February 19, 2019 – Warren Buffett and his business partner Charlie Munger became billionaires through stock market investing. The long-time business partners heading up the investment conglomerate Berkshire Hathaway have generated market-beating returns for many decades utilizing their value + quality investing mantra to invest in companies with sustainable competitive advantages (ie. “moats”) at attractive prices.

Unsurprisingly, their investment success has been heavily replicated over the years. In 1986, 1,000 people attended Berkshire Hathaway’s annual meeting (the so-called “Woodstock for Capitalists”). In 2017, over 42,000 people attended the event. Warren Buffett’s annual letter to shareholders, released each February, is read by thousands or even millions of investors. Every move Berkshire makes is dissected by countless analysts and market pundits. Google “Warren Buffett” and you’ll get 28.6 million results. A search for “Berkshire Hathaway” nets 45.4 million. Warren and Charlie’s investment process has been meticulously analyzed and detailed in a myriad of books, studies, blog posts and articles.

Basically, Warren Buffett is the Bret Hart of investing – “The Best There Is, the Best There Was, the Best There Ever Will Be”.

According to Berkshire’s 2017 annual report, its stock has compounded at 20.9% annually since 1965 for a total gain of 2,404,748%. Over that timeframe, the S&P 500 has compounded at 9.9% for a total gain of 15,508%. Clearly, their investment technique works and it works exceptionally well!

Since inception, Berkshire has handily outperformed the S&P 500 over any 10-year timeframe, that is until recently.

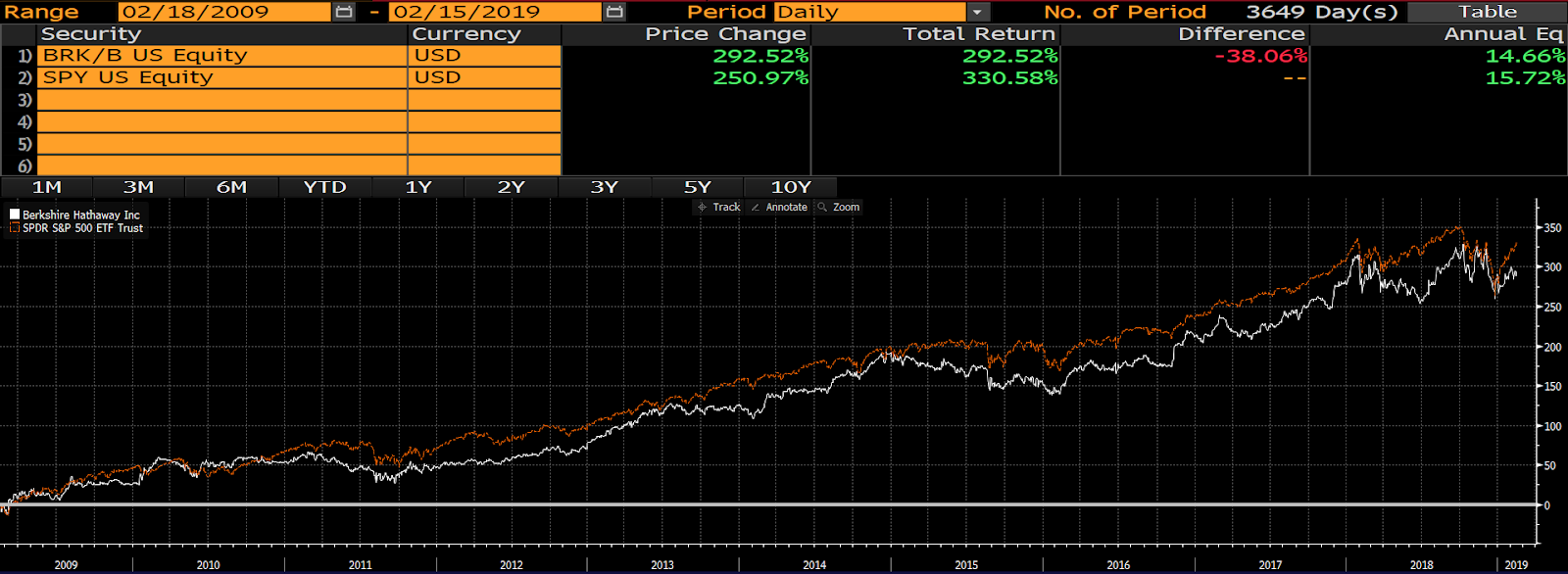

From February 2009 to present, Berkshire had a 292.5% total return. It was beaten by the S&P 500 ETF, which returned 330.6% over the past 10 years.

Source: Bloomberg

Berkshire failed to even beat the broad stock market index over the past decade, which it used to do with ease.

What happened?

Did Warren and Charlie lose their touch?

Did Berkshire grow too big?

Did their investment methods stop outperforming?

When an investment methodology, such as Berkshire’s value + quality strategy, gets replicated by too many copycats, it tends to stop working. While the size of Berkshire certainly is a limiting factor in its outperformance, no doubt when too many other investors began mimicking Berkshire’s investment process, its outperformance began to decline.

The always delightful Charlie Munger addressed this notion recently in the Wall Street Journal:

‘The money managers among them are “like a bunch of cod fishermen after all the cod’s been overfished… They don’t catch a lot of cod, but they keep on fishing in the same waters. That’s what’s happened to all these value investors. Maybe they should move to where the fish are.”’

-Berkshire Hathaway Vice Chairman Charlie Munger

There are hundreds of thousands of Buffett-wannabees. So many such that Berkshire’s investment strategy has become heavily overfished by keen copycat analysts hoping to create the second-coming of Berkshire.

So what’s an investor to do? Clearly, copying a heavily replicated strategy is not the answer. It’s good to be influenced by great investors and study their methodologies and techniques, but ultimately, to find success in investing an investor must find his or her own style.

Buffett’s “three I’s” expresses this idea succinctly: First come the innovators, who create something unique and novel. Then come the imitators, who seek to copy the innovators. Finally come the idiots, whose greed tends to ruin what the innovators created.

Whether it be investing, business or any other pursuit, to truly find astounding success, one must be unique in their approach.

Be an innovator.

-Julian