September 3, 2023 – Despite its reliance on modern technology to keep its passengers safe, the modern roller coaster has roots going back several centuries.

The initial concept of the roller coaster can be traced back to Russian ice slides, which were built in the 15th and 16th centuries. These slides were made of ice with wooden supports, and people would zip down the 70-foot-plus slides on sleds. This early incarnation of a heart-pumping amusement park ride provided the blueprint for a controlled descent down a steep track.

Constructed in Pennsylvania in the early 1800s, the Mauch Chunk Switchback Railway is considered one of the earliest roller coasters. It was built to transport coal from the mines to the canal, however, people soon discovered the thrilling experience of riding the coal cars downhill, and it became a popular attraction. This railway consisted of tracks with ups and downs, creating a rudimentary coaster experience. Its earliest documented riders attended in 1827 when it hauled visitors to admire its new railway technology.

During the late 19th and early 20th centuries, roller coasters continued to evolve and improve with innovations such as loops, banked turns, and the use of steam-powered mechanisms to haul cars to the top of hills. Notable examples include the “Switchback Railway” at Coney Island, which featured a circular loop, and the “Leap-the-Dips” coaster, known for its figure-eight layout. The 1920s saw the rise of amusement parks and the construction of larger, more elaborate roller coasters. However, after World War II, the popularity of roller coasters began to decline due to various factors, including the rise of television and changing entertainment preferences.

The roller coaster industry experienced a revival in the 1970s with the introduction of innovative, modern-day designs. Corkscrew and loop designs paved the way for more intense rider experiences. Innovation in computer-aided design and manufacturing techniques allowed for precise coaster designs providing for smoother and safer rides.

Today, roller coasters come in various designs, from traditional wooden coasters to high-tech steel coasters with advanced features. They remain a popular form of entertainment in amusement parks worldwide, continually pushing the limits of physics and engineering to provide adrenaline-boosting experiences for their riders.

Similar to the pulse-pounding ups and downs of the modern roller coaster, with its many twists, turns, and loops, certain speculative and volatile stocks can provide an equivalent thrill for speculative-minded investors.

Adrenaline-addicted thrill-seekers crave the slow ascents and rapid declines of the world’s fastest rollercoasters. Stock market speculators crave the rapid ascents and gambling-like “action” of a rapidly increasing share price to juice their need for thrills.

GameStop’s 8,000% rise in late 2020 and early 2021 inspired a new type of speculator and brought us the meme stock era. There was no need for Ben Graham’s classic, “Security Analysis”, or any rational fundamental investigation of the investment. The only requirement when seeking a quick buck and accompanying day-trading thrill in the market for volatile stocks was a catalyst to drive the stock up over the next several hours or even the next several minutes. The catalyst that drove GameStop’s and other meme stock’s meteoric surge was based on two related factors.

First, meme stocks needed to exhibit a large short interest. Speculators figured that if they could organize in large groups to manipulate the shares higher, they would force short sellers to cover their shares, pushing the stock price higher. Reminiscent of old-school “corners” such as the attempt by the Hunt brothers to corner the silver market in the 1980s, these online traders made a concerted effort to manipulate the share prices of heavily shorted names to corner the supply and push the market price rapidly higher.

Second, these traders did not have the financial firepower of the Hunt brothers to run a corner themselves. Reddit chat boards enabled individual speculators to pool their capital and work in unison to organize group manipulations of stocks. While highly illegal, these stock price manipulations were fueled by thousands of individual traders, each with a small bankroll, making tracking and enforcement of these illegal activities challenging and impractical.

No profits at the company? Doesn’t matter. Spiraling toward bankruptcy? Even better. All that mattered was short interest, and in the mind of the meme stock speculator, the higher, the better. This dynamic meant that the worse the fundamentals at the company, the more rational market participants would short its stock and, therefore, the greater the short squeeze potential.

Unsurprisingly, the meme stock craze was unsustainable. Since the companies whose shares were being manipulated were generally in dire financial condition, they would issue shares into the market to raise equity capital and prolong their lives. The rapidly increasing supply of stock overwhelmed the gang of meme stock traders’ attempted cornering, and like a roller coaster, the shares’ quick ascent was followed by a dramatic and gut-wrenching plunge.

With the decline of meme stocks, which, as expected, have provided devastating losses for their Reddit chat-room supporters, the new “roller coaster” stocks are found in a corner of the market known as deSPACs.

A deSPAC refers to a publicly traded company that recently completed its stock market listing through a business combination with a blank check company.

As the SPAC market went from red-hot to ice-cold and investors lost interest in blank check mergers, SPAC redemptions have proliferated, causing many mergers to be completed with little cash remaining and very few shares outstanding.

Clever speculators, who had moved on from meme stocks seeking the next quick action, honed in this dynamic. Recognizing similar dynamics to the meme stock manipulations of the past few years, traders had found a new plaything – low float deSPACs.

In order for a blank check company to close a merger with an operating company, it presents the transaction to its shareholders, who must approve the merger at a shareholder vote. Concurrently with the vote, shareholders are offered an opportunity to redeem their shares in SPAC at its underlying net asset value (which is about $10.50 cash on average).

With the decline in sentiment for blank check mergers, SPAC business combinations have suffered consistently high redemptions recently, some upward of 99%. These high redemptions leave deSPACs, or recently completed blank check mergers, with very few shares outstanding since most of the SPAC investors had chosen to get their money back (plus interest) at the redemption opportunity.

This low-float deSPAC dynamic is manna from heaven for traders looking to manipulate a share price higher. They learned their lesson from meme stocks, in which the companies would rapidly issue shares, dampening the effect of the attempted corner by increasing supply to counteract the spike in demand. In a new deSPAC, the company is restricted from issuing stock or unlocking restricted shares for a limited time, making a manipulation attempt more appealing.

VinFast is an electric vehicle manufacturer based in Vietnam. In May 2023, it announced a merger with SPAC Black Spade Acquisition at a stunning $27 billion valuation. As expected, most rational investors were not interested in owning the shares of a new emerging markets EV player with an enormous valuation and limited revenue. Unsurprisingly, redemptions were high, with more than 92% of shares redeemed.

After the merger closed, VinFast was listed with a tradable float of just 1.3 million shares. With more than 2.3 billion shares outstanding, VinFast’s tradable float was just 0.5% of the company.

Like a magnet to metal, speculators were instantly attracted to VinFast’s miniscule float and began accumulating its stock immediately. Its stock began to surge.

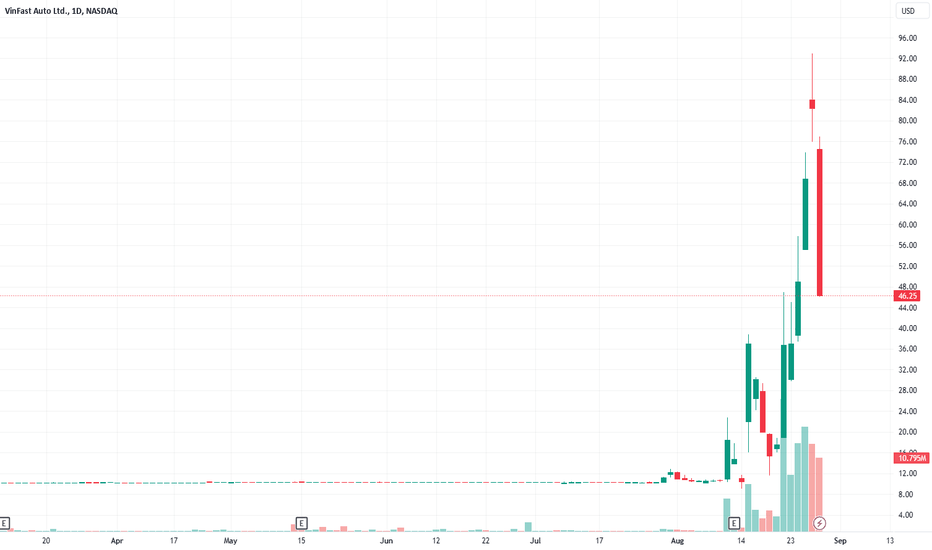

Source: TradingView

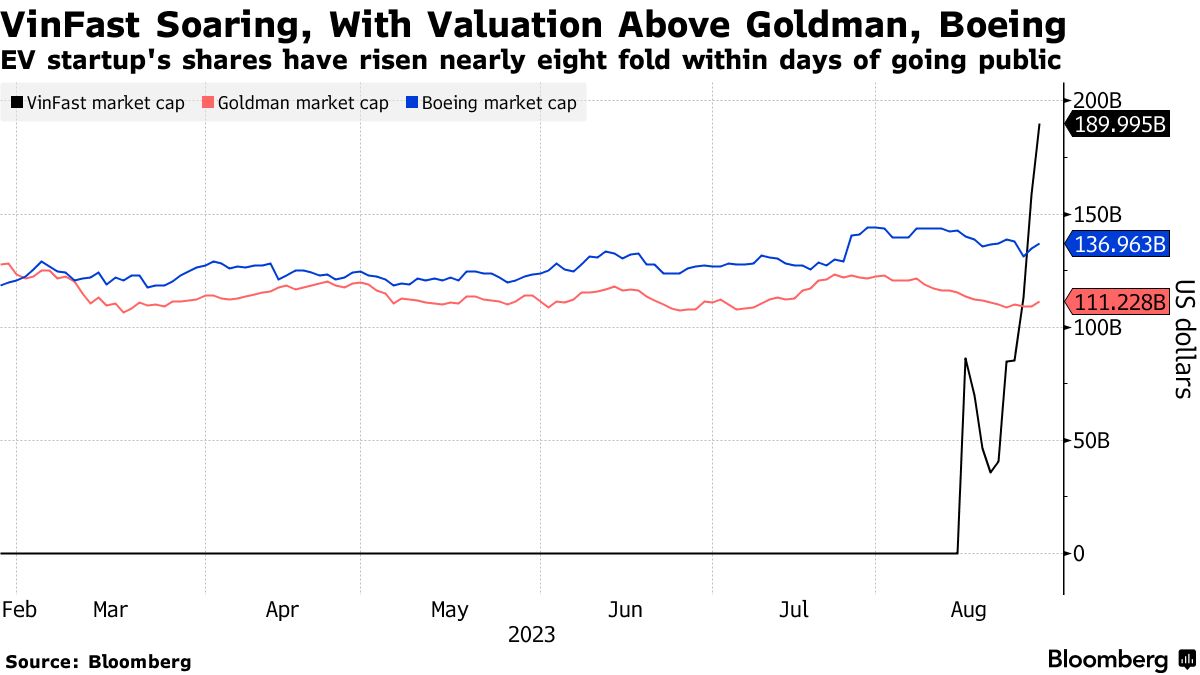

The SPAC merger vote, featuring blank check shares redeemable at $10.39, was held on August 10th. Within two weeks, VinFast’s stock climbed to nearly $100 per share. At this astronomical (and fragile) share price, VinFast was “worth” almost $200 billion, and its Founder was briefly the world’s second richest man.

Like all roller coasters, the good times come to an end. VinFast shares have been through a loop, resulting in a plunge of nearly -70% from their highs. Nonetheless, the low-float dynamic still exists, as it will take time for more shares to unlock, so expect the stock to remain highly volatile.

However, similar to meme stocks, we know where these things go. While a roller coaster may feature exciting lifts, rolls, spins, and loops, they always settle back at the bottom. Look to low-float deSPACs to exhibit a similar dynamic.

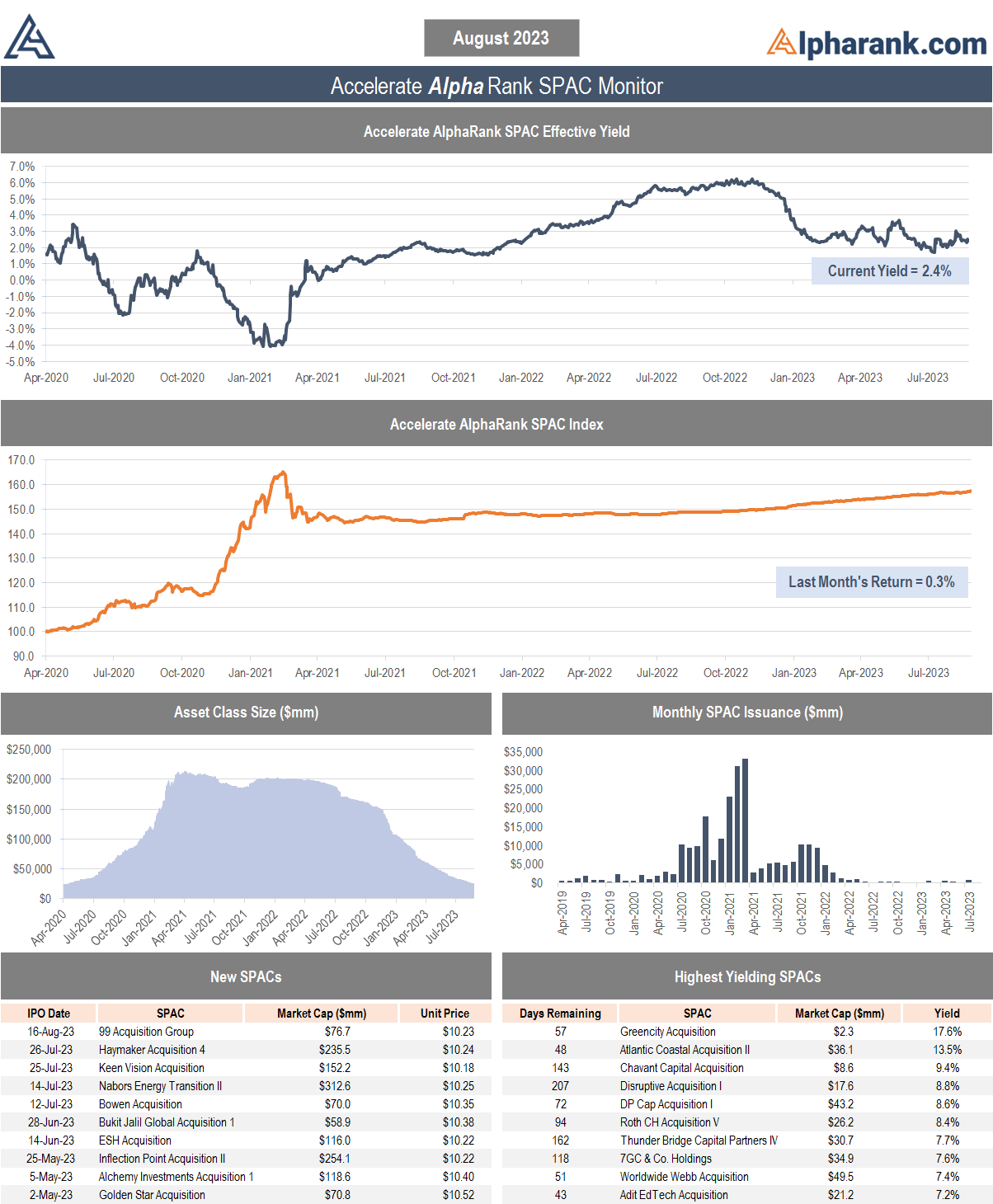

Beyond the odd deSPAC manipulation sideshow, the blank check market remains demonstrably unexciting. In August, there was just one SPAC IPO, 99 Acquisition Group, which raised $75 million (disclosure: Long in the Accelerate Arbitrage Fund (TSX: ARB)). During the month, 19 business combinations were announced, worth a total of $7.3 billion, while 23 SPACs matured. Of these maturing SPACs, 11 had a business combination, and 12 liquidated without a deal.

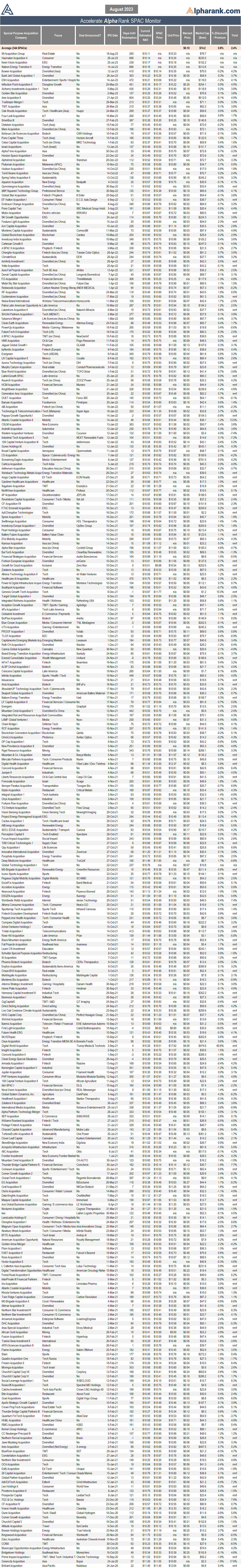

The Accelerate AlphaRank SPAC Monitor details various metrics on the current opportunity set while offering details on every individual SPAC currently outstanding. The Accelerate AlphaRank SPAC Effective Yield tracks the average arbitrage yield offered. The Accelerate AlphaRank SPAC Index tracks the price return of the SPAC universe.

* AlphaRank is exclusively produced by Accelerate Financial Technologies Inc. (“Accelerate”). The Accelerate Arbitrage Fund may hold a number of securities discussed in this research. Visit AccelerateShares.com for more information.