January 16, 2020 – Global equities have had an excellent run over the past decade, returning about 10% annually.

One major outperformer has been the U.S. equity market, which represents about 34% of global equity value.

In 2019, the S&P 500’s total return exceeded 30%, but profit growth was nil. An increase in the valuation of stocks in the index, known as multiple expansion, generated nearly all of the price gains of the index.

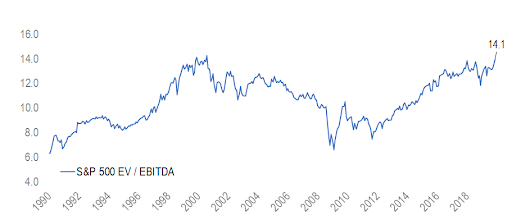

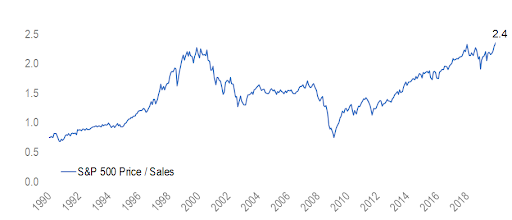

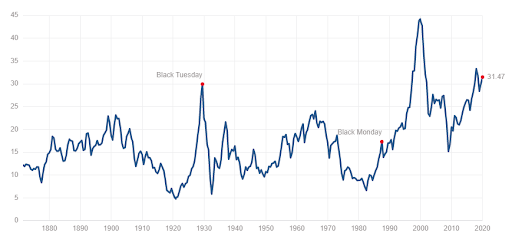

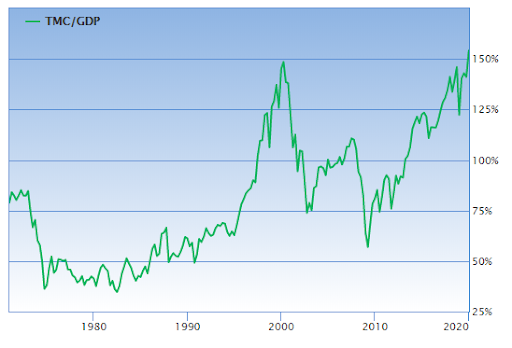

After the nearly 30% increase in the S&P 500 earnings multiple over the past year, the index now sits at a record or near-record high valuation on a multitude of measures.

Source: Bloomberg, Accelerate

On an EV / EBITDA basis, the valuation of the S&P 500 now matches the record level briefly reached during the 2000 dot-com bubble.

Source: Bloomberg, Accelerate

Looking at the index’s valuation on an EV / sales basis, the valuation of the S&P 500 is now at an all-time high, exceeding the level reached at the previous peak in 2000.

Source: Multpl

The cyclically-adjusted price-to-earnings ratio (“CAPE”) looks at the price of the index as compared to the trailing 10-year earnings of the index. On this measure, the S&P 500’s valuation now exceeds the level set at the peak in 1929. The market’s current CAPE ratio seems stretched, however, it still sits below the peak level reached briefly in 2000.

Source: Gurufocus

Warren Buffett’s favourite valuation indicator, total market cap / GDP, also sits at a new all-time high. In 2001, Buffett penned an article in Fortune magazine stating, “If the percentage relationship falls to the 70% or 80% area, buying stocks is likely to work very well for you.” No wonder Warren has been hoarding cash lately, claiming that “prices are sky-high for businesses possessing decent long-term prospects.”

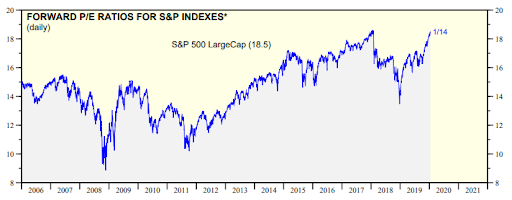

Source: Yardeni Research

Although forward earnings estimates are consistently too high (and generally get revised downward over time), they still make for a decent indication of stock market valuation. Currently, the forward price-to-earnings ratio of the S&P 500 sits at its highest level since 2000.

With U.S. equity valuations high by historical standards, investors may want to seek opportunities to diversify their portfolios.

What is market neutral investing?

Market neutral investing refers to when an investor seeks to profit from both rising and falling securities prices while eliminating market risk. An equity market neutral strategy goes long stocks expected to outperform and shorts stocks expected to underperform, hedging the long exposure with an equivalent amount of short exposure and therefore eliminating effects of swings in the market.

A market neutral strategy typically seeks to generate a return irrespective of market direction. Despite media criticism of specific strategies such as market neutral not keeping up with the S&P 500, a market neutral strategy’s return should have zero correlation to a broad-based, long-only equity index. It is a conservative strategy that seeks to generate returns with low risk and minimal volatility.

Market neutral returns consist of capital appreciation, generated from the performance spread between the long and short portfolios, combined with interest income on cash generated from short sales.

Why Hold Market Neutral in Your Portfolio?

Given minimal market risk exposure, a market neutral strategy generally seeks to return a spread above cash. Typically, this spread is around 2% – 4%.

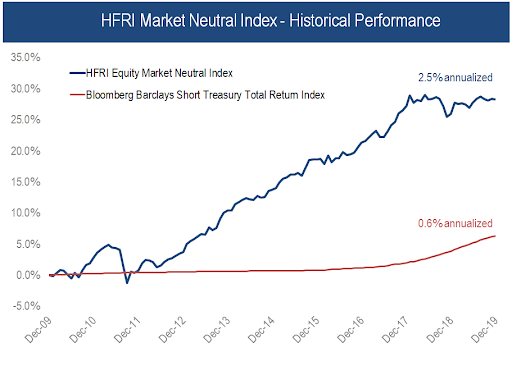

Source: HFRI, Bloomberg, Accelerate

Over the past ten years, the HFRI equity market neutral index has returned 2.5% annually. Cash has returned 0.6% per year over this period and market neutral strategies have generated about a 2% premium to cash.

The main appeal of this low-risk strategy is to help to diversify a portfolio by reducing its volatility. In contrast to long-biased hedge fund strategies, market neutral funds tend to have the lowest correlation to traditional investment strategies.

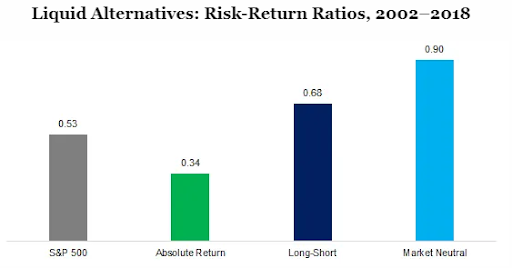

Source: CFA Institute

Since 2002, market neutral strategies have produced an attractive risk-adjusted return of 0.9.

How Market Neutral Investing is Implemented

The goal of the strategy is to eliminate market risk, hence the term “neutral”. With this neutrality, an investor tries to limit exposure to both market exposure and sector exposure on either a dollar-basis or beta exposure.

The typical equity market neutral fund is well-diversified, holding hundreds of stocks both long and short. The goal of this diversification is to limit the effect of any one position, specifically on the short side. The portfolio manager is seeking to generate returns from performance differences between baskets of securities and doesn’t want any individual security overly influencing the volatility of the portfolio.

Market neutral strategies tend to utilize leverage. The most basic market neutral portfolio is 100% long and 100% short, equating to a 200% gross exposure.

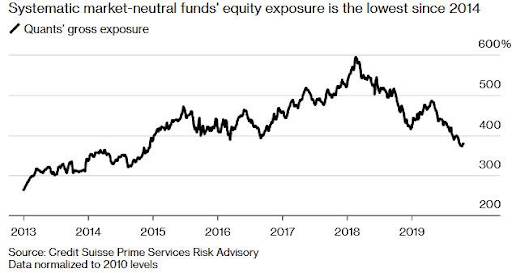

Source: Bloomberg

Historically, market neutral funds have operated with gross exposures levels of 300% – 600%.

Generally, market neutral strategies are implemented with multi-factor models, which filter and rank stocks by certain predictive factors such as value, quality, operating momentum, price momentum and trend. The theory behind this style of trading is that these factors have a predictive ability, over the long term, which is used to select securities that are expected to outperform (for the long portfolio) and underperform (for the short portfolio). This strategy is implemented on a systematic basis, which eliminates potential human biases.

A Solution to “Sky-High” Stock Prices

As valuations increase, prospective returns drop and risk increases. With the S&P 500 at historically record valuations on several measures, it could make sense for investors to seek to further diversify their portfolios.

Given its role in reducing risk and decreasing portfolio volatility, market neutral is an investment strategy that can help diversify your portfolio.

-Julian