April 9, 2020 – The coronavirus pandemic continued to wreak havoc on both communities and markets during the month of March. Investor fear reached an unprecedented level, with the VIX hitting a record 85 on March 18th. Stock markets plummeted, suffering some of the largest monthly losses on record. On March 16th, the Dow Jones Industrial Average fell nearly -13%, its second largest daily decline of all time.

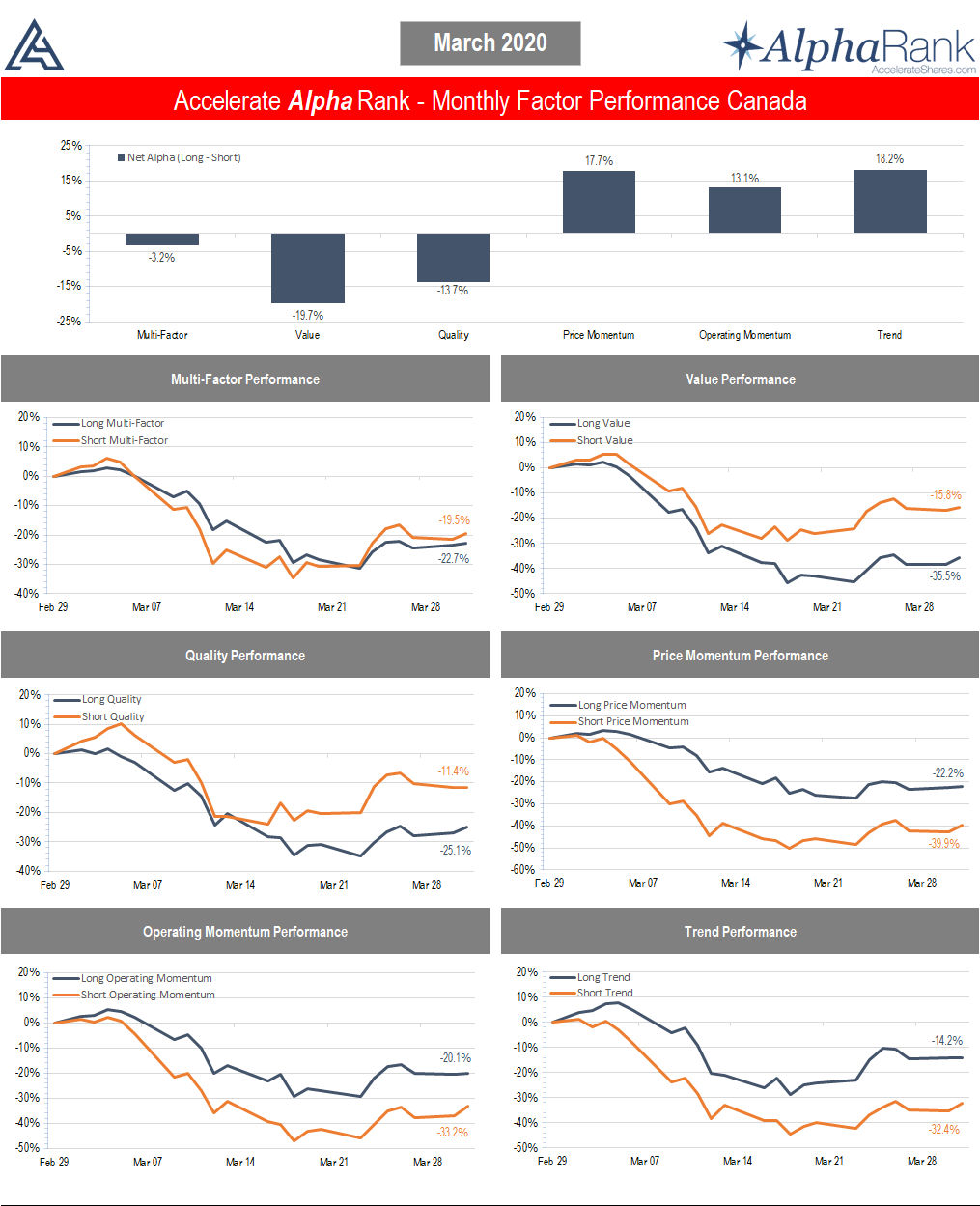

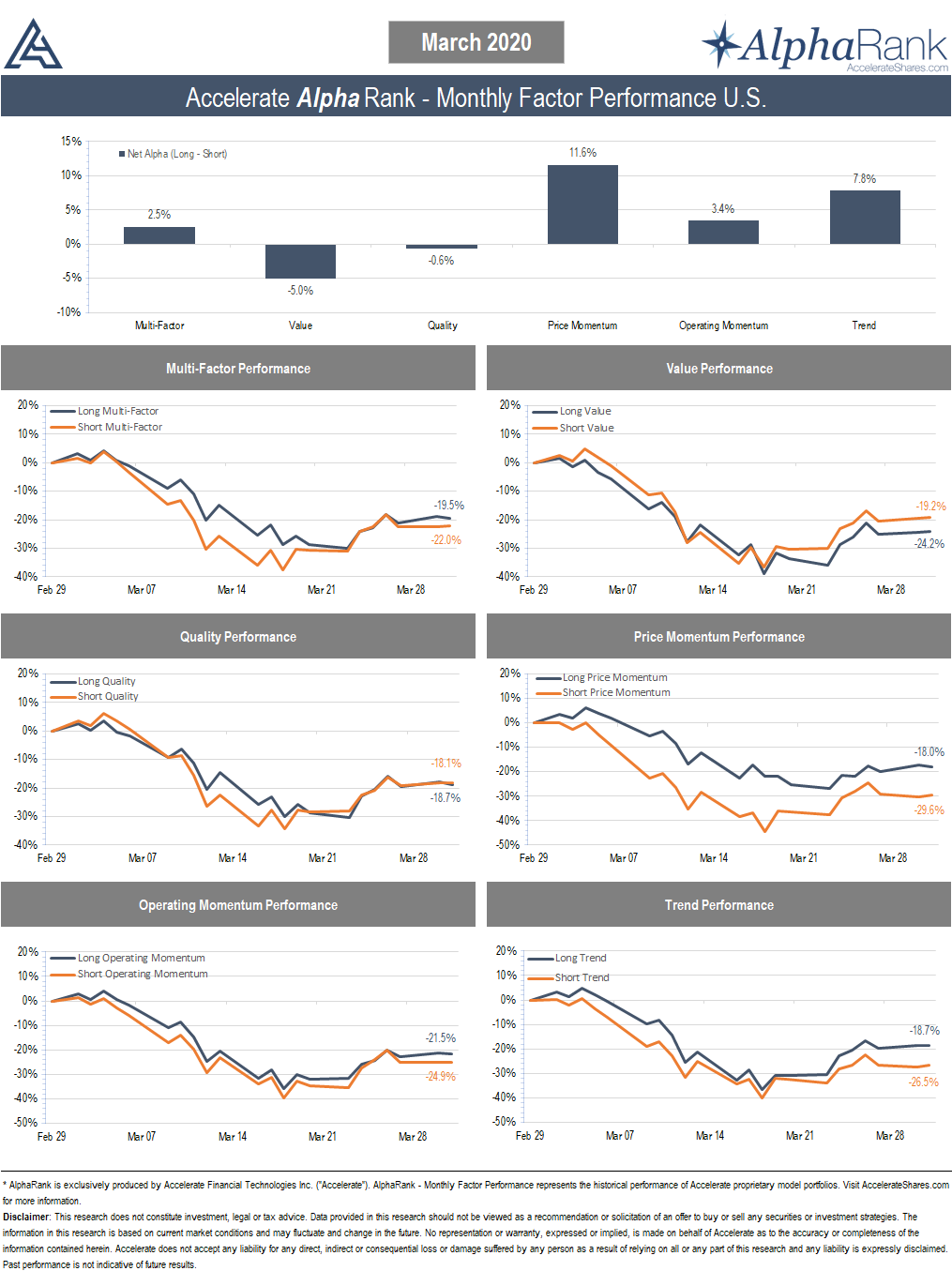

All things considered, long-short factor performance held up quite well amidst the unrivaled market volatility. The multi-factor long-short portfolio gained 2.5% in the U.S. and fell -3.2% in Canada.

Looking at Canadian factor performance for last month, I’ve never seen such a divergence. Value and quality were absolutely smoked, falling more than -13%, while price momentum, operating momentum and trend all surged, gaining more than 13%.

In the U.S., factor performance was directionally similar but less extreme. Value and quality fell by only -5.0% and -0.6%, while price momentum, operating momentum and trend only gained by 11.6%, 3.4% and 7.8%, respectively.

AlphaRank Factor Performance represents the daily historical performance of Accelerate’s proprietary model factor portfolios.