September 11, 2023 – The Guinness World Record for surviving the highest fall without a parachute is held by Vesna Vulović, a Serbian flight attendant.

In 1972, while working on a Yugoslav Airlines flight, a bomb exploded, causing the plane to be torn into three pieces at an altitude of approximately 33,000 feet. As the cabin rapidly depressurized, passengers and crew members were tragically sucked out into the frigid skies, plummeting to their deaths. Vesna’s astonishing survival was attributed to her being wedged under a food cart at the rear of the fuselage. This section of the plane separated from the rest and crash-landed in a snow-covered area at an angle that likely spared her life.

Miraculously, Vesna was the sole survivor among the 28 people on board. She sustained multiple injuries, including a fractured skull and legs, but eventually made a near-full recovery.

She may also be a shoo-in for a Guinness World Record for being the world’s luckiest person.

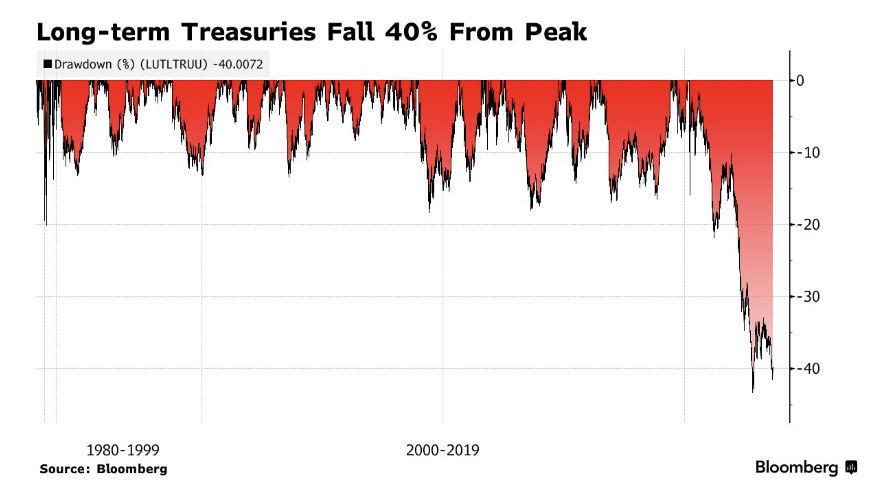

While far less ghastly, from an investor’s perspective, long-term Treasury bonds have crashed, leaving some portfolios in smouldering ruins.

The rise in interest rates has blown apart bond portfolios over the last several years, leaving these low-risk (or even “risk-free”) allocations in double-digit drawdowns. It has not been pretty.

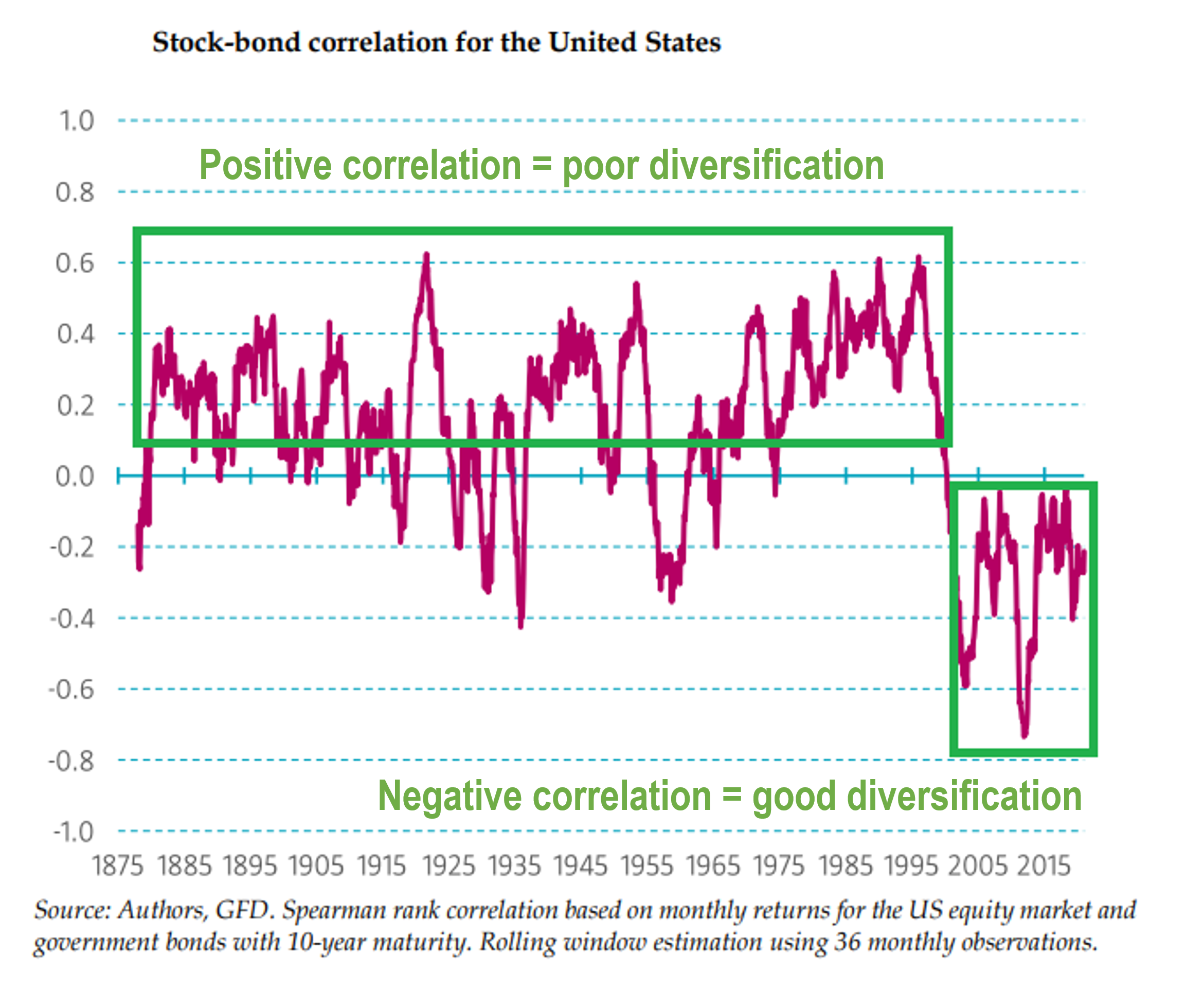

Over the twenty-year period prior to 2022, investors who held the traditional 60/40 stock and bond portfolio had been lucky, as the allocation generated attractive long-term returns with reasonable volatility.

This low volatility of the 60/40 portfolio was due to the negative correlation between the two asset classes. However, this environment was “lucky” for investors because, throughout the vast majority of history, stocks and bonds have been positively correlated, making them poor diversifiers.

Allocators can expect stocks and bonds to move in the same direction more often than not, as occurred in 2022. Last year, major bond and stock indexes were both down double-digits. Counting on two correlated assets for diversification is risky business. Hopefully, many learned their lesson from last year. However, the idea of the traditional 60/40 portfolio as a “balanced” allocation lives on despite much evidence to the contrary.

Most investment portfolios continue to rely on just two risk premia, the equity risk premium and the credit risk premium, creating unnecessary volatility and periodic gut-wrenching drawdowns for investors.

Asset allocation 2.0 calls for a more diversified approach beyond just two assets (stocks and bonds) in order to generate the same or higher returns with lower risk and less volatility. To accomplish this goal, investors should look beyond the traditional risk premia and to alternative risk premia.

There are a myriad of alternative risk premia beyond traditional equity and credit that investors can harvest to generate attractive risk-adjusted returns:

- illiquidity premium

- merger risk premium

- value premium

- momentum premium

- quality premium

- volatility premium

- etc.

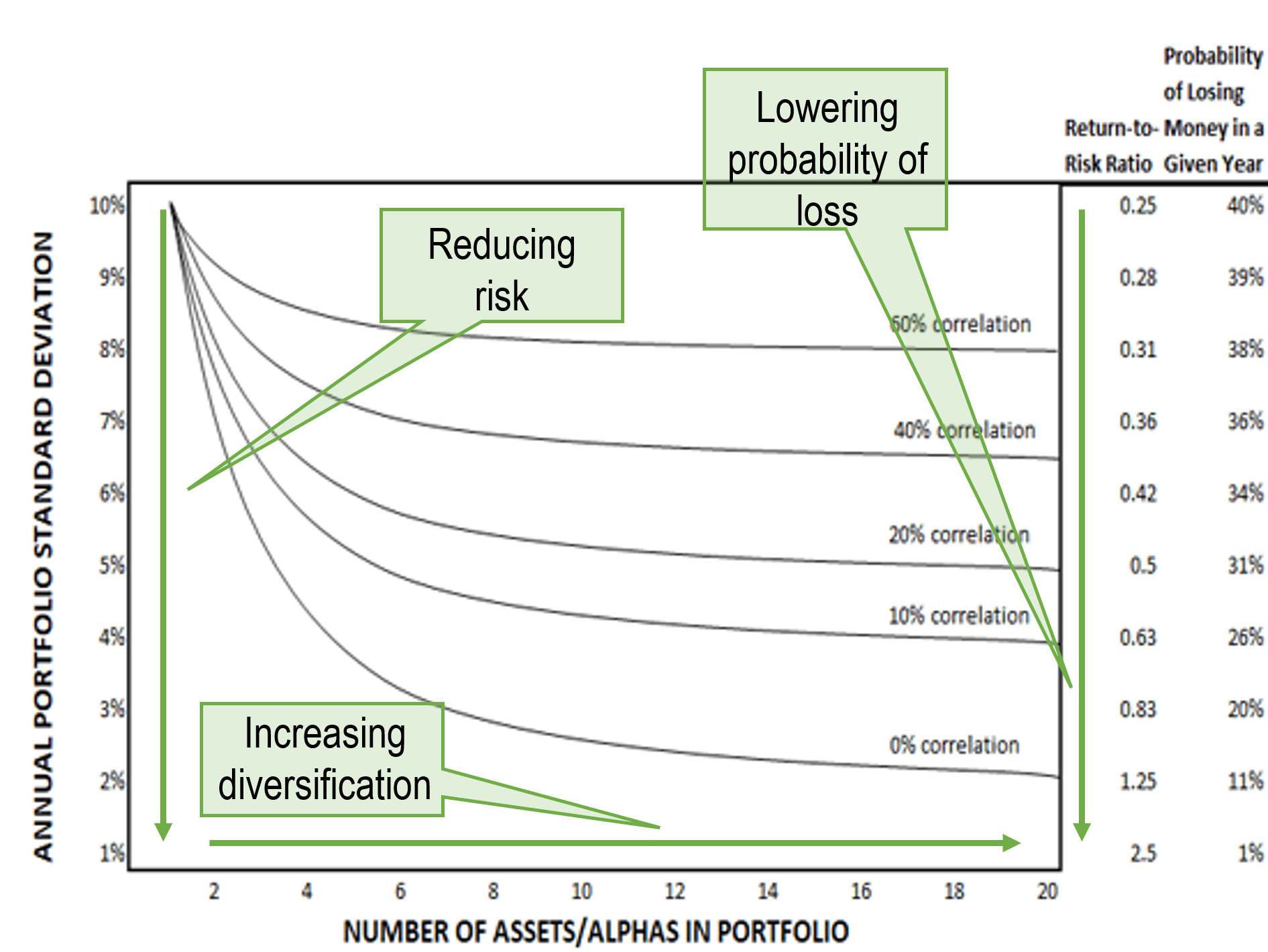

Legendary hedge fund manager Ray Dalio spoke of the “Holy Grail of Investing”, which stipulates that investing in ten to fifteen uncorrelated assets could reduce portfolio risk by about 80% without sacrificing return. Dramatically reducing risk for the same return seems much more logical than relying on luck.As portfolio diversification increases by adding uncorrelated assets, volatility decreases and the probability of losing money in a given year falls. With enough portfolio diversification, investors will likely not suffer through any major drawdowns, hence the “holy grail” nature of portfolios diversified with at least 10 asset classes.

Source: Ray Dalio, Accelerate

While the holy grail of investing exists in concept, its formula has not been solidified. However, we do have the first step to crafting the holy grail for investors:

Absolute return + arbitrage

Absolute return and arbitrage are two tried and true alternative asset classes that have proved their worth over decades. Both strategies have historically produced attractive risk-adjusted returns while, more importantly, doing so with a low correlation to traditional asset classes.

Since 2020, arbitrage and absolute return have had a correlation with stocks of near zero, showcasing their worth as diversifiers within the holy grail allocation.

In addition, while the equity risk premium has recently compressed with higher interest rates, making stocks less attractive, both arbitrage and absolute return face much brighter prospects in a higher interest rate environment. “Cash plus” liquid alternatives are the primary beneficiaries of higher interest rates.

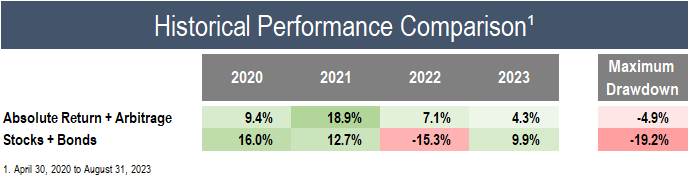

From a performance perspective, absolute return + arbitrage (orange line below) has trounced stocks + bonds (blue line below), on both an absolute return and risk-adjusted return basis.

Source: Accelerate, Bloomberg

Source: Accelerate, Bloomberg

In fact, absolute return + arbitrage has attained nearly 3x the risk-adjusted return of the stock + bond portfolio since 2020.

The key to crafting a long-term asset allocation framework is mitigating drawdowns. The number one cause of investors getting knocked off their plan is a significant fall in the value of their portfolio. If you can limit portfolio drawdowns and generate a smoother return profile, investors are much more likely to stick with their plan and enjoy the ride.

The holy grail of investing aims to reduce the odds and magnitude of potential portfolio drawdowns through its multi asset class diversification. On the loss-reduction front, the absolute return + arbitrage allocation shows well. Since 2020, the traditional stock + bond portfolio had a stomach-churning peak-to-trough decline of nearly -20%, while the absolute return + arbitrage strategy fell less than -5%. In addition, given its low correlation, the absolute return + arbitrage allocation produced positive returns every year since 2020, while the traditional allocation suffered a steep loss in 2022.

Source: Accelerate, Bloomberg

Capital preservation is the primary objective for many allocators, while return on investment comes second. In crafting a diversified allocation for this contingent of allocators, the focus on mitigating portfolio drawdowns and reducing the odds of an annual portfolio loss fits the approach of the holy grail portfolio.

If you worry about the downside, the upside will take care of itself.

The beautiful part of investing is that asset allocation is not mutually exclusive. The holy grail calls for ten to fifteen uncorrelated assets. Therefore, stocks will likely be a primary allocation within the holy grail framework. The holy grail does not require one to give up on the S&P 500.

It does not have to be absolute return + arbitrage instead of stocks + bonds.

The holy grail portfolio promotes a diversified allocation including stocks, bonds, absolute return, arbitrage, and other alternative asset classes.

Through diversification, investors need not rely on the luck that carried the traditional 60/40 stock + bond portfolio in the 2000s and 2010s. While Vesna Vulović survived a 33,000-foot fall through pure luck, investors should not rely on a miracle to meet their financial goals.

The dynamic duo of absolute return + arbitrage provides the first step of diversification beyond the traditional portfolio for those pursuing the holy grail of appreciable returns with low risk and mitigated drawdowns.

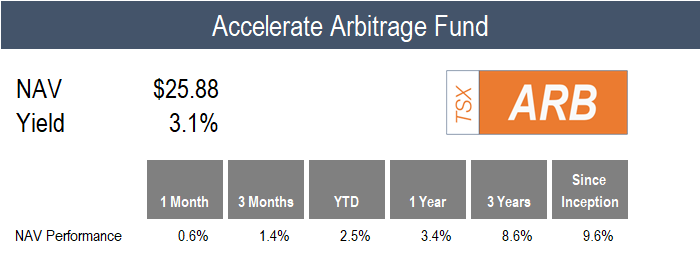

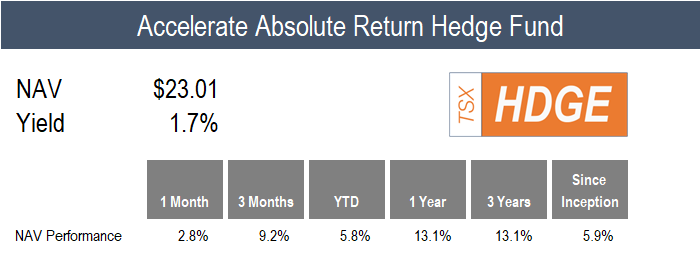

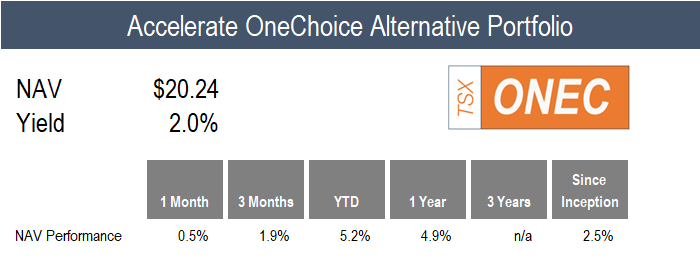

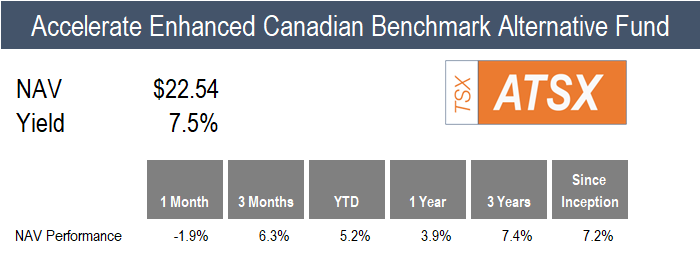

Accelerate manages four alternative ETFs, each with a specific mandate:

- Accelerate Arbitrage Fund (TSX: ARB): Cash Plus

- Accelerate Absolute Return Hedge Fund (TSX: HDGE): Portfolio Protector

- Accelerate OneChoice Alternative Portfolio ETF (TSX: ONEC): Portfolio Stabilizer

- Accelerate Enhanced Canadian Benchmark Alternative Fund (TSX: ATSX): Canadian 150/50

ARB gained 0.6% in August, with several positive catalysts contributing to positive Fund performance.

In the merger arbitrage portfolio, the APE / AMC dual-class share conversion saga finally came to an end as the transaction was completed. In addition, the FTC settled with Amgen and Horizon, allowing their merger to be completed next month. Eight merger arbitrage investments closed during August, and the Fund added two new mergers to the portfolio.

There was just one SPAC IPO during the month, and the Fund participated, given its attractive features including a $10.10 overfunded trust plus one full right and one full warrant. We remain hopeful that IPO issuance increases, given the attractive economics offered to those who participate (as we do). We believe activity will pick up as SPAC sponsors start to recognize that a dearth of vehicles will be on the shelf come the back half of 2024.

The Fund is currently allocated 65% to SPAC arbitrage and 35% to merger arbitrage with gross exposure (long + shorts) of 150% and a weighted-average yield to maturity above 8.0%.

HDGE gained 2.8% in a month in which alternative risk premia performed well.

In the U.S. long-short portfolio, all factors generated a positive return in August, with value, quality, and price momentum all producing returns of around 10.0% for the month. For example, high-quality stocks fell -2.7% while low-quality securities slumped -13.0%, leading to a 10.3% return for the long-short quality portfolio. All long-short factor portfolios in the U.S. generated positive performance for the month, in every case driven by the short portfolios.

The Canadian long-short portfolio contributed positively as well, led by the value portfolio, which gained 10.2% as undervalued securities notched a 1.8% increase and the overvalued stocks dropped -8.4%. The remaining Canadian long-short portfolio, including quality, price momentum, operating momentum, and trend, had mixed results.

Given that HDGE is 110% long / 50% short (60% net dollar long), it is not dollar market-neutral, however, it is generally beta-neutral. The Fund’s short positions average approximately 1.7x beta while its long book is around 1.0x. That is why in down markets, the Fund generally does well, as its high-beta short positions tend to drop precipitously while its longs hold up reasonably okay. In a month in which the factor portfolios generated all their alpha from their short positions, HDGE will not display as large of an effect, given its 50% (although higher beta) short exposure. This structure is utilized to protect investors in up-markets.

ONEC generated a 0.5% return for a month in which the results of its underlying allocations were mixed.

The absolute return, leveraged loan, and arbitrage allocations gained 2.6%, 1.0%, and 0.6%, respectively. The Fund’s other private credit allocation, mortgages, was flat.

ONEC’s inflation protection bucket fell in August as the gold and commodities allocations dropped -1.5% and -0.7%, respectively. Real assets also detracted from performance as real estate fell -0.2% and infrastructure dropped -2.6%.

In addition, the global macro and alternative equity allocations also produced negative performance, with risk parity falling -3.4% and enhanced long-short down -1.9%. The managed futures strategy was flat for the month.

ATSX fell -1.9%, while its benchmark, the TSX 60, dropped -1.5% in August. The Fund’s 50/50 long-short alpha overlay portfolio underperformed by -0.4%.

While the Canadian long-short portfolio did well on average, certain factors produced mixed results. Unfortunately, ATSX’s alpha overlay portfolio leaned toward long-short factor portfolios that did not generate positive performance for the month.

![]()

Have questions about Accelerate’s investment strategies? Click below to book a call with me:

Disclaimer: This distribution does not constitute investment, legal or tax advice. Data provided in this distribution should not be viewed as a recommendation or solicitation of an offer to buy or sell any securities or investment strategies. The information in this distribution is based on current market conditions and may fluctuate and change in the future. No representation or warranty, expressed or implied, is made on behalf of Accelerate Financial Technologies Inc. (“Accelerate”) as to the accuracy or completeness of the information contained herein. Accelerate does not accept any liability for any direct, indirect or consequential loss or damage suffered by any person as a result of relying on all or any part of this research and any liability is expressly disclaimed. Past performance is not indicative of future results. Visit www.AccelerateShares.com for more information.