August 31, 2021 – Traditionally, investors have pondered three major considerations when allocating capital.

What is the expected return?

What is the estimated risk?

How does it fit within my portfolio?

The Investment Case For Bitcoin

While bitcoin represents a relatively new asset class, recently, it has outperformed nearly all asset classes on both an absolute return and risk-adjusted basis. Note that this outperformance came with high risk and significant volatility, so position sizing is imperative.

I previously highlighted that bitcoin should be considered for a small allocation in portfolios given its positive historical quantitative metrics:

“Bitcoin has a 5-year annualized return of 109% with a Sharpe ratio (return per unit of risk) of 1.27, compared to Sharpe ratios of 0.52 and 0.55 for stocks and bonds, respectively.”

Once an asset’s return per unit of risk is considered attractive, it must be deemed appropriate from a portfolio allocation perspective.

The main consideration for investors when evaluating the addition of an attractive investment opportunity to their portfolio is: Does the asset provide diversification benefits?

If an asset under consideration behaves similarly to an asset already held within a portfolio, the diversification benefit is minimal. For example, adding another oil stock to a portfolio filled with oil stocks provides little diversification benefit, as these assets would all be highly correlated.

To properly diversify, we must add attractive assets that exhibit low correlation to other assets held within a portfolio. Low, or negative, correlation is the essence of diversification.

Not only has bitcoin historically displayed exceptional risk-adjusted returns, it has done so in an uncorrelated manner. This lack of correlation indicates that bitcoin has beneficial diversification properties (a correlation of zero indicates it moves independently while a correlation of one means the asset prices move in the same direction together).

“Over the long-term, bitcoin has had a 0.16 correlation to stocks and a 0.06 correlation to bonds, indicative of a very low correlation to traditional asset classes. This low correlation furthers bitcoin’s case to be included in an investor’s portfolio, given its diversifying properties.”

Bitcoin’s historical return, risk and diversification properties check the boxes for a potential allocation in an investor’s portfolio.

These days, however, investors are considering issues above and beyond traditional investment metrics when building their portfolios.

Bitcoin from an ESG Perspective

Currently, environmental, social, and governance (“ESG”) concerns are top of mind for investors. These societal issues are important to allocators, even if they potentially reduce expected returns. In addition, societal concerns such as climate change, diversity, inclusion and equality are now critical considerations for many people’s major life decisions, investing included.

Therefore, prior to making an investment decision, the typical investor may evaluate bitcoin from an ESG perspective.

Historically, bitcoin has a mixed ESG track record.

On the positive side, bitcoin’s distributed authority and immutable blockchain grant it strong attributes from a governance perspective. Bitcoin’s lack of central authority and collaborative nature support positive governance credentials.

In addition, the fact that bitcoin provides all human beings in the world with easy access to a predictable supply of truly sovereign money that cannot be manipulated by central banks or inflated by governments makes bitcoin one of the strongest ranking assets from a social perspective. As one of the only assets that can readily provide financial freedom and protection from authoritarian regimes, not to mention provide relative stability in hyper-inflating economies, bitcoin provides virtually unmatched social benefits.

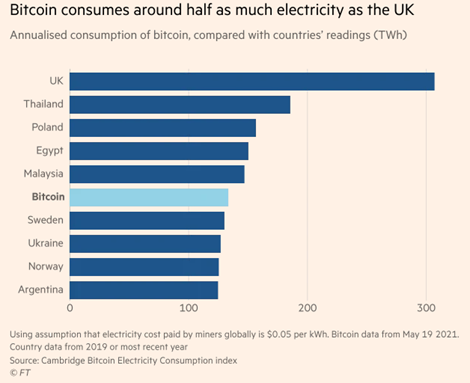

On the other hand, bitcoin’s environmental track record is poor. The bitcoin blockchain’s energy-intensive proof of work algorithm is expected to consume roughly 130 terawatt-hours of energy, which represents approximately 0.6% of global electricity consumption.

Source: Financial Times

The blockchain’s strength, an energy-intensive and valuable process that makes hacking the distributed ledger impossible, is also its greatest weakness. No matter which way you cut it, bitcoin ranks abysmally on an environmental basis.

Carbon-Negative Bitcoin

The one major drawback of bitcoin ownership within a portfolio is its negative environmental track record. This drawback can be rectified.

The controversy with today’s ESG investing is the notion of “greenwashing”.

Greenwashing refers to the act of providing false or misleading information with respect to how a product is more environmentally sound or sustainable. It is commonly thought of as marketing spin in which green marketing is deceptively utilized to persuade consumers that a product is eco-friendly. The investment management business is notorious for greenwashing, in an effort to gather assets and charge higher fees for undifferentiated products.

Historically, ESG-branded investment funds have bought securities based on ESG ratings. These ratings are typically derived from an index provider, such as MSCI, who makes a judgement call on how eco-friendly the underlying companies are behind the investable securities. Unfortunately, ESG ratings provide no tangible benefit to the environment.

Recently, we have seen some investment firms purchase carbon credits in an attempt to cloak their funds in green. Skeptics take a dim view of carbon credits, given many of them were issued to reward activities that are not actually beneficial for the environment. As the Wall Street Journal detailed, some carbon credits are issued to forest owners for not cutting down their trees, which rewards the act of not damaging the environment, instead of providing a net positive benefit for the planet.

According to Yale University, critics warn of a growing market in outdated credits that offer no carbon benefit for the planet, since the carbon-saving projects they were once intended to fund have long been in operation without the benefit of sales of credits. The market “contains hundreds of millions of tons of poor-quality credits,” says Mark Maslin of University College London.

Given that investing based on financial-company-issued ESG ratings or carbon credits generally do not provide a net tangible benefit to the environment, Accelerate took the greenwashing issue to heart.

Accelerate has created an exposure to bitcoin, combined with a novel decarbonization initiative, in the Accelerate Carbon-Negative Bitcoin ETF (TSX: ABTC).

To rectify bitcoin’s poor environmental effects, Accelerate’s novel decarbonization initiative is focused on planting trees. One of the most effective ways to counteract carbon emissions is through sequestration, and nature offers some of the best solutions.

Forests are nature’s carbon sink – a naturally occurring and visually appealing way to sequester CO2.

Tree planting provides numerous benefits over traditional ESG strategies such as the purchase of carbon credits or the use of ESG-ratings, including:

- Forests provide a tangible net benefit for the environment

- Forests are aesthetically pleasing

- Forests are unlikely to be accused of greenwashing

Mangrove forests have been found to sequester carbon at a rate two to four times greater than mature tropical forests. Accelerate’s global tree planting initiative is initially concentrated on planting mangrove trees in Madagascar.

According to third-party estimates, for each $1,000 invested in ABTC, an estimated 3.45 trees are planted and over one net tonne of carbon emissions are expected to be sequestered per year. This level of carbon sequestration represents more than 60x the emissions caused by ABTC’s bitcoin transactions. Accelerate’s goal is to ultimately plant 21 million trees, one for each bitcoin in existence.

Diversify Your Investment Portfolio While Benefiting The Environment

Given its track record of success and diversification benefits, a small position in bitcoin may be justified within a well-diversified investment portfolio.

With ABTC now available to investors, they can now gain exposure to bitcoin in a climate-positive way.

Buy bitcoin, save the planet. Visit investABTC.com to see the estimated environmental benefit that your investment in ABTC provides to the earth.

-Julian

Certain statements included in this news release constitute forward-looking statements, including, but not limited to, those identified by the expressions “expect”, “intend”, “will” and similar expressions to the extent they relate to a Fund or Accelerate. The forward-looking statements are not historical facts but reflect Accelerate’s current expectations regarding future results or events. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. Although Accelerate believes that the assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and, accordingly, readers are cautioned not to place undue reliance on such statements due to the inherent uncertainty therein. Accelerate undertakes no obligation to update publicly or otherwise revise any forward-looking statement or information whether as a result of new information, future events or other such factors that affect this information, except as required by law.