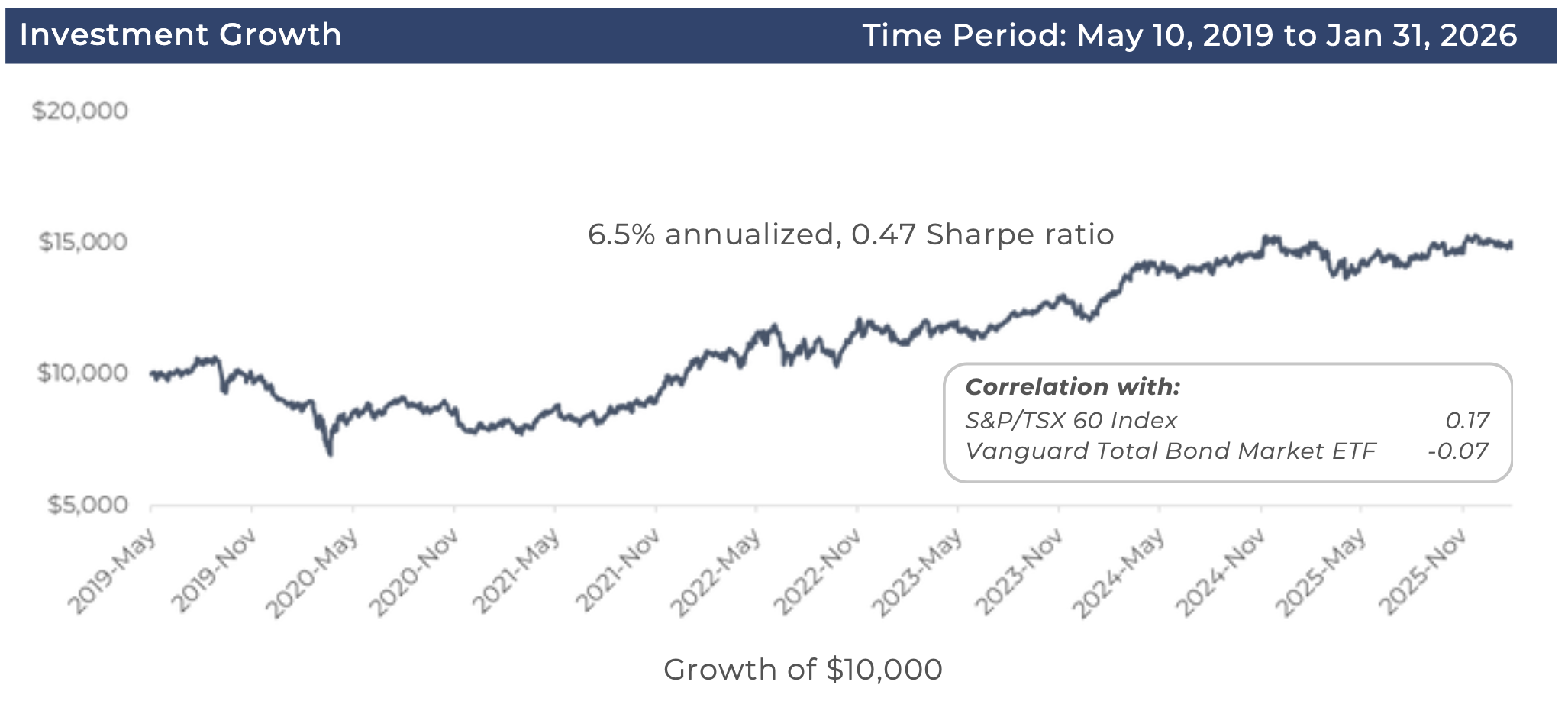

Track Record

Investment Process

- Value

- Quality

- Price Momentum

- Operating Momentum

- Trend

The Fund is long a portfolio of stocks chosen from those having the highest expected return according to our data-driven multi-factor model. At the same time, the Fund is short a portfolio of of stocks chosen from those having the lowest expected return. The portfolio is rebalanced on a monthly basis to achieve the highest expected risk-adjusted return for investors.

Performance as of 2026-Jan-31

| 1 Month | 3 Months | YTD | 1 Year | 3 Years | 5 Years | Since Inception | ||

|---|---|---|---|---|---|---|---|---|

| HDGE | -1.4% | 1.3% | -1.4% | -0.7% | 10.4% | 13.9% | 6.5% |

Fund Characteristics as of 2026-Jan-31

| Long | Short | |

|---|---|---|

| Number of Securities | 48 | 43 |

| Average Market Cap ($mm) | $36,714 | $7,622 |

| Median Market Cap ($mm) | $17,410 | $1,350 |

| Beta | 1.0 | 1.3 |

| EBITDA/EV | 9.7% | 0.9% |

| FCF/EV | 6.2% | -3.6% |

| Trailing Return | 40.3% | -17.2% |

| Pct of 52 Week High | 93.1% | 53.2% |

| Return on Capital | 25.8% | -8.9% |

| Gross Profits/Assets | 9.1% | 2.7% |

| 50 DMA to 200 DMA | 115.3% | 96.4% |

| EPS Revision | 1.3% | -4.1% |

| Change In Shares | -2.6% | 7.8% |

| Earnings Abnormal Return | 4.5% | -7.2% |

Sector Weightings as of 2026-Jan-31

| Long | Short | |

|---|---|---|

| 0.0% | Long | Short |

| Communication Services | 9.2% | -1.1% |

| Consumer Discretionary | 13.7% | -5.4% |

| Consumer Staples | 13.8% | -1.1% |

| Energy | 11.5% | -3.2% |

| Financials | 13.7% | -2.1% |

| Health Care | 11.5% | -6.4% |

| Industrials | 11.5% | -9.6% |

| Information Technology | 11.5% | -6.4% |

| Materials | 11.5% | -8.6% |

| Real Estate | 2.3% | -2.1% |

| Utilities | 0.0% | 0.0% |

Top Holdings as of 2026-Jan-31

| Long Security Name | Weight | |

|---|---|---|

| Valmont Industries Inc | 2.3% | |

| Celestica Inc | 2.3% | |

| Ulta Beauty Inc | 2.3% | |

| HCA Healthcare Inc | 2.3% | |

| Medpace Holdings Inc | 2.3% | |

| Jabil Inc | 2.3% | |

| McKesson Corp | 2.3% | |

| Expedia Group Inc | 2.3% | |

| Cardinal Health Inc | 2.3% | |

| BRP Inc | 2.3% | |

| Synchrony Financial | 2.3% | |

| US Foods Holding Corp | 2.3% | |

| Coca-Cola Europacific Partners | 2.3% | |

| Loblaw Cos Ltd | 2.3% | |

| OceanaGold Corp | 2.3% | |

| DPM Metals Inc | 2.3% | |

| Match Group Inc | 2.3% | |

| George Weston Ltd | 2.3% | |

| Bank of Montreal | 2.3% | |

| Imperial Oil Ltd | 2.3% | |

| Tenet Healthcare Corp | 2.3% | |

| Kinross Gold Corp | 2.3% | |

| Wesdome Gold Mines Ltd | 2.3% | |

| Garrett Motion Inc | 2.3% | |

| Surge Energy Inc | 2.3% | |

| Endeavour Mining PLC | 2.3% | |

| Pegasystems Inc | 2.3% | |

| Saputo Inc | 2.3% | |

| Okeanis Eco Tankers Corp | 2.3% | |

| Hamilton Insurance Group Ltd | 2.3% | |

| Finning International Inc | 2.3% | |

| Genpact Ltd | 2.3% | |

| EverQuote Inc | 2.3% | |

| Cargurus Inc | 2.3% | |

| Dropbox Inc | 2.3% | |

| Fox Corp | 2.3% | |

| Griffon Corp | 2.3% | |

| TechnipFMC PLC | 2.3% | |

| Bancorp Inc/The | 2.3% | |

| Adtalem Global Education Inc | 2.3% | |

| Monster Beverage Corp | 2.3% | |

| Ferguson Enterprises Inc | 2.3% | |

| Lamar Advertising Co | 2.3% | |

| Royal Bank of Canada | 2.3% | |

| Autodesk Inc | 2.3% | |

| Valero Energy Corp | 2.3% | |

| Markel Group Inc | 2.3% | |

| Booking Holdings Inc | 2.3% |

DISCLAIMER: This information on this web page does not constitute investment, legal or tax advice. Performance is inclusive of reinvested distributions. Past performance is not indicative of future results. Any data provided on this web page should not be viewed as a recommendation or solicitation of an offer to buy or sell any securities or investment strategies. The information on this web page is based on market conditions and may fluctuate and change without notice. Accelerate does not accept any liability for any direct, indirect or consequential loss or damage suffered by any person as a result of relying on all or any part of this website and any liability is expressly disclaimed.