January 28, 2024 – Passive income, representing earnings derived from a source in which a person is not actively involved, is a popular theme amongst individual investors. Unlike active income, which is earned through labour, passive income is generated through an initial investment in which little to no effort is required to maintain the income stream.

The key advantage of passive income is the potential to generate earnings with minimal daily effort, allowing one to focus on other interests, hobbies, or other income-generating activities. Investors crave passive income, given the independence and freedom it provides.

Often, when discussing passive income-generating investments, many investors focus on the “big two”: Dividend stocks and real estate.

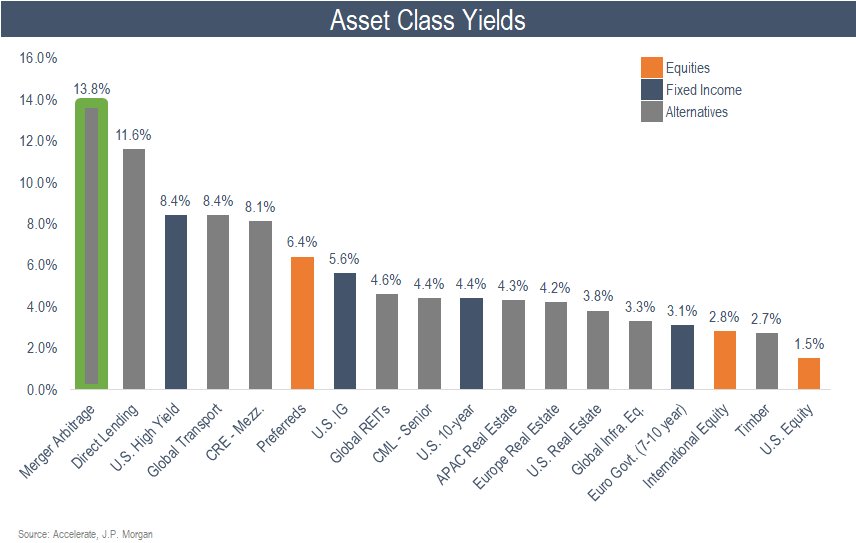

While equities and real estate form part of a diversified investment portfolio, they are just two of a myriad of asset classes that provide attractive yields to investors. Moreover, several asset classes present far higher yields, with some offering low-double-digit yields to allocators.

Many income-seeking investors don’t realize that real estate and equities are on the low-yielding end of the scale for income-generating asset classes, with yields below 5%.

While high-yield bonds and direct lending offer seemingly attractive average yields of 8.4% and 11.6%, respectively, many are surprised to learn that merger arbitrage tops the scales as the highest-yielding major asset class with an average yield of 13.8%

In contrast to investors’ love of income-producing assets and passive investments, most rational investors dislike paying taxes. In an effort to keep as much of their income as possible themselves and as little sacrificed to the government, thoughtful investors put time and effort into minimizing taxes.

Therefore, when considering building a portfolio of income-generating assets, it is essential to pay attention to how that yield is generated.

In addition to generating the highest pre-tax yield, merger arbitrage shines as a tax-efficient income-producing asset class for certain types of investors. Merger arbitrage can be a tax-efficient yield-producing investment for certain investors since it generates income via capital gains, which are taxed at half the rate of income-generating asset classes such as bonds or real estate.

As such, on an after-tax basis, merger arbitrage stands out of the crowd of yield-producing asset classes and can add further diversification to an investment portfolio, given its uncorrelated return stream.

In last month’s memo, 2024: What’s On The Way For M&A?, we forecast three themes in the merger market in 2024:

- Continued activity in the biotech sector as large-cap pharmaceutical companies pursue growth via acquisition to refill declining drug pipelines.

- The re-emergence of private equity buyouts as lower financing costs, due to softening interest rates, combined with additional willing corporate sellers, given the recent stock market rally, allow more bid-ask spreads to converge which may facilitate higher leveraged buyout activity.

- Increased consolidation in the oil patch. Industry heavyweights Exxon Mobil and Chevron kicked off the consolidation trend with their $60 billion+ acquisitions of Pioneer Natural Resources and Hess, respectively. Look for increased M&A in the energy and natural resources segments next year. (Disclosure: the Accelerate Arbitrage Fund (TSX: ARB) is long both Pioneer and Hess and short both Exxon and Chevron).

This call was arguably a lay-up. Nonetheless, where we forecast, the market delivered.

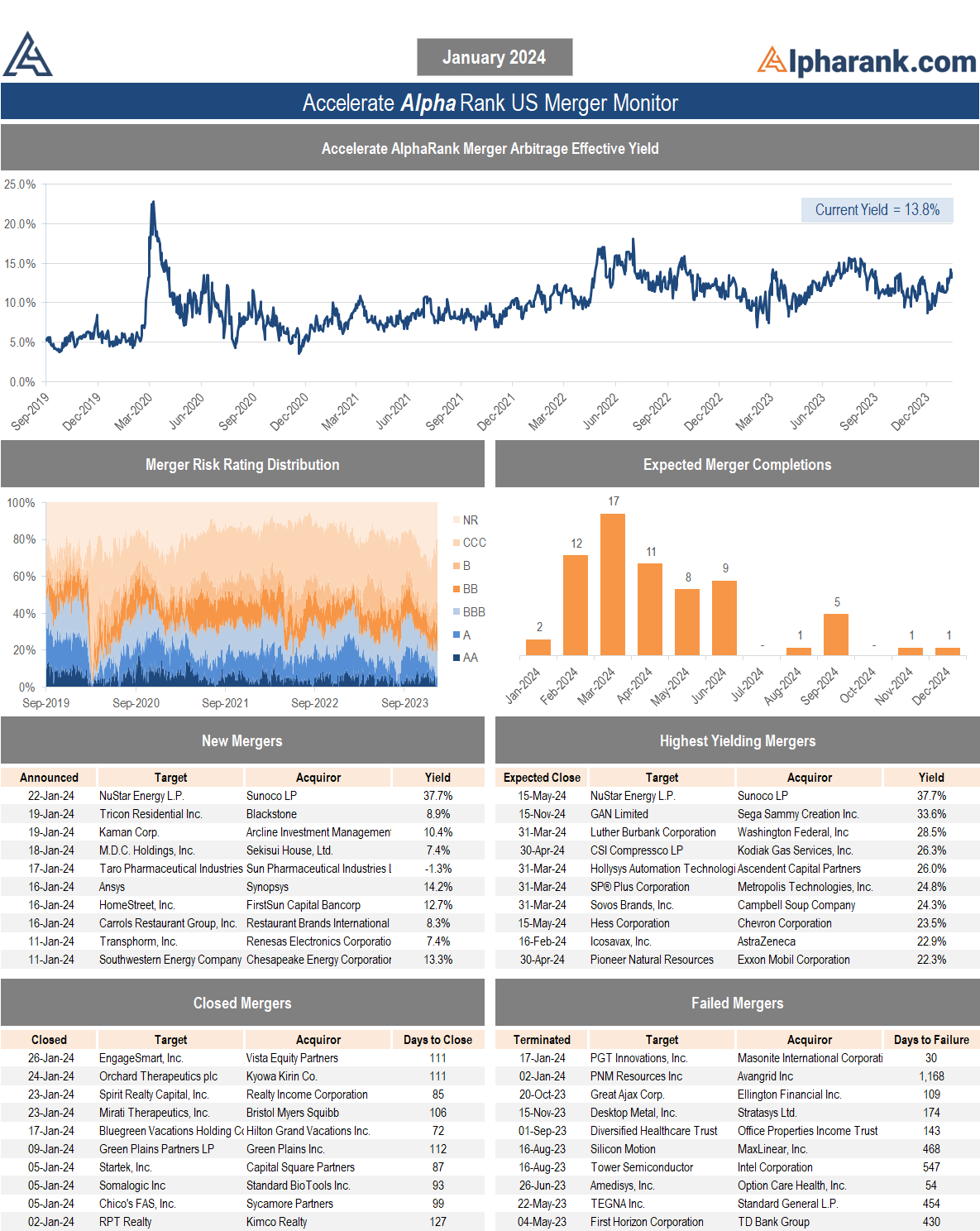

2024 is off to a strong start for mergers and acquisitions, offering an attractive opportunity set for merger arbitrageurs. This month, 18 M&A deals worth a total of $97 billion were announced.

Notably, consolidation continued in the oil patch, with APA’s $4.5 billion acquisition of Callon Petroleum and Chesapeake Energy’s $12.3 billion merger with Southwestern Energy.

Large pharmaceutical companies continued their tuck-in biotech acquisition strategies, including Johnson & Johnson’s $1.9 billion Ambrx Biopharma deal and Merck’s $680 million acquisition of Harpoon Therapeutics.

Lastly, private equity reemerged this month, including Blackstone’s $9.0 billion buyout of real estate company Tricon Residential and Arcline Investment’s $1.8 LBO of aerospace and defense firm Kaman.

Outside of the year-end forecast themes, technology transactions are still very active. This month, we saw a big one, with Synopsys and Ansys announcing a $35 billion merger.

Regarding expected returns, January’s collection of merger deals offers an average arbitrage yield of 11.3%.

It is an active start to 2024 in M&A, with an attractive (and growing) high-yielding merger arbitrage opportunity set for allocators to consider. And as we approach this upcoming tax season, investors could use an increased focus on tax-efficient income-generating asset classes.

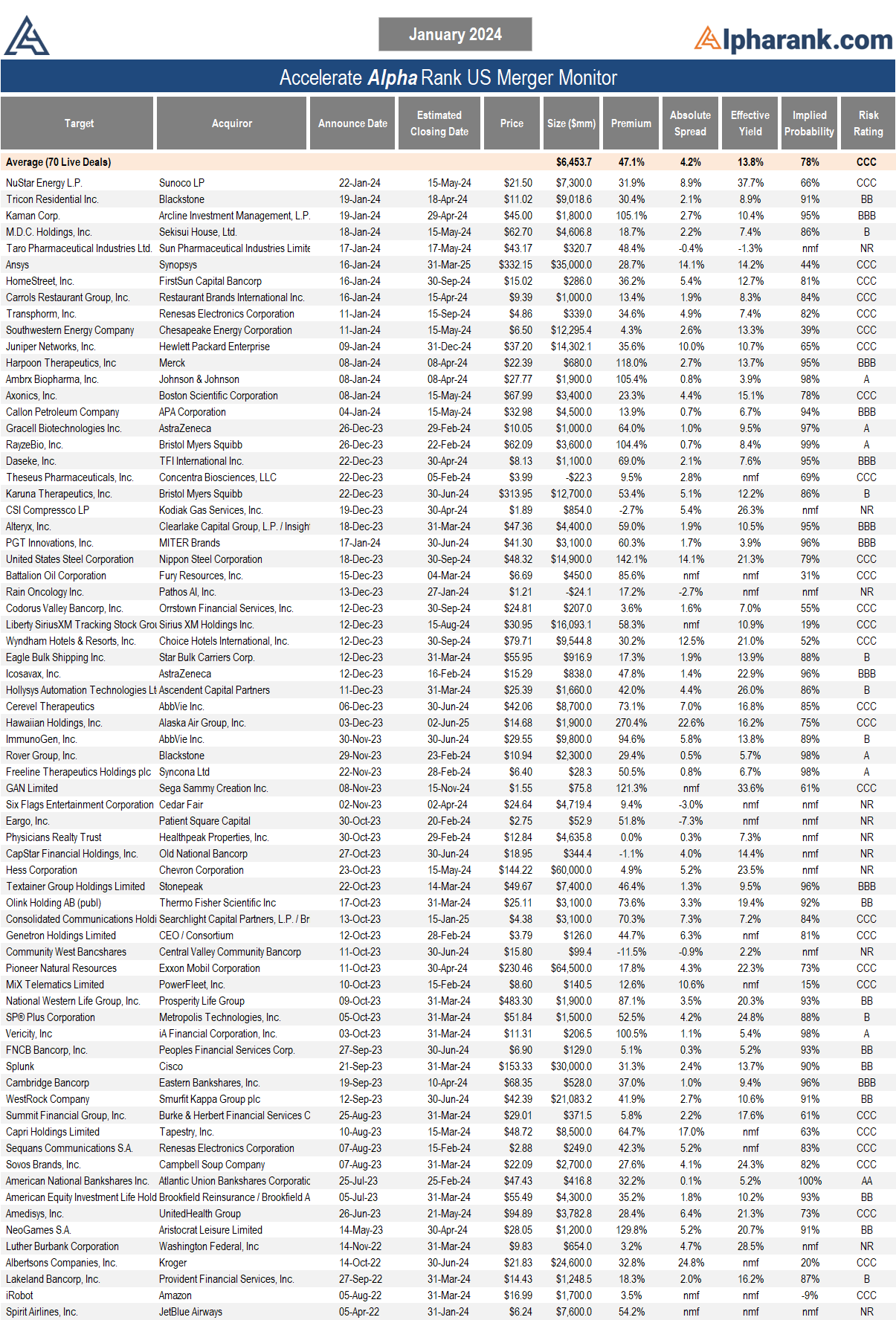

The AlphaRank.com Merger Monitor below represents Accelerate’s proprietary analytics database on all announced liquid U.S. mergers. The AlphaRank Merger Arbitrage Effective Yield represents the average annualized returns of all outstanding merger arbitrage spreads and is typically viewed as an alternative to fixed income yield.

Each individual merger is assigned a risk rating:

- AA – a merger arbitrage rated ‘AA’ has the highest rating assigned by AlphaRank. The merger has the highest probability of closing.

- A – a merger arbitrage rated ‘A’ differs from the highest-rated mergers only by a small degree. The merger has a very high probability of closing.

- BBB – a merger arbitrage rated ‘BBB’ is of investment grade and has a high probability of closing.

- BB – a merger arbitrage rated ‘BB’ is somewhat speculative in nature and has a greater than 90% probability of closing.

- B – a merger arbitrage rated ‘B’ is speculative in nature and has a greater than 85% probability of closing.

- CCC – a merger arbitrage rated ‘CCC’ is very speculative in nature. The merger is subject to certain conditions that may not be satisfied.

- NR – a merger-rated NR is trading either at a premium to the implied consideration or a discount to the unaffected price.

The AlphaRank merger analytics database is utilized in running the Accelerate Arbitrage Fund (TSX: ARB), which may have positions in some of the securities mentioned.

* AlphaRank is exclusively produced by Accelerate Financial Technologies Inc. (“Accelerate”). Visit Alpharank.com for more information. Disclaimer: This research does not constitute investment, legal or tax advice. Data provided in this research should not be viewed as a recommendation or solicitation of an offer to buy or sell any securities or investment strategies. The information in this research is based on current market conditions and may fluctuate and change in the future. No representation or warranty, expressed or implied, is made on behalf of Accelerate as to the accuracy or completeness of the information contained herein. Accelerate does not accept any liability for any direct, indirect or consequential loss or damage suffered by any person as a result of relying on all or any part of this research and any liability is expressly disclaimed. Accelerate may have positions in securities mentioned. Past performance is not indicative of future results.