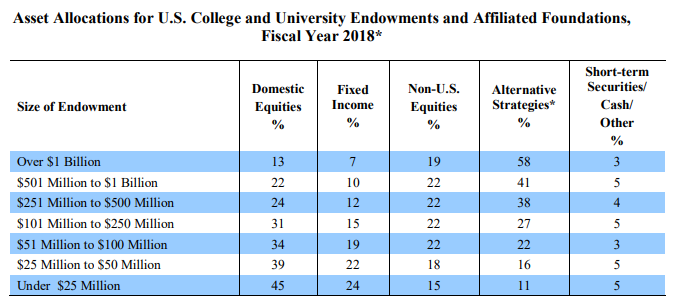

February 26, 2019 – The 2018 NACUBO-TIAA Study of Endowments was recently released. This study looks at the asset allocation of 802 U.S. college and university endowments and foundations, representing approximately $617 billion in professionally managed financial assets.

NACUBO’s study looks at each endowment’s asset allocation, including investments in domestic stocks, domestic bonds, international stocks, alternative strategies and cash.

By alternative strategies they mean the following asset classes:

- Private equity

- Hedge funds

- Venture capital

- Private real estate

- Energy and natural resources

- Distressed debt

What’s notable is that endowments of all sizes allocate large portions of their portfolios to alternative strategies.

Source: NACUBO

The largest of endowments, those managing over $1 billion, on average allocate 58% to alternatives. Endowments under $25 million still have an 11% allocation to alternatives. On a dollar-weighted basis, endowments in the study allocated more than half (53%) of their assets to alternative strategies.

Sophisticated investors are allocating large portions of their portfolios to alternative investment strategies.

This large use of alternative strategies stands in stark contrast to the portfolios held by financial advisors and individuals, which are largely made up of domestic equities and bonds.

Why do endowments allocate so heavily to alternatives?

Institutional investors typically add alternatives to their portfolios for these three reasons:

- Increased returns – Alternatives may offer higher return potential than stock and bond indexes.

- Decreased risk – Alternatives may “zig” while other traditional investments “zag”. This can potentially dampen the effects of volatility in a portfolio.

- Higher consistency – Adding alternatives that have a low correlation to stocks and bonds may bring more consistency to a portfolio’s investment performance.

All endowments have aggressive investment return targets that they need to achieve in order to satisfy their spending obligations. Endowments tend to focus more on the performance of their investments compared to the typical financial advisor or individual investor.

Endowments make heavy use of alternatives as they believe this will give them a higher chance of satisfying their investment goals. Effectively, endowments are using alternative strategies to increase their portfolio returns on a risk-adjusted basis.

Alternatives are a distinctively valuable tool in the toolbox to help investors satisfy their financial goals.

-Julian