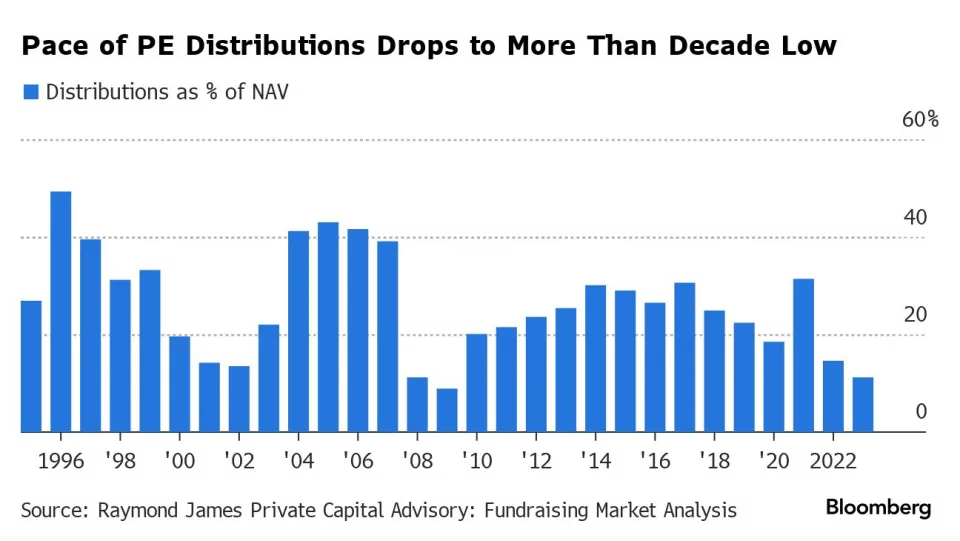

March 1, 2024 – Over the past year, private equity funds have experienced a challenging environment for exiting investments to crystallize returns for their investors, returning the lowest amount of cash to allocators since the financial crisis that shook the global economy 15 years ago.

In 2023, distributions to private equity limited partners averaged 11% of PE funds’ net asset value, the lowest since 2009 and significantly below the median of 25% over the past 25 years.

High borrowing costs, combined with wide bid-ask spreads from sellers and buyers in the private markets, have led to a marked slowing in secondary transactions.

This underwhelming recent performance from private equity as an asset class has become a focal point of concern among institutional investors and market participants. The much-ballyhooed downturn in PE distributions has highlighted vulnerabilities within private equity and prompted a reevaluation of portfolio allocations among major allocators. Institutional investors, who typically allocate significant portions of their portfolios to private equity in search of higher returns, are now scrutinizing the asset class’s ability to deliver on its promises, particularly in uncertain economic times.

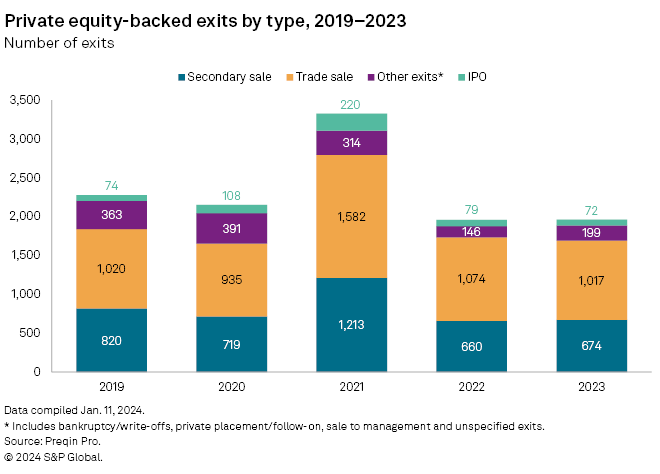

Typically, private equity firms finance distributions to limited partners by exiting investments in one of three ways:

- Initial public offering – Sell a portion of the shares to the public, and once the shares are “seasoned” over time, fully divest the rest to public equity investors.

- Sale to a strategic investor – Sell the entire business to a larger publicly traded competitor.

- Sale to another sponsor – Sell the entire business to a sponsor-backed competitor or another private equity fund.

Historically, selling a company to a strategic acquiror or another private equity fund accounted for the vast majority of PE exits. However, in 2021 and years prior, exiting through an IPO was also a popular route for PE funds to divest their holdings.

Unsurprisingly, the IPO market has slowed dramatically over the past couple of years, as investor attention focuses on large-cap growth stock darlings and the Magnificent 7. In the current market environment, public markets have little appetite for PE exits or buying PE-controlled stocks in general. For the private equity funds that sought to exit their holdings in the public markets in 2021 and earlier, intending to fully exit over the subsequent years, this market stalemate has left them stuck with listed company shares they are unable to divest.

With these challenges, private equity firms have devised a creative solution: the reacquisition.

A reacquisition entails a private equity fund acquiring the minority stake held in their holding sold into the IPO market years ago, taking the majority-controlled company fully private again.

For example, say a private equity fund sells 25% of a portfolio company via IPO, controlling 75% of the now publicly traded company with the goal of divesting the rest over the next few years. The market does not cooperate, the shares trade down, and the private equity fund buys out the 25% of shares it previously sold. This trade is sometimes completed in the same PE fund, or the company is acquired by a subsequent vintage fund run by the same private equity firm, switching money from one pocket to the other (LPs generally do not like this).

Nonetheless, while we have seen a pick-up in private equity buyouts of public companies over the past month, most of them have been reacquisitions:

- Private equity firms General Atlantic and Stone Point Capital announced the buyout of HireRight Holdings (HRT)* for $14.35 per share, representing an enterprise value of $1.65 billion. General Atlantic and Stone Point Capital own 75% of HRT, having taken the company public in late 2021 at $19.00 per share. The PE firms are reacquiring the 25% piece they sold off two and a half years ago at a price -25% below where they sold in the IPO.

- Thomas H. Lee Partners announced the buyout of Agiliti (AGTI) for $10.00 cash per share, for a total deal value of $2.5 billion. The firm controls 72.82% of Agiliti, having sold a portion of its shares in a spring 2021 IPO at $14.00 per share. Thomas H. Lee Partners is reacquiring AGTI shares -29% below where they sold them in its IPO.

- Sababa Holdings, run by financier Martin Franklin, announced the buyout of Whole Earth Brands (FREE)* for $637 million. While not a technical reacquisition, as Martin did not take Whole Earth Brands public, he did own a 20% controlling stake and had previously appointed his son as CEO. However, Whole Earth Brands had been passed around between other sponsors. In 2020, it was known as Flavors Holdings, owned by MacAndrews & Forbes (Ronald Perelman’s holding company), when it was flipped to SPAC Act II Global Acquisition, which took the company public at $10.00 per share as Whole Earth Brands in June of 2020. Franklin acquired shares in the market starting in spring 2022 and built the stake until he could establish control, before launching the recent takeover at $4.88 per share, -51% below its 2020 going-public price. FREE’s life as a public company will have lasted just under four years.

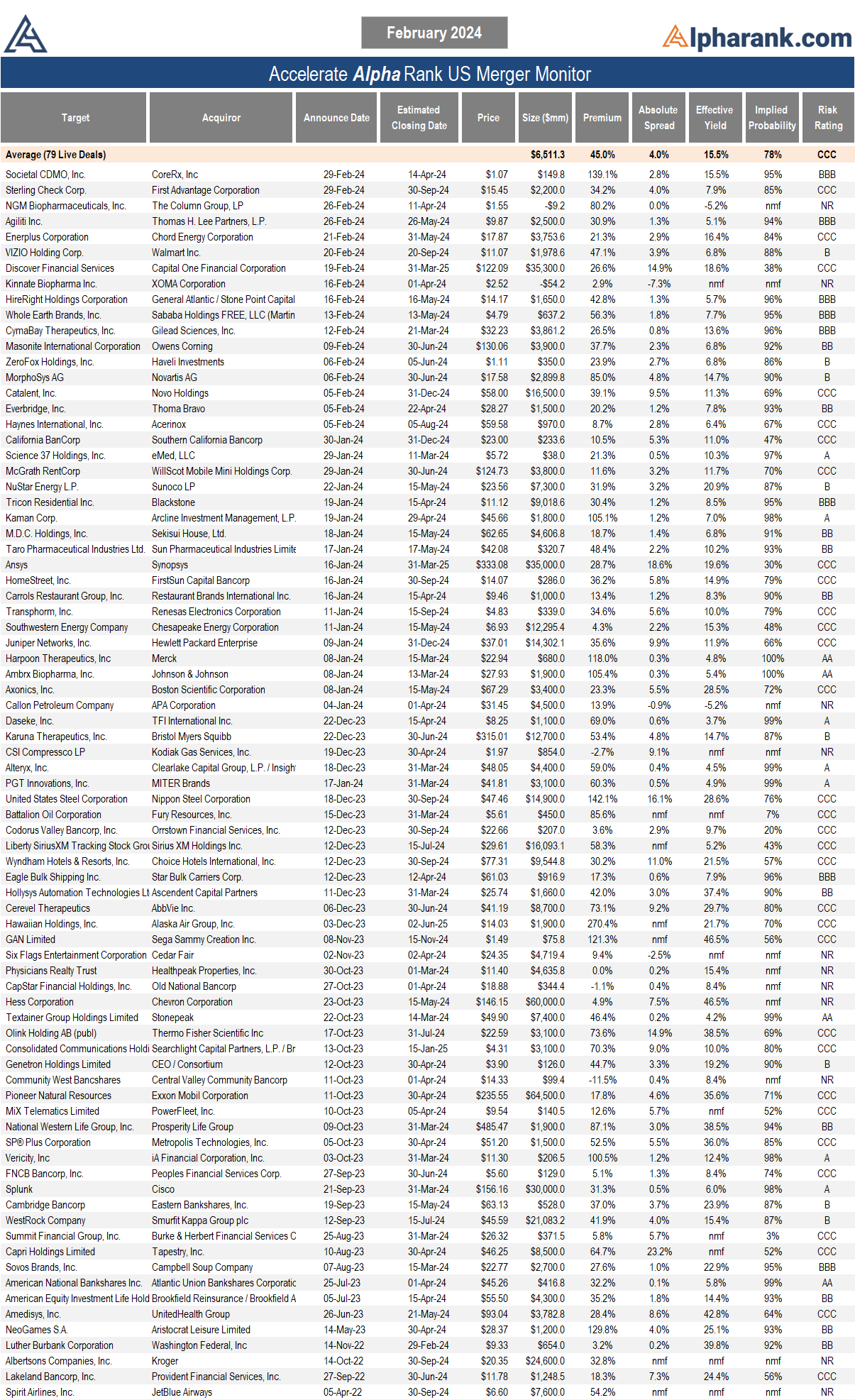

These low-risk reacquisition deals offer yields around 7-8%, reflecting a high probability of closing on the original terms. While outstanding reacquisition merger arbitrage opportunities offer yields below the current average merger arbitrage yield of 15.5%, they do provide a low-risk premium to cash of around 200bps.

Nevertheless, in addition to private equity buyouts, M&A activity remains robust in North America, with 19 public transactions worth an aggregate of $79 billion announced in February. In addition, while we haven’t seen a frenzy in bidding wars break out, we did see an overbid in February when Yintai Gold topped Dundee Precious Metals’s bid for Osino Resources (OSI)* by 33%, in a $368 million gold mining deal.

All signs point to the continuation of this robust merger arbitrage environment, with participation from both strategic acquirors and private equity sponsors, as market participants have settled into higher interest rates and stable economic conditions.

* Disclosure: the Accelerate Arbitrage Fund (TSX: ARB) holds shares of Osino Resources (OSI), Whole Earth Brands (FREE), and HireRight Holdings (HRT).

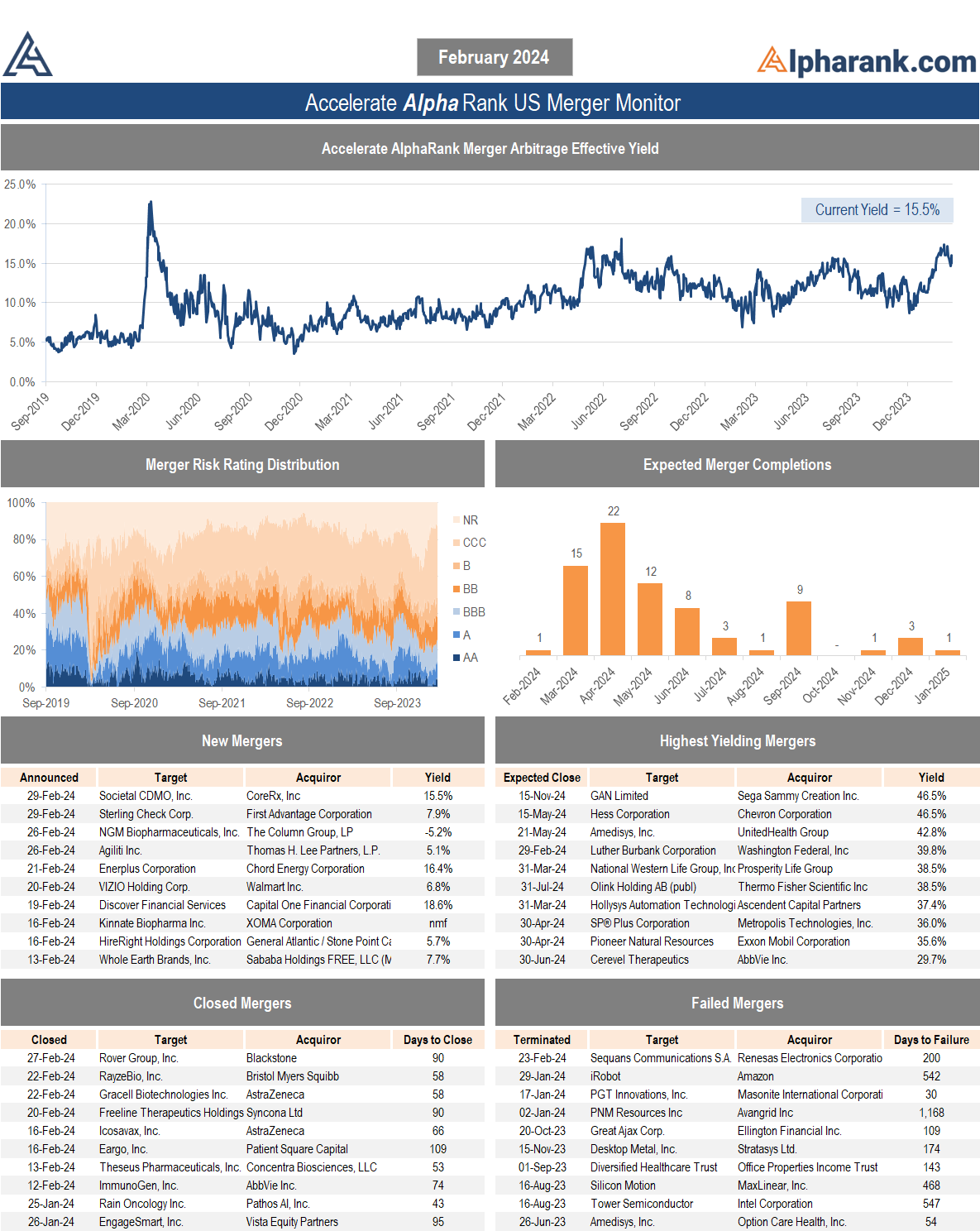

The AlphaRank.com Merger Monitor below represents Accelerate’s proprietary analytics database on all announced liquid U.S. mergers. The AlphaRank Merger Arbitrage Effective Yield represents the average annualized returns of all outstanding merger arbitrage spreads and is typically viewed as an alternative to fixed income yield.

Each individual merger is assigned a risk rating:

- AA – a merger arbitrage rated ‘AA’ has the highest rating assigned by AlphaRank. The merger has the highest probability of closing.

- A – a merger arbitrage rated ‘A’ differs from the highest-rated mergers only by a small degree. The merger has a very high probability of closing.

- BBB – a merger arbitrage rated ‘BBB’ is of investment grade and has a high probability of closing.

- BB – a merger arbitrage rated ‘BB’ is somewhat speculative in nature and has a greater than 90% probability of closing.

- B – a merger arbitrage rated ‘B’ is speculative in nature and has a greater than 85% probability of closing.

- CCC – a merger arbitrage rated ‘CCC’ is very speculative in nature. The merger is subject to certain conditions that may not be satisfied.

- NR – a merger-rated NR is trading either at a premium to the implied consideration or a discount to the unaffected price.

The AlphaRank merger analytics database is utilized in running the Accelerate Arbitrage Fund (TSX: ARB), which may have positions in some of the securities mentioned.

* AlphaRank is exclusively produced by Accelerate Financial Technologies Inc. (“Accelerate”). Visit Alpharank.com for more information. Disclaimer: This research does not constitute investment, legal or tax advice. Data provided in this research should not be viewed as a recommendation or solicitation of an offer to buy or sell any securities or investment strategies. The information in this research is based on current market conditions and may fluctuate and change in the future. No representation or warranty, expressed or implied, is made on behalf of Accelerate as to the accuracy or completeness of the information contained herein. Accelerate does not accept any liability for any direct, indirect or consequential loss or damage suffered by any person as a result of relying on all or any part of this research and any liability is expressly disclaimed. Accelerate may have positions in securities mentioned. Past performance is not indicative of future results.