May 8, 2019 – We had previously warned investors not to invest in stocks based on their dividend yields in a recent piece entitled “Whatever You Do, Don’t Invest Based On Dividend Yield”.

In the piece, we posited that “dividends have lost their luster ever since share buybacks came to dominate shareholder yield over the past 15 years”.

The S&P 500’s share buyback yield is nearly 4%, almost double the index’s dividend yield of 2%. Given that buybacks now account for two-thirds of the S&P 500’s shareholder yield of 6%, the buyback yield is a far larger determinant in the success of an investment as compared to dividend yield. Note that the terms buybacks and repurchases are used interchangeably.

Buyback Yield Yes, Dividend Yield No

Turns out, not only are share repurchases a much larger and more important portion of shareholder yield, share buybacks are a much better predictive factor of future equity performance as compared to dividends.

Let’s look at the numbers produced from a historical simulation of monthly-rebalanced buyback yield portfolios in both Canada and the U.S.

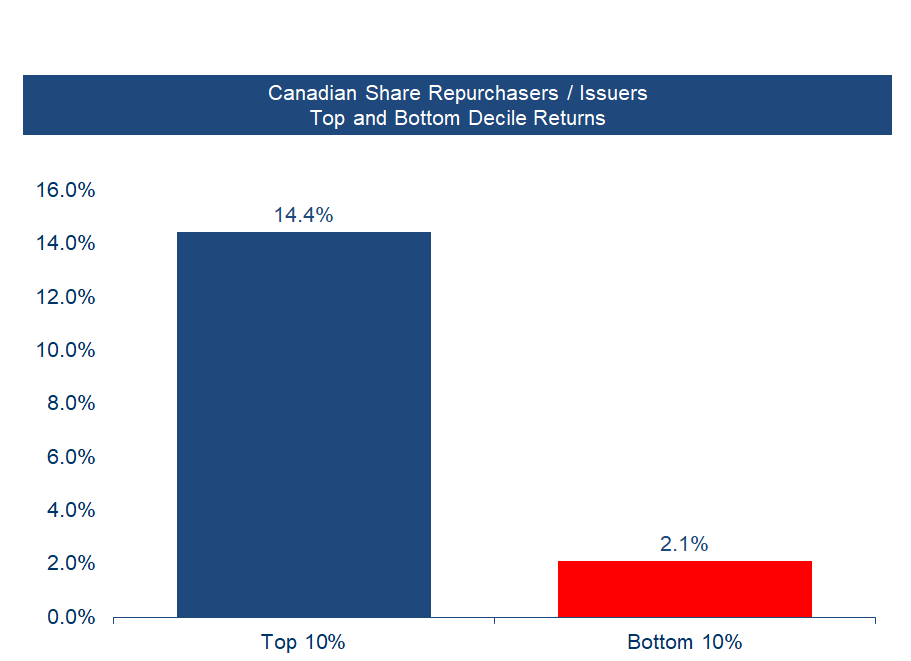

A portfolio of top-decile share repurchasers in Canada, meaning the top 10% of companies that most aggressively bought back their own shares, returned nearly 1,400% over the past 20 years. This represents a compound annual growth rate of 14.4% per annum.

A portfolio of the bottom 10% ranked stocks by share buybacks, or those companies issuing the most shares (the opposite of buying them back), returned only 50% over the past 20 years, representing a compound annual growth rate of just over 2% per year.

Source: Accelerate, S&P CapitalIQ, Compustat

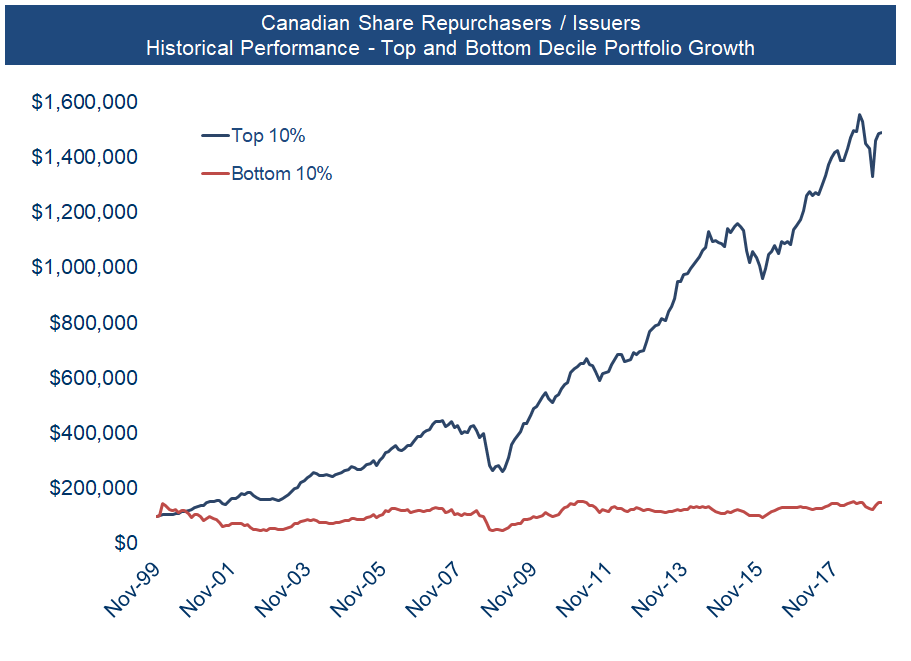

A $100,000 investment into a portfolio of the top 10% of share repurchasers in Canada would have grown to $1.5 million over 20 years.

Meanwhile, the same $100,000 investment into a portfolio of the bottom 10% of share repurchasers (meaning the largest issuers of stock, or those with a negative buyback yield) would have grown to just $150,000 over the 20 year timeframe.

Source: Accelerate, S&P CapitalIQ, Compustat

We see a similar dynamic in the performance of U.S. share repurchasers and equity issuers.

A portfolio of the top 10% of U.S. stocks buying back their shares has seen a 946% return over the past 20 years, representing a 12.5% annualized return. A $100,000 investment into this portfolio would have grown to over $1 million over 20 years.

A portfolio of the bottom 10% of U.S. stocks ranked by share repurchases, or those with the greatest negative buyback yield (net share issuers) would have seen a -23% loss over the past 20 years (-1.2% annualized), turning a $100,000 investment into just $77,000.

Source: Accelerate, S&P CapitalIQ, Compustat

Clearly, there’s a large divergence between the top and bottom decile ranked share buyback portfolios in both geographical markets. This means that the share buyback factor could be deemed robust and could perhaps be expected to have reasonable predictive ability.

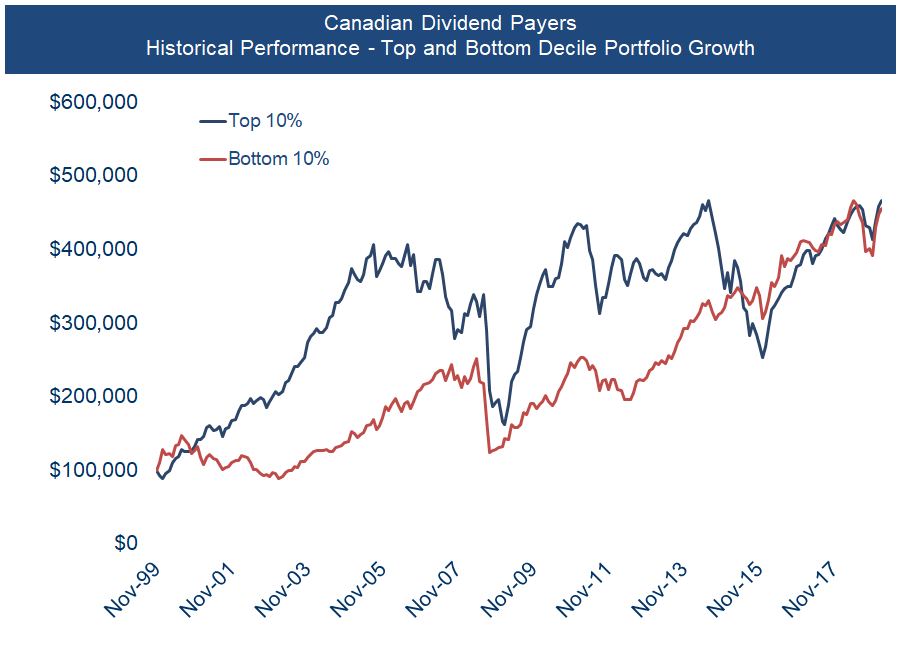

Contrast this to the performance of dividend-ranked portfolios. Looking at a portfolio of the top 10% Canadian dividend payers, or those stocks that pay the highest dividend yield, it performed in-line with a portfolio of the bottom 10% of dividend payers at approximately 8% per year, over the past 20 years.

Source: Accelerate, S&P CapitalIQ, Compustat

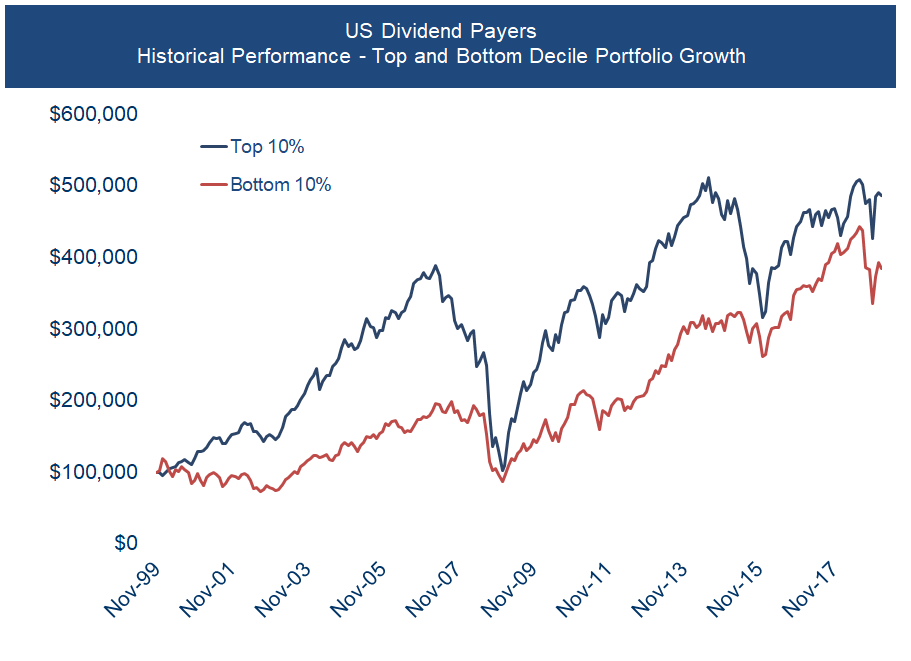

A similar historical performance was notched by top and bottom U.S. dividend yield portfolios over the past 20 years. The top decile, highest yielding dividend portfolio returned 8.2% per annum while the bottom decile, or lowest yielding dividend portfolio, returned 7.0% per annum.

Source: Accelerate, S&P CapitalIQ, Compustat

Not only did the top dividend yield portfolios underperform the top share buyback portfolios by 6.4% and 4.3% per year in Canada and the U.S., respectively, over the past 20 years, there was really no material divergence in performance between the top and bottom decile dividend yield portfolios.

This means that dividend yield is really not a robust factor because one cannot create a market-neutral portfolio, being long top decile dividend yielders and short bottom decile yielders, that produces material alpha.

Buybacks For The Win

There are two salient points to note in the buybacks versus dividends debate in investing:

- As a proportion of shareholder yield, buybacks are a far larger share of capital being returned to shareholders, and therefore buyback yield should be a much more important factor to consider when analyzing a stock and the company’s capital allocation with respect to shareholder yield.

- The top decile portfolio of share repurchasers has outperformed the top decile portfolio of dividend payers, while also displaying a substantially larger divergence in performance between the factor’s top and bottom decile portfolios. Said simply, buybacks have a much better track record of predictive outperformance than dividends.

Bottom line? When considering the shareholder yield conundrum, focus on a stock’s share buyback yield and ignore its dividend yield.

-Julian