May 25, 2024 – Spring showers bring May… disinflation?

Given the above-average performance of equities year-to-date, holders of risk assets have pinned their hopes on the decline in the inflation rate to continue until it gradually reaches the Federal Reserve’s 2% target.

While the jury’s still out on the timing of the inflation rate’s path of decline, more relative certainty has emerged that the Fed’s monetary policy actions have tightened the economy sufficiently that its end goal is in sight.

With that, most sell-side bank forecasters and other market prognosticators now believe we’ll see the first interest rate cut from the Fed in September, with December the next-most-likely date for an additional rate reduction. However, this call is far from consensus, with some economists still forecasting the possibility of zero rate cuts this year.

Incoming data remain choppy, and by no means are one or two rate cuts in the U.S. certain to occur this year. Just five month ago, market consensus called for six to seven rate cuts in 2024. Data-dependent central banks are focused on balancing the risks of keeping rates too high for too long and unnecessarily punishing the economy against the risk of cutting benchmark interest rates prematurely and restoking inflation. In any event, despite near-term volatility, economists believe we’ll see the Fed’s preferred 2.0% inflation rate hit in 2025.

Incoming data remain choppy, and by no means are one or two rate cuts in the U.S. certain to occur this year. Just five month ago, market consensus called for six to seven rate cuts in 2024. Data-dependent central banks are focused on balancing the risks of keeping rates too high for too long and unnecessarily punishing the economy against the risk of cutting benchmark interest rates prematurely and restoking inflation. In any event, despite near-term volatility, economists believe we’ll see the Fed’s preferred 2.0% inflation rate hit in 2025.

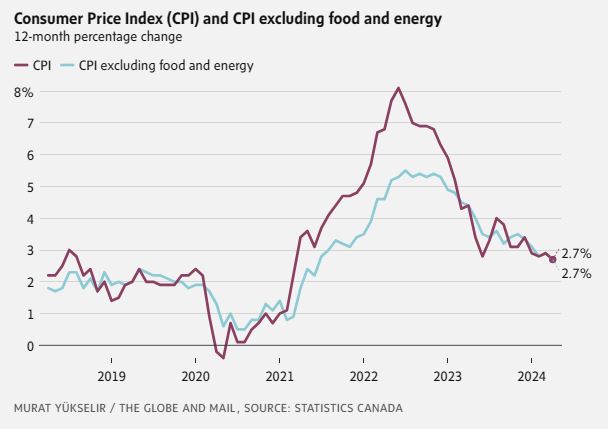

Comparably, price pressures continue to “behave” more appropriately north of the border. Compared to the U.S., inflation’s path down to the Bank of Canada’s 1-3% target range, which has held for four consecutive months, makes an earlier rate cut from the BoC more likely.

Forecasts indicate a greater than 50% odds of a rate cut next month from the Bank of Canada, providing some comfort to Canadian consumers and lending a helping hand to the country’s struggling economy.

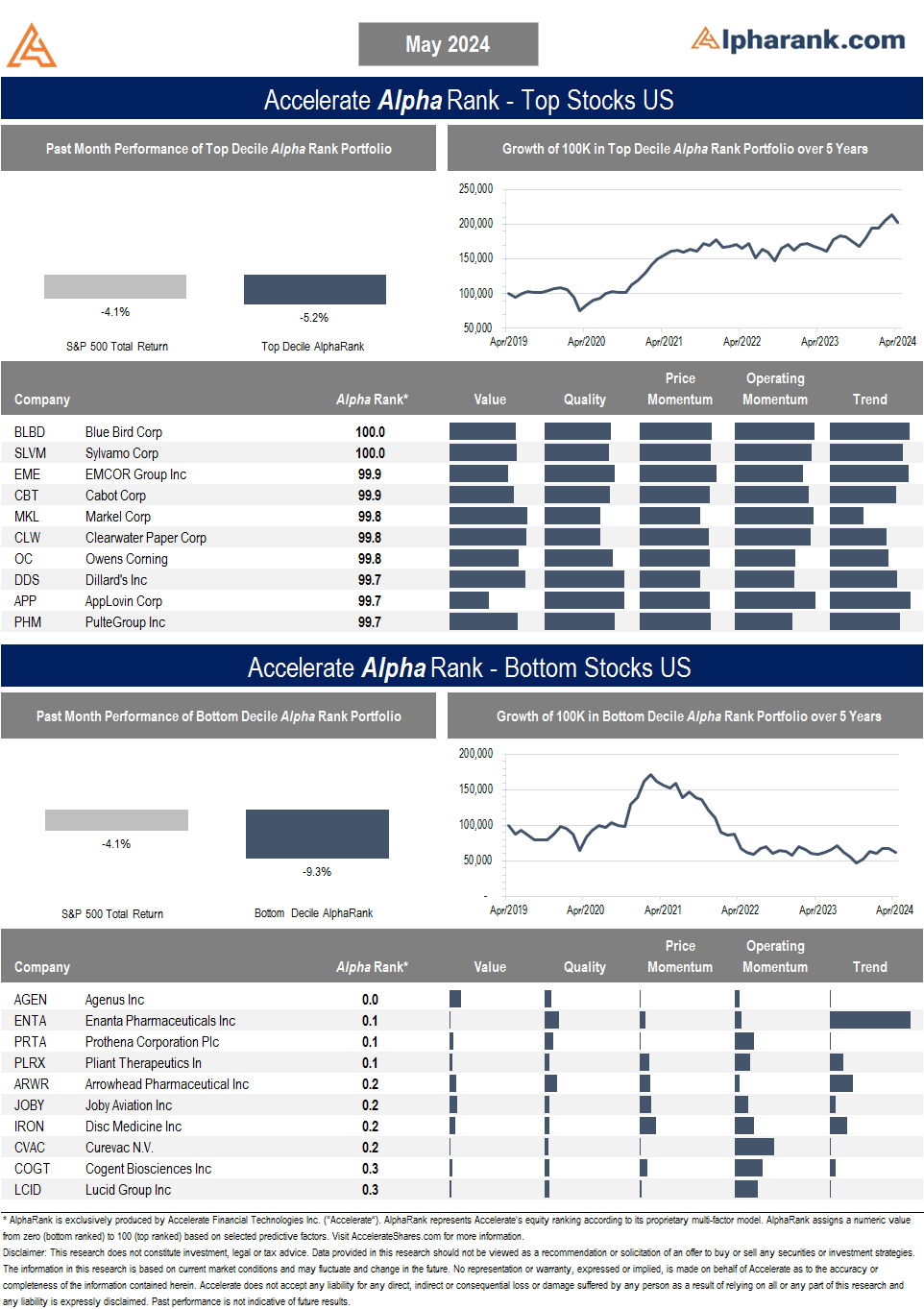

Nevertheless, it is clear that central bankers remain data dependent, and any crystal ball into the path of inflation, and with that rate cuts, has been understandably murky. Regardless, long-short equity stands out as a strategy that can protect equity investors should forecast rate cuts not turn out exactly as planned. Ergo, to further long-short equity investors, we highlight one top-decile stock expected to outperform and one bottom-decile stock expected to underperform in this month’s AlphaRank Top Stocks.

OUTPERFORM: Owens Corning (NYSE: OC) is a global leader in the building and construction materials industry, known for its innovative products in roofing, insulation, and composites. The company has a solid track record of financial performance, with 2023 sales reaching $9.7 billion. Owens Corning is well-positioned, with leading market shares in key segments. The acquisition of Masonite International, a significant player in interior door manufacturing, is expected to enhance its market position and drive future growth. OC’s attractive valuation, at 7.4x EBITDA and an 8.1% free cash flow yield, along with its high return on capital at 29%, has the stock ranking high on value and quality metrics. In addition, its capital allocation, including share repurchases, dividends, and disciplined M&A, leads to a high operating momentum ranking. We expect OC’s positive share price momentum to continue. Disclosure: Long OC in the Accelerate Absolute Return Fund (TSX: HDGE).

UNDERPERFORM: Canfor Corp (TSX: CFP) operates as an integrated forest products company primarily involved in the production and sale of softwood lumber, engineered wood products, and pulp and paper. Canfor has been experiencing significant financial challenges. In the first quarter of 2024, the company reported an operating loss of $86 million. This poor performance is attributed to sustained pressure on global lumber markets and pricing, particularly for Southern Yellow Pine. The company’s revenue has been declining. For the fiscal year ending December 31, 2023, Canfor’s revenue decreased by 26.9% to $5.4 billion compared to the previous year. This sharp decline showcases the company’s difficulties maintaining market share and profitability. The lumber and pulp markets are highly cyclical and under pressure due to economic uncertainties and fluctuating demand. This cyclical nature, combined with Canfor’s current financial difficulties, makes the stock potentially vulnerable to further declines. CFP’s high valuation, low return on capital, and negative free cash flow create an environment in which the stock is expected to continue to underperform. Disclosure: Short CFP in the Accelerate Canadian Long Short Equity Fund (TSX: ATSX).

The AlphaRank Top and Bottom stock portfolios exhibited mixed performance last month:

- In Canada, the top decile stock portfolio outperformed the TSX 60 by 3.3%, while the bottom decile portfolio outperformed by 3.1%. The top decile basket outperformed the bottom by 0.2% in May and more than 125% over the past five years.

- In the U.S., both AlphaRank portfolios underperformed the S&P 500. While the top decile portfolio fell by -5.2%, underperforming the S&P 500 by -1.1%, the bottom decile-ranked stocks declined by -9.3%, underperforming the S&P 500 by -5.2%. The top-ranked stocks outperformed the bottom-ranked by 4.1% in May and more than 140% over the past five years.

AlphaRank Top Stocks represents Accelerate’s predictive equity ranking powered by proven drivers of return. Stocks with the highest AlphaRank are expected to outperform, while stocks with the lowest AlphaRank are anticipated to underperform. AlphaRank assigns a numeric value to each security from zero (bottom-ranked) to 100 (top-ranked) based on selected predictive factors. All Canadian and U.S. stocks priced above $1.50 per share and $100 million in market capitalization are evaluated. In both the Accelerate Absolute Return Fund (TSX: HDGE) and the Accelerate Canadian Long Short Equity Fund (TSX: ATSX), Accelerate funds may be long many top-ranked stocks and short many bottom-ranked stocks. See AccelerateShares.com for more information.