September 20, 2025 – The critically acclaimed TV series The Last of Us tells a story about a post-apocalyptic world in which the human race is brought to the brink of extinction by a horrifying pandemic. In the show, a mutated Cordyceps fungus evolves to infect humans after a sudden rise in global temperatures. Once infected, people lose their free will and become bloodthirsty “infected” as the fungus consumes their brains, leaving their zombie-like bodies intent on killing all humans. Notably, part of the first season was filmed in Calgary and briefly featured a zombified Accelerate headquarters.

Ultimately, The Last of Us is a story about the dwindling survivors navigating both monstrous infections and the equally dangerous choices of other desperate humans. It was a deadly environment for the survivors.

Which brings us to today’s market reality. Just as a violent and aggressive fungal pandemic ravaged the human race in the TV series, the current surge in frenzied speculative trading in the stock market has devastated short sellers. So much so that pure short sellers have seemingly completely died off – victims of the outperformance of junk stocks over the past several years. All that remains are the hedgers, who pair long positions against their shorts in an attempt to mitigate market risk – and given the current challenging conditions in short selling, even their existence is threatened.

Short selling, when an investor sells borrowed shares in anticipation of buying them back at a lower price, can significantly enhance market efficiency. Short sellers typically bet against overvalued stocks or companies with weak fundamentals, and their selling pressure helps bring prices closer to intrinsic value more quickly, limiting bubbles and mispricings. One can think of short sellers as the sheriffs and cops of the stock market, attempting to help speculative fervours from getting out of hand and keep market excesses in check.

However, just as sheriffs who seek to bring peace and justice to the streets are demonized by criminals, short sellers are vilified by stock-pumping retail investors. They really dislike it when hedge funds short stocks they own, so much so that an entire trading strategy, known as meme stock investing, focused on squeezing heavily-shorted low-quality stocks, has become shockingly popular. It is as if a large contingent of retail investors has become infected by a Cordyceps-like plague, likely by spending too much time in internet chat rooms, causing zombie-adjacent symptoms in which they overly focus not on bloodshed but on short squeezes and pump and dump schemes (instead of investment fundamentals).

Despite the visceral and angry reactions short sellers get from amateur investors on Reddit, in which they claim those who short stocks are either evil or unpatriotic, there are many reasons why hedge funds short securities that are by no means evil, including:

- A risk arbitrage hedge, in which one shorts an acquiror’s stock to hedge the share consideration in a merger.

- A convertible bond arbitrage hedge, in which one shorts a company’s stock to hedge a long convertible bond position in the same corporation.

- An option delta hedge, in which one shorts a company’s stock to hedge an options position in the same corporation.

- A statistical arbitrage hedge, in which one shorts a company’s stock for a brief period in relation to price movements in a similar company’s stock.

- A funding short, in which one shorts a company’s stock to fund a long position that one expects will outperform.

Most of the above reasons to short sell securities do not even express bearish views on the shorted stock, and therefore accusations of short sellers being cruel or anti-altruistic are generally unfounded.

From a practical perspective, long short equity hedge funds short stocks for two reasons (none of which involve shorts necessarily going to zero):

- To fund long positions – When one shorts a stock, they borrow the security and sell it in the market, generating a cash credit in their account. They can then use that cash credit to buy a long position that they believe will outperform. The key to short selling stocks to fund purchases of long securities is that one is only betting on the funding shorts underperforming their longs, and not even necessarily declining in price. A long short equity hedge fund shorts stocks in order to leverage their long positions and attain additional exposure to their favourite stocks that they believe will outperform. The shorts generate the funds needed to purchase these long positions.

- To hedge market exposure – No one likes to lose money in the market. The ideal investment participates in the market’s upside while sidestepping its downside. Timing this dynamic, by jumping in and out of asset classes (known as “market timing”), is practically impossible. As legendary investor Peter Lynch famously said, “Far more money has been lost by investors preparing for corrections than has been lost in the corrections themselves”. One of the more realistic methods of generating upside returns while reducing downside participation is to hedge one’s long portfolio with counteracting short positions. Theoretically, one’s short positions decline at least as much, or drop further, than one’s long positions in a bear market, allowing the hedged investor to sail through the storm largely unscathed.

“In theory, there is no difference between theory and practice. In practice there is,” is a famous saying attributed to baseball legend Yogi Berra. It highlights how real-world application often introduces complications and variations that differ from idealized theoretical models. While theories provide a framework and ideal conditions, practice is subject to real-world factors and unforeseen challenges.

A long short equity approach, in which one hedges their long positions with shorts that are expected to underperform, should work out well over the long term. However, just as any investment strategy, it is bound to experience performance setbacks, primarily in markets where speculative stocks (of which short sellers tend to target) are outperforming.

The Goldman Sachs Most Shorted Basket tracks the stocks with the highest short interest in the market. These stocks have a very high short interest relative to their equity float, meaning that the smart money may be betting against these securities. This basket is typically comprised of low-quality, unprofitable “junk stocks” that tend to underperform over the long term.

That said, recently, the GS Most Shorted basket has been dramatically outperforming the broader markets. Stocks with high short interest have posted strong gains lately, suggesting that many of those who are short may be getting squeezed, which involves being forced to cover their shorts by buying back the securities, adding further fuel to the fire.

Since the “obliteration day” market bottom five months ago, the GS Most Shorted basket (white line below) is up +79%, more than double the return of the S&P 500 (orange line below).

Source: Bloomberg

All it takes is a quick scroll through Fintwit, or financial Twitter (now known as X), and one will find retail investors doing victory laps with purportedly ungodly returns attained through risky, highly leveraged long investments (often through the copious use of call options) into ultra-speculative, unprofitable or even zero-revenue companies (we have previously written on the phenomena of meme stocks and crypto treasury companies, for a couple of examples). Meanwhile, fundamental investors are stuck banging their heads against the wall, wondering why their short portfolios are getting obliterated. It appears that the Cordyceps fungus affecting retail traders’ brains is proliferating, causing the bubble in junk stocks to inflate further. Just as the surviving humans in The Last of Us were constantly needing to outrun the infected, the remaining short sellers in this market need to exercise diligence and risk management if they are to survive the onslaught of the mindless stock pumpers. Time will tell which side of these warring factions succeeds. I would not count the short sellers out – they do have fundamentals on their side.

Despite the long short equity model facing its current challenges, due to tough conditions for short selling, we do not believe these difficult conditions will last. Therefore, there is still merit in taking a hedged equity approach. To help facilitate idea generation, we highlight one top-decile stock that is forecast to outperform and one bottom-decile stock that is predicted to underperform in this month’s AlphaRank Top Stocks.

OUTPERFORM: Royal Bank of Canada (TSX: RY) is a diversified financial services business and the biggest bank in Canada (not to mention the largest market capitalization stock on the Toronto Stock Exchange). RBC possesses many of the qualities that enterprising investors look for in a stock: steady earnings, good management, attractive capital allocation, room for growth (especially within wealth management), and a below-market valuation. With an AlphaRank score of 99.5/100, we expect RY shares to outperform. Disclosure: Long RY shares in the Accelerate Canadian Long Short Equity Fund (TSX: ATSX).

UNDERPERFORM: Snap Inc. (NYSE: SNAP) owns and operates Snapchat, a social media platform focused on younger users with features like disappearing messages, media sharing, and AR lenses. Despite being a public company for more than eight years, Snap is still running at a net loss, which widened in the most recent quarter compared to a year ago. It is left funding its unprofitable business model by issuing shares and consistently diluting shareholders. Since Q2 2022, Snap shares have dropped an average of -13.1% after reporting quarterly results, missing Street expectations in 11 of the past 13 quarters. With an AlphaRank score of 7.7/100, we expect the shares to underperform. Disclosure: Short SNAP shares in the Accelerate Absolute Return Fund (TSX:HDGE).

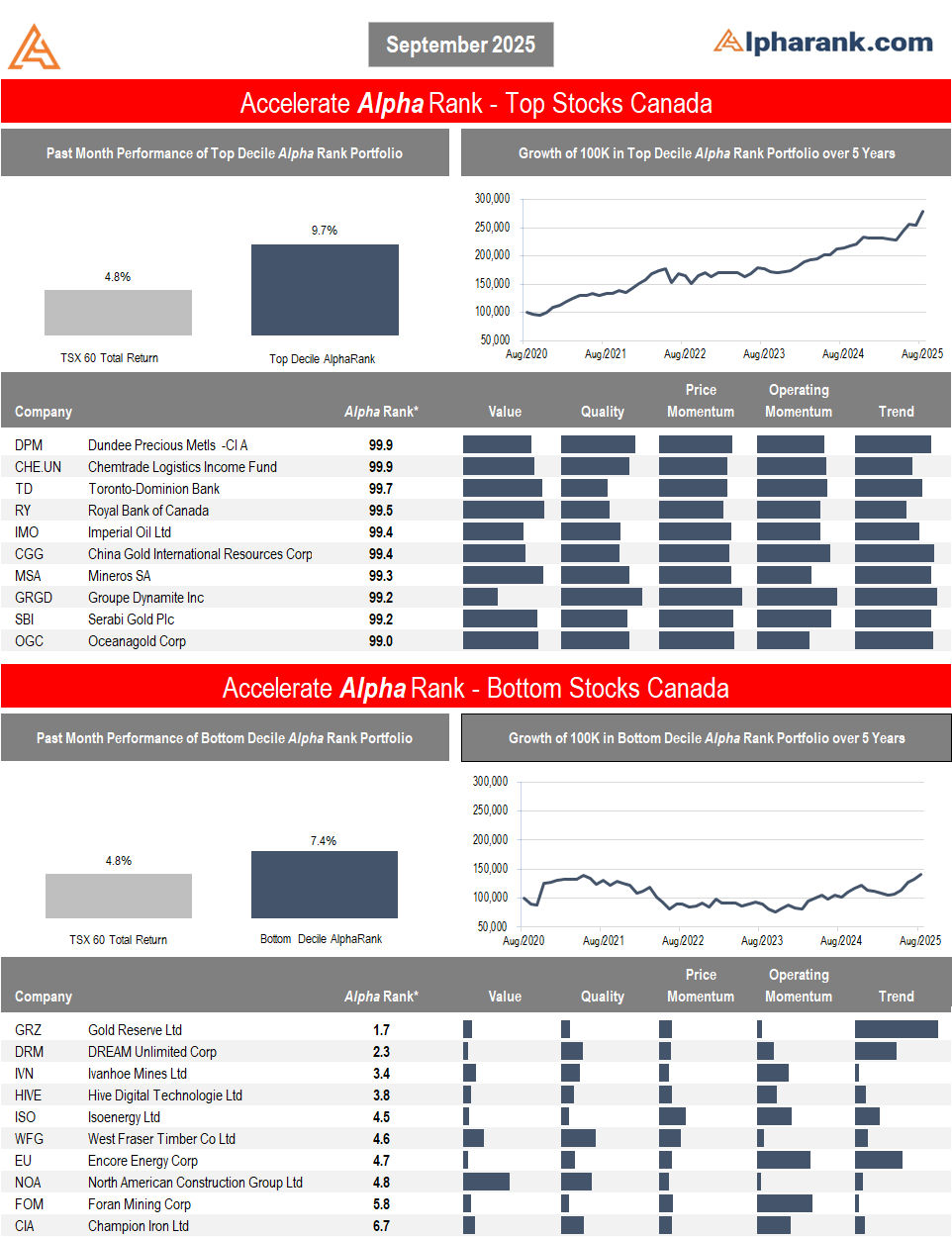

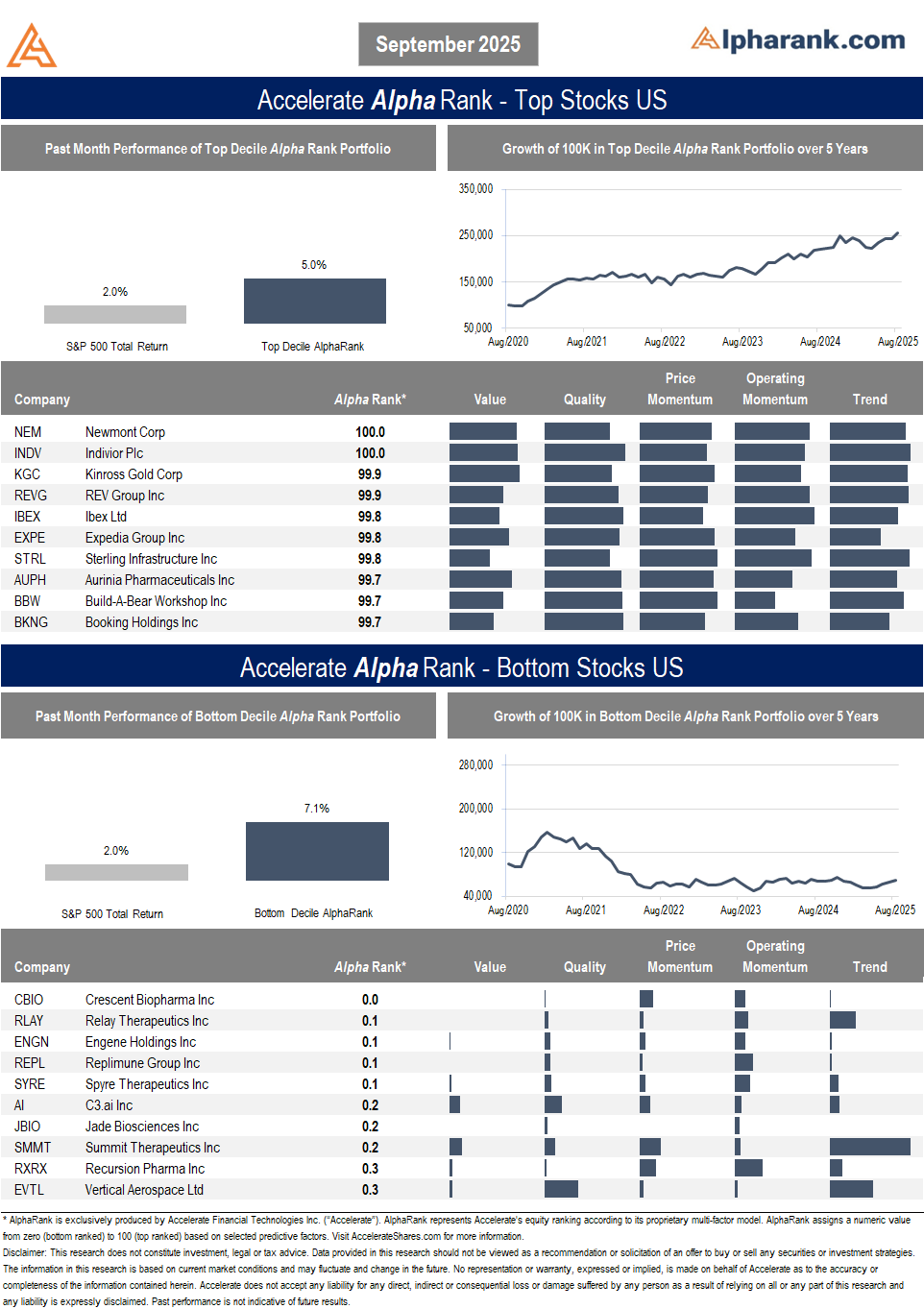

The AlphaRank Top and Bottom stock portfolios exhibited mixed relative performance last month:

- In Canada, the top-ranked AlphaRank portfolio of stocks returned 9.7%, outperforming the benchmark’s 4.8% return, while the bottom-ranked portfolio of Canadian equities gained 7.4%. The long-short portfolio (top minus bottom ranked stocks) increased by 2.3%, as the top-ranked stocks outperformed the bottom-ranked securities. Over the past five years, the top decile AlphaRank portfolio has gained more than 170%, while the bottom-ranked portfolio has risen less than 50%.

- In the U.S., the top-decile-ranked equities returned 5.0%, outperforming the S&P 500’s 2.0% return. Meanwhile, the bottom-ranked stocks jumped by 7.1%, resulting in a -2.1% return for the top decile minus the bottom decile long-short portfolio. Over the past five years, the top-ranked U.S. equities have gained more than 150%, while the bottom-ranked portfolio has declined by more than -30%.

AlphaRank Top Stocks represents Accelerate’s predictive equity ranking powered by proven drivers of return. Stocks with the highest AlphaRank are expected to outperform, while stocks with the lowest AlphaRank are anticipated to underperform. AlphaRank assigns a numeric value to each security, ranging from 0 (bottom-ranked) to 100 (top-ranked), based on selected predictive factors. All Canadian and U.S. stocks priced above $1.50 per share and with a market capitalization exceeding $100 million are evaluated. In both the Accelerate Absolute Return Fund (TSX: HDGE) and the Accelerate Canadian Long Short Equity Fund (TSX: ATSX), Accelerate funds may be long many top-ranked stocks and short many bottom-ranked stocks. See AccelerateShares.com for more information.