June 12, 2019 – Stock market returns in May were volatile, with the S&P 500 down -6.4% and the S&P / TSX Composite down -3.1%.

In contrast to the rough market performance, Accelerate’s proprietary multi-factor portfolio generated substantial alpha in the month of May, largely from the short side.

Accelerate’s proprietary multi-factor model is based on five main factors:

- Value

- Quality

- Price Momentum

- Operating Momentum

- Trend

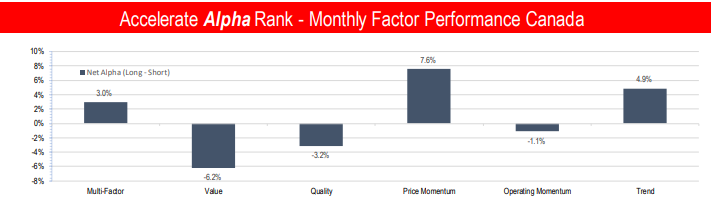

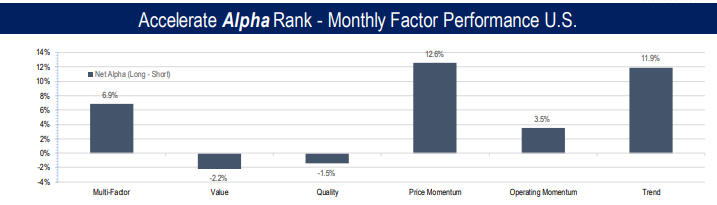

The multi-factor portfolio generated a net alpha of 3.0% in Canadian equities and 6.9% in U.S. stocks for the month.

Most of the alpha was generated from the momentum factor.

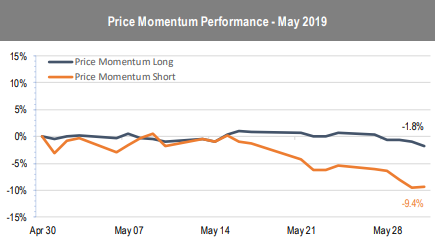

The Canadian long price momentum portfolio returned -1.8% while the short portfolio returned -9.4%, for a net alpha of 7.6%.

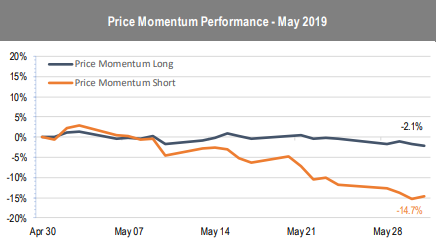

The U.S. long price momentum portfolio returned -2.1% while the short portfolio returned -14.7%, for a net alpha of 12.6%.

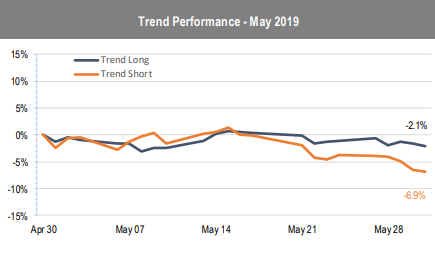

The trend factor also contributed to multi-factor alpha for the month. The Canadian long trend portfolio dropped -2.1% while the short portfolio dropped -6.9% for a net alpha of 4.9%.

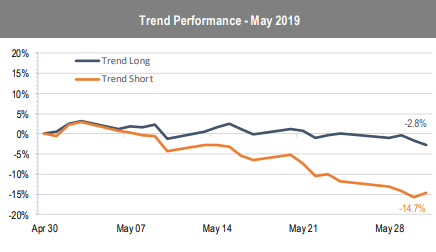

The trend factor performed well in the U.S. as well, notching 11.9% alpha as the long portfolio dropped -2.8% while the short portfolio dropped -14.7%.

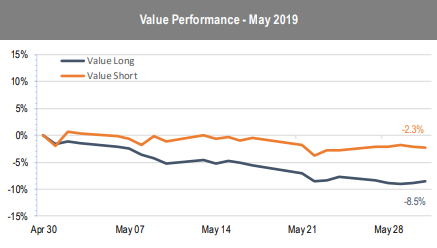

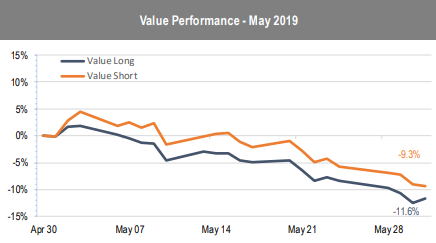

Value was a laggard for the month, with both long value portfolios in Canada and the U.S. underperforming the short value portfolios.

The Canadian long value portfolio dropped -8.5% while the short portfolio only dropped -2.3%, for a net alpha of -6.2% (by far the worst factor performance for the month).

Net long-short value performance was less bad in the U.S. due to the short portfolio, which dropped -9.3% while the long U.S. value portfolio dropped -11.6%, for a net alpha of -2.2%.

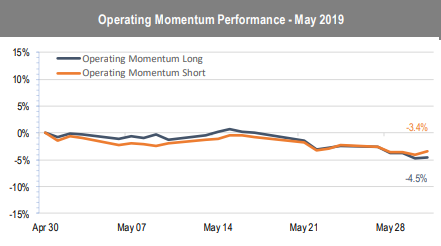

The operating momentum factor was a mixed bag for the Month of May. It was negative in Canada, as the long portfolio dropped -4.5% while the short portfolio dropped -3.4% for a net alpha of -1.1%.

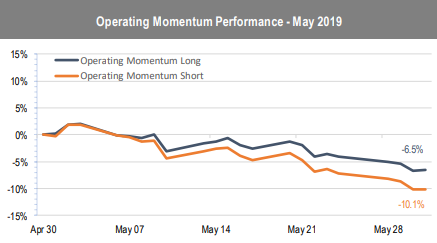

Operating momentum alpha was positive in the U.S. as the long operating momentum portfolio dropped -6.5% while the short portfolio dropped -10.1% for a net alpha of 3.5%.

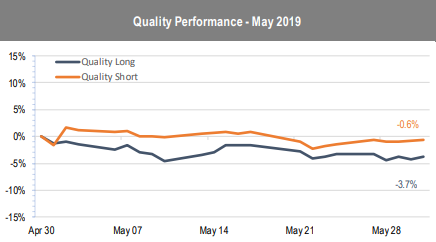

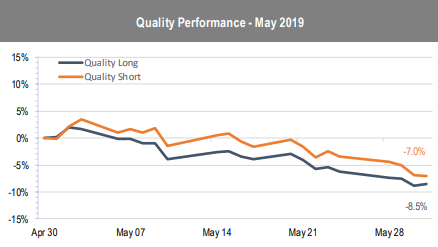

The quality factor was negative for both Canadian and U.S. equities last month.

The quality factor in Canada generated a net alpha of -3.2% as the long portfolio dropped -3.7% while the short portfolio dropped only -0.6%. Ironically, the short Canadian quality portfolio was the highest returning portfolio for the month of May. We would typically expect to see the lowest quality stocks (the stocks in the short portfolio) decline the most, and the exact opposite happened.

The U.S. quality portfolio generated a net alpha of -1.5% as the long portfolio declined -8.5% while the short portfolio declined -7.0%.

Overall, significant alpha was generated from the multi-factor portfolio during a pretty tough month for stocks. The vast majority of alpha was generated by the momentum and trend factors, with the best results coming from the U.S, with double-digit alpha generation. Operating momentum was a mixed bag while quality and value suffered. The value factor in Canada really struggled during the month.

The positive alpha generation in an environment of elevated market volatility and broad-based declines in stock market indices showcases the importance of having short positions to generate alpha during down markets.

Download the AlphaRank Factor Performance– May 2019 here.

-Julian