October 9, 2019 — The age-old adage “the trend is your friend until it ends” is an appropriate description of the market action that prevailed over the past few months.

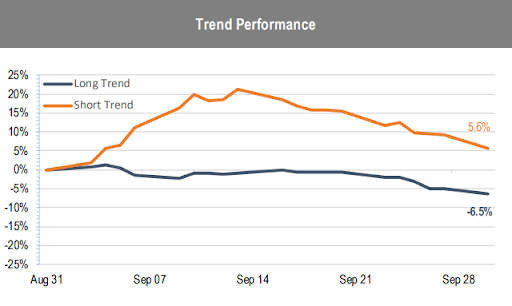

Until the end of August, the trend and price momentum factors (factors related to the price-action of securities) were having a banner year. These technical investment factors were adding alpha to multi-factor portfolios, largely from the short side. Stocks that were performing poorly continued to do so, fattening the wallets of short-sellers and hedge funds alike, that is until recently.

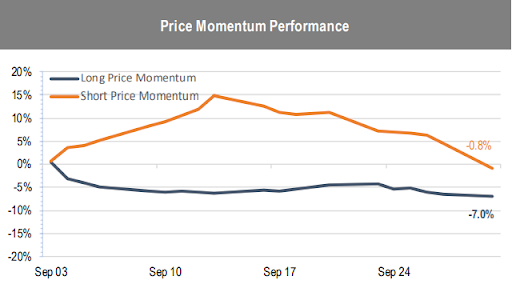

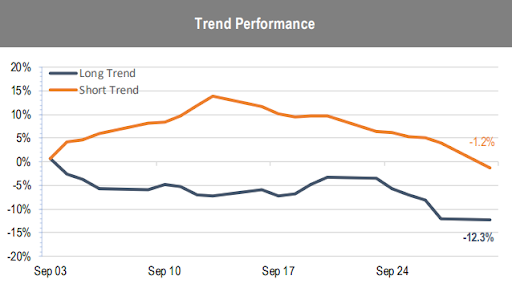

The price momentum factor along with its cousin trend were having a banner year until the start of September, when these long-short strategies went temporarily haywire and racked up losses for the month. The massive short squeeze on the short momentum and trend portfolios during September, along with the reversal of fortunes on the long-side of these portfolios, was one of the most important market events of the year.

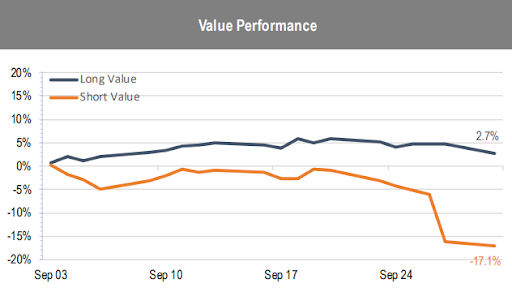

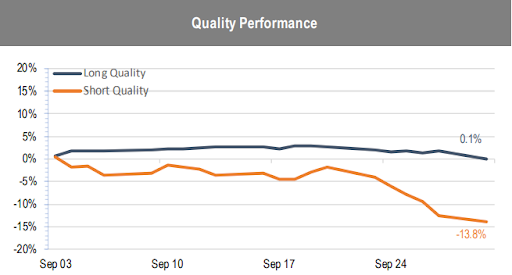

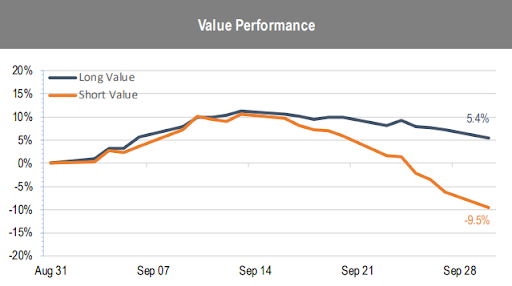

Another notable event during September was the performance of the value and quality factors. These former poster children of poor investment performance finally began pulling their respective weights and added substantial long-short outperformance throughout the month.

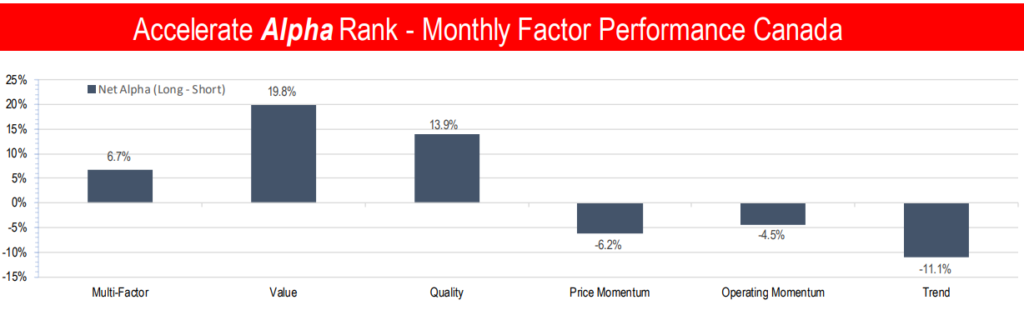

AlphaRank Canadian Stocks

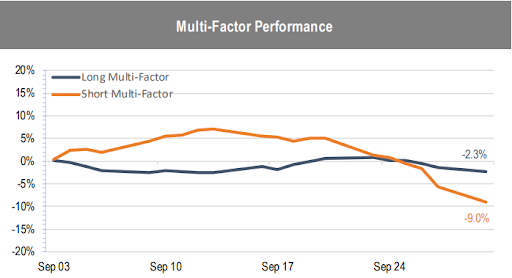

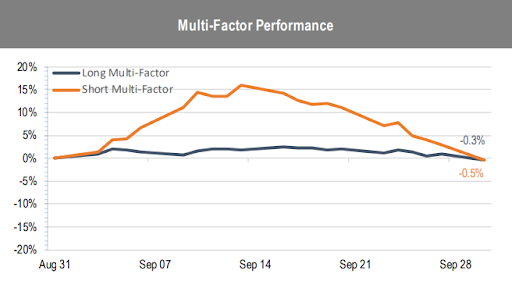

Despite the long-leg of the Canadian multi-factor portfolio falling -2.3% for the month, the long-short multi-factor portfolio generated 6.7% of alpha due to the plummeting value of the short portfolio. Note that a falling short portfolio is profitable for the hedge fund investor.

What’s noteworthy is the price action of the multi-factor short portfolio throughout September, as seen in the graph above. In the first two weeks of the month, the short portfolio staged a massive rally, rising 7% and putting the hurt on short-sellers and hedge funds. Meanwhile, the long portfolio fell -3%, inflicting more pain on long-short investors.

On September 19, 2019, I wrote “Live From the Trading Desk: The Great Short Squeeze of 2019” to document this highly unusual and painful price action of the short portfolio. Ironically, right after this analysis was published, the phenomenon completely reversed as the short portfolio dropped precipitously, falling from being up 5% mid-month to ending the month down -9%. This represented a -14% downdraft in about 10 trading sessions. The short-sellers who stayed in the trade throughout the pain were ultimately rewarded.

The Canadian long value and quality portfolios barely broke even for the month, rising 2.7% and 0.1% respectively. The real alpha came from the short side, with the short value portfolio (overvalued stocks) falling -17.1% and the short quality portfolio (low quality stocks) dropping -13.8%.

The long price momentum and trend portfolios were a bane on hedge funds’ existence in September. The best performing stocks over the past year, the long momentum portfolio, fell -7% in the month. The portfolio of stocks with the most positive trends fell an astounding -12.3%. Fortunately, the stunning short squeeze on the short portfolios was fully reversed by month’s end, mitigating some of the damage to the long-short portfolio.

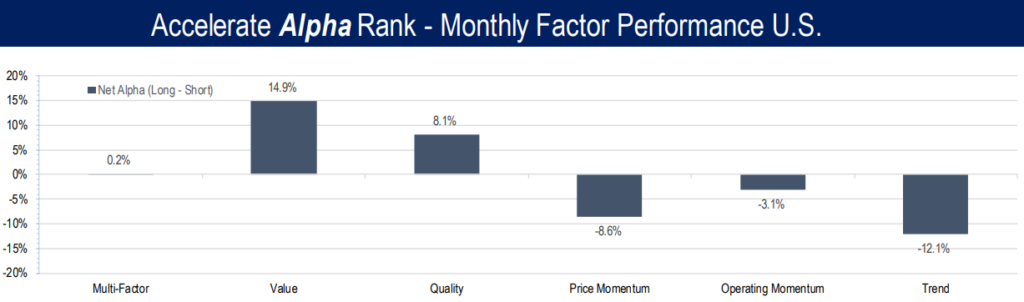

AlphaRank U.S. Stocks

The U.S. short multi-factor portfolio staged a stunning rally, a 15% rise which ultimately fizzled out, while the long multi-factor remained stuck in the mud. There was a lot of thrashing about during the month, but ultimately the mark-to-market losses suffered by hedge funds mid-month due to the short squeeze were largely reversed by month’s end.

The value factor absolutely crushed it in September, gaining 14.9% from the long-short portfolio. However, long-only value investors were not fully vindicated, given that two-thirds of the outperformance came from the short side of the trade. Nonetheless, it was a positive respite for hobbled value investors (if there are in fact any left).

Where long-short value investors profited, long-short trend investors got smoked as their portfolio dropped -12.1% in September due to an equal amount outperformance from the short portfolio and underperformance from the long portfolio (the exact opposite of what we want).

Tempest in a Teapot

What began as The Great Short Squeeze of 2019 ultimately fizzled out, all within the span of 20 trading sessions. After a brief but violent move upward for the short portfolios, they came down to earth just about as quickly. Now all is well in the world again. While many hedge fund investors may have experienced heart attacks by mid-month given the painful short squeeze, the quick reversal of the violent price action resulted in a tempest in a teapot.

Aside from the wild action in the short portfolios, it’s notable that value had an exceptional month, with both Canadian and U.S. long-short value portfolios clocking in double-digit gains. After much pain and suffering for value investors throughout much of this market cycle, many are wondering – is value back?

Stay tuned to find out.

-Julian