February 26, 2020 – In 1956, Warren Buffett started his hedge fund, the Buffett Partnership, after apprenticing under the tutelage of legendary value investor Ben Graham for a handful of years.

By 1969, a $100,000 investment into the Buffett Partnership would have grown to nearly $2 million. He earned approximately 25% annualized returns for investors while the Dow Jones Industrial Average returned only about 7.4% per year.

Not only did the Buffett Partnership earn substantially greater returns than the market averages, but it accomplished the feat while taking much less risk.

How did he do it? Well, Buffett famously had two rules when it came to investing:

“Rule No.1: Never lose money. Rule No. 2: Never forget rule No.1.”

He made the management of risk, as defined as the potential to lose money, his top priority. To accomplish the difficult task of generating market-beating returns while taking significantly less risk, Buffett had to use unconventional methods.

One investment strategy that Buffett implemented within this risk-management-first ethos was merger arbitrage.

In the 1988 Chairman’s letter to Berkshire Hathaway shareholders, Buffett wrote:

“In past reports we have told you that our insurance subsidiaries sometimes engage in arbitrage as an alternative to holding short-term cash equivalents. We prefer, of course, to make major long-term commitments, but we often have more cash than good ideas. At such times, arbitrage sometimes promises much greater returns than Treasury Bills…”

Merger arbitrage, an investment strategy that capitalizes on the spread between a company’s current share price and the consideration paid for its acquisition in the context of an announced merger transaction, is a strategy favoured by Buffett given its low-risk nature and low correlation to traditional asset classes. He views it as a great place to park cash and has generated exceptional returns for investors throughout his career with arbitrage.

Buffett isn’t the only investor to focus on risk management in his investment process. Famed investor John Paulson, the architect of “The Greatest Trade Ever”, said the following about running a merger arbitrage strategy:

“Risk arbitrage is not about making money, it’s about not losing money. If you can minimize the downside, you get to keep all your earnings and that helps performance.”

Never Lose Money

The popular Wall Street maxim states that there are old traders and there are bold traders, but there are very few old, bold traders. Nowhere does this saying hold more true than in merger arbitrage.

It is from a risk-management-first perspective in which a successful merger arbitrage strategy can be implemented. The goal isn’t to hit home runs; it is to hit singles. Small and steady wins over the short-to-medium-term can add up to consistently positive annual returns over the long-term.

Evaluating a Deal

The implementation of a merger arbitrage strategy requires a unique mix of analytical, quantitative and qualitative skills from a number of disciplines including business, law, international politics and game theory.

Experience is the best teacher, but in its absence, I’ll walk you through our process of managing a merger arbitrage book. We implement our merger arbitrage strategy as follows:

We start with a research funnel. Merger arbitrage is a high-turnover strategy with an average deal duration of approximately 3 months. To have a well-diversified portfolio (again, risk management first), an investor needs the largest opportunity set possible.

It is important to source all outstanding merger investment opportunities to put into the merger database, which is utilized to select merger securities for the portfolio. To make sure we source and analyze all available merger investment opportunities, we use the following sources: digital media (including news sources, trade publications, social media), proprietary data screens (Google, Bloomberg, stock exchanges) and sell-side desk reports.

Once a deal is publicly announced, we put it into our valuation model, which contains thousands of merger deals meticulously researched and analyzed over the past decade. The most critical documents that must be analyzed include the press release, the merger agreement and the proxy statement.

The press release of the merger contains the most important terms of the deal. These terms include:

- Which companies are involved in the deal?

- Who is the target and who is the acquiror?

- What is the nature of the deal?

- Is it friendly (board-supported) or unsolicited (hostile)?

- What is the type of consideration offered?

- Is it cash, stock, a mix of cash and stock, or other consideration including a special dividend, preferred shares, a spin-off, etc.?

- What is the value of the consideration offered?

- What is the structure of the transaction?

- Is it a merger, take-over, plan of arrangement, scheme of arrangement or amalgamation?

- Is the deal definitive of is it just a non-binding letter of intent or memorandum of understanding?

- Is the buyer strategic or financial?

- Is it a leveraged buyout?

- What is the premium over the unaffected price of the target?

- What is the size of the transaction?

- What is the strategic rationale?

- Is it accretive? Are there synergies?

- What is the expected timing of deal completion?

- Who is providing the financing, if applicable, and what are the terms?

- What are the major conditions of the deal?

- Who are the financial and legal advisors and are they reputable?

- Is there a go-shop provision?

- Was the deal the result of a review of strategic alternatives?

- Have any shareholders agreed to “lock-up” their shares and vote in favour of the deal?

Sometimes the target and the acquiror file a joint press release. If not, the press releases from both companies must be analyzed. Along with the press release, there is typically an accompanying 8-K along with a conference call and investor presentation which may contain incremental deal data that should be analyzed.

To start, we take this data, input it into the merger database and add a myriad of valuation metrics. These valuation metrics are used to conduct an analysis of the target’s valuation compared to its peers, along with analyzing precedent transactions in the sector with the goal of determining whether the price paid is fair. If the valuation seems low, then it could be indicative that a higher proposal in the form of a competing offer could be forthcoming.

After the press release, the merger agreement is filed. The merger agreement is a more fulsome document that provides additional details regarding the transaction that are not in the press release, including:

- Are there break fees for the buyer and / or seller?

- When is the termination date?

- What are all the deal conditions?

- Is the financing committed?

Usually, within a few weeks of the deal announcement, the proxy circular for the transaction is released. This document is required to stage a shareholder vote or conduct a tender offer for the deal. It contains further incremental information, such as the background negotiations of how the deal came to fruition. It may also include an updated estimated deal completion date.

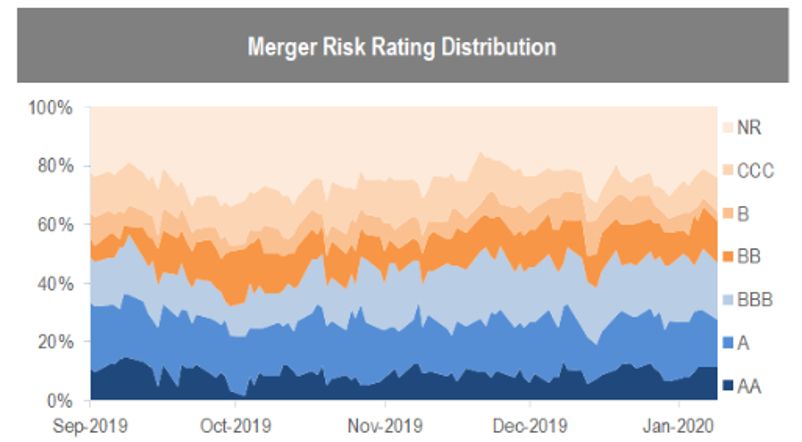

Once the deal is in the merger database, we assign a proprietary AlphaRank risk rating to each merger transaction. A rating of AA denotes the highest quality deal with minimal conditions and a reputable buyer. The lowest rating of CCC denotes a low-quality deal with a major potential issue, such as significant regulatory hurdles or potential financing issues.

Source: Accelerate

Historically, 50% of friendly merger deals are rated BBB or higher, which would be deemed “investment grade”. Risk ratings, along with the notion of investment grade or speculative grade rankings, will be used in evaluating a deal and sizing the position within the portfolio.

Merger transactions typically fail for one of five reasons: a block by antitrust regulators, a block by foreign investment regulators, a financing failure, a shareholder vote failure or the buyer gets cold feet. Accordingly, once all the initial deal data is in the database from the myriad of materials that were released, the following additional analysis is conducted:

- Are there potential antitrust issues?

- A deal can be blocked by the Competition Bureau in Canada or either the Federal Trade Commission or Department of Justice in the U.S. if there are concerns that the deal could substantially lessen competition.

- Are there potential foreign investment issues?

- A deal in which the acquiring company is non-domestic can be blocked by the Department of Innovation, Science and Economic Development Canada or the Committee on Foreign Investment in the United States if the acquisition brings up national security concerns.

- Are there potential financing issues?

- A deal can fail if third-party financing gets pulled.

- Are there potential shareholder issues?

- A deal can fail if a large or controlling shareholders vote against it.

As for the buyer getting cold feet and walking from the deal, which may accompany lawsuits and a lengthy trial, it is important to continuously monitor the acquiror, the target, the sector and the broad market and economy for any hint of additional risk. For example, for a deal in the gold mining sector, one should monitor the price of the precious metal as a swoon in the commodity price could increase the risk of the buyer walking away.

Conversely, in terms of a higher consideration offered, either by the initial acquiror or a competing interloper to the transaction, abnormally good fundamental results or a re-rating of the sector can bring about this positive development.

Once all the deal data is collected, analyzed and input into the model, there are two key quantitative factors to calculate including the merger yield and the implied odds of success.

The merger yield is the estimated annualized return provided by the merger spread. To calculate this figure, take the current net spread as represented by the percent discount the target stock is trading at compared to the consideration offered and annualize it. The net spread is calculated as the gross spread adjusted for various items such as dividends, commissions and short borrow costs.

Merger Consideration = Cash Consideration + (Exchange Ratio x Acquiror Share Price) + Net Dividends

Net Spread = Merger Consideration – Current Share Price – Trading Commission – Short Borrow Cost

Merger Yield = (1 + Net Spread / Current Share Price) (365 / Days Until Completion) -1

The main determinant when evaluating whether to allocate capital to a merger arbitrage investment includes:

- Is the merger yield attractive?

- Does it exceed the investor’s cost of capital?

Once the merger yield is determined, we calculate the merger’s implied odds of success.

The following equations layout the calculation of upside, downside and the resulting implied odds of success:

Upside = Merger Consideration – Current Share Price

Downside = Current Share Price – Unaffected Share Price

Odds of Success = Downside / (Upside + Downside)

A merger’s odds of success is a determinant of its risk rating, as defined below.

The risk rating is utilized to drive capital allocation and position sizing, with higher-rated deals garnering larger allocations and lower-rated deals getting low or no allocations.

| Risk Rating | Definition |

| AA | A merger arbitrage rated ‘AA’ has the highest rating assigned by AlphaRank. The merger has the highest probability of closing. |

| A | A merger arbitrage rated ‘A’ differs from the highest-rated mergers only by a small degree. The merger has a very high probability of closing. |

| BBB | A merger arbitrage rated ‘BBB’ is of investment grade and has a high probability of closing. |

| BB | A merger arbitrage rated ‘BB’ is somewhat speculative in nature and has a greater than 90% probability of closing. |

| B | A merger arbitrage rated ‘B’ is speculative in nature and has a greater than 85% probability of closing. |

| CCC | A merger arbitrage rated ‘CCC’ is very speculative in nature. The merger is subject to certain conditions that may not be satisfied. |

| NR (not rated) | A merger rated NR is trading either at a premium to the implied consideration or a discount to the unaffected price. |

Managing Risk Before Allocating

It has been well-established that the most important consideration when running a merger arbitrage strategy is the management of risk. That being said, there is a risk-mitigation checklist that we go through that helps us to appropriately manage risk. The following are reasons to pass on a merger arbitrage investment:

- Does the buyer lack credibility?

- If a buyer has walked from a deal before or doesn’t have the funds to pay for the acquisition, it’s an easy pass.

- Does the financing source lack credibility?

- If it is difficult to discern where exactly the money to pay for the acquisition comes from, stay away.

- Is the deal non-definitive?

- Too many non-definitive deals fall apart, so don’t get involved until it is definitive.

- Hostile deals can introduce market beta into the return stream, so be careful with these.

- Is the regulatory risk too great?

- Some complex antitrust cases present odds no better than a coin flip. Don’t rely on luck.

- Is there a buy-side vote?

- If the acquiror requires its shareholders to approve a deal, immediately pass on the potential merger investment. This is because a buy-side vote puts the acquiror in play (i.e. it makes the acquiror a potential target). For example, if a company is issuing a material amount of shares to pay for an acquisition, it is required to seek shareholder approval. This shareholder approval allows a would-be hostile interloper to pounce and offer to buy the acquiror at a premium. This is a sure-fire way to break the original merger transaction, as shareholders would vote against the original proposed deal to get the premium consideration from the hostile interloper instead, which forces the acquiror’s board of directors to agree to the would-be acquiror’s acquisition by the hostile interloper.

- This situation leads to the arbitrageur’s worst case scenario. Not only will their long target investment plummet given the deal failed, but their short acquiror hedge will skyrocket due to the interloper’s premium bid. I have seen too many arbs get hit on this scenario (myself included).

- If the acquiror requires its shareholders to approve a deal, immediately pass on the potential merger investment. This is because a buy-side vote puts the acquiror in play (i.e. it makes the acquiror a potential target). For example, if a company is issuing a material amount of shares to pay for an acquisition, it is required to seek shareholder approval. This shareholder approval allows a would-be hostile interloper to pounce and offer to buy the acquiror at a premium. This is a sure-fire way to break the original merger transaction, as shareholders would vote against the original proposed deal to get the premium consideration from the hostile interloper instead, which forces the acquiror’s board of directors to agree to the would-be acquiror’s acquisition by the hostile interloper.

Position Sizing and Portfolio Management

Every so often, a deal will break, irrespective of the risk-mitigation checklist one goes through and prudence exercised prior to investing. This is just part of the process when running a well-diversified merger arb book. It is somewhat analogous to running a fixed income portfolio – one will generally have the odd default within a portfolio. The key lies in managing this risk prior to the deal breaking.

The main way to manage deal-break risk, in addition to the risk mitigation checklist, is through position sizing and diversification. The way that we control for this potential downside risk is to select position sizing to limit the risk of loss on a deal break to a -2% decline of the portfolio’s net asset value. For example, if a deal as ⅓ downside in a deal-break scenario, its maximum position in the portfolio would be 6% given that if the deal fails, the maximum loss to the portfolio would be -2%.

We also look at the proprietary AlphaRank deal rating when allocating position sizes. Riskier deals, ranked BB or lower, will be smaller portions of the portfolio.

In order to judge the downside risk of a position, it helps to start with the stock’s unaffected price prior to the deal announcement. From this, we can generate an estimate of a potential deal-break price based on comparable companies and sector performance, along with the target company’s fundamental performance.

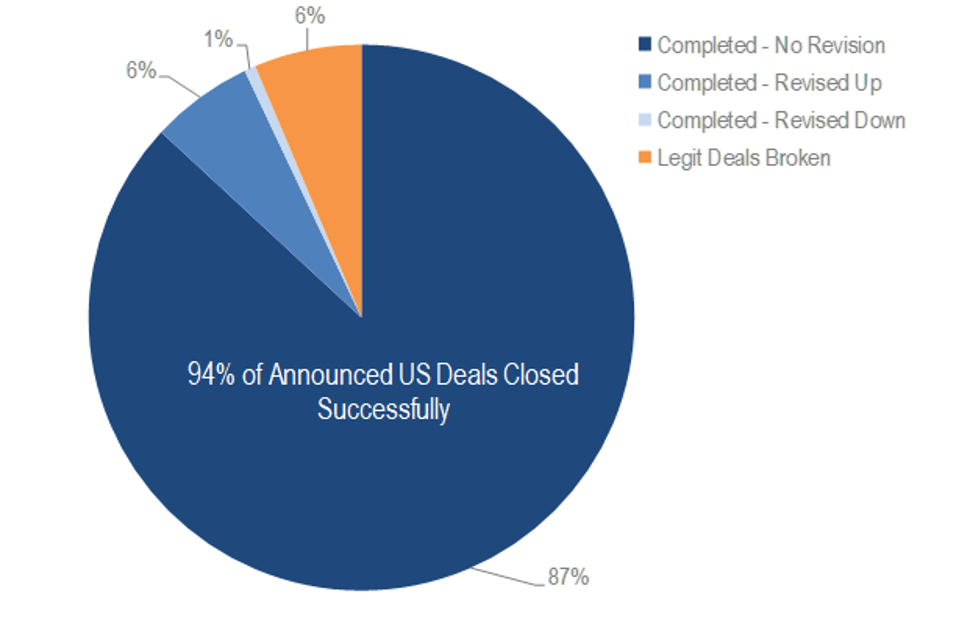

Historically, 6% of merger deals have failed. Conversely, 6% of merger deals have had the consideration revised upward, either via an overbid from an interloper or a bump in price from the initial acquiror. So, if an arbitrageur were to invest in 50 deals a year, they should expect three deals to break, causing losses. However, statistics indicate that they should also expect price increases on three deals, somewhat mitigating the effects of the losses from broken deals.

Merger arbitrage is typically run on a leveraged basis given its low-risk nature. Leverage enhances returns, but also increases risk. How much leverage an arbitrageur employs depends on what they, and their investors, are comfortable with. Personally, I believe the sweet spot is gross exposure (longs + shorts) of 150% – 200%. For example, our current reference portfolio is 154% long and 28% short (126% net and 182% gross). Gross exposure will meander with the opportunity set, depending on the quantity and attractiveness of outstanding mergers.

Sector and deal-type diversification is necessary as well. One does not want to allocate too much to any one sector, lest they face increased cyclical or regulatory risks. In addition, limiting exposure to leveraged buyouts is prudent given their cyclicality and exposure to credit markets.

Maximum position sizes help keep an arbitrageur out of trouble. The primary goal of arbitrage is to live to fight another day.

Merger Arbitrage Trading

Once a merger is publicly announced, its data is input into the database, its risks evaluated and its position sizing determined, it is time to trade the merger security.

Typically, merger arbitrage is conducted on a company’s common shares. However, there may be other opportunities to earn a merger spread, including through a company’s preferred shares or bonds, or also through derivative securities such as options or warrants. Each security should be analyzed to determine which presents the highest risk-adjusted return.

If one is trading the common shares of a target in an all-cash deal, then the trade is fairly simple. The trader places their bid for the target at the desired price and waits to get hit.

If the deal includes stock consideration, then it gets more complicated. First, short borrow must be secured in order to short the acquiror’s stock. If borrow is prohibitively expensive or unavailable, then pass on the deal. It would be disastrous to have the short borrow recalled prior to a deal closing, which could cause an arbitrageur to be forced to cover the short position into a potential short squeeze.

Once short borrow has been secured, a trader can set up the spread. To implement this type of trade, one should use a pair trader. The way a pair trader works is that it trades both legs of a merger arbitrage spread, being the target and acquiror, at the same time. The trader sets the desired merger spread into the pair trading system, based on the merger consideration, and gets filled on both legs long and short. For example, if Company A buys company T for two A shares per T share, one would set their pair trader to short sell 200 Company A shares for each 100 Company T shares bought. Trading the respective paired securities with as little lag time as possible is ideal, so speed is imperative.

Bringing Home the Bacon

Once the deal terms have been analyzed, the deal checklist reviewed, the risks mitigated, the position sized appropriately and the merger traded successfully, an arbs work isn’t done.

At this point, an arbitrageur is in monitor-mode as they wait for the deal conditions to be satisfied. However, it is not on cruise control. If the transaction is structured as a tender offer or a takeover bid, then a shareholder must tender their shares in order to be paid the consideration. If the transaction is structured as a merger or plan of arrangement, then a shareholder should vote and elect the consideration (cash or shares) where applicable.

In terms of monitoring ongoing developments, all press releases, quarterly reports along with company and sector media coverage should be continuously monitored. In addition, all regulatory, financing and market activities should be closely followed.

As the deal progresses along its timeline, various conditions of the deal get satisfied. Typical hurdles that need to be cleared prior to completion include the shareholder vote and regulatory approval. A transaction can close in as quickly as 45 days under a tender offer or multiple years under a merger with complex regulatory risk.

Once all conditions have been satisfied and the deal closes, the arbitrageur gets paid the consideration. If it’s a cash deal, the funds show up in the account. If it’s a share consideration, then the acquiror’s shares cover the short position from the arbitrage trade and the spread is earned.

Never Forget Rule #1

Buffett’s first rule of investing is to never lose money. From an arbitrageur’s perspective, this rule is paramount. The goal of a merger arbitrage is to generate low-risk, consistent returns, not beat the S&P 500.

Warren Buffett’s long-time business partner Charlie Munger once stated how “it is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent.”

To run a successful merger arbitrage strategy, keep risk management as the top priority. Instead of being too clever by half, focus on not doing anything stupid. Worry about the downside and the upside will take care of itself.