December 17, 2023 – The tremendous rally in equities and risk assets in November, spurred by declining interest rates and the most significant easing of financial conditions in four decades, was led by the lowest-quality stocks.

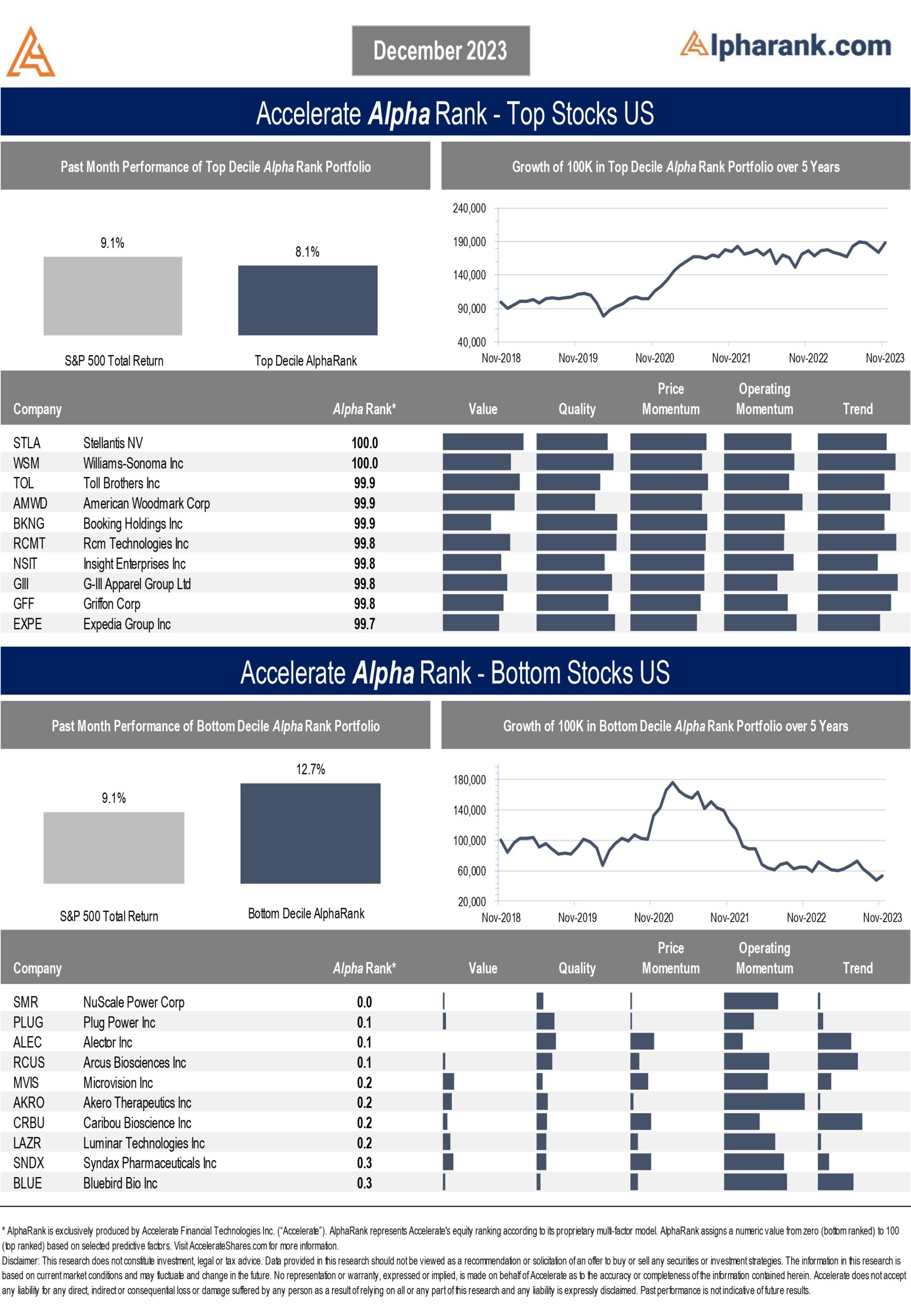

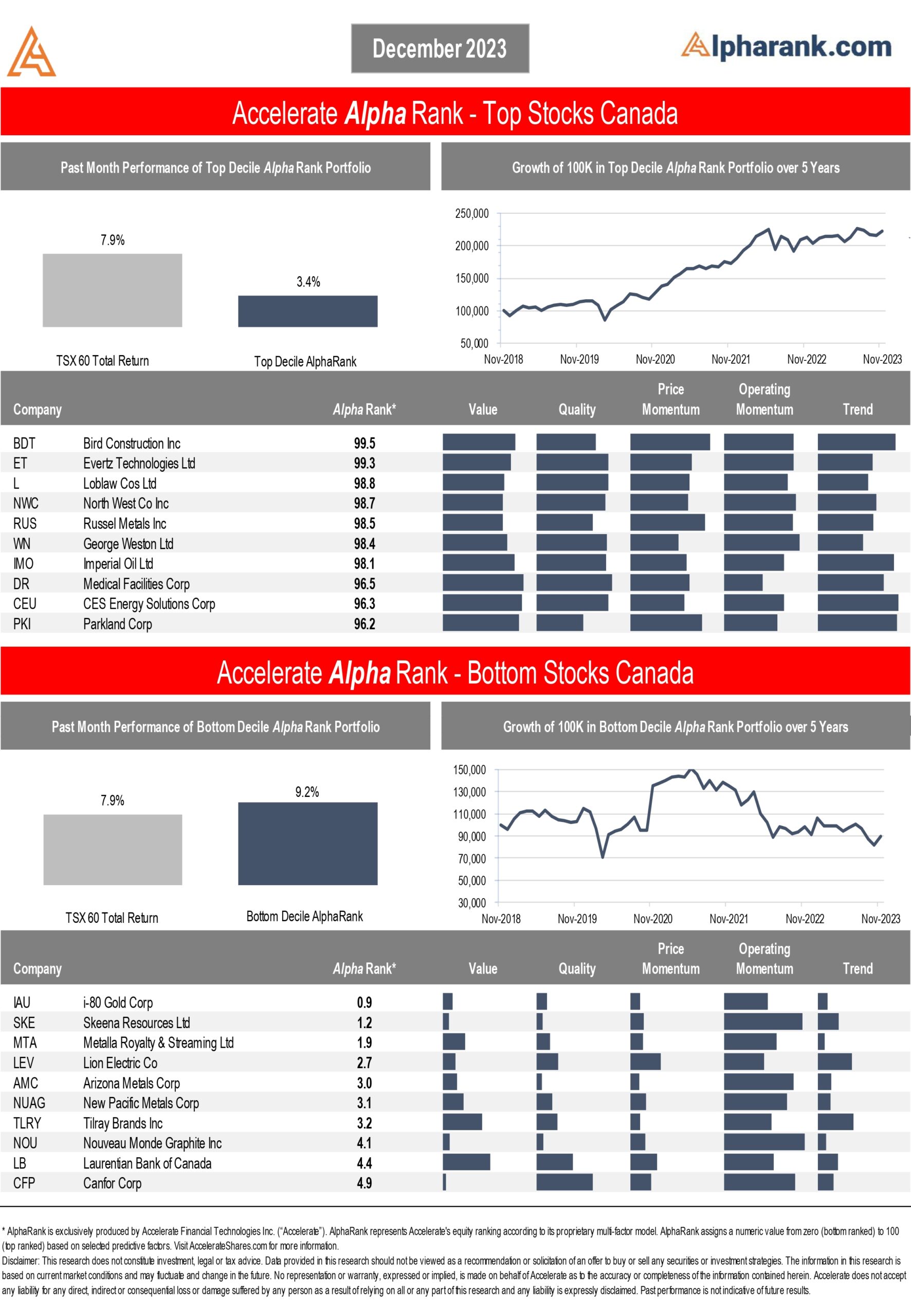

Last month, top-ranked Canadian stocks gained 3.4% while the top-decile U.S.-listed names rallied 8.1%, underperforming the benchmark by -4.5% and -1.0%, respectively. Over the past five years, the top-decile AlphaRank stocks in Canada have increased by 130% and gained 90% in the U.S.

In contrast, November saw bottom-ranked equities surge 12.7% in the U.S. and 9.2% in Canada, outperforming the benchmarks by 3.6% and 1.3%, respectively. However, over the past five years, bottom-ranked U.S. stocks have fallen more than -40% and -10% in Canada. While proven drivers of return (also known as factors) produce attractive portfolio results, both long and short, over the long term, occasional months generate relatively poor results (as they have for the last couple of months of 2023).

Peering into 2024, the average market strategist’s 2024E S&P 500 target is 4837, with EPS of $237 for a return of 2.5% (excluding dividends) and a P/E of 20.4. Street expectations are for between one and four interest rate cuts from the Federal Reserve, in contrast to the market pricing in five to seven rate cuts.

Source: Barron’s

While the market has priced in a soft landing and smooth sailing ahead for equities with the VIX south of 13, prudent investors may choose to augment the robustness of their portfolios by incorporating hedges and long-short allocations. To assist with this diversification, we present AlphaRank’s Top Stocks to provide stock selection ideas, both long and short.

For December, we highlight one top-decile stock expected to outperform and one bottom-decile stock expected to underperform in this month’s AlphaRank Top Stocks.

OUTPERFORM: Williams-Sonoma (WSM) is an American cookware, appliances, and home furnishings retailer. It operates four leading brands: Williams Sonoma, Pottery Barn, Pottery Barn Kids and Teen, and West Elm. It is known for its high-quality products, exclusive in-house brands, and robust e-commerce platforms. WSM has a loyal customer base and a strong brand reputation in the home goods market. Williams-Sonoma has attractive gross margins, a relatively low valuation, and an industry-leading return on capital north of 50%, along with a solid track record of dividend growth and share repurchases. WSM has been beating street expectations and executing consistently, with continued positive momentum. WSM has an Alpharank score of 100/100 and is the top-ranked U.S. equity, expected to outperform. (Disclosure: Long WSM in the Accelerate Absolute Return Hedge Fund (TSX: HDGE)).

UNDERPERFORM: Laurentian Bank of Canada (LB) is a Schedule 1 bank that operates primarily in the province of Quebec, with commercial and business banking offices throughout Canada. LB offers a range of banking products and services, including credit cards, loans, mortgages, accounts, plans, investments, and private banking. LB has had several adverse events that may take a while to recover from, including a failed sale process, which indicates that its private market value is below its share price, major operational hiccups such as its recent system outage, revenue pressures, decelerating loan growth, declining earnings estimates, along with highly publicized recent management turnover. Laurentian Bank is in a turnaround situation, and as Warren Buffett says, “Turnarounds rarely turn”. LB has an Alpharank score of 4.4/100, ranking in the bottom ten Canadian stocks expected to underperform. (Disclosure: Short LB in the Accelerate Enhanced Canadian Benchmark Alternative Fund (ATSX)).

AlphaRank Top Stocks represents Accelerate’s predictive equity ranking powered by proven drivers of return. Stocks with the highest AlphaRank are expected to outperform, while stocks with the lowest AlphaRank are anticipated to underperform. AlphaRank assigns a numeric value to each security from zero (bottom-ranked) to 100 (top-ranked) based on selected predictive factors. All Canadian and U.S. stocks priced above $1.50 per share and $100 million in market capitalization are evaluated. In both the Accelerate Absolute Return Hedge Fund (TSX: HDGE) and the Accelerate Enhanced Canadian Benchmark Alternative Fund (TSX: ATSX), Accelerate funds may be long many top-ranked stocks and short many bottom-ranked stocks. See AccelerateShares.com for more information.