May 28, 2024 – Hipster Antitrust is a novel antitrust philosophy that challenges the traditional consumer welfare standard, which has historically relied on rational price theory analysis.

This contemporary antitrust movement seeks to go above and beyond by addressing broader societal concerns stemming from the potential negative effects of market concentration on seemingly unrelated areas, such as income inequality, consumer rights, and wage growth, rather than the traditional approach of focusing solely on consumer prices and market efficiencies.

The progressive approach to antitrust policy emphasizes the structure of the market over the effects on consumers. It suggests that regulators should have more leeway to address transactions or behaviours that may not traditionally fall under the regulators’ purview.

Traditional antitrust policy focuses on consumer welfare, primarily on lower prices, increased production, and efficiencies. Historically, regulators would sound the alarm whenever a firm was suspected of engaging in behaviours harmful to consumers, such as monopolistic product price increases.

Hipster antitrust advocates argue that the traditional approach fails to address the negative impacts of corporate concentration on disparate economic segments, such as inequality and market dynamism, along with other highly subjective perceived ills. This aggressive and progressive antitrust approach suggests that mergers and business practices should be scrutinized not just for their impact on prices but also for their broader societal effects, disregarding decades of legal precedent.

In practice, proponents of the movement seek more aggressive antitrust enforcement and regulatory reforms to prevent corporations from stifling competition and harming public interests. This approach includes a more skeptical view of mergers, particularly those involving dominant firms, and a willingness to challenge practices that might reinforce perceived monopolistic power.

Nineteenth-century English historian Lord Acton once stated, “Power tends to corrupt and absolute power corrupts absolutely”. Market prognosticators, including yours truly, criticize the hipster antitrust movement as just another power grab by government bureaucrats (and they would be right). Look no further than the SEC’s anti-crypto approach to exemplify unelected bureaucrats’ lust for power beyond their codified mandate.

The problem with the hipster antitrust approach to regulation is that it lacks solid empirical evidence to support its effectiveness or justify its implementation. Critics are highly skeptical of the movement, arguing that broadening antitrust goals to include socio-political factors introduces subjectivity and unpredictability into enforcement. This regulatory uncertainty can lead to inconsistent court rulings and potential misuse of regulatory power for political purposes.

There is no greater proponent of hipster antitrust than current FTC Chair, Lina Khan. Under the influence of this new, radical and progressive antitrust approach, she has become the thorn in the side of a myriad of market participants, from mega-cap tech looking to acquire new technologies, to private equity seeking to roll up industries, to corporations trying to extract synergies, to startup founders pursuing an exit opportunity. More importantly, she has added additional regulatory uncertainty and analytical complexity to merger arbitrage.

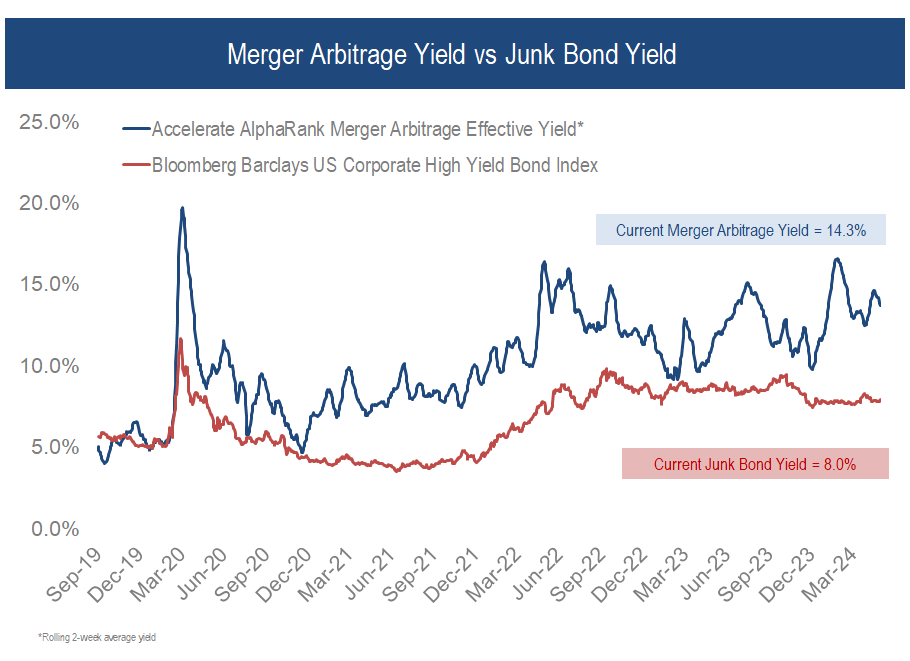

Ms. Khan, previously an antitrust researcher focused on criticizing big tech, was sworn in as chair of the U.S. FTC in June of 2021. Around that time, merger arbitrage yields began increasing.

Prior to implementing this aggressive approach to antitrust starting in mid-2021, merger arbitrage yields traded similar to or at a slight premium compared to junk bond yields. Over the past three years, merger arbitrage yields have averaged a 440bps premium to junk bond yields. Currently, the average U.S. merger arbitrage yields a stunning 630bps premium to the average junk bond yield.

Source: Accelerate, Bloomberg

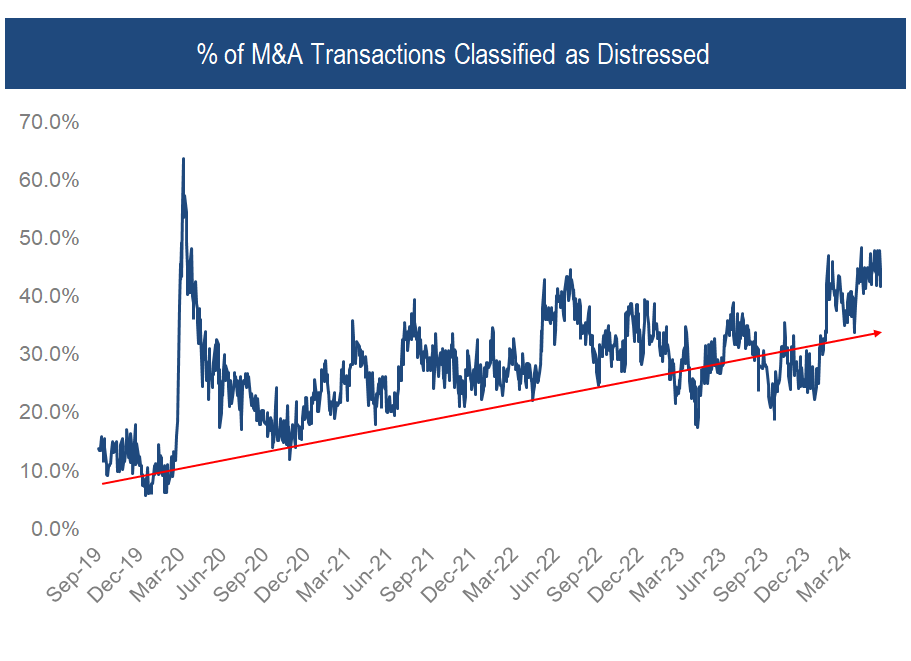

Clearly, the hipster antitrust movement has affected merger arbitrage risk premia. For example, the number of merger arbitrage spreads classified as distressed, defined as the market-implied odds of deal completion below 80%, have risen to more than 40% of the merger market (nearly one in two deals are trading at “distressed” levels). This level represents the highest in recent memory, aside from a brief moment during the depths of the Covid market panic.

Source: Accelerate

In any event, merger arbitrageurs are much more cautious these days, given the enhanced regulatory uncertainty. However, it is worthwhile to investigate whether the new hipster antitrust movement justifies wider merger arbitrage spreads

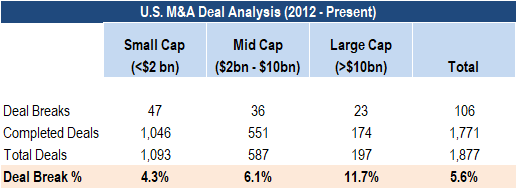

Analyzing nearly 2,000 U.S. public mergers over the past dozen years reveals an average deal termination rate of 5.6%. As expected, larger transactions have a higher failure rate given the regulatory and market complexities that come with an increase in deal size, leading to a 11.7% termination rate for acquisitions valued north of $10 billion. Less concerning small cap mergers (sub $2 billion) had the lowest failure rate out of the segments, clocking in at 4.3%.

Source: Accelerate

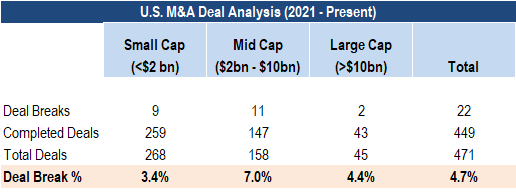

Isolating the data for mergers announced post-June 2021, recognized as the dawn of the implementation of hipster antitrust, we can observe whether this new regulatory regime has created an elevated level of deal terminations.

Source: Accelerate

While the data set is somewhat limited, current observations indicate that the FTC’s aggressive approach to U.S. antitrust has not resulted in a recent increase in merger terminations. Over the past three years, the rate of U.S. deal breaks has hovered around 5%, in line with its historical average since 2012. While the regulatory environment has been more uncertain and unpredictable, perhaps corporations have incorporated this unfriendly climate into their M&A strategies, shying away from complex and potentially problematic deals amidst a harsher antitrust regime.

Aggressive antitrust enforcement, particularly regarding pro-competitive deals such as Microsoft’s acquisition of Activision Blizzard and Amgen’s merger with Horizon Therapeutics, made for entertaining media folly while testing novel theories of harm. Ultimately, these ill-advised (and unsuccessful) merger challenges led to longer closing timelines than would typically be expected.

For example, the Microsoft/Activision Blizzard deal was initially expected to close by June 30th, 2023. It ended up completing on October 13th of that year. The Amgen/Horizon Therapeutics transaction was forecast to close in the first half of 2023, however, it was not consummated until October 6th. Deal delays are harmful to merger arbitrageurs, as they extend timeframes, amplify deal risks, and compress arbitrage yields. A 5% gross spread that closes in six months represents an approximate 10% annualized yield (a good return), while a 5% gross spread that gets extended and takes a year to close yields below cash (not a good return on risk).

Another thesis to explain widening risk premia in merger arbitrage can be attributed to the risk of timeline extensions due to regulatory issues such as deal delays from HSR second requests and merger challenges/lawsuits. Timeline extensions reduce merger arbitrage returns, hence could justify widening spreads and elevated deal risk premia.

We compared two regulatory regimes a decade apart to test this thesis. In 2013, all U.S. public mergers from that year took 125 days on average from announcement to closing, with the median at 107 days. In 2023, U.S. public mergers took 129 days on average to complete, with 99 days the median closing timeline.

Ergo, hipster antitrust has had no discernable effect on deal closing timelines, at least not yet. One major obstacle to the FTC’s aggressive antitrust regulatory regime is that it has effectively failed after losing a significant number of merger challenges in court. As The Hill recently stated in its article, Internal emails show FTC’s Lina Khan is trying to win by losing, the author states, “Khan’s plan to win by losing may turn out to be a poor strategy. Given the external failure and internal turmoil at the FTC, it is more likely that Khan will simply lose by losing.” Challenging mergers that they know they will lose in court has not been supportive of their hipster antitrust movement.

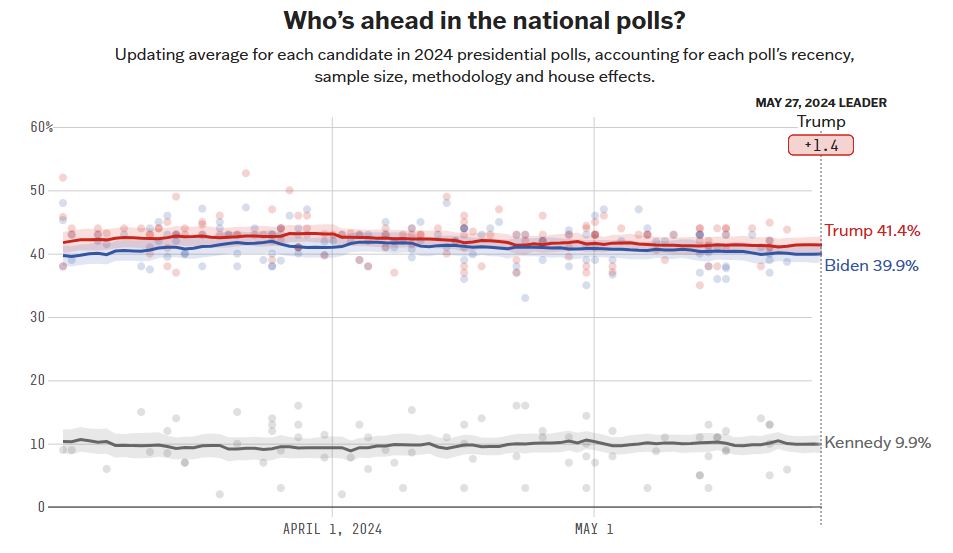

Nevertheless, a positive catalyst appears on the horizon. A Trump win in the upcoming 2024 presidential election could lead to the conclusion of the current iteration of hipster antitrust, with a likely turnover in leadership at the FTC to a more business-friendly regime. Currently, this scenario appears to be an increasingly likely outcome. However, elections are notoriously difficult to predict, particularly when they are close.

Source: 538

Nevertheless, until then, merger arbitrageurs must stay on alert to successfully navigate an increasingly uncertain environment. However, the pursuit may be worthwhile, with rewarding yields and attractive spoils available for those who can traverse hipster antitrust successfully.

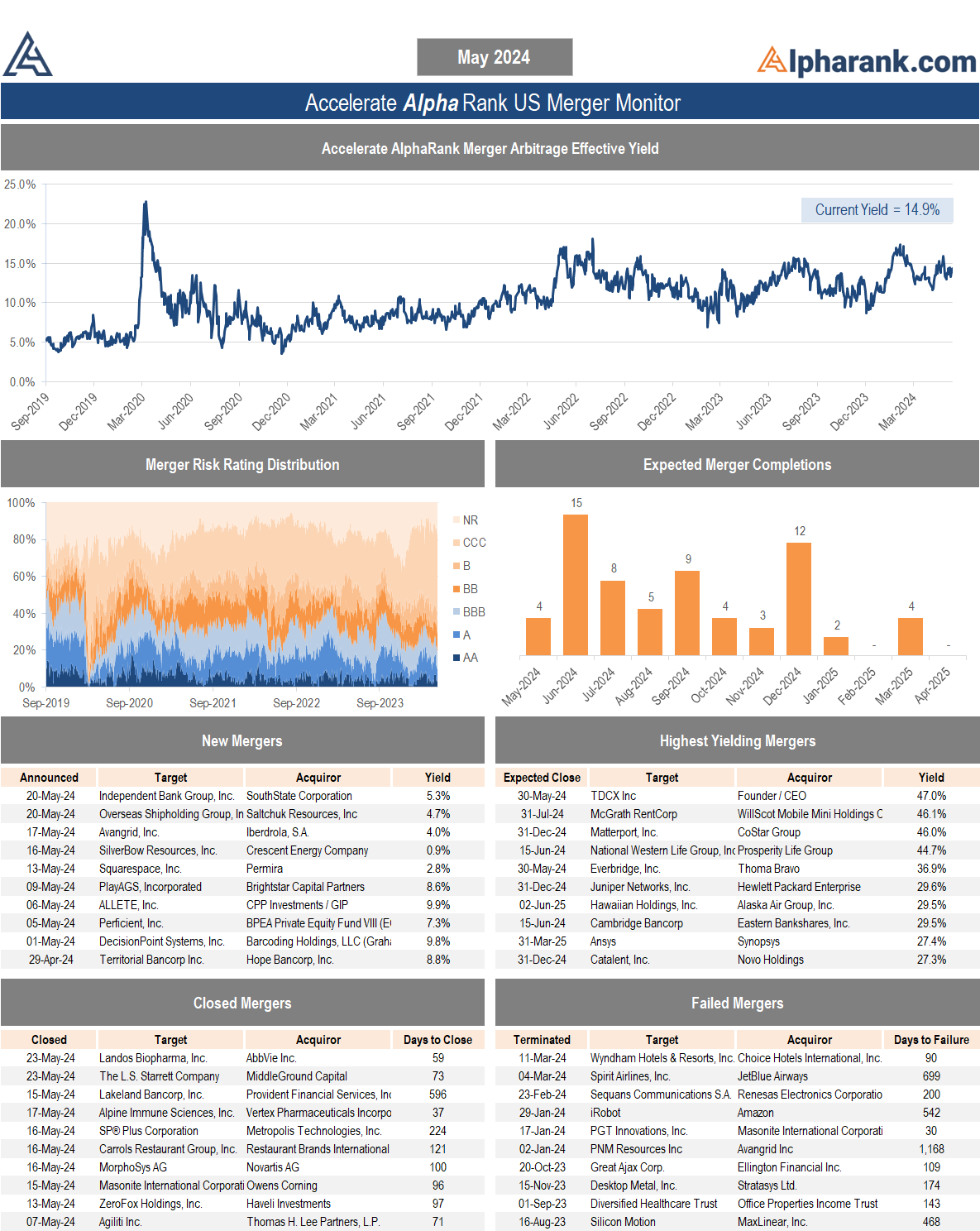

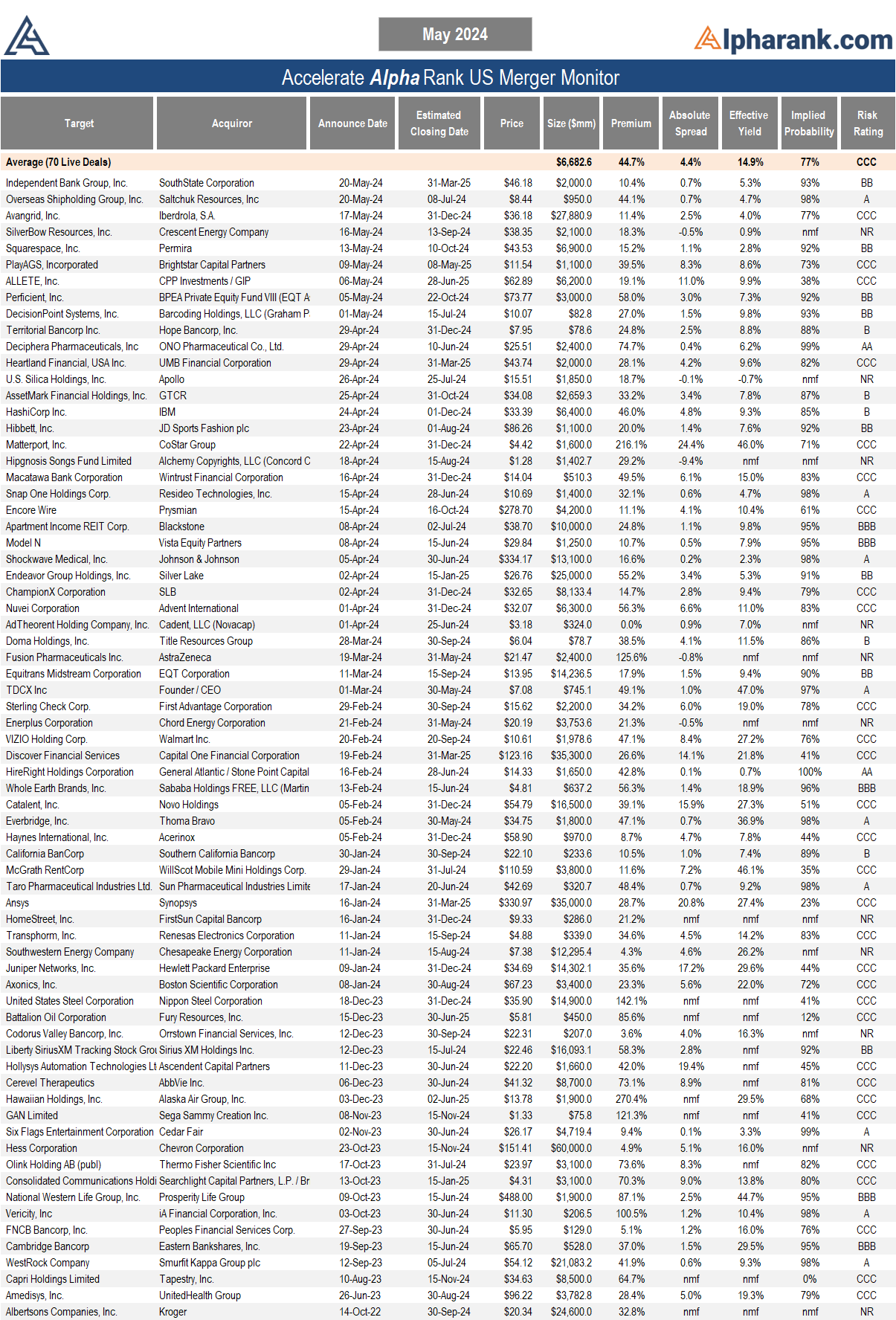

The AlphaRank.com Merger Monitor below represents Accelerate’s proprietary analytics database on all announced liquid U.S. mergers. The AlphaRank Merger Arbitrage Effective Yield represents the average annualized returns of all outstanding merger arbitrage spreads and is typically viewed as an alternative to fixed income yield.

Each individual merger is assigned a risk rating:

- AA – a merger arbitrage rated ‘AA’ has the highest rating assigned by AlphaRank. The merger has the highest probability of closing.

- A – a merger arbitrage rated ‘A’ differs from the highest-rated mergers only by a small degree. The merger has a very high probability of closing.

- BBB – a merger arbitrage rated ‘BBB’ is of investment grade and has a high probability of closing.

- BB – a merger arbitrage rated ‘BB’ is somewhat speculative in nature and has a greater than 90% probability of closing.

- B – a merger arbitrage rated ‘B’ is speculative in nature and has a greater than 85% probability of closing.

- CCC – a merger arbitrage rated ‘CCC’ is very speculative in nature. The merger is subject to certain conditions that may not be satisfied.

- NR – a merger-rated NR is trading either at a premium to the implied consideration or a discount to the unaffected price.

The AlphaRank merger analytics database is utilized in running the Accelerate Arbitrage Fund (TSX: ARB), which may have positions in some of the securities mentioned.