November 14, 2022 – If you were to ask the average person what is a pressing issue in their life, the most common answer would likely be interest rates (or the economic issues that they cause). Specifically, what is top of mind for consumers is the current level of interest rates and their future direction. It is an aspect of life that affects nearly all consumers, especially those who own a home or a car.

Interest rates act as financial gravity, and drive many aspects of everyday life for most of us, even those not active in financial markets (believe it or not!). But for those involved in the capital markets, this financial gravity is paramount.

Just as a zero-gravity physical environment has dramatic effects on the life of an astronaut, central banks’ zero interest rate policy had pronounced effects on investors experience with the capital markets.

Specifically, record low interest rates for most of the past thirteen years created a myriad of market inefficiencies and dislocations.

The Federal Reserve, along with major central banks across the world, pinned interest rates to near zero from 2009 to 2016 and 2020 to 2022. This zero-interest rate policy benefited certain asset classes, and created bubbles in specific areas of the market (specifically, a bubble was created in speculative growth stocks).

That asset bubble’s previous outperformance, and recent significant underperformance, were inversely correlated with interest rates. Specifically, zero interest rates created a massive dislocation in the stock market by sending low-quality, speculative growth stocks to their most egregious valuations on record (even higher than during the tech bubble in 1999-2000) while high-quality, undervalued stocks languished.

As interest rates normalized this year, the bubble burst, which caused speculative growth stocks to fall markedly, with some declining more than -90%. This swift and brutal market reaction is unsurprising, given it is just a reversal of previous excesses built up over several years.

There’s an old Wall Street saying, “what is a stock down -95%?”

“It is a stock down -90% that got cut in half again.”

There’s more pain coming for unprofitable speculative equities in particular, and growth indexes such as the Nasdaq in general. In addition, there are several years left in the outperformance of value stocks. What’s old is new again.

The issues that fueled the speculative bubble presented challenges to other strategies, and vice versa. On strategy specifically, the short selling of stocks, was nearly impossible in an environment of 0% interest rates for two reasons:

- The best stocks to short – overvalued, low-quality “junk” stocks – were rallying like crazy.

- Shorting created a negative carry trade because the borrow cost on short positions exceeded the zero interest on the cash generated on the short sales.

In 2022, this dynamic has flipped. Rates are rising, which has reversed the challenges of bubble stocks surging along with the negative carry trade on short selling, creating a substantial tailwind for long-short equity investment strategies.

In contrast to many risk assets, long-short equity has been a massive beneficiary of rising interest rates. Higher rates benefit investment strategies with short portfolios, given they generate higher returns via interest on the cash from short sales. This excess return generation on cash provides a baseline return for the strategy of ~4% from the cash generated from the short book. The average cost to borrow a stock is approximately 0.8%, so the positive carry on the short portfolio is now well above 3% (being the interest on cash minus the borrow cost).

Years of 0% interest rates led to some of the most significant equity market mispricings in history. Now that rates are normalizing, equity securities are becoming more rationally priced, with the value/growth gap and quality/junk gap closing.

As overvalued junk stocks underperform, and undervalued quality stocks outperform, long-short equity strategies can be expected to generate positive returns from three segments of the strategy:

- The long portfolio of undervalued, quality stocks, which are expected to outperform

- The short portfolio of overvalued, junk stocks, which are expected to underperform

- The cash generated from the short portfolio

The combination of these three alpha-generating segments has led long-short equity to market-beating returns with low market correlation.

I previously stated, “this market dynamic may create another “golden era” for long-short equity, likely lasting several years”.

Long-short equity did +30% in 2021 and is up double-digits in 2022. I am gaining more confidence in this thesis as it plays out as predicted.

Ultimately, long-short equity is an investment strategy that relies upon tried and true predictive factors, including:

- Undervalued stocks outperform overvalued

- Quality stocks outperform junk

- Stocks with positive momentum outperform negative

- Share repurchasers outperform share issuers

- And so on

The predictive outperformance of these factors has been well-documented across decades of academic finance. When those predictive factors are utilized to assemble a portfolio of long securities that are expected to outperform, short securities that are expected to underperform, and cash generated from short sales that now generates a positive baseline return, it is a powerful investment strategy.

And the higher rates go, the more of a beneficiary that long-short equity is. The next “golden era” has started, and we expect it to last several more years.

Accelerate manages five alternative ETFs, each with a specific mandate:

- Accelerate Arbitrage Fund (TSX: ARB): SPAC and merger arbitrage

- Accelerate Absolute Return Hedge Fund (TSX: HDGE): Long-short equity

- Accelerate OneChoice Alternative Portfolio ETF (TSX; ONEC): Alternatives portfolio solution

- Accelerate Enhanced Canadian Benchmark Alternative Fund (TSX: ATSX): Buffered index

- Accelerate Carbon-Negative Bitcoin ETF (TSX: ABTC): Eco-friendly bitcoin

ARB gained 0.7% for the month, with the gains largely coming from the merger arbitrage book.

The Fund monitored the Twitter/Musk arbitrage opportunity and allocated once the deal was largely derisked but still offered a very attractive return. As detailed in the recently published case study, From The Trading Desk: Musk’s Twitter Buyout, ARB was able to generate a 170% annualized return in the Twitter merger arbitrage.

ARB’s current portfolio is allocated 76% to SPAC arbitrage and 24% to merger arbitrage, which is split between 15% in strategic M&A and 9% in LBOs. The current underlying yield of the Fund is 12.0% (median arbitrage investment yields 6.5%) with an average duration of 2.5 months.

![]()

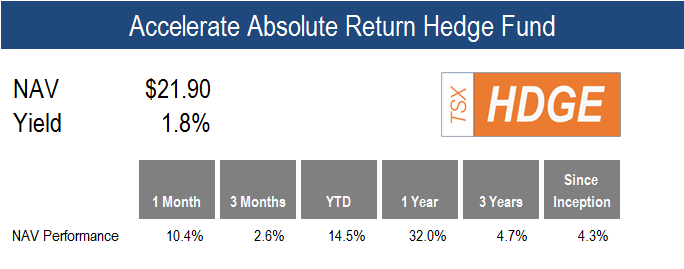

HDGE’s streak of outperformance continued as it gained 10.4% in October, taking its year-to-date performance to 14.5%.

In the U.S., all multi-factor long-short portfolios were up during the month. The Fund’s outperformance was led by the long-short value portfolio, which surged 7.9% as undervalued securities outperformed overvalued ones. The quality portfolio increased substantially as well, up 6.7% in October, as high-quality stocks continued their stretch of outperformance over junk.

Over the long term, we expect the rules of the market to continue to work. This means that we expect undervalued stocks to outperform overvalued, quality stocks to outperform junk, equities with positive momentum to outperform those with negative, and share repurchasers to outperform share issuers. As long as these “rules” work, HDGE will continue to add positive performance to investment portfolios irrespective of stock or bond market performance.

It is notable that HDGE is up 32.0% over the past year while the S&P 500 is down -14.5%, for an outperformance of nearly 4,700bps in a down market. The S&P 500 is not the Fund’s benchmark, however, the strong positive performance of HDGE in a challenging environment for equities strengthens its case as a market hedge within investors’ portfolios.

ONEC gained 2.1% as eight of the ten alternative allocations attained positive performance last month.

Long-short equity powered the Fund higher with a 10.4% return, followed by enhanced Canadian equity with a 8.2% gain. The infrastructure and bitcoin allocations both added 4.6% for the month. Risk parity, leveraged loans, real estate and arbitrage all added less than 2%.

The two allocations that detracted from ONEC’s performance were the mortgage portfolio, down -0.7%, and gold, which fell -2.0%.

![]()

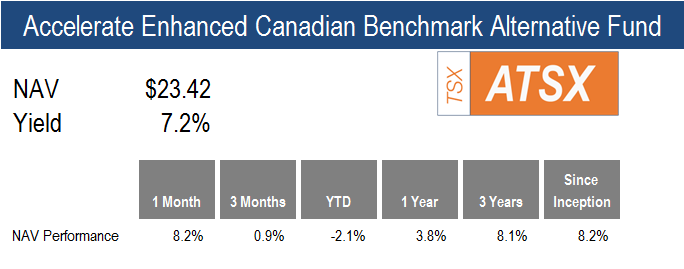

ATSX gained 8.2% in October, with the Fund’s overlay portfolio generating 2.7% of additional return above the benchmark TSX60’s 5.5% total return.

The Canadian multi-factor long-short portfolio surged during the month, with the long portfolio up 12.3% while the short portfolio gained just 1.6%.

All five of the multi-factor portfolios had their long positions outperform the shorts, which is to be expected over the long term. This can occur in both bull and bear markets, but it more often than not occurs while the market is falling. Nonetheless, multi-factor long-short portfolios have generated alpha on a fairly consistent basis in Canada over the short-term and long-term, allowing ATSX to outperform its benchmark both YTD and since inception while experiencing lower volatility.![]()

Have questions about Accelerate’s investment strategies? Click below to book a call with me:

Disclaimer: This distribution does not constitute investment, legal or tax advice. Data provided in this distribution should not be viewed as a recommendation or solicitation of an offer to buy or sell any securities or investment strategies. The information in this distribution is based on current market conditions and may fluctuate and change in the future. No representation or warranty, expressed or implied, is made on behalf of Accelerate Financial Technologies Inc. (“Accelerate”) as to the accuracy or completeness of the information contained herein. Accelerate does not accept any liability for any direct, indirect or consequential loss or damage suffered by any person as a result of relying on all or any part of this research and any liability is expressly disclaimed. Past performance is not indicative of future results. Visit www.AccelerateShares.com for more information.