March 22, 2025 – Walter Wriston was the Chairman and CEO of Citicorp from 1967 to 1984 and was regarded as the most influential banker of his time. Wriston played a major role in shaping the modern U.S. banking system, which is inextricably linked to the global economy. He often clashed with regulators and policymakers over capital controls and bureaucracy, arguing that markets would find a way around them.

“Capital goes where it’s welcome and stays where it’s well treated”, a quote attributed to Wriston, is one of the most famous axioms in modern finance. It alludes to the idea that investors and businesses deploy money in countries that allow foreign investment, have transparent rules, and offer economic opportunity. Capital remains invested in places where it is protected by law, respected by policy, and allowed to earn a fair return – meaning low corruption, strong property rights, stable institutions, and investor-friendly regulations. The quote explains why investors might pull out of a country after policy changes, such as capital controls, expropriation, tax hikes, or tariffs.

Capital is the life blood of an economy, and countries should implement policies to welcome it with open arms.

However, policy uncertainty, combined with rapid implementation of tariffs, should be expected to chase capital away.

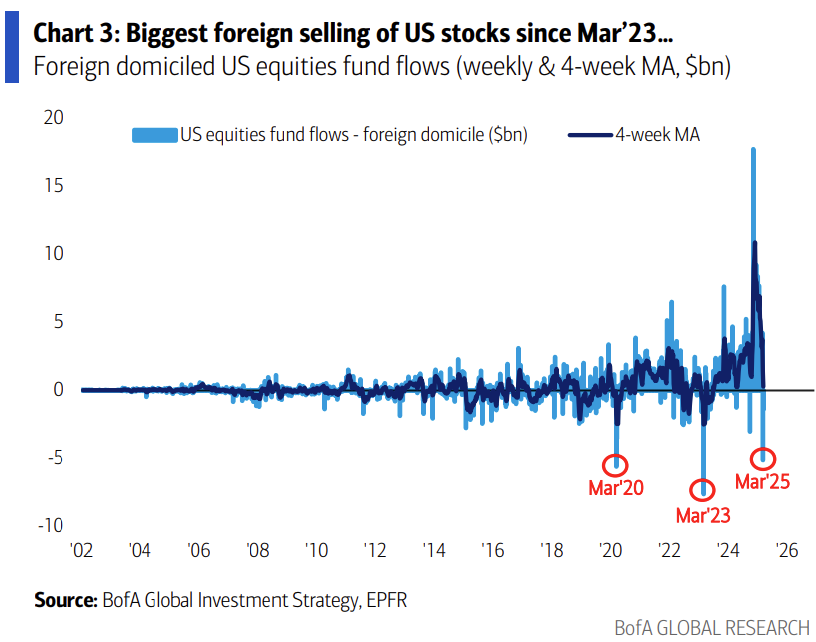

Therefore, it is unsurprising that investors have begun to flee the U.S. equity market. Foreign domiciled capital flows in and out of the U.S. have turned negative, reaching their highest net outflows since March 2023.

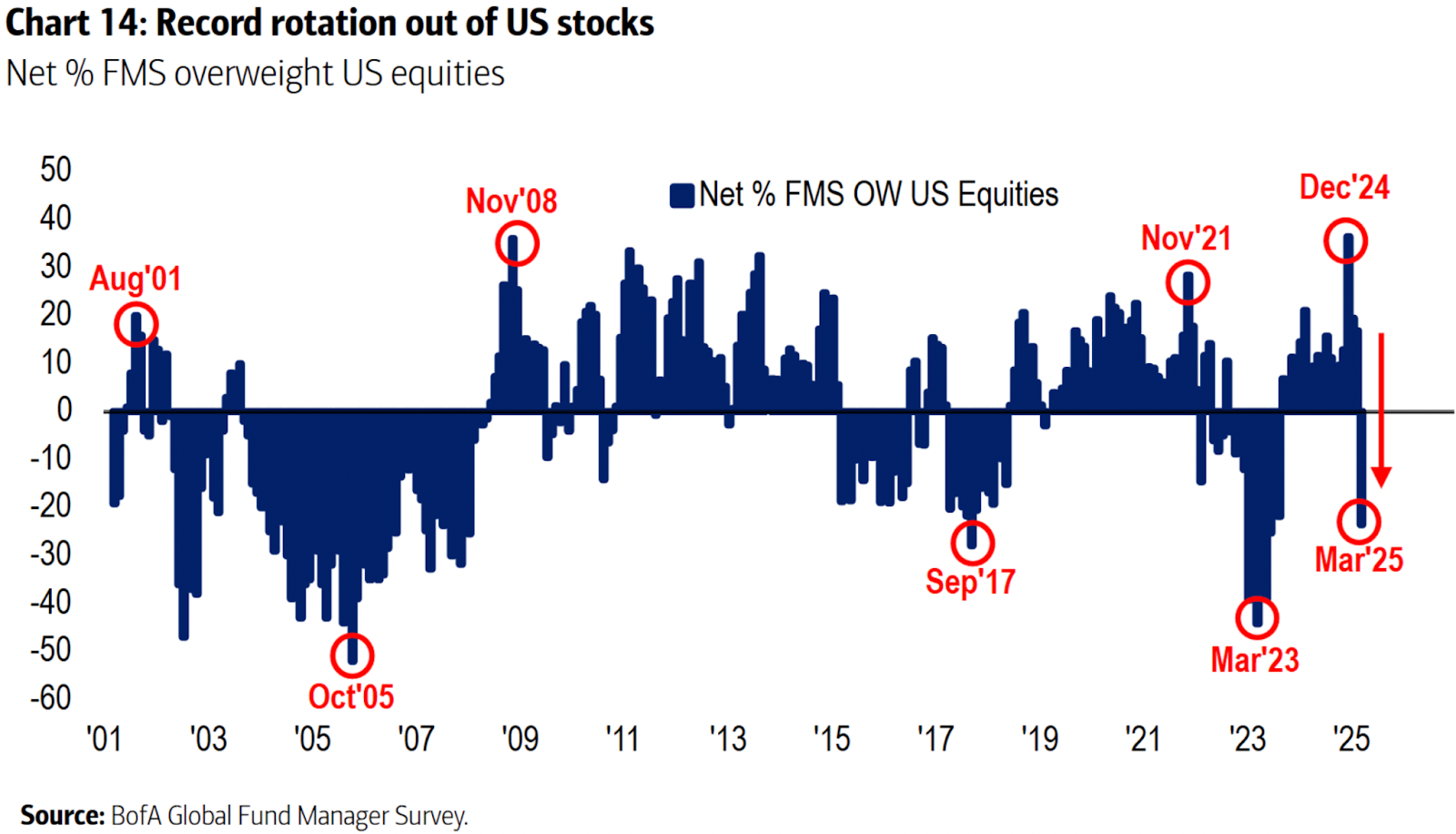

The Bank of America Global Fund Manager Survey (FMS) is a widely followed monthly survey that gathers the views of institutional fund managers managing hundreds of billions in assets. It is considered a key barometer of investor sentiment and positioning, reflecting what professional investors are thinking and doing.

Policy uncertainty has taken its toll on allocator confidence. Fund managers are now net underweight U.S. equities for the first time since March 2023.

Amidst the chaos, allocators have found foreign markets to be more welcoming. Not only do international markets offer lower valuations and less economic uncertainty, but they have been implementing economic policies to welcome foreign capital and treat it well. For example, Germany recently approved a blockbuster €1 trillion spending package to boost civilian and defence investments. This plan aims to strengthen the economy and reduce reliance on external military support, marking a significant shift from previous fiscal discipline. The package includes a €500 billion fund dedicated to infrastructure investment, signaling a commitment to long-term economic growth and sustainability.

In addition, European financial leaders have advocated for substantial reforms to enhance long-term investment in European companies. Initiatives include reducing barriers to investment, improving competitiveness, and encouraging the mobilization of considerable household savings into productive investments.

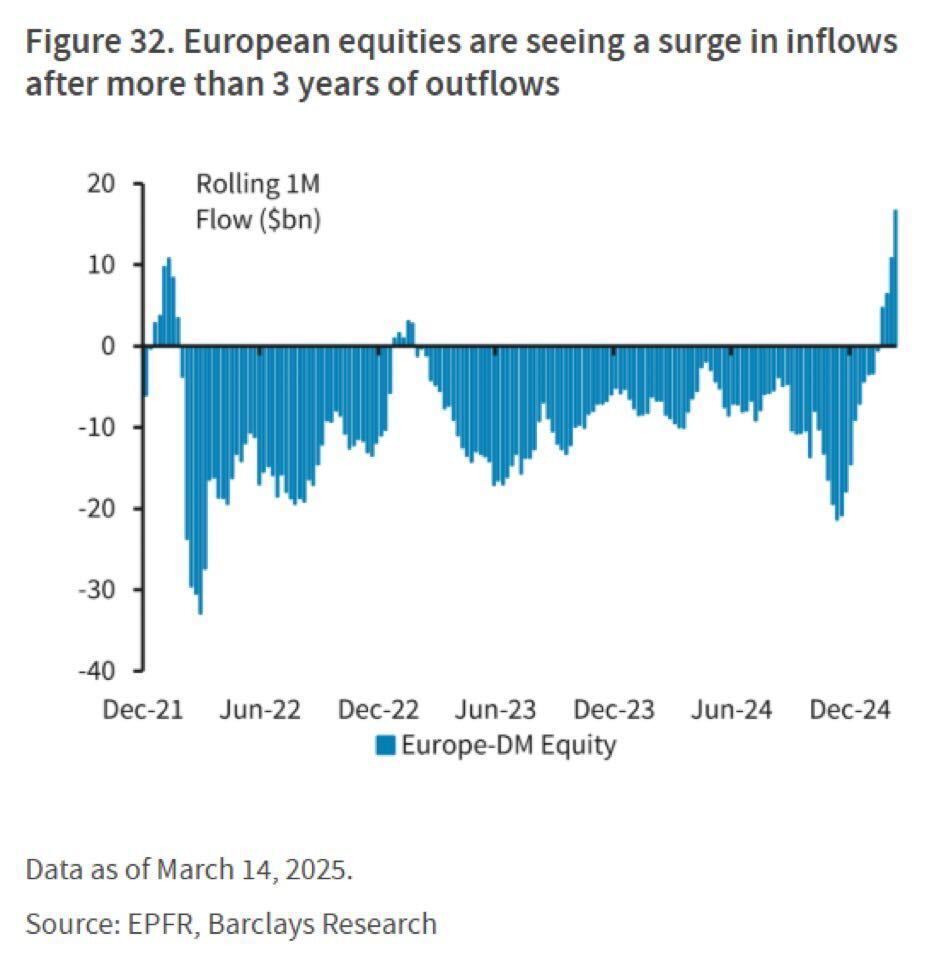

European equity markets, such as Germany’s DAX index, have outperformed the S&P 500 this year. Investors have dumped American stocks in favour of European stocks, which are less exposed to the impact of the Trump administration’s tariffs and volatile economic policies.

Unsurprisingly, equity flows into Europe have turned positive for the first time in three years, as investors seek greener pastures for their capital. While the U.S. economic approach remains volatile and uncertain, which is expected in a “policy by Tweet” environment in which tariffs can be on again and then off again within hours, we expect allocators to continue to seek opportunities outside of the market that has treated them so well for so long.

That said, one needn’t to throw the baby out with the bath water. There remain world-class businesses in the U.S. that will likely generate significant returns for investors irrespective of the chaos happening in Washington. In addition, there will be stocks that will get the short end of the stick as capital flees, leading to equity market underperformance and creating opportunities for short sellers.

Given the policy uncertainty and wider variance of expected stock market outcomes over the near to medium term as fund flows turn from positive to negative, investors may want to take a hedged equity approach. To facilitate idea generation, we highlight one top-decile stock that is forecast to outperform and one bottom-decile stock that is forecast to underperform in this month’s AlphaRank Top Stocks.

OUTPERFORM: Autozone Inc (NYSE: AZO) is the leading retailer and distributor of automotive replacement parts and accessories in the U.S., with a growing presence in Mexico and Brazil. It is a shareholder-friendly business that is popular name among enterprising investors due to its strong fundamentals, defensive characteristics, and consistent performance. Despite its long-term track record of outperformance, AZO trades at a below-market valuation. The stock’s low beta (0.6) can help investors through the downturn, further buoyed by beating investor expectations last quarter. With an AlphaRank of 99.6/100, we expect the stock to continue to outperform. Disclosure: Long AZO in the Accelerate Absolute Return Fund (TSX:HDGE).

UNDERPERFORM: Ivanhoe Mines Ltd (TSX: IVN) is a Canadian mining company focused on the exploration, development, and production of minerals and metals, primarily in Africa. Its key projects include the Kamoa-Kakula Copper Complex and the Kipushi Project in the Democratic Republic of Congo (DRC), and the Platreef Project in South Africa. Despite the geopolitical risks faced by the company, along with its low return on capital, IVN trades at a sky-high valuation. The stock’s high beta (1.4) could sting investors in a market downturn, particularly given the lack of valuation support, further challenged by the economic sensitivity of its business model. With an AlphaRank of 5.6/100, we expect the stock to continue to underperform. Disclosure: Short in the Accelerate Absolute Return Fund (TSX:HDGE).

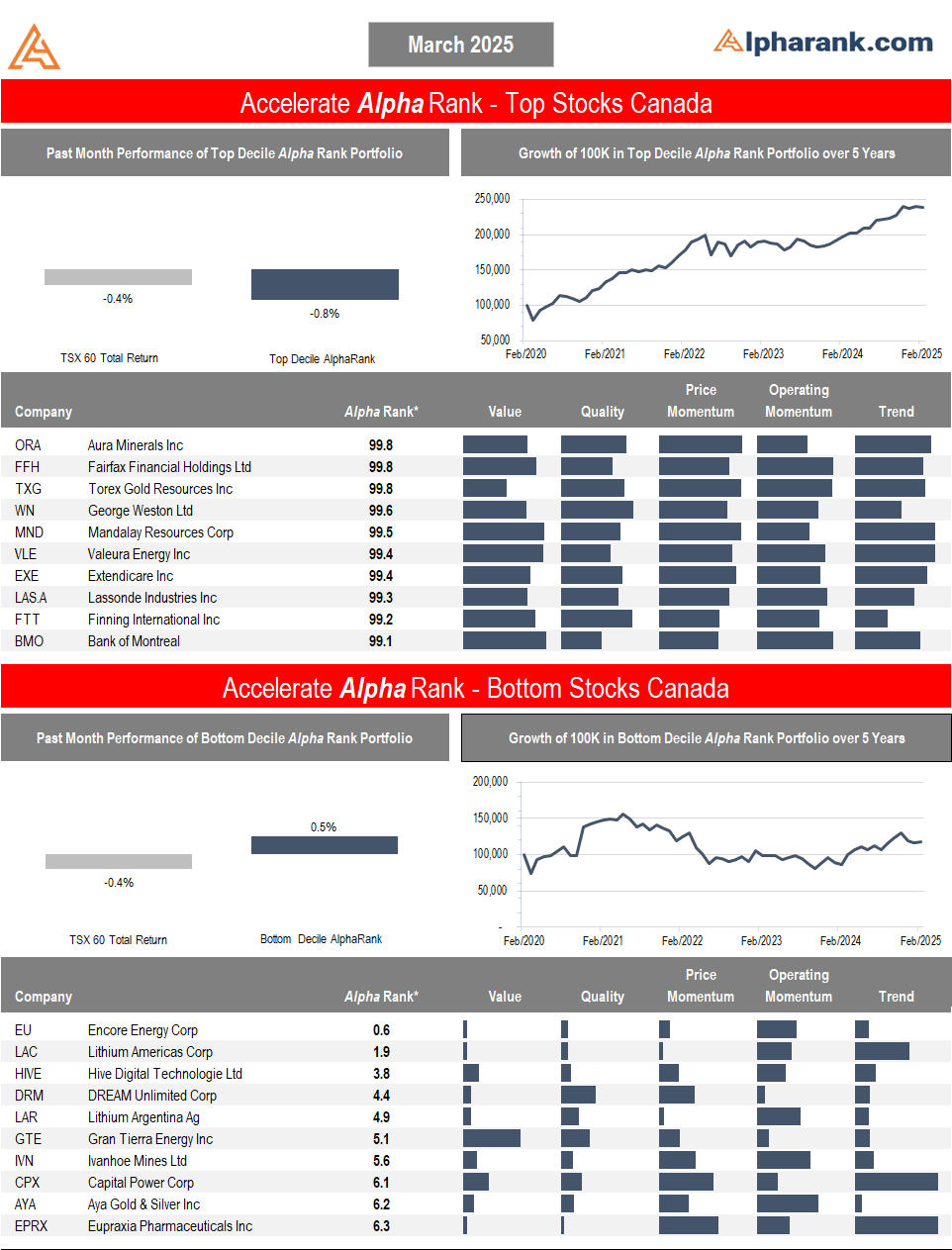

The AlphaRank Top and Bottom stock portfolios exhibited mixed performance last month:

- In Canada, the top-ranked AlphaRank portfolio of stocks fell by -0.8% compared to the benchmark’s -0.4% decline, while the bottom-ranked portfolio of Canadian equities ticked up by 0.5%. The long-short portfolio (top minus bottom ranked stocks) fell -1.3%, as the top-ranked stocks underperformed the bottom-ranked securities. Over the past five years, the top decile AlphaRank portfolio has risen more than 140%, while the bottom-ranked portfolio has risen approximately 15%.

- In the U.S., the top-decile-ranked equities dropped -3.0%, underperforming the S&P 500’s -1.3% decline. Meanwhile, the bottom-ranked stocks plunged by -8.8%, leading to a 5.8% return for the top decile minus the bottom decile long-short portfolio. Over the past five years, the top-ranked U.S. equities have gained more than 150%, while the bottom-ranked portfolio has fallen nearly -30%.

AlphaRank Top Stocks represents Accelerate’s predictive equity ranking powered by proven drivers of return. Stocks with the highest AlphaRank are expected to outperform, while stocks with the lowest AlphaRank are anticipated to underperform. AlphaRank assigns a numeric value to each security from zero (bottom-ranked) to 100 (top-ranked) based on selected predictive factors. All Canadian and U.S. stocks priced above $1.50 per share and with a market capitalization exceeding $100 million are evaluated. In both the Accelerate Absolute Return Fund (TSX: HDGE) and the Accelerate Canadian Long Short Equity Fund (TSX: ATSX), Accelerate funds may be long many top-ranked stocks and short many bottom-ranked stocks. See AccelerateShares.com for more information.