March 31, 2024 – The pharmaceutical industry is constantly under pressure to innovate and develop new medicines to address society’s unmet medical needs and to satiate Wall Street’s demand for earnings growth and continued profitability.

One of the major challenges facing large pharmaceutical companies is the expiration of patents on their leading drugs. When a patent expires, generic drug manufacturers are allowed to produce and sell cheaper versions of the drug, leading to a significant decrease in sales for the original drug developer. This phenomenon is often referred to as the “patent cliff.” To navigate this challenge, pharmaceutical companies are increasingly turning to mergers and acquisitions in the biotech industry to fuel their need for growth.

Biotech firms are at the forefront of researching and developing innovative therapies, including biologics (drugs derived from living organisms), gene therapies, and personalized medicine. These companies often focus on novel targets and mechanisms of action that have not been explored by larger pharmaceutical companies. Biotech companies are typically smaller and more agile than their larger pharmaceutical counterparts. They can focus on niche research areas and rapidly adapt to new scientific discoveries, making them hotbeds for innovation.

Biotech firms are known for their willingness to take on high-risk projects that may lead to breakthrough treatments. While not all projects succeed, those that do can offer significant therapeutic advancements and financial rewards. While many fail during this high-risk gambit, the successful ones usually end up on the receiving end of an attractive takeover offer.

The synergies between the large pharmaceutical companies and the biotech industry are an important segment of the merger market. To address the challenges of patent expirations and the need for a constantly evolving pipeline of innovative medicines, large-cap pharma companies have recently driven a substantial proportion of M&A, while often paying large takeover premiums.

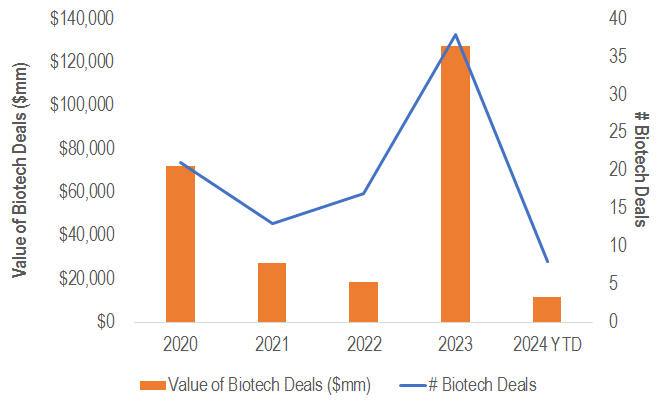

The biotech M&A cycle is volatile, with 2023 representing a blockbuster year of dealmaking with more than $120 billion of biotech M&A announced. 2024 is off to a good start, with 8 biotech mergers announced worth approximately $12 billion in total.

Source: Accelerate

Since 2020, there have been 94 biotech acquisitions worth an aggregate of $256 billion, representing 14% of all M&A deals and 9% of total deal value. Since 2023, the biotech sector has represented more than one-fifth of total U.S. public company mergers and acquisitions.

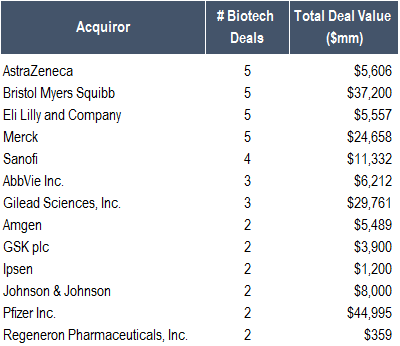

There are only a handful of large, global pharmaceutical companies active as serial acquirors. Since 2020, there have been thirteen pharma companies that have executed more than one biotech acquisition. The most active include AstraZeneca, Bristol Myers Squibb, Eli Lilly, and Merck, all of which have 5 biotech M&A deals under their belts over the past four years. As a serial acquiror, size and credibility are paramount.

Source: Accelerate

Examining biotech M&A more closely reveals three unique characteristics:

1. High takeover premiums – Biotech takeovers typically feature significant control premiums. Since 2020, the average biotech takeover premium was 87.5%, compared to the M&A universe average (ex-biotech) of 41.7%. In addition, takeover over premiums in the biotech sector can soar to truly astronomical levels, with seven deals featuring a takeover premium above 200%, two north of 300%, and one at a stunning 667% premium. Large takeover premiums are extremely rewarding to investors.

2. Low odds of deal failure – Over the past four years, there has only been one failed friendly acquisition of a U.S. publicly traded biotech company, and it was due to a lack of shareholder support given the takeover price was deemed too low. Historically, given biotech’s relatively small size and lack of commercial products, they typically do not receive significant regulatory scrutiny. Therefore, biotech M&A transactions have a much lower than average deal failure rate and may be considered “safer” by merger arbitrageurs, as compared to mergers in highly concentrated industries.

3. CVRs – A Contingent Value Right (CVR) is a financial instrument that entitles its holders to receive additional benefits or payments contingent upon the occurrence of specific events post-merger. These events are usually predefined and agreed upon by both parties involved in the transaction. CVRs are often used to bridge valuation gaps between the acquiring and target companies, especially when there are uncertainties about the future performance or regulatory approvals of certain assets, products, or milestones within the target company. CVRs are particularly common in the biotech industry, where the value of a company can significantly depend on the outcome of clinical trials and regulatory approvals. Of the 94 biotech deals since 2020, 34% have featured a CVR as part of the deal consideration. Outside of biotech, the use of CVRs in mergers is rare.

As the population ages and health care becomes a more significant portion of the economy, the pharmaceutical industry is set for continued growth. Given the synergies between large-cap pharma companies and small-cap innovative biotech firms, we expect the trend of biotech acquisitions to become an increasingly material part of the M&A market. We expect the largest dozen or so pharma companies to carry on their biotech acquisition strategies, which will become a more meaningful contributor to merger arbitrage investment returns over time.

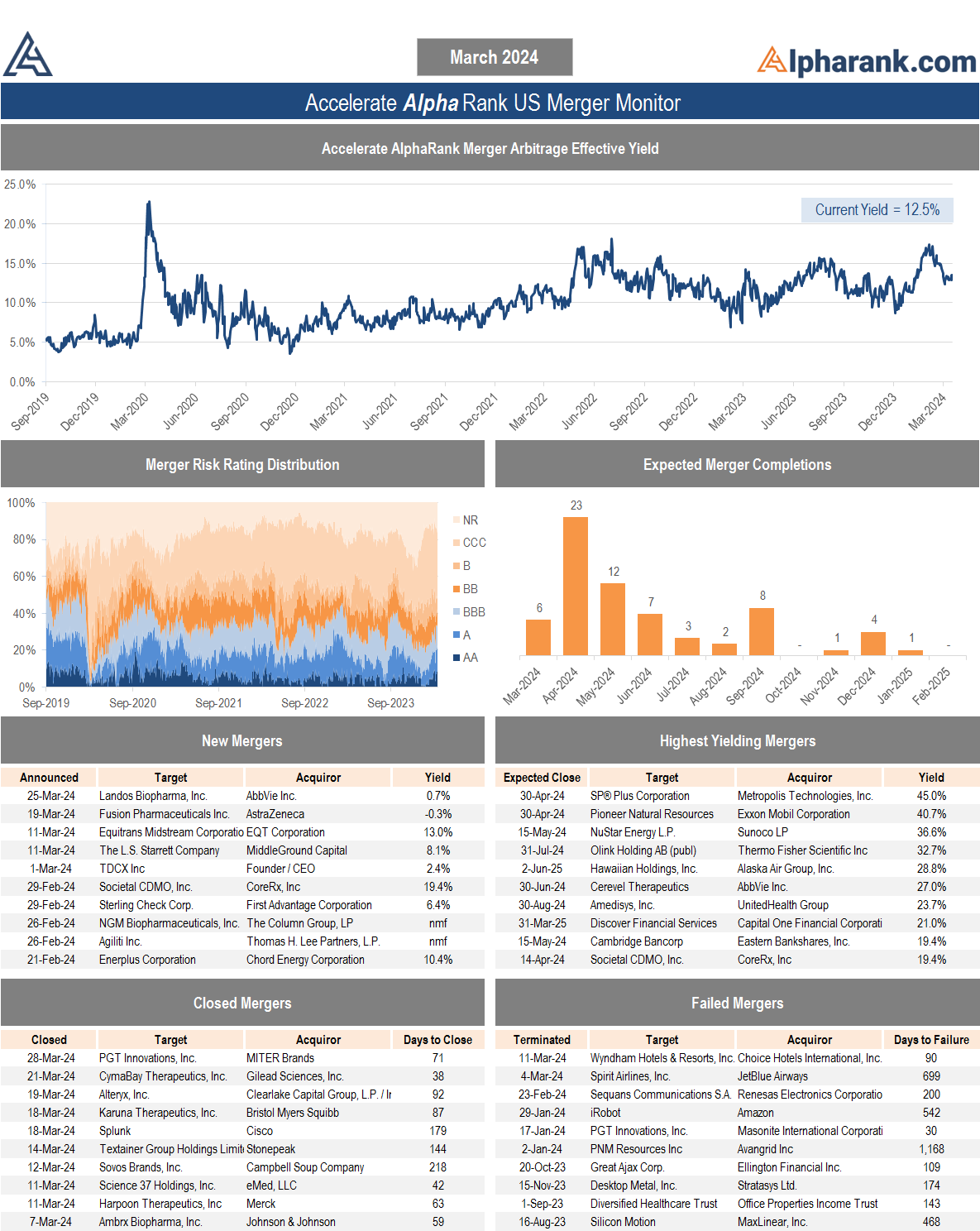

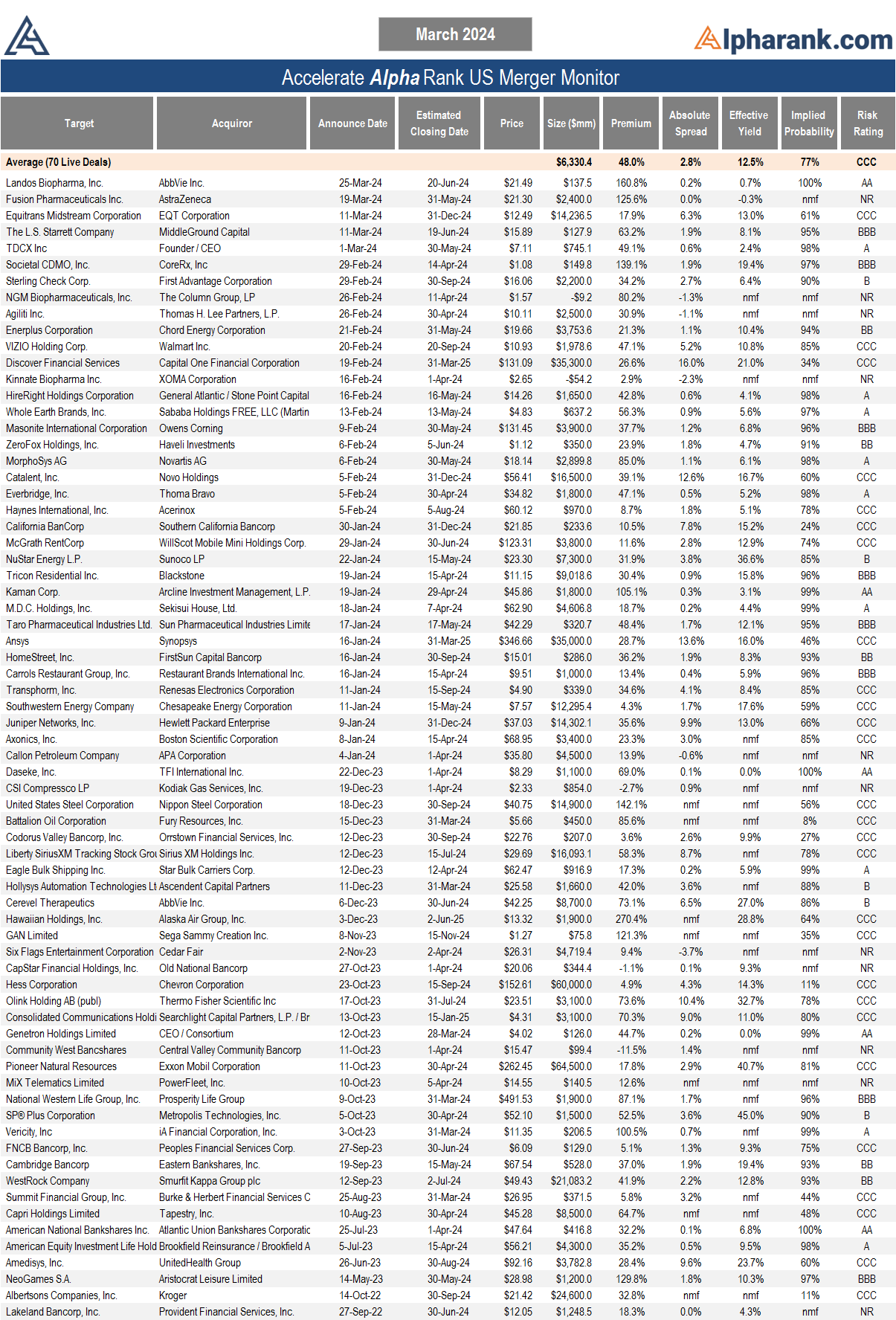

The AlphaRank.com Merger Monitor below represents Accelerate’s proprietary analytics database on all announced liquid U.S. mergers. The AlphaRank Merger Arbitrage Effective Yield represents the average annualized returns of all outstanding merger arbitrage spreads and is typically viewed as an alternative to fixed income yield.

Each individual merger is assigned a risk rating:

- AA – a merger arbitrage rated ‘AA’ has the highest rating assigned by AlphaRank. The merger has the highest probability of closing.

- A – a merger arbitrage rated ‘A’ differs from the highest-rated mergers only by a small degree. The merger has a very high probability of closing.

- BBB – a merger arbitrage rated ‘BBB’ is of investment grade and has a high probability of closing.

- BB – a merger arbitrage rated ‘BB’ is somewhat speculative in nature and has a greater than 90% probability of closing.

- B – a merger arbitrage rated ‘B’ is speculative in nature and has a greater than 85% probability of closing.

- CCC – a merger arbitrage rated ‘CCC’ is very speculative in nature. The merger is subject to certain conditions that may not be satisfied.

- NR – a merger-rated NR is trading either at a premium to the implied consideration or a discount to the unaffected price.

The AlphaRank merger analytics database is utilized in running the Accelerate Arbitrage Fund (TSX: ARB), which may have positions in some of the securities mentioned.

* AlphaRank is exclusively produced by Accelerate Financial Technologies Inc. (“Accelerate”). Visit Alpharank.com for more information. Disclaimer: This research does not constitute investment, legal or tax advice. Data provided in this research should not be viewed as a recommendation or solicitation of an offer to buy or sell any securities or investment strategies. The information in this research is based on current market conditions and may fluctuate and change in the future. No representation or warranty, expressed or implied, is made on behalf of Accelerate as to the accuracy or completeness of the information contained herein. Accelerate does not accept any liability for any direct, indirect or consequential loss or damage suffered by any person as a result of relying on all or any part of this research and any liability is expressly disclaimed. Accelerate may have positions in securities mentioned. Past performance is not indicative of future results.