January 15, 2019 – Risk management is an important aspect of investment portfolio construction. However, this much-needed protection against adversity is rarely implemented before it’s too late.

Unfortunately, instead of a well-thought-out and implemented risk management plan, many investors are stuck panicking after a large market drawdown and some even end up capitulating and selling their investments at the lows, realizing significant losses and interrupting their long-term investment goals. These spooked investors remain out of the market, unable to capitalize on the bounce back in asset values.

Instead of worrying about risk management when it’s too late, the best approach is to plan ahead. And the best way to manage risk before the turbulence hits is through diversification.

Diversification is a risk management technique that combines a wide variety of investments within a portfolio. The purpose of true diversification is to hold a myriad of asset classes which don’t move in the same direction as each other (ie. uncorrelated assets).

This pre-planned diversification has another term: Asset allocation.

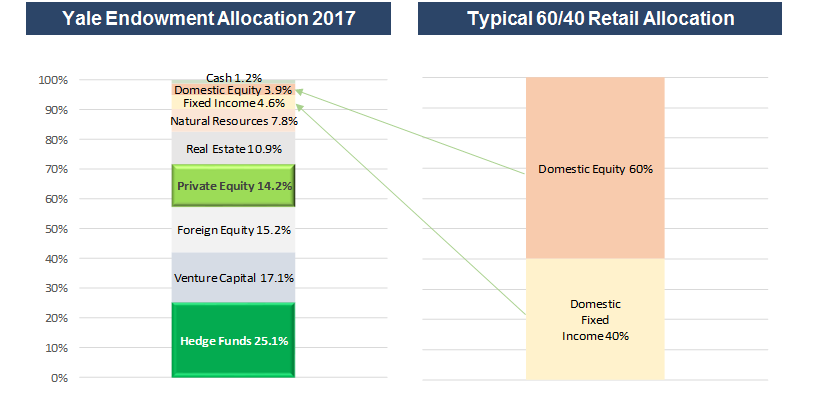

How do the top institutional investors in the world approach asset allocation? Let’s take a look at the Yale University endowment for guidance:

Source: 2017 Yale Endowment

As you can see, Yale’s asset allocation (ie. diversified portfolio) varies dramatically from the standard 60% / 40% mix of stocks and bonds typically recommended to average investors.

In fact, instead of a 60% allocation to domestic stocks, Yale only has a 3.9% allocation. Instead of a 40% allocation to domestic bonds, Yale only has a 4.6% allocation.

What’s going on here?

Yale is viewed as the “gold-standard” in asset allocation and is led by legendary investor David Swensen. It has achieved remarkable, long-term success in investing. In their own words:

“During the decade ending June 30, 2017, Yale’s investment program added $5.3 billion of value relative to the results of the mean endowment. The University’s 20-year market-leading return of 12.1 percent per annum produced $24.3 billion in relative value. Over the past 30 years, Yale’s investments have returned an unparalleled 12.5 percent per annum, adding $28.0 billion in value relative to the Cambridge mean. Sensible long-term investment policies, grounded by a commitment to equities and a belief in diversification, underpin the University’s investment success.”

The more diversified asset allocation of Yale’s endowment, with healthy allocations to alternative strategies, helped produce market-beating long-term returns.

Yale currently has a significant portion of their assets invested in alternative strategies – 25% allocated to hedge funds (also known as Absolute Return strategies) and 14% allocated to private equity.

When seeking to further diversify your portfolio and manage risk before it’s too late, look to the “gold-standard” of asset allocators. Consider going beyond just stocks and bonds and investigate whether alternatives, such as hedge funds and private equity strategies, are right for your portfolio.

-Julian