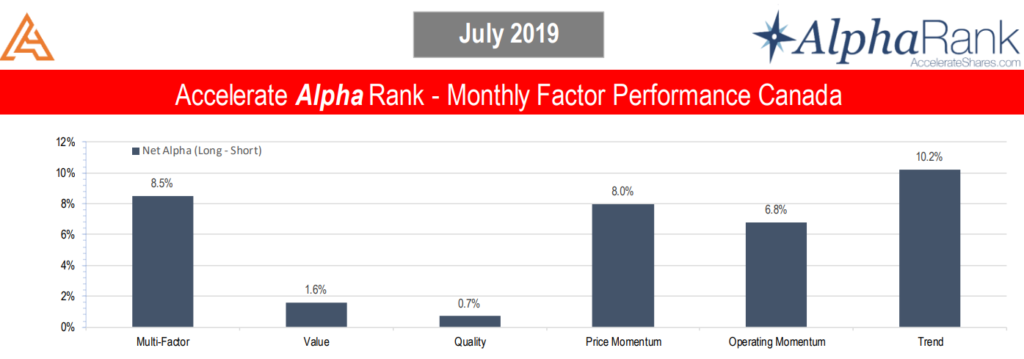

August 9, 2019 – In a month with relatively pedestrian returns for U.S. and Canadian equity markets, up 1.4% and 0.3% respectively, the multi-factor portfolios downright kicked ass in the month of July with an 8.5% gain (long minus short) in Canada and an 8.9% return in the U.S.

All factors in both the U.S. and Canada experienced positive returns in the month. AlphaRank went 12 for 12 in July.

AlphaRank Canadian Stocks

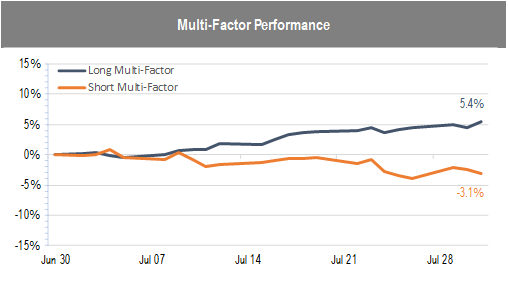

The Canadian multi-factor long-short portfolio gained 8.5% for the month, consisting of a 5.4% gain for the long multi-factor portfolio and a -3.1% decline for the short multi-factor portfolio. The outperformance of the multi-factor portfolio was driven by both the long and short performance of the price momentum, operating momentum and trend factors in Canada. The value and quality factors generated small positive contributions to performance.

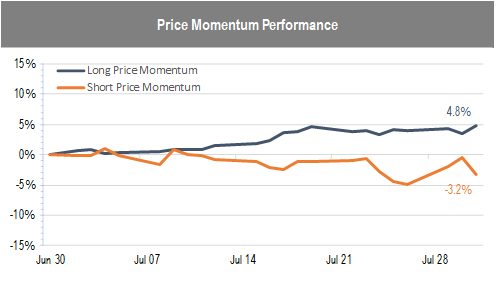

The portfolio of stocks with top decile positive price momentum went up 4.8% in July, while the portfolio of bottom decile momentum stocks, the 10% of Canadian stocks with the most negative price momentum, declined -3.2%.

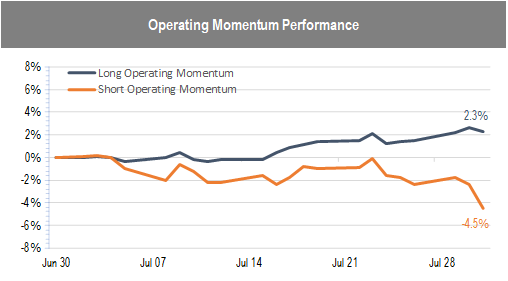

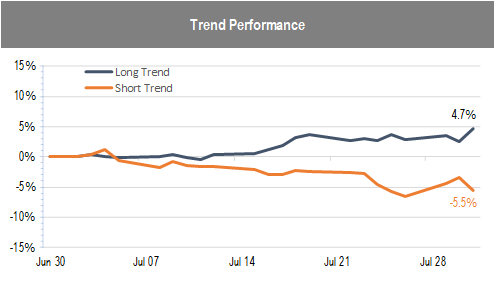

Both operating momentum and trend had similar performance in July. Top decile operating momentum and trend stocks in Canada were up 2.3% and 4.7%, respectively. On the short side, both factors contributed to positive performance with a decline of -4.5% for bottom decile operating momentum stocks and a -5.5% fall for the worst trending stocks.

AlphaRank U.S. Stocks

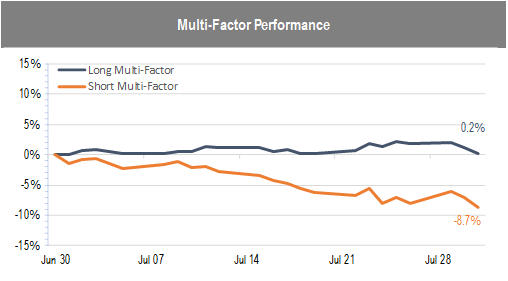

In July, the multi-factor model outperformed substantially in the U.S., with a net alpha of 8.9%.

In contrast to the Canadian multi-factor portfolio performance, the U.S. multi-factor portfolio’s performance came exclusively from the short side. The long portfolio had slight gains but nearly all the alpha generated came from the short side, as the short bottom decile multi-factor portfolio fell -8.7% in July.

The long performance of all U.S. factor portfolios was effectively flat, but all of the short portfolios suffered significant declines (which is desired when one is short the stocks).

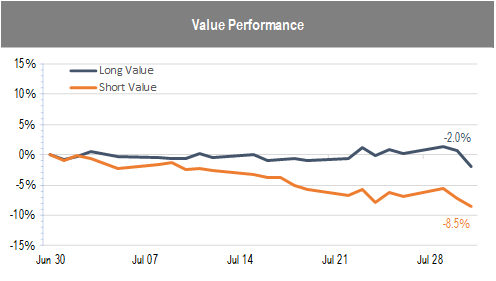

The long U.S. value portfolio struggled in July, declining -2.0%. However, this loss was more than offset by a -8.5% decline for the short value portfolio, which is short the 10% of stocks with the least attractive valuations.

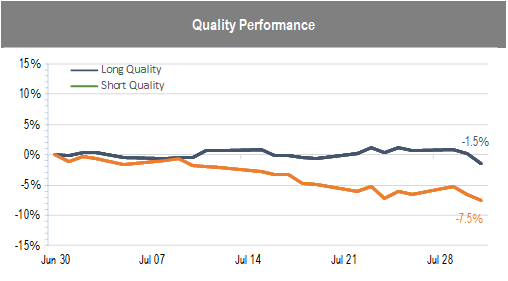

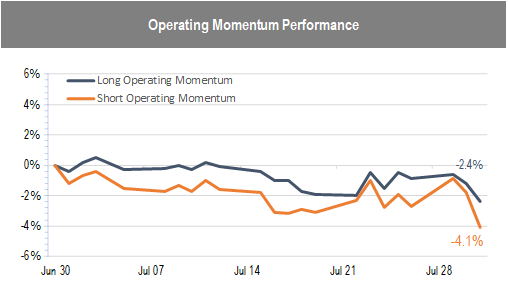

The long U.S. top decile quality and operating momentum portfolios experienced similar underperformance, falling -1.5% and -2.4% respectively. However, these long-short factor portfolios notched gains as the short portfolios more than offset losses on the long side. The short bottom decile quality portfolio dropped -7.5% while the short bottom 10% operating momentum stocks declined -4.1%.

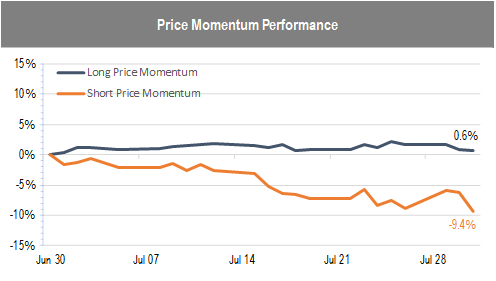

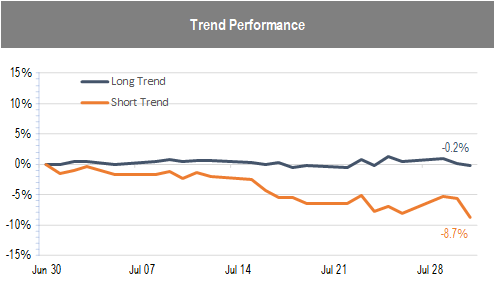

Long U.S. top decile price momentum and trend portfolios were roughly flat for the month, while the short bottom decile price momentum and trend portfolios performed exceptionally well, dropping -9.4% and -8.7% respectively.

A Grand Slam For the AlphaRank Multi-Factor Portfolios

The AlphaRank factors went 12 for 12 in July, with each factor generating long-short alpha for the month. While both Canada and U.S. multi-factor portfolios generated significant outperformance of 8.5% and 8.9% respectively, it’s notable that nearly all of the U.S. multi-factor portfolio’s performance came from the short side. This is especially noteworthy in a month when the S&P 500 was up 1.4%.

Multi-factor investment products are starting to proliferate in the market, with many ETFs looking to capitalize on the positive expected returns provided by harvesting factors. AlphaRank proves that these multi-factor ETFs miss one of the main drivers of factor outperformance, which is the short portfolios.

-Julian