December 17, 2019 — Merger and acquisition activity remained robust over the past month, with a number of sizable transactions announced including Charles Schwab’s blockbuster $26 billion acquisition of TD Ameritrade and LVMH’s $17.8 billion acquisition of Tiffany & Co.

Interestingly, of the seven new U.S. deals announced month-to-date, four are trading through the consideration, implying a negative yield.

This month, three announced biotech acquisitions came with large takeover premiums, including:

- Merck’s acquisition of ArQule at a 107% premium

- Astellas’ acquisition of Audentes at a 110% premium

- Sanofi’s acquisition of Synthorx at a 172% premium

A number of large M&A transactions closed recently, including CBS’s $20.2 billion acquisition of Viacom and Bristol-Myers Squibb’s $84.8 billion acquisition of Celgene.

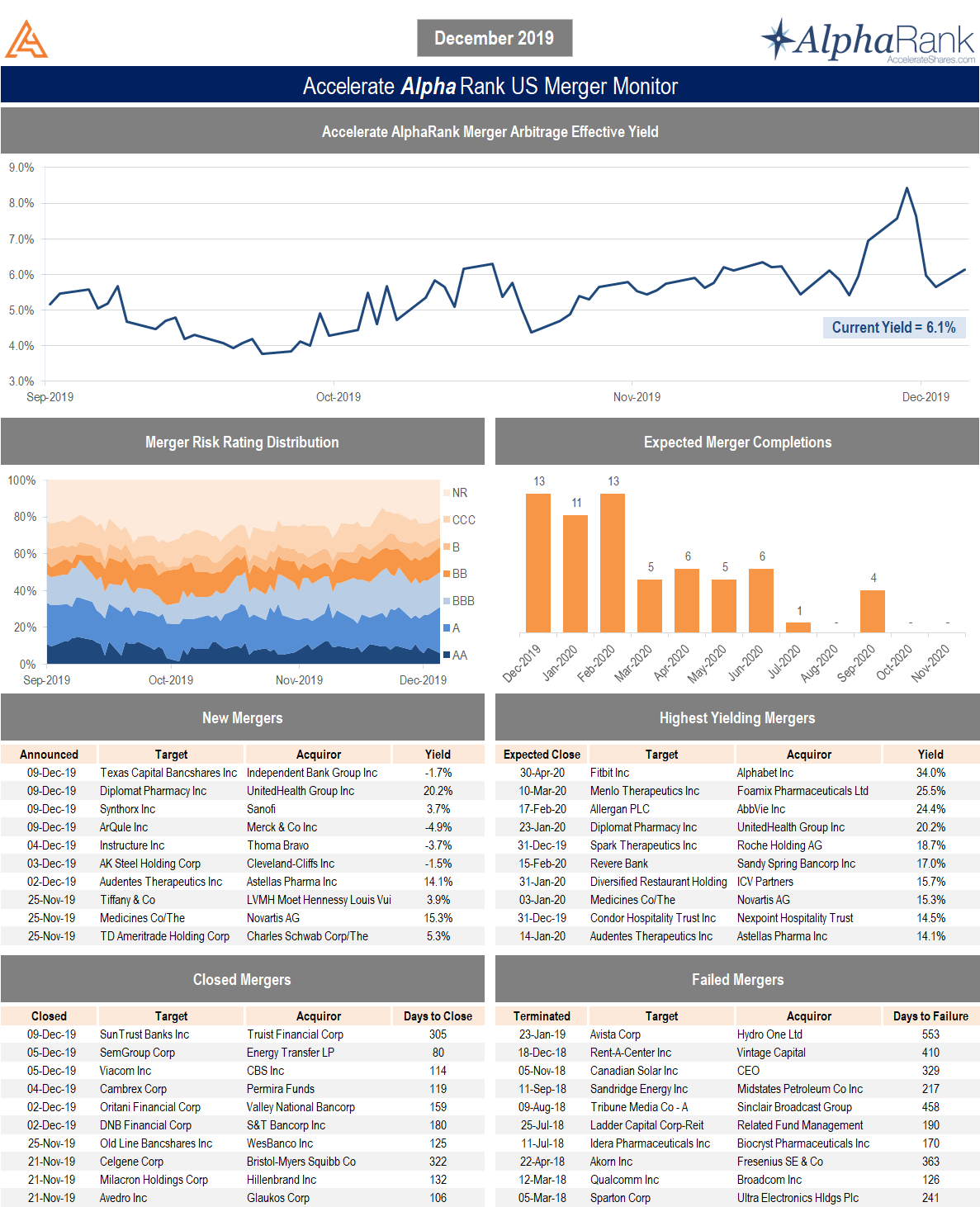

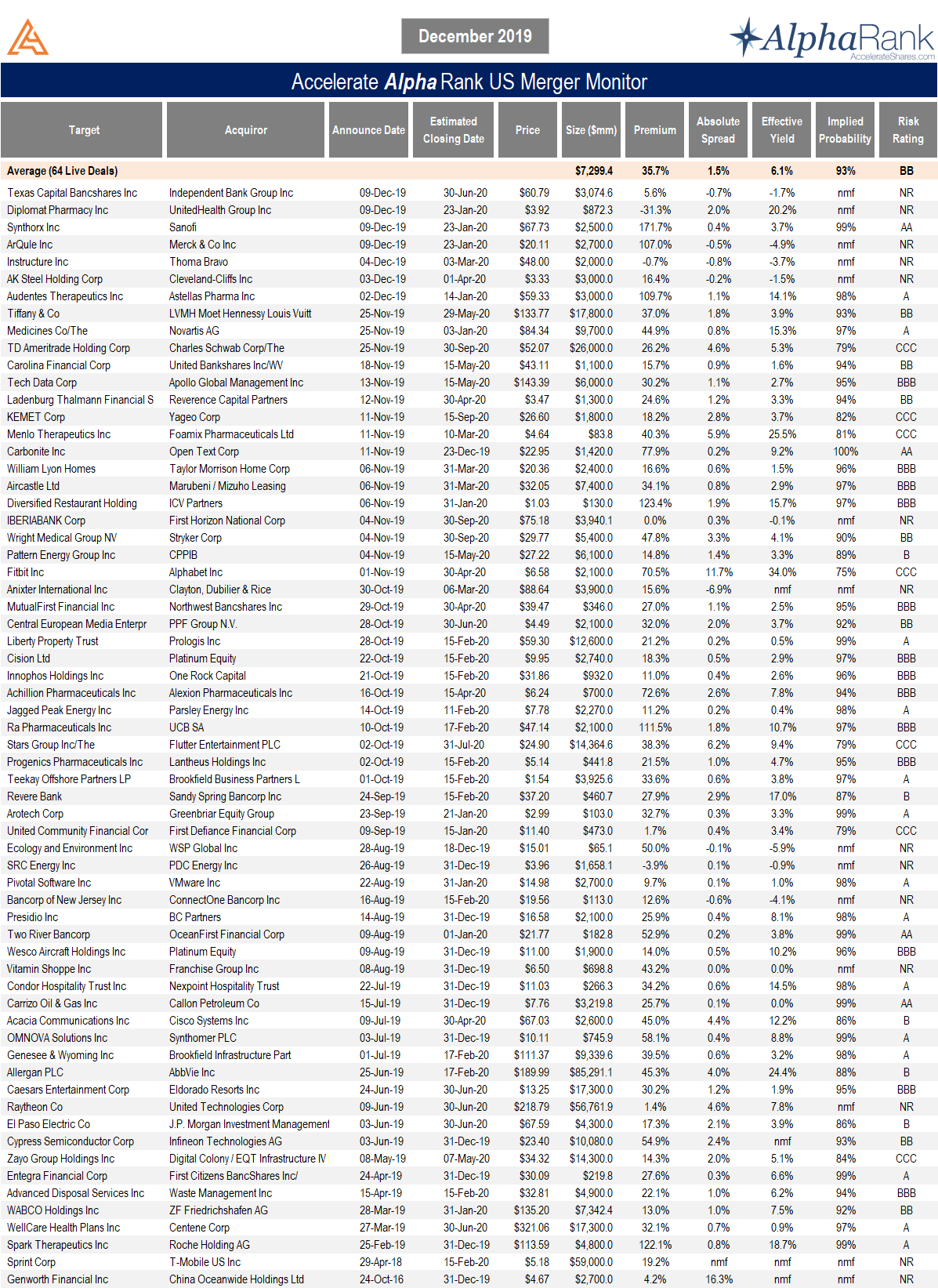

The below AlphaRank Merger Monitor represents Accelerate’s proprietary analytics database on all announced liquid U.S. mergers. The AlphaRank Merger Arbitrage Effective Yield represents the average annualized return of all outstanding merger arbitrage spreads and is typically viewed as an alternative to fixed income yield.

Each individual merger is assigned a risk rating:

- AA – a merger arbitrage rated ‘AA’ has the highest rating assigned by AlphaRank. The merger has the highest probability of closing.

- A – a merger arbitrage rated ‘A’ differs from the highest-rated mergers only by a small degree. The merger has a very high probability of closing.

- BBB – a merger arbitrage rated ‘BBB’ is of investment grade and has a high probability of closing.

- BB – a merger arbitrage rated ‘BB’ is somewhat speculative in nature and has a greater than 90% probability of closing.

- B – a merger arbitrage rated ‘B’ is speculative in nature and has a greater than 85% probability of closing.

- CCC – a merger arbitrage rated ‘CCC’ is very speculative in nature. The merger is subject to certain conditions that may not be satisfied.

- NR – a merger rated NR is trading either at a premium to the implied consideration or a discount to the unaffected price.

The AlphaRank merger analytics database is utilized in running Accelerate’s merger arbitrage investment strategy.

* AlphaRank is exclusively produced by Accelerate Financial Technologies Inc. (“Accelerate”). Visit AccelerateShares.com for more information.