February 24, 2024 – Equities continue to experience a “goldilocks” rally. With inflation not too hot, and central banks not too cold, stocks have entered the realm of conditions that appear to be “just right”.

Constructive momentum, combined with rapidly growing positive sentiment toward AI-adjacent large-cap growth stocks, have caused fund flows into technology stocks in general, and the Magnificent 7 in particular, to reach frenetic levels. Such a dramatic inflow of capital into just one sector supports the continuation of near-term momentum. As the old Wall Street adage goes, “The trend is your friend, until the end when it bends”.

Although market participants have pared their rate-cut expectations significantly, with 30-Day Fed Funds futures pricing in just three rate cuts in 2024 (down from seven cuts priced in as little as two months ago), central bank easing supports a bullish case for equities in the near term, valuations be damned. Continued economic strength in the U.S. has taken down recession odds for this year, providing market participants with respite from a potential bear market in the imminent future.

History doesn’t repeat but it often rhymes. Compared to the late 90’s tech bubble, the current AI bubble is much more subdued. Precedents indicate that upside momentum and valuations can get much crazier. If one chooses to partake in the rally, make sure to incorporate portfolio hedges to mitigate downside risk. Artificial intelligence is undoubtedly a compelling investment theme, but be sure to see the upside in hedging the downside. With valuation risks growing, and positive investor sentiment reaching a fevered pitch, tech fund flows could easily and quickly reverse, leaving investors at risk of a potential air pocket to the downside. Proceed with caution.

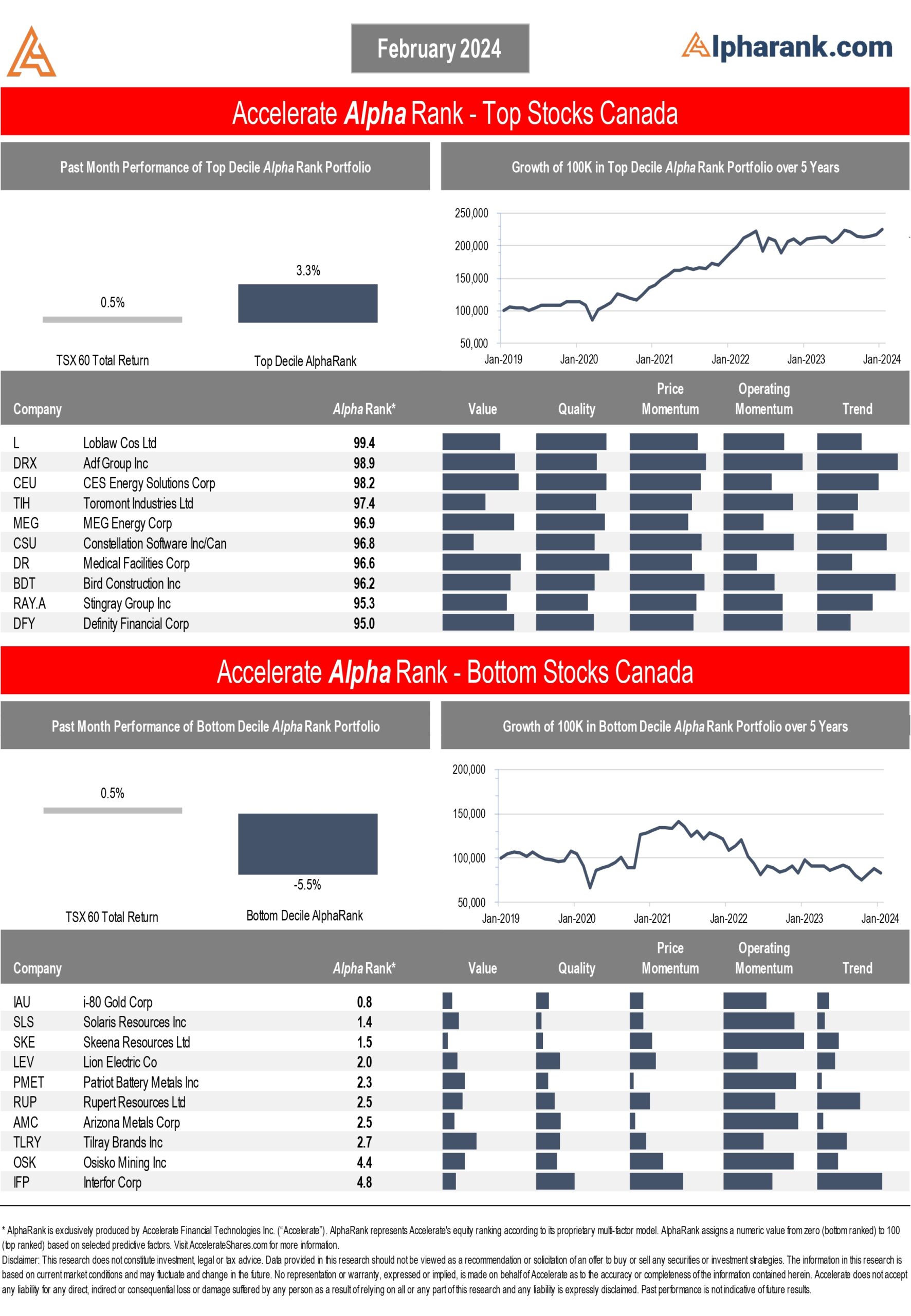

For February, we highlight one top-decile stock expected to outperform and one bottom-decile stock expected to underperform in this month’s AlphaRank Top Stocks.

OUTPERFORM: NVIDIA Corp (NVDA), which Goldman Sachs deemed the most important stock on Earth, is the poster child of the artificial intelligence revolution. With the stock’s tremendous rally, including a 63.6% year-to-date return and a 238.5% trailing twelve-month return, some investors may be shocked to see NVDA appear on the AlphaRank top 10 stock list. Unmistakably, the stock notches top quantitative ranking scores on both price momentum, with its scorching share price performance, and operating momentum, as it continues to crush Street earnings estimates and has been consistently raising both revenue and earnings expectations with each consecutive quarterly earnings report. Nvidia’s growth in high-margin revenue at its scale is perhaps unprecedented in the capital markets and the main question that investors have is how sustainable its exceptional fundamental business performance is. The only thing growing faster than NVDA’s stock price is its earnings per share, which is expected to help sustain its near-term stock price momentum and continued outperformance.

UNDERPERFORM: QuantumScape Corporation (QS) is a company focused on the development of solid-state lithium-metal batteries for electric vehicles. It aims to revolutionize energy storage by creating batteries that offer greater energy density, efficiency, and safety than conventional lithium-ion technology. The company’s technology is in the developmental stage with substantial execution risk, with full commercialization and mass production projected to be a few years away, making the stock highly speculative. QuantumScape is pre-revenue, incurring losses due to research and development expenses, with no guarantee of success. The battery technology sector is highly competitive, and numerous companies and research institutions are working on similar solid-state battery technologies. Solid-state battery technology faces significant technical hurdles that need to be overcome to ensure reliability, longevity, and cost-effectiveness. The stock has experienced significant downward momentum, driven by changing investor sentiment regarding green technology investments. Short sellers have homed in on the money-losing stock, and investors should be aware that high short interest may predict future share price underperformance. With forecast operating losses well into the future, the stock is expected to continue to underperform. Disclosure: The Accelerate Absolute Return Hedge Fund (TSX: HDGE) is short QS shares.

AlphaRank Top Stocks represents Accelerate’s predictive equity ranking powered by proven drivers of return. Stocks with the highest AlphaRank are expected to outperform, while stocks with the lowest AlphaRank are anticipated to underperform. AlphaRank assigns a numeric value to each security from zero (bottom-ranked) to 100 (top-ranked) based on selected predictive factors. All Canadian and U.S. stocks priced above $1.50 per share and $100 million in market capitalization are evaluated. In both the Accelerate Absolute Return Hedge Fund (TSX: HDGE) and the Accelerate Enhanced Canadian Benchmark Alternative Fund (TSX: ATSX), Accelerate funds may be long many top-ranked stocks and short many bottom-ranked stocks. See AccelerateShares.com for more information.