October 2, 2019 – Paul Tudor Jones was one of the greatest hedge fund managers of his generation. He was a trader’s trader, highly focused on price trends of the vast array of financial instruments he was trading. Jones gained notoriety for making a killing during the Black Monday stock market crash of 1987 along with beating the market by significant sums in the 80’s and 90’s.

One of Jones’ major rules of trading was “losers average losers”. This manifesto was posted above his computer screen such that he was reminded of its interpretation on a daily basis. The rule meant that only losers would double-down on a position that has gone against them. Buying a stock, watching it drop, and then adding to the position was strictly prohibited in Jones’ book. The note was a reminder for Jones not to add to a losing position.

Losers Buy Money-Losers

Acknowledging Paul Tudor Jones, I posit a Losers Average Losers 2.0 as a modern edict for our current times: Losers Buy Money-Losers.

Basically, the Losers Buy Money-Losers rule states that only losers buy stocks of companies that lose money. Winners buy shares of profitable companies.

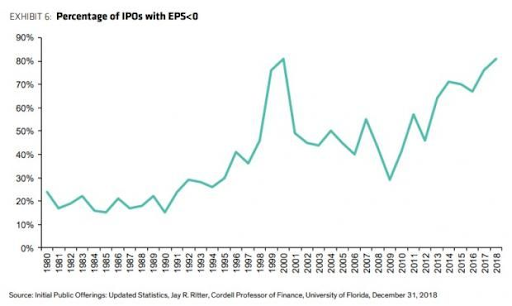

There has been a surge of initial public offerings with negative earnings and 2018 was a banner year for money-losing IPOs. With the recent IPOs of profligate spenders such as Uber, Lyft and Beyond Meat, an analysis of the share price performance of money-losing stocks is relevant for today’s investors.

2018 had the largest percentage of money-losing companies go public since the tech bubble of 2000 as approximately four-fifths of companies going public had negative earnings.

Money-losing companies are having a banner year to go public as 2019 is shaping up to have the largest amount of unprofitable initial public offerings on record. Money-losing companies are apparently all the rage these days.

How Do Money-Losing Stocks Perform?

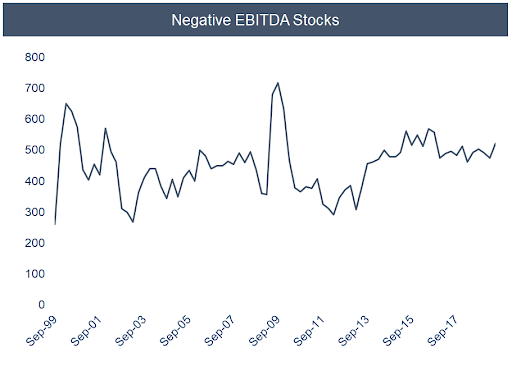

For the purpose of this analysis, money-losing stocks are defined as shares of companies with negative EBITDA over the past 12 months. Earnings before interest, taxes, depreciation and amortization (EBITDA) is a proxy for cash flow.

An analysis was run on the universe of U.S. stocks with market capitalizations above $100 million and share prices above $1.50. Over the past 20 years, on average there were about 450 money-losing stocks per year in the U.S.

Source: Accelerate, Compustat, S&P Capital IQ

Source: Accelerate, Compustat, S&P Capital IQ

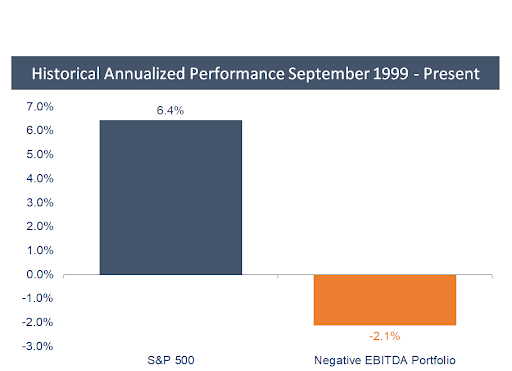

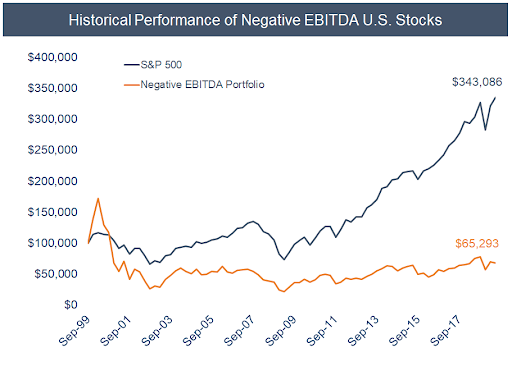

To judge the investment performance of a portfolio of all U.S. stocks that lose money (the “Negative EBITDA Portfolio”), a simulation was run over the past 20 years. The Negative EBITDA Portfolio was rebalanced on a quarterly basis.

As expected, the Negative EBITDA Portfolio underperformed the market by a substantial sum.

Source: Accelerate, Compustat, S&P Capital IQ

The Negative EBITDA Portfolio lost -2.1% per year over the past 20 years, trailing the market by 8.5% and losing investors’ money while the market was up significantly.

Source: Accelerate, Compustat, S&P Capital IQ

A $100,000 investment in the Negative EBITDA Portfolio shrunk to approximately $65,000 over two decades, while an equivalent sum invested in the S&P 500 grew to almost $350,000.

Positive Cash Rules Everything Around Me

The fabled 1990’s hip-hop supergroup Wu-Tang Clan said it best in their breakout hit “C.R.E.A.M.”, an acronym for Cash Rules Everything Around Me. While the track was recorded in 1993, its objective is no less relevant today and investors should obey the notion that positive cash flow rules everything in the market.

Paul Tudor Jones would remind himself not to be a loser and buy stocks that have lost him money. Notwithstanding this sage advice, investors would be richer to observe the updated rule for the money-losing IPO-bonanza age: Losers Buy Money-Losers.

Don’t be a loser, buy shares of profitable companies.

-Julian