January 31, 2026 – For the past 3,000 years, the Chinese Zodiac has assigned each year an animal sign, along with its reputed attributes, to interpret cycles of fortune. Each animal of the zodiac represents personality archetypes and social energy.

The 12 animals assigned to each year in the 12-year cycle created an ancient timekeeping system used to determine personality and prosperity, based on one’s birth year. Moreover, each year is ascribed one of five elements, and when combined with the 12 animals, it creates a 60-year cycle.

Following this sexagenary cycle and combining the designated animal sign and element, 2026 represents the year of the Fire Horse.

While following astrology is pretty far down one’s list of technical indicators in investing, it is important in some cultures, and therefore, can become somewhat of a self-fulfilling prophecy. Then again, some market participants pay attention to “head and shoulders” and “cup and handle” trading patterns, so perhaps ancient mythology is not too much of a stretch. In addition, the “sell in May and go away” superstition is one that remains pervasive in the market (it doesn’t work but it does rhyme). At the very least, perhaps the Chinese Zodiac can serve as a fun lens for interpreting current events.

With that, it is notable that the Fire Horse is one of the most intense combinations in Chinese astrology, seen as the most volatile and high-energy of the entire zodiac system. In the capital markets, Fire Horse years can be associated with rapid change and instability, in which trend-chasing behaviour spikes and risk-taking is elevated. Specifically, one can imagine a market characterized by momentum investing and speculative manias along with sudden sharp reversals.

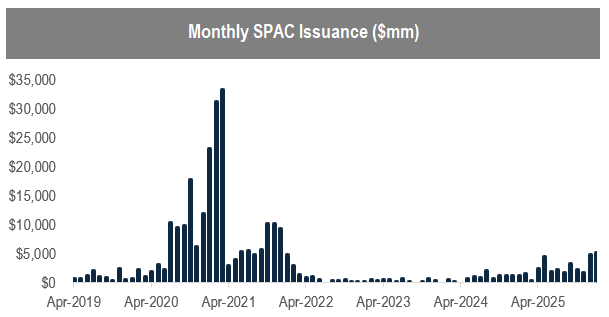

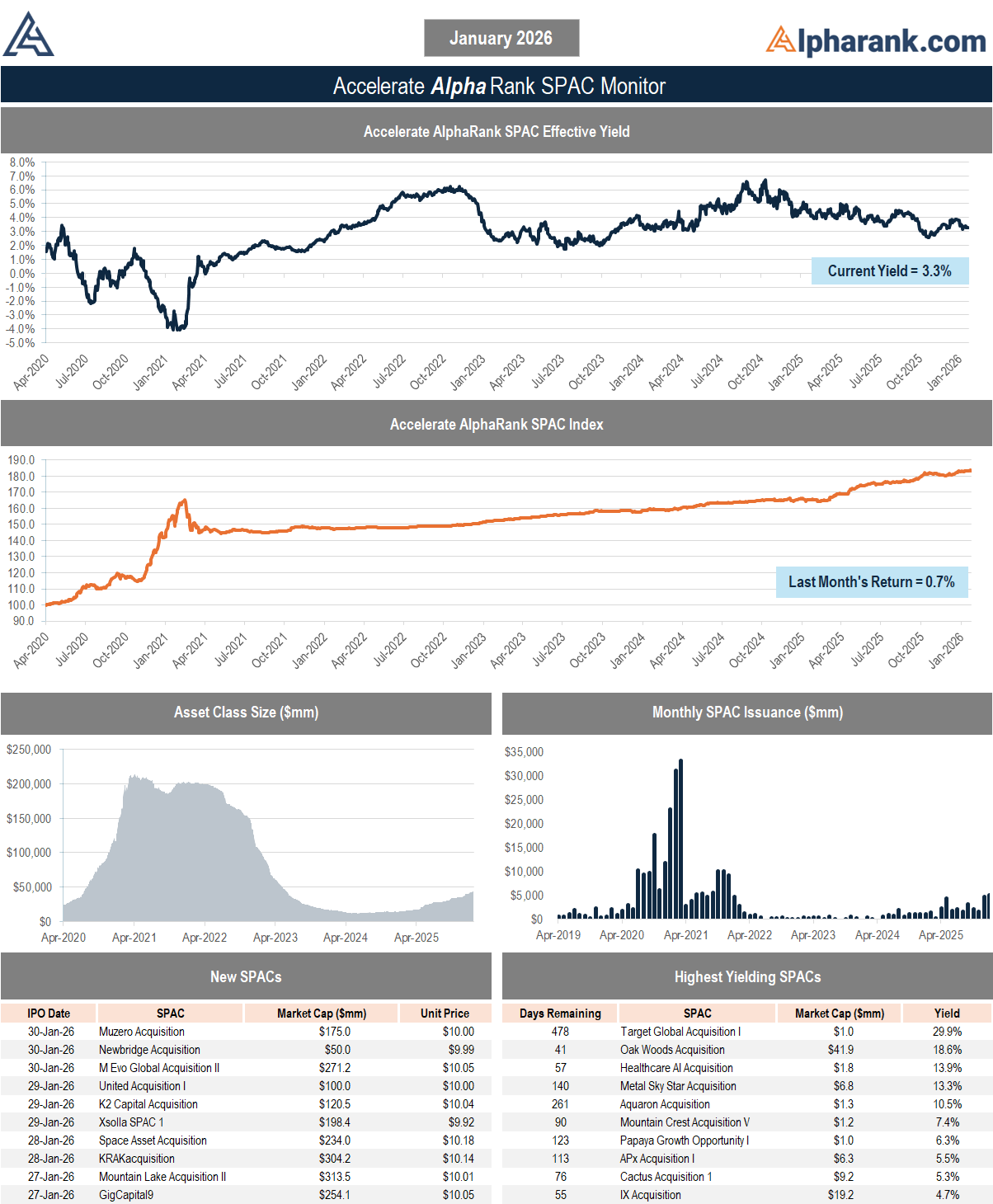

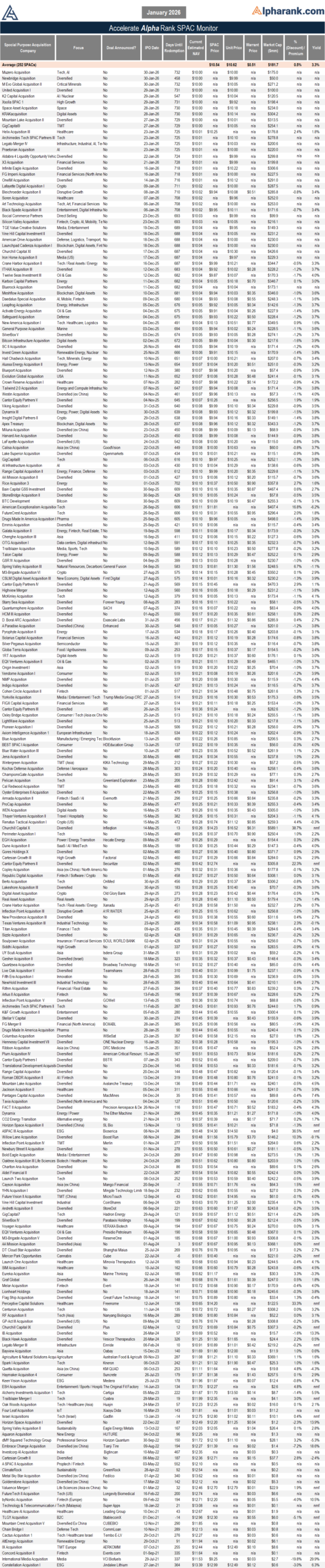

Some of those attributes accurately describe the first month of 2026. For example, Special Purpose Acquisition Company (SPAC) issuance surged in January to $5 billion ($5.4 billion including over allotment options), the highest monthly tally for initial public offerings (IPOs) since December 2021, signalling a speculative environment. After a three year lull in activity, the SPAC market has finally returned to life, displaying the speed and vigour of a horse and the risk-taking associated with fire.

Source: Accelerate

While far outnumbered by the twenty-four SPAC IPOs completed throughout the month, just seven business combinations were announced, leading to a somewhat imbalanced SPAC market. Of these mergers, the market was particularly keen on one, with Spring Valley Acquisition III (SVAC) announcing a business combination with advanced fusion technology company General Fusion. SVAC saw the price of its units jump nearly 10% on the news.

Nevertheless, for the SPAC IPO boom to continue, the market will need to see more blank check merger announcements and going-public transactions. Otherwise, the market will become flooded with blank check companies searching for deals, similar to what occurred in 2021.

The traditional merger and acquisition market in North America remained active throughout the month, with 13 deals announced, worth a total of nearly $40 billion. As it relates to the Chinese Zodiac and the year of the Fire Horse, there was one particular M&A transaction that stands out as a potential harbinger of an intriguing trend.

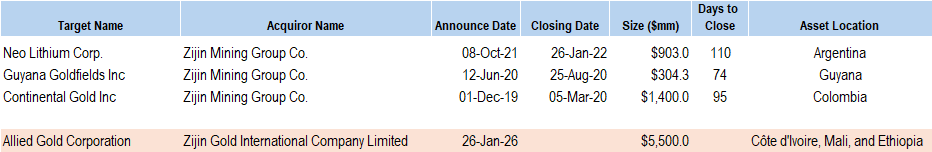

On Monday, large cap Chinese gold mining company Zijin Gold announced the friendly acquisition of TSX-listed African gold producer Allied Gold for $5.0 billion.

The deal is notable for two reasons. First, Chinese companies have resumed acquisitions of Canadian listed companies (albeit with international assets). Second, despite Friday’s market crash, a broader rally in metal prices is accelerating M&A activity across the mining sector.

Zijin Gold is the gold-focused subsidiary of China’s giant mining firm Zijin Mining Group. It has completed several acquisitions of Canadian listed mining firms in the past. However, its most recent deal was announced back in 2021. That said, historically, Zijin’s transactions have closed relatively quickly (in 93 days) and without issue.

Source: Accelerate

As we enter the Year of the Fire Horse, look for the surge in SPAC IPO and M&A deal activity to continue. Last year marked the return of the megadeal in traditional mergers and acquisitions, while this year looks to be one of the return of the SPAC IPO boom. From an industry specific perspective, we would not be surprised to see a material pick-up in both China-led acquisitions and mining-focused deals.

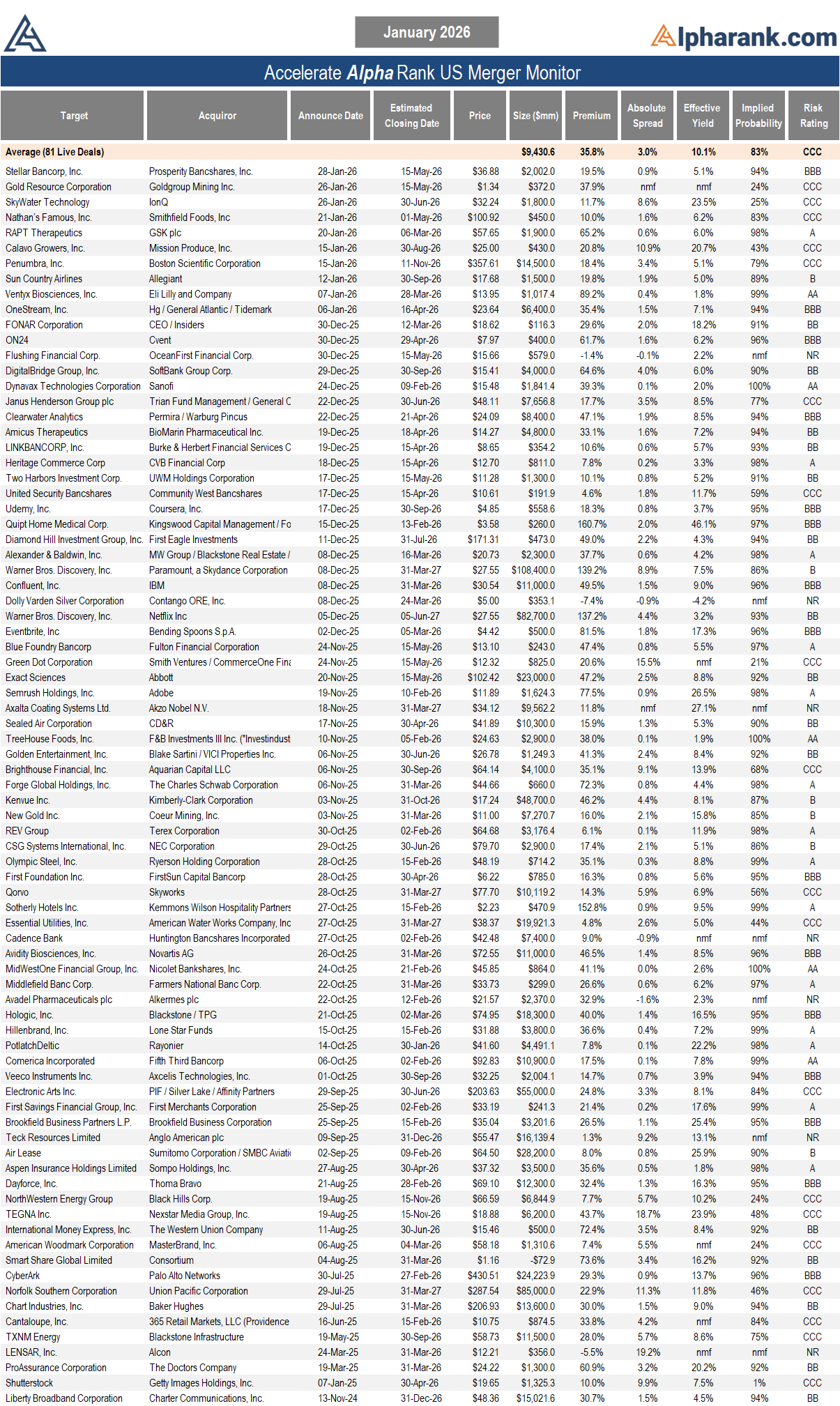

Each individual merger is assigned a risk rating:

- AA – a merger arbitrage rated ‘AA’ has the highest rating assigned by AlphaRank. The merger has the highest probability of closing.

- A – a merger arbitrage rated ‘A’ differs from the highest-rated mergers only by a small degree. The merger has a very high probability of closing.

- BBB – a merger arbitrage rated ‘BBB’ is of investment grade and has a high probability of closing.

- BB – a merger arbitrage rated ‘BB’ is somewhat speculative in nature and has a greater than 90% probability of closing.

- B – a merger arbitrage rated ‘B’ is speculative in nature and has a greater than 85% probability of closing.

- CCC – a merger arbitrage rated ‘CCC’ is very speculative in nature. The merger is subject to certain conditions that may not be satisfied.

- NR – a merger-rated NR is trading either at a premium to the implied consideration or a discount to the unaffected price.

The AlphaRank merger analytics database is utilized in running the Accelerate Arbitrage Fund (TSX: ARB), which may have positions in some of the securities mentioned.

* AlphaRank is exclusively produced by Accelerate Financial Technologies Inc. (“Accelerate”). Visit Alpharank.com for more information. Disclaimer: This research does not constitute investment, legal or tax advice. Data provided in this research should not be viewed as a recommendation or solicitation of an offer to buy or sell any securities or investment strategies. The information in this research is based on current market conditions and may fluctuate and change in the future. Accelerate does not accept any liability for any direct, indirect or consequential loss or damage suffered by any person as a result of relying on all or any part of this research and any liability is expressly disclaimed. Accelerate may have positions in securities mentioned. Past performance is not indicative of future results.