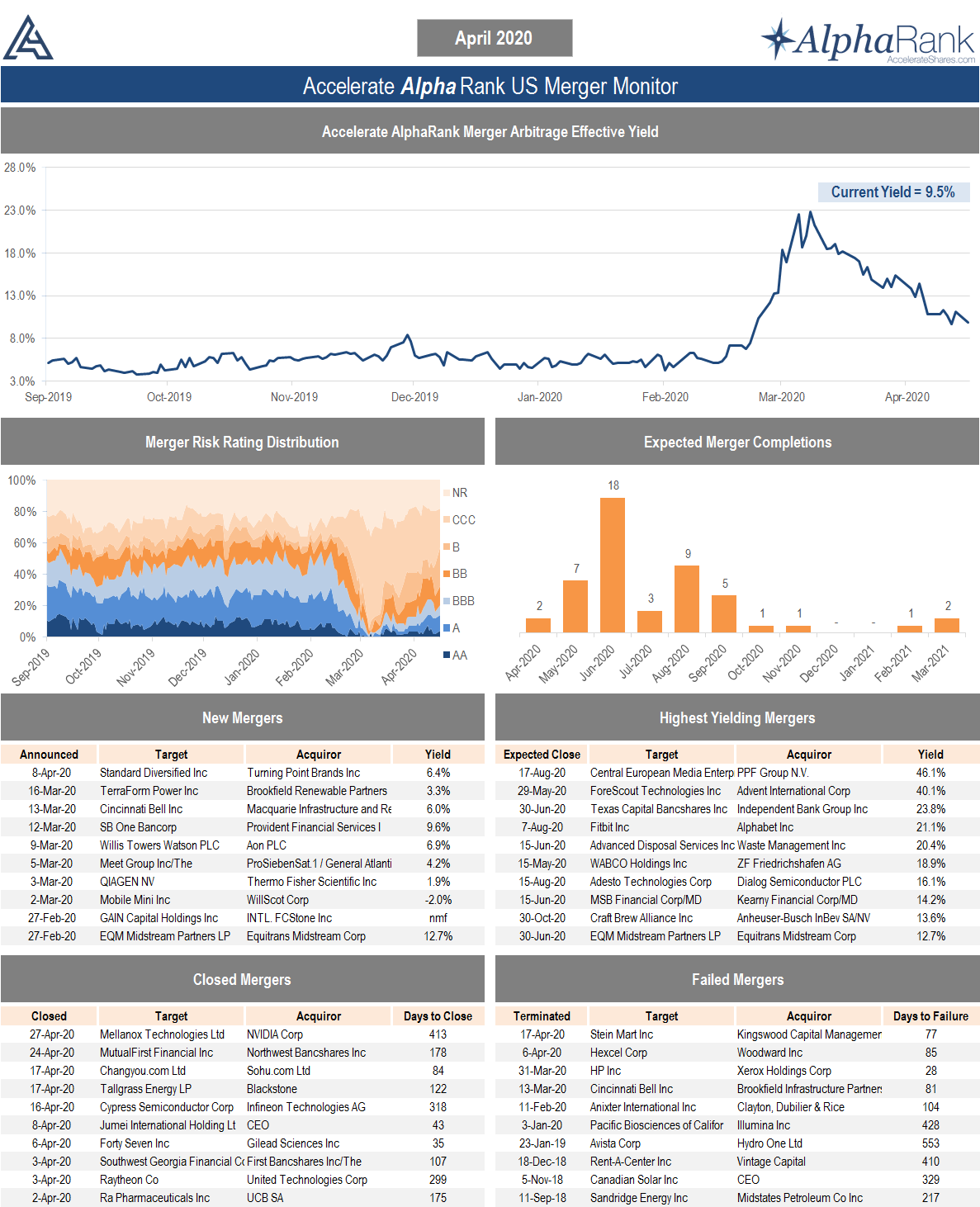

April 28, 2020— In last month’s Special Edition of the AlphaRank Merger Monitor, the opportunity set was so attractive that I called it “the most fruitful environment for merger arbitrage in my investment career,” and “the opportunity set in merger arbitrage is incredible and presents a generational buying opportunity, perhaps even greater than of 2008-2009.”

Five weeks later, that call was proven prescient. At the time, the market was pricing in pandemonium and a world-is-ending dynamic into merger arbitrage spreads, with the average implied probability of closing of just 60% and an average merger yield of 23%. This dire prediction by market participants did not come to pass, and merger arbitrage investors were rewarded handsomely as many deals closed on the terms and few were terminated.

Since the coronavirus market panic began in late February, 34 public M&A deals have closed in North America while only three failed (including one hostile deal which was shaky even prior to COVID-19). Zero deals have been repriced lower and one deal was repriced higher. Over the past two months, the success rate of public mergers has been 92%, slightly lower than the 94% historical average, but significantly higher than the 60% that the market was pricing in during the market trough last month.

Over $160 billion of public M&A transactions closed in April, including T-Mobile’s $59 billion acquisition of Sprint, United Technologies’ $57 billion merger with Raytheon, Infineon’s $10 billion all-cash acquisition of Cypress Semiconductor and NVIDIA’s $6.9 billion acquisition of Mellanox Technologies, amongst others.

Blackstone closed its $10 billion acquisition of Tallgrass Energy, whose share price was signalling a guaranteed deal-break in March, indicating that even financial buyers remain committed to closing definitive agreements. Tallgrass shares traded as low as $10.93 last month, providing enterprising investors the opportunity to earn more than a 100% return in one month if held to the $22.45 closing deal price. A similar dynamic was found in the small-cap go-private for Strad, whose shares traded as low as $1.05 in March, only to see the deal close at $2.40 a few weeks later.

While the coronavirus market panic has provided some exceptional investment opportunities, one drawback from a capital markets perspective is the slowdown in deal announcements. Corporations remain gun-shy with respect to M&A as they focus on their own operations, which have been significantly disrupted for many businesses. In April to-date, only two small deals have been announced, compared to five deals announcements in April of last year.

While merger spreads have tightened dramatically over the past month and the average yield has decreased from a record 23% to about 10%, the current average yield is still roughly double of that in February. The opportunity set for investors in merger arbitrage remains exceptional.

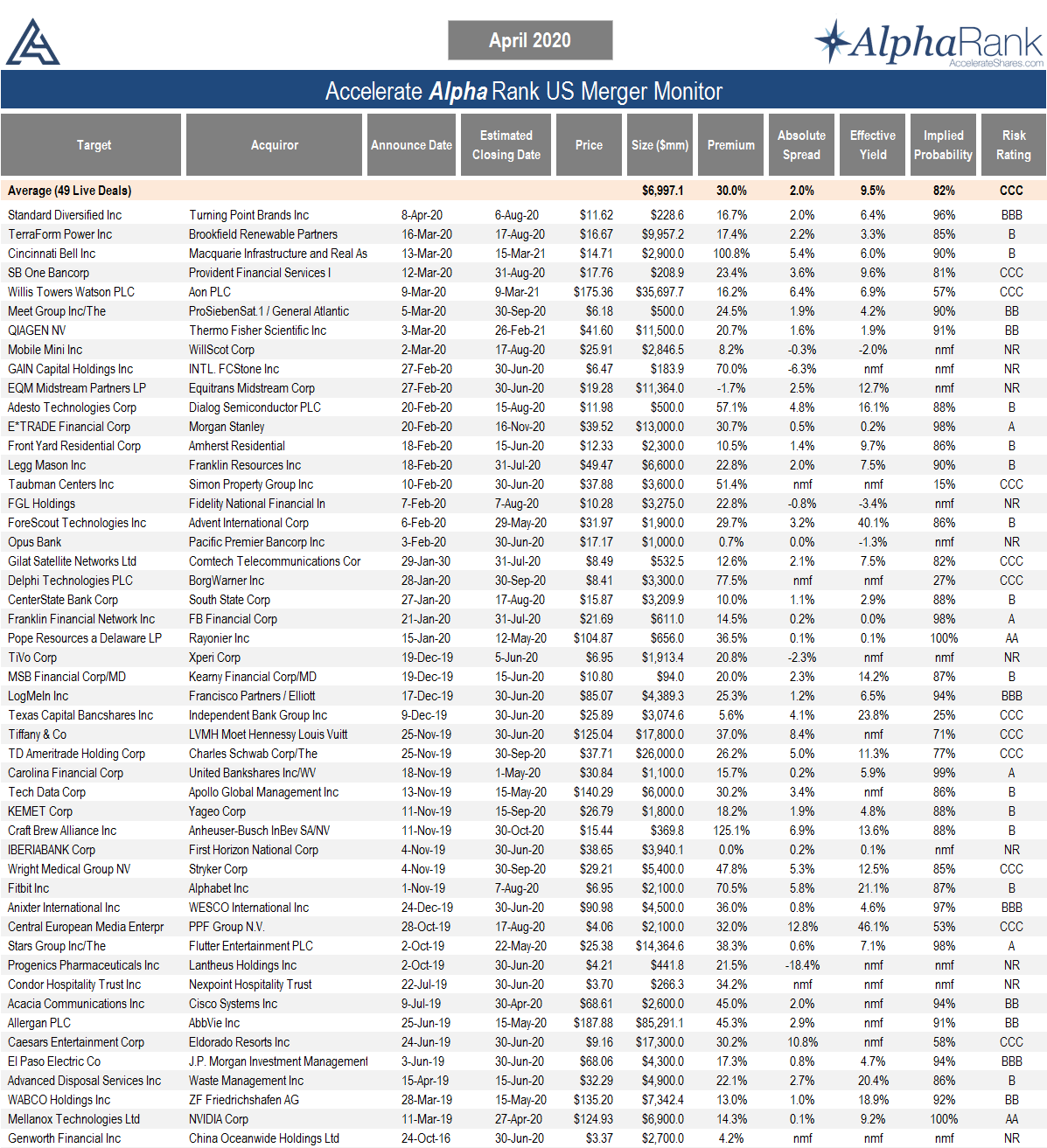

The below AlphaRank Merger Monitor represents Accelerate’s proprietary analytics database on all announced liquid U.S. mergers. The AlphaRank Merger Arbitrage Effective Yield represents the average annualized return of all outstanding merger arbitrage spreads and is typically viewed as an alternative to fixed income yield.

Each individual merger is assigned a risk rating:

- AA – a merger arbitrage rated ‘AA’ has the highest rating assigned by AlphaRank. The merger has the highest probability of closing.

- A – a merger arbitrage rated ‘A’ differs from the highest-rated mergers only by a small degree. The merger has a very high probability of closing.

- BBB – a merger arbitrage rated ‘BBB’ is of investment grade and has a high probability of closing.

- BB – a merger arbitrage rated ‘BB’ is somewhat speculative in nature and has a greater than 90% probability of closing.

- B – a merger arbitrage rated ‘B’ is speculative in nature and has a greater than 85% probability of closing.

- CCC – a merger arbitrage rated ‘CCC’ is very speculative in nature. The merger is subject to certain conditions that may not be satisfied.

- NR – a merger rated NR is trading either at a premium to the implied consideration or a discount to the unaffected price.

The AlphaRank merger analytics database is utilized in running Accelerate’s merger arbitrage investment strategy.

* AlphaRank is exclusively produced by Accelerate Financial Technologies Inc. (“Accelerate”). Visit AccelerateShares.com for more information.