March 20, 2020 – Investors are in the midst of one of the most volatile market environments of all time, with the VIX index reaching all-time record levels, so I will keep this piece short and sweet.

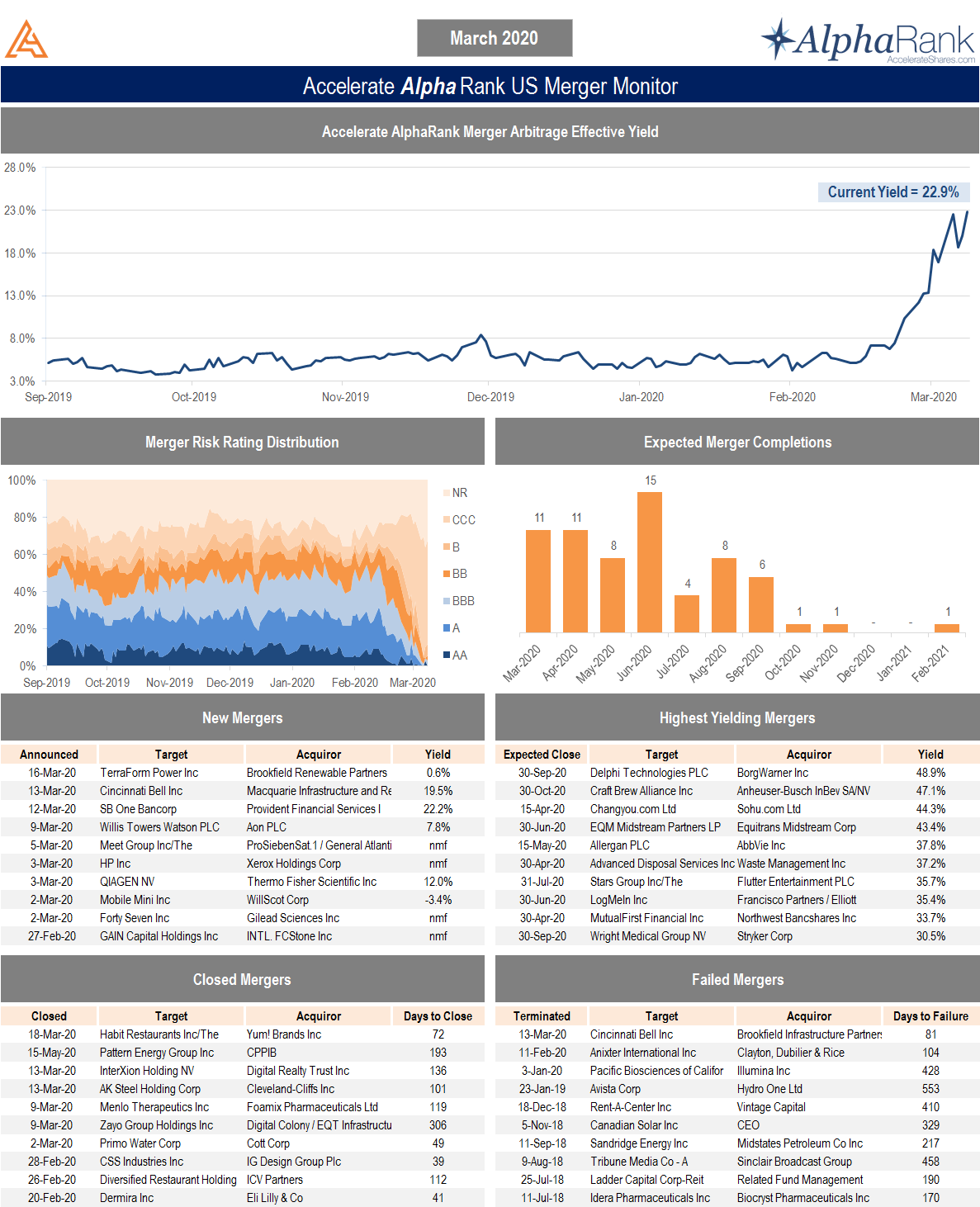

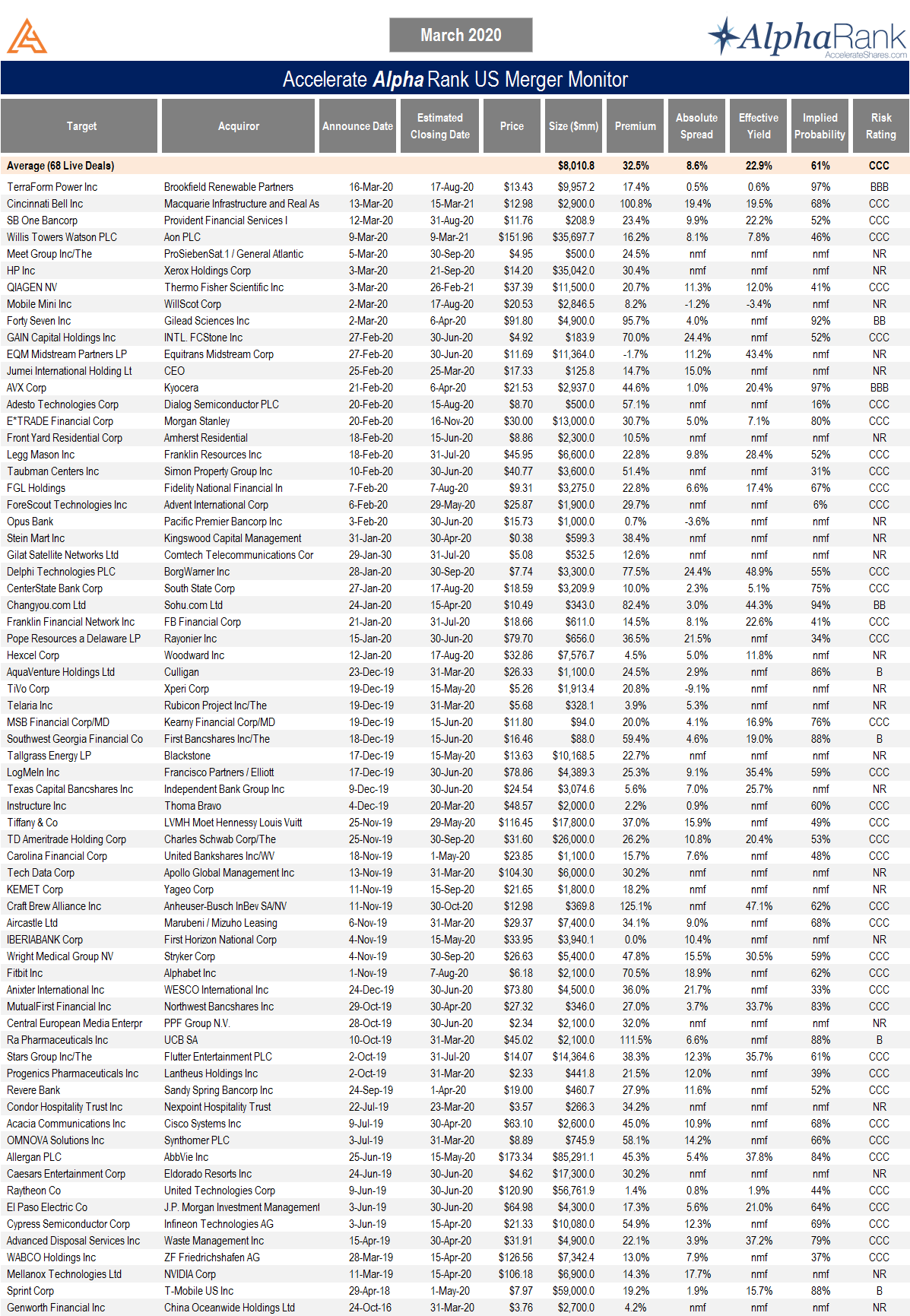

This is the most fruitful environment for merger arbitrage in my investment career. The average merger yield has gone from 5.6% last month to nearly 23%. Low-risk deals that used to be available at yields of 2-3% are now offering double-digit annualized returns. Riskier deals are yielding north of 100%. The opportunity set in merger arbitrage is incredible and presents a generational buying opportunity, perhaps even greater than of 2008-2009.

Veteran arbitrageur Roy Behren of Westchester Capital Management stated, “I have been doing this for 25 years, and I have never seen panic like this coming out of merger arbitrage spreads.”

Certainly the coronavirus pandemic presents a risk to merger transactions, and some deals may break given the economic fallout. However, in the U.S., the market is pricing in that 40% of definitive mergers will break and nearly 100% of leveraged buyouts will fail. In Canada, the market is pricing in that every outstanding M&A deal will fall apart. There is a market mispricing writ large, and for the most part it is driven by a lack of liquidity, not an increase in deal risk.

Since the coronavirus panic began three weeks ago, there have been 13 deals in North America that have closed and zero that have failed. The only deal to be cancelled was Brookfield’s acquisition of Cincinnati Bell because the target company went with a higher bid from interloping acquiror Macquarie. Moreover, despite having two potential acquirors, Cincinnati Bell now trades at a 20% yield. In a normal environment you would count that annualized return on two or three fingers.

I am pounding the table on merger arbitrage as an asset class available at one of the most attractive points in history.

The below AlphaRank Merger Monitor represents Accelerate’s proprietary analytics database on all announced liquid U.S. mergers. The AlphaRank Merger Arbitrage Effective Yield represents the average annualized return of all outstanding merger arbitrage spreads and is typically viewed as an alternative to fixed income yield.

Each individual merger is assigned a risk rating:

- AA – a merger arbitrage rated ‘AA’ has the highest rating assigned by AlphaRank. The merger has the highest probability of closing.

- A – a merger arbitrage rated ‘A’ differs from the highest-rated mergers only by a small degree. The merger has a very high probability of closing.

- BBB – a merger arbitrage rated ‘BBB’ is of investment grade and has a high probability of closing.

- BB – a merger arbitrage rated ‘BB’ is somewhat speculative in nature and has a greater than 90% probability of closing.

- B – a merger arbitrage rated ‘B’ is speculative in nature and has a greater than 85% probability of closing.

- CCC – a merger arbitrage rated ‘CCC’ is very speculative in nature. The merger is subject to certain conditions that may not be satisfied.

- NR – a merger rated NR is trading either at a premium to the implied consideration or a discount to the unaffected price.

The AlphaRank merger analytics database is utilized in running Accelerate’s merger arbitrage investment strategy.

* AlphaRank is exclusively produced by Accelerate Financial Technologies Inc. (“Accelerate”). Visit AccelerateShares.com for more information.