June 22, 2025 – Writing about markets is not only therapeutic, but it is intellectually clarifying. Putting the proverbial pen to paper allows one to reframe events, explore various scenarios, and to make sense of the complex dynamics inherent in world markets.

These investment memos typically get crafted on Saturday and Sunday mornings. In my opinion, nothing beats waking up as the sun rises and theorizing about both micro and macro economic events, particularly on the weekend when one is not distracted by the price action of the equity capital markets (although the crypto market is a great weekend distraction).

While the majority of micro and macro economic incidents, along with typical corporate events, occur during the business week, significant geopolitical events occasionally occur during the weekend when most markets are closed.

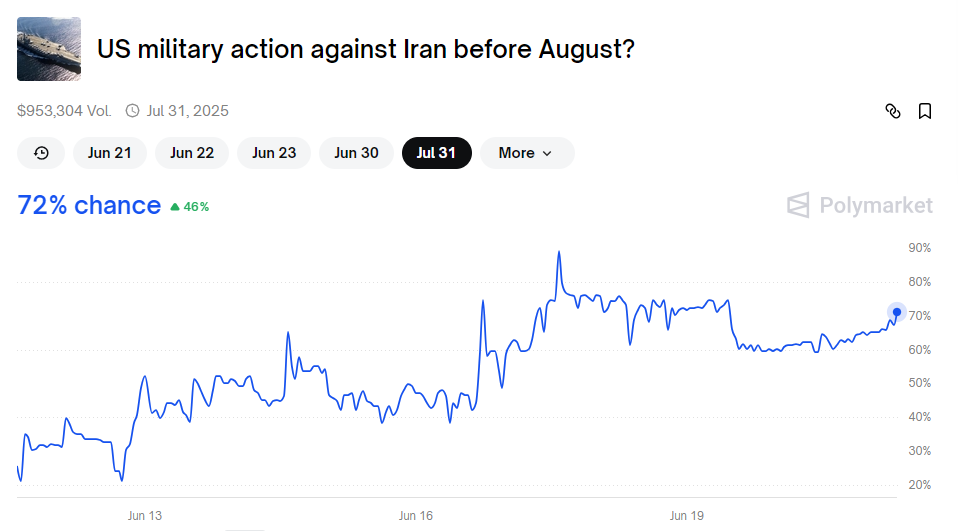

As of Saturday morning, prediction markets were pricing in a 72% chance that the United States would commence military action against Iran before August.

Source: Polymarket

Several hours after this data grab, the U.S. military bombed three nuclear sites in Iran, taking the probability of the event occurring to 100%. Prior to the military strike, market prices had already incorporated a probable chance of this geopolitical escalation, and therefore the near-term market reaction should be somewhat subdued given it was mostly expected. The crypto markets, which serve as a convenient measure of investor sentiment and a global risk measure on the weekend when traditional markets are closed, confirmed the priced-in nature of the event, with bitcoin experiencing only modest declines through Saturday evening.

That said, several implications arise from this escalation in geopolitical strife.

First, while President Trump did give a “two weeks” warning to Iran, the TACO moniker (Trump Always Chickens Out – meaning he does not follow through on threats) may no longer stand. Whether it is military action, tariffs, or other significant policy implementations, the market may ascribe higher probabilities to the outcomes as pontificated in his tweets (or, technically, “truths”).

Second, the escalation of the war in the Middle East has immediate effects on the global commodity markets – particularly oil and gold, which should see a bump in prices. The implication for investors is straightforward. Mainly, we can expect the bull run for the yellow metal to continue, buoying investment portfolios with an allocation to gold (which continues to make sense for diversified allocations). In addition, stock markets with a greater quantity of gold miners and oil producers (i.e. the Canadian stock market) will likely continue their outperformance over tech-dominated equity markets such as the S&P 500.

Third, theoretically, risk premia should increase as investors price in an increased probability of global warfare, causing equity multiples to decline and pressuring elevated stock market prices. While increased tensions in the Middle East may be a catalyst and current core driver of elevated risk premia, it is not the only major macro risk faced by investors. The U.S. administration continues to pursue an aggressive economic agenda, with the country’s effective tariff rate estimated to be above 15%, its highest level since 1937. Economic indicators are weakening, suggesting that the weight of tariffs may be taking a toll on worldwide growth. At the same time, the U.S. faces mounting fiscal pressure, with soaring debt and widening deficits unsettling the Treasury market. Not to mention Section 899 of the proposed One Big Beautiful Bill Act, which includes a “revenge tax” on international investors that may cause them to flee American markets, increasing the cost of capital for both the U.S. Government and corporations. This policy would cause Treasury yields to rise and stock prices to decline, all else equal, in addition to layering more selling pressure on the U.S. dollar as capital flees.

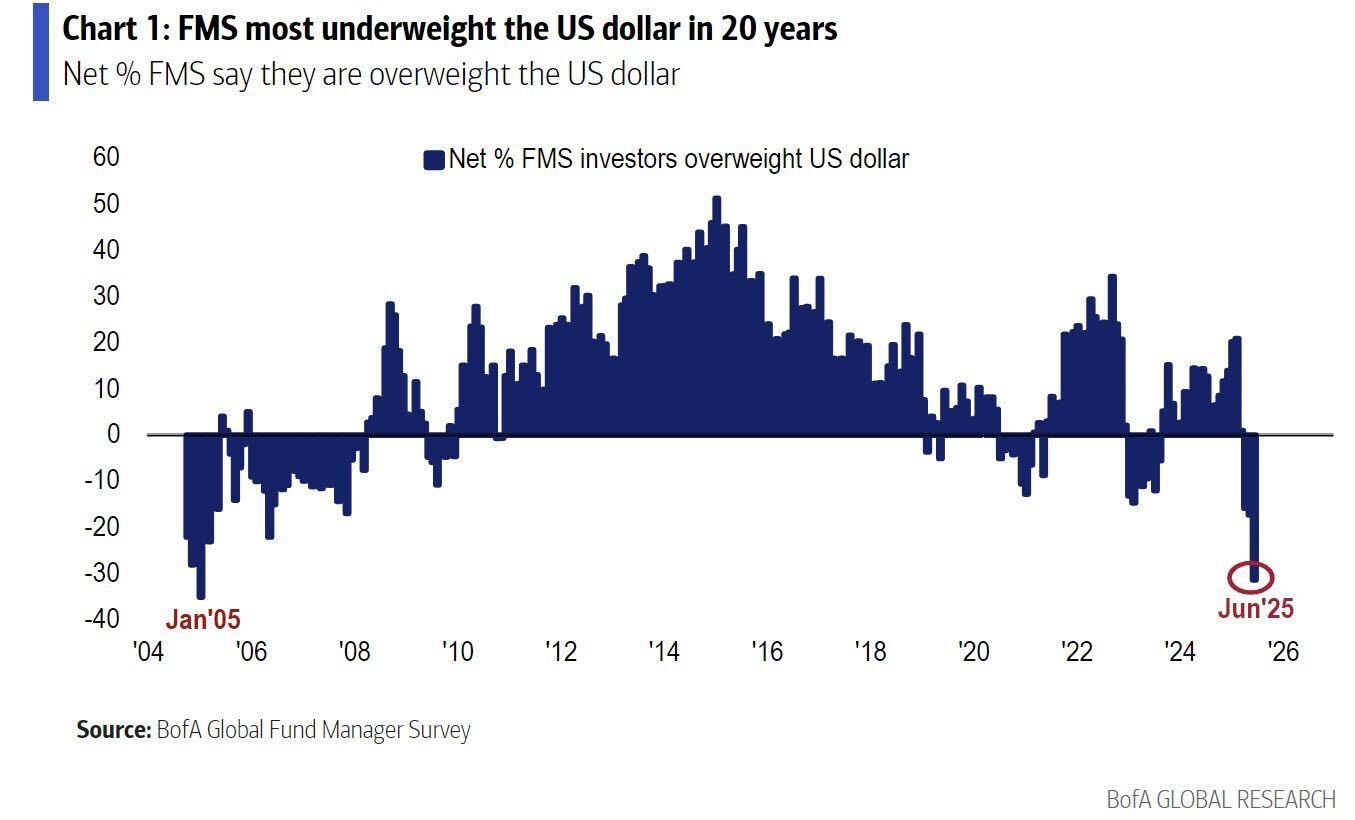

Speaking of which, the U.S. dollar has been struggling under the weight of recent policy changes. According to BofA’s latest global fund manager survey, portfolio managers have the lowest weighting to the dollar in twenty years.

Nonetheless, amidst geopolitical strife and continued economic policy uncertainty, we expect markets to remain somewhat choppy and directionless in the near to medium term. The current market environment is conducive to a focus on capital preservation. Therefore, investors may want to consider taking a hedged equity approach. To help facilitate idea generation, we highlight one top-decile stock that is forecast to outperform and one bottom-decile stock that is predicted to underperform in this month’s AlphaRank Top Stocks.

Nonetheless, amidst geopolitical strife and continued economic policy uncertainty, we expect markets to remain somewhat choppy and directionless in the near to medium term. The current market environment is conducive to a focus on capital preservation. Therefore, investors may want to consider taking a hedged equity approach. To help facilitate idea generation, we highlight one top-decile stock that is forecast to outperform and one bottom-decile stock that is predicted to underperform in this month’s AlphaRank Top Stocks.

OUTPERFORM: Finning International Inc (TSX: FTT) is the world’s largest Caterpillar equipment dealer, serving Western Canada, South America (notably Chile), and the U.K. / Ireland. The company provides sales, rentals, parts, and maintenance services for Caterpillar machinery used in mining, construction, energy, forestry, and power systems. Finning is leveraged to the global mining cycle, especially copper. With electrification trends and a bullish long-term outlook for copper, demand for mining equipment should remain robust. Approximately 50% of Finning’s revenue is derived from product support, which is high-margin and recurring. This high-quality business model is evident in its return on capital (ROC) of 27.2%. Free cash flow has been strong post-COVID, as FTT has a robust 12.8% free cash flow yield, and management has emphasized shareholder returns (dividends and buybacks, which has led to a -5.8% year-over-year reduction in shares outstanding). Lastly, FTT trades at an attractive below-market multiple of 7.9x EBITDA, and performance has been solid, recently exceeding quarterly expectations. With an AlphaRank score of 99.8/100, we expect the shares to outperform. Disclosure: Long FTT shares in the Accelerate Absolute Return Fund (TSX:HDGE).

UNDERPERFORM: Aecon Group Inc (NSYE: ARE) is a Canadian construction and infrastructure development company that operates across civil, industrial, urban transportation, and nuclear sectors. Recent years have seen significant cost overruns, which have led to a negative ROC along with negative free cash flow. Aecon often needs to borrow or issue equity to fund working capital and project losses, putting pressure on the balance sheet. A recent quarterly miss has punished the stock. Compared to better-run Canadian peers, Aecon lags in profitability, capital return, and project delivery consistency. With an AlphaRank score of 4.2/100, we expect the shares to underperform. Disclosure: Short ARE shares in the Accelerate Canadian Long Short Equity Fund (TSX: ATSX).

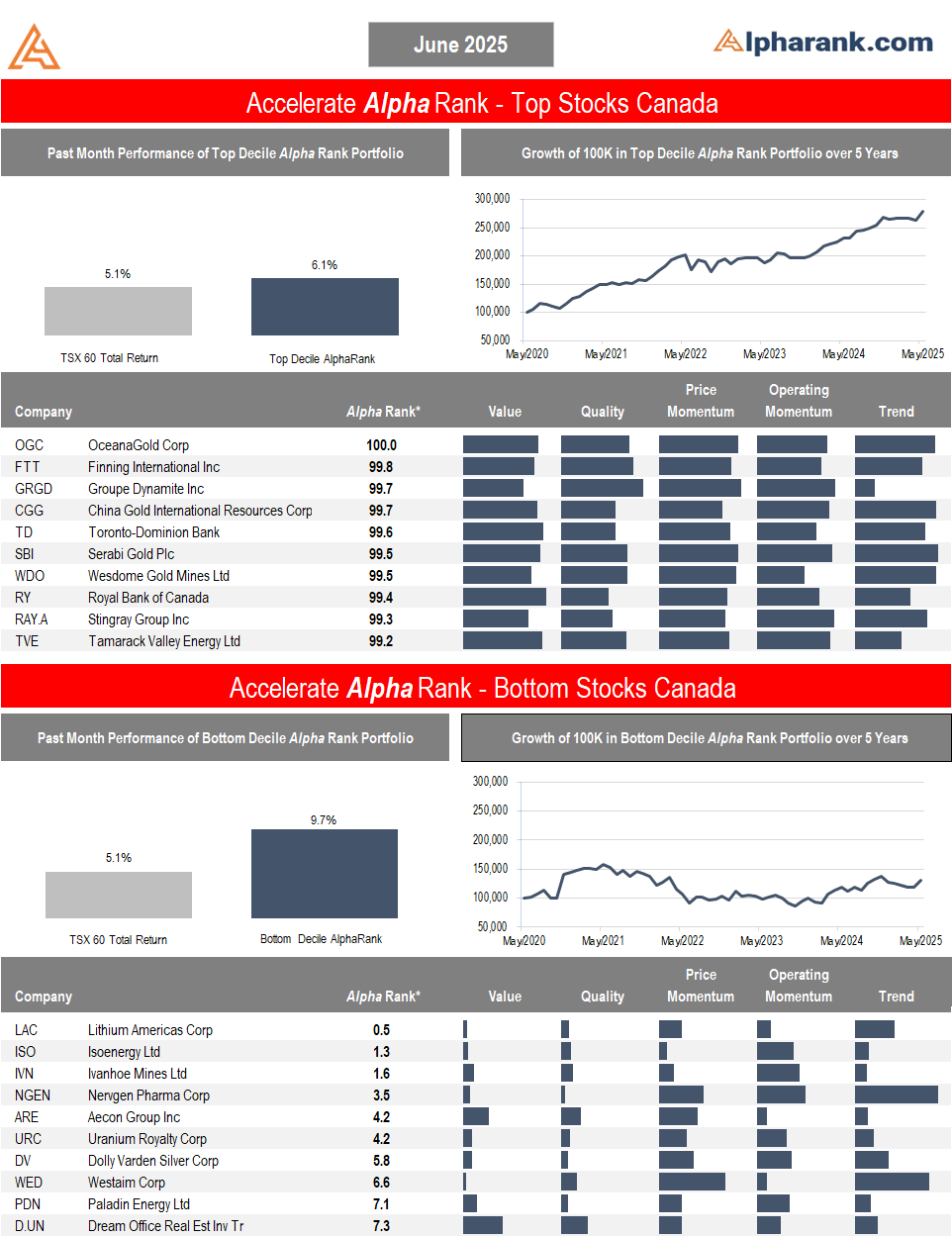

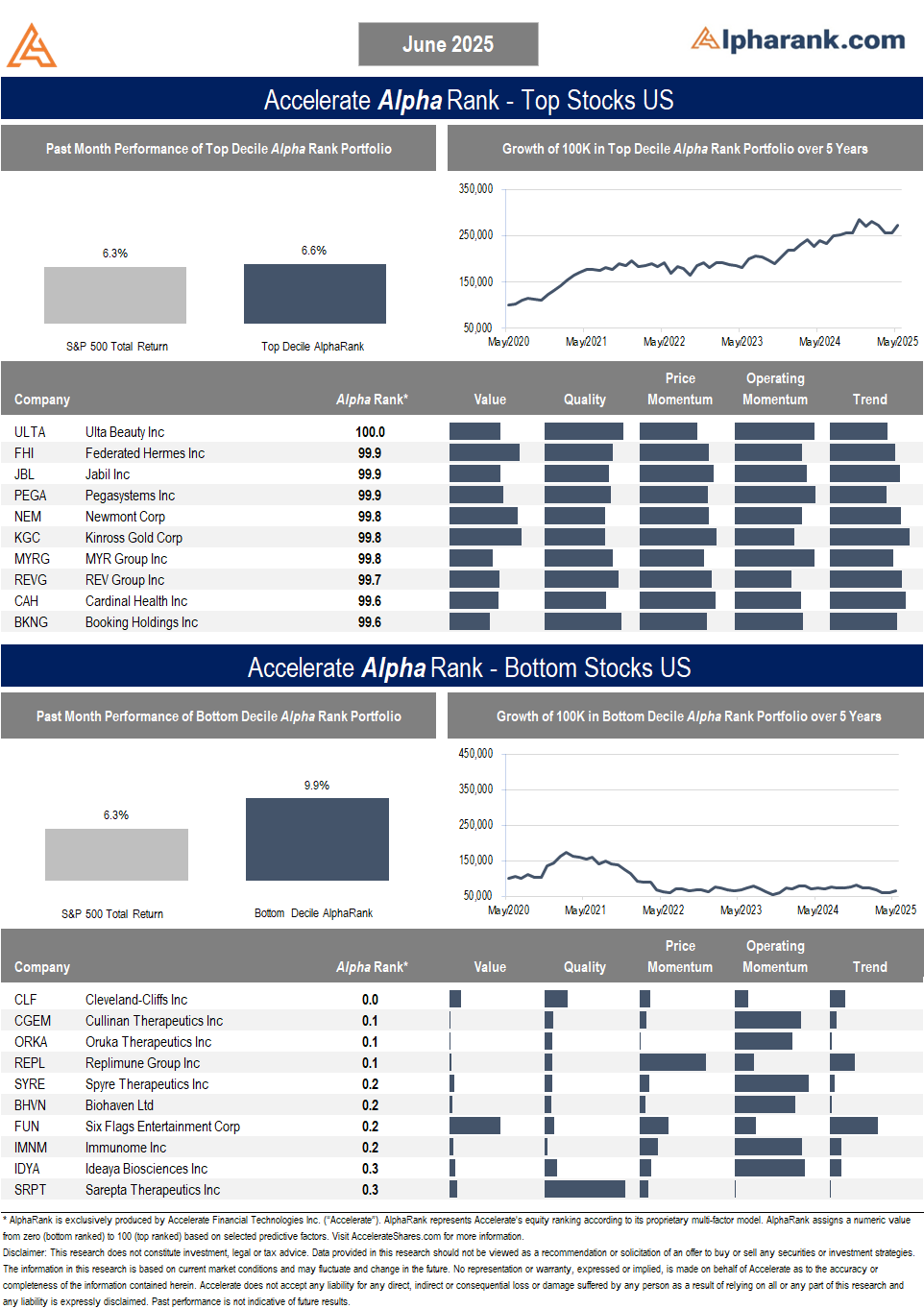

The AlphaRank Top and Bottom stock portfolios exhibited mixed relative performance last month:

- In Canada, the top-ranked AlphaRank portfolio of stocks returned 6.1%, outpacing the benchmark’s 5.1% return, while the bottom-ranked portfolio of Canadian equities surged 9.7%. The long-short portfolio (top minus bottom ranked stocks) fell -3.6%, as the bottom-ranked stocks outperformed the top-ranked securities. Over the past five years, the top decile AlphaRank portfolio has gained nearly 200%, while the bottom-ranked portfolio has risen less than 50%.

- In the U.S., the top-decile-ranked equities return 6.6%, ahead of the the S&P 500’s 6.3% return. Meanwhile, the bottom-ranked stocks rallied by 9.9%, leading to a -3.3% return for the top decile minus the bottom decile long-short portfolio. Over the past five years, the top-ranked U.S. equities have gained more than 150%, while the bottom-ranked portfolio has fallen nearly -40%.

AlphaRank Top Stocks represents Accelerate’s predictive equity ranking powered by proven drivers of return. Stocks with the highest AlphaRank are expected to outperform, while stocks with the lowest AlphaRank are anticipated to underperform. AlphaRank assigns a numeric value to each security from zero (bottom-ranked) to 100 (top-ranked) based on selected predictive factors. All Canadian and U.S. stocks priced above $1.50 per share and with a market capitalization exceeding $100 million are evaluated. In both the Accelerate Absolute Return Fund (TSX: HDGE) and the Accelerate Canadian Long Short Equity Fund (TSX: ATSX), Accelerate funds may be long many top-ranked stocks and short many bottom-ranked stocks. See AccelerateShares.com for more information.