December 1, 2025 – One major market expectation of the Trump administration’s Make America Great Again agenda was a resurgence in corporate merger and acquisition activity.

As market participants waited with bated breath for the commencement of the new administration’s presumed business-friendly agenda, a rocky start ensued.

It was not just the trade war and the associated market volatility that tempered animal spirits and dampened M&A activity during 2025’s first few months. Two unexpected lawsuits seeking to block mergers on antitrust grounds announced earlier this year may have further dampened the appetites of corporate dealmakers.

For example, just ten days after the inauguration, Trump’s Department of Justice (DOJ) sued to block Hewlett Packard Enterprise Co.’s (HPE) proposed $14 billion acquisition of Juniper Networks.

Then, five weeks later, Trump’s Federal Trade Commission (FTC) sued to block the $611 million acquisition of Surmodics by private equity firm GTCR. This merger challenge was unprecedented – no public company buyout by a private equity firm had ever been blocked on antitrust grounds under any administration.

While M&A practitioners were scratching their heads as to why these particular transactions, which generally posed no major antitrust or competitive issues, attracted lawsuits from a supposedly business-friendly government, markets gyrated with significant volatility due to the emerging trade war.

As a result, market participants’ early expectations of a business environment conducive to deal-making cooled quickly, to say the least.

However, that was then, and this is now.

As the year has progressed and the tariff-related market volatility has dissipated, further regulatory scrutiny has declined. It did not hurt that the DOJ lost its first merger challenge, choosing to settle with HPE and Juniper on a small divestiture and licensing agreement, that allowed the merger to close in July. Moreover, the FTC subsequently lost its aggressive gambit to block GTCR’s buyout of Surmodics after the judge ruled against the antitrust regulator. GTCR successfully closed the transaction on November 19th.

Going zero for two right off the bat in two high-profile cases would hurt any regulator’s enthusiasm for additional lawsuits. Furthermore, budget cuts initiated under the Department of Government Efficiency and the broader 2025 federal budget have substantially reduced resources at both the FTC and DOJ. These once fearsome deal watchdogs now find themselves defanged and disorganized. Meanwhile, corporations are pouncing on the opportunity to pursue deals that would not have been viable under previous governments.

Given these market dynamics, with supportive capital markets and subdued antitrust regulators, deal activity has surged.

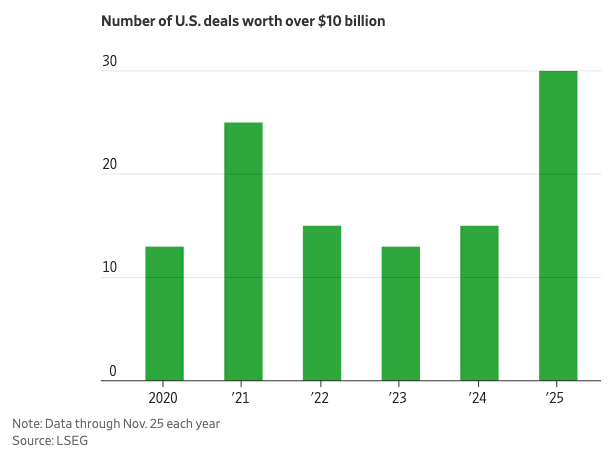

In 2025, transactions larger than $10 billion have climbed to record levels, fueled by the Trump administration’s deregulatory drive that has re-energized Wall Street and set off a wave of global dealmaking.

Deal value in the U.S. year-to-date is up more than 40% from the same period in 2024 to nearly $2.0 trillion. Almost twice as many deals worth more than $10 billion have been announced compared to the same period in 2024.

This market dynamic has resulted in three significant implications for merger arbitrageurs and M&A investors:

- An expanded opportunity set in public mergers and acquisitions has created a supply-demand imbalance, such that there may be insufficient merger arbitrage capital to provide enough liquidity in announced M&A deals, leading to higher than expected merger arbitrage spreads. In early November, the number of announced but not yet closed U.S. public mergers reached 95, the highest amount on record since we started tracking the data in 2010.

- More regulatory certainty means that deals can close quickly. A reduced timeframe can lead to increased internal rates of return for arbitrageurs.

- Reduced regulatory appetite to challenge mergers results in fewer deal terminations, reducing risk and increasing returns for merger arbitrageurs.

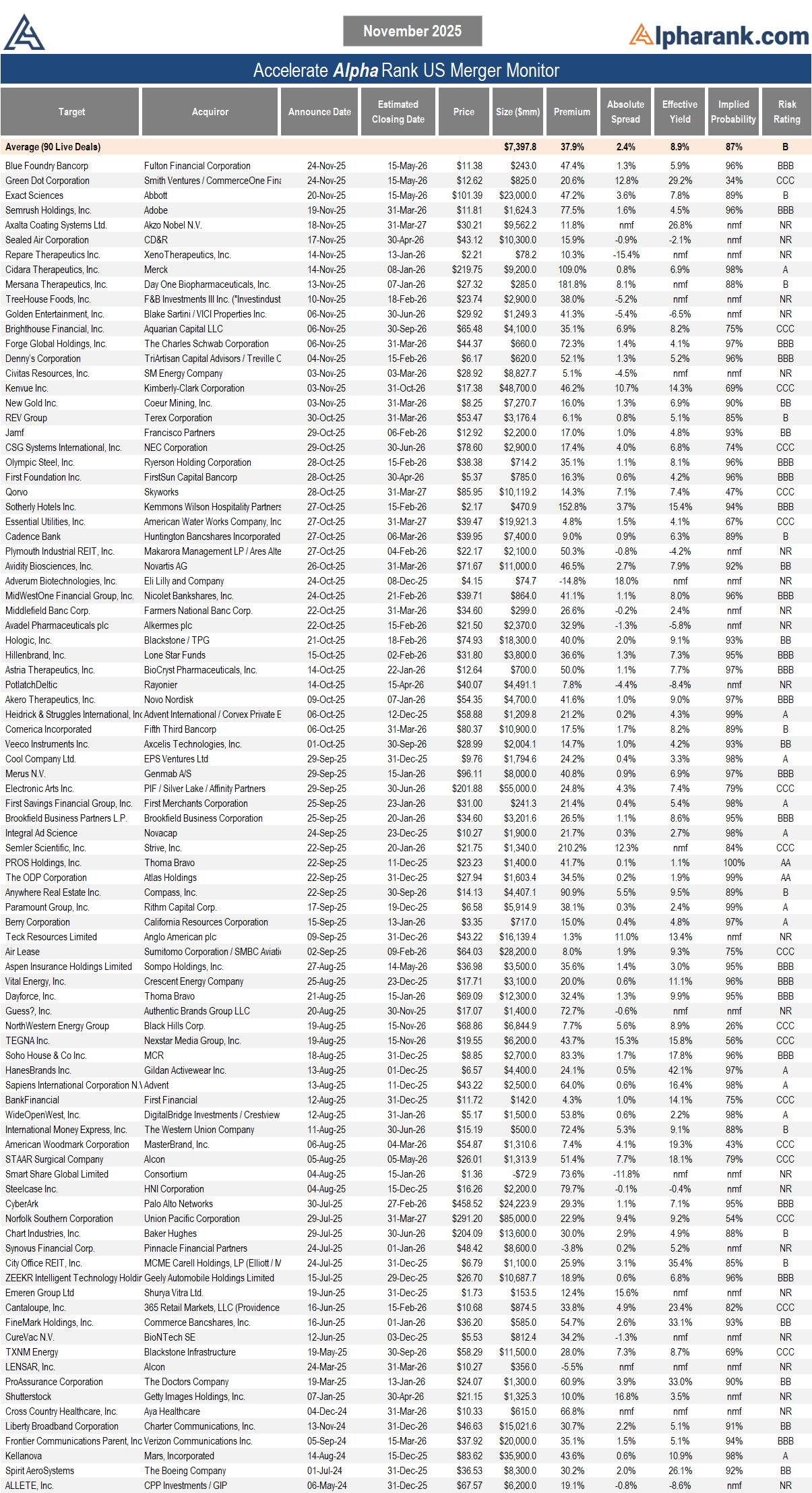

November’s solid M&A activity has brought the current number of announced but not yet closed M&A deals in the U.S. to 90 – a tally worth more than $665 billion in total. With strong deal flow providing a large supply of investable M&A opportunities, it is no wonder that merger arbitrage has seen its highest returns in years. Moreover, the deal deluge has left merger arbitrage spreads at healthy levels, with annualized merger arbitrage yields averaging 8.9%, more than 500bps above Treasury bills and 200bps greater than high yield bonds.

With the reemergence of the megadeal, and a record number of M&A transactions announced, the good times in mergerville are certainly rolling. The main question now is how long this dynamic will continue.

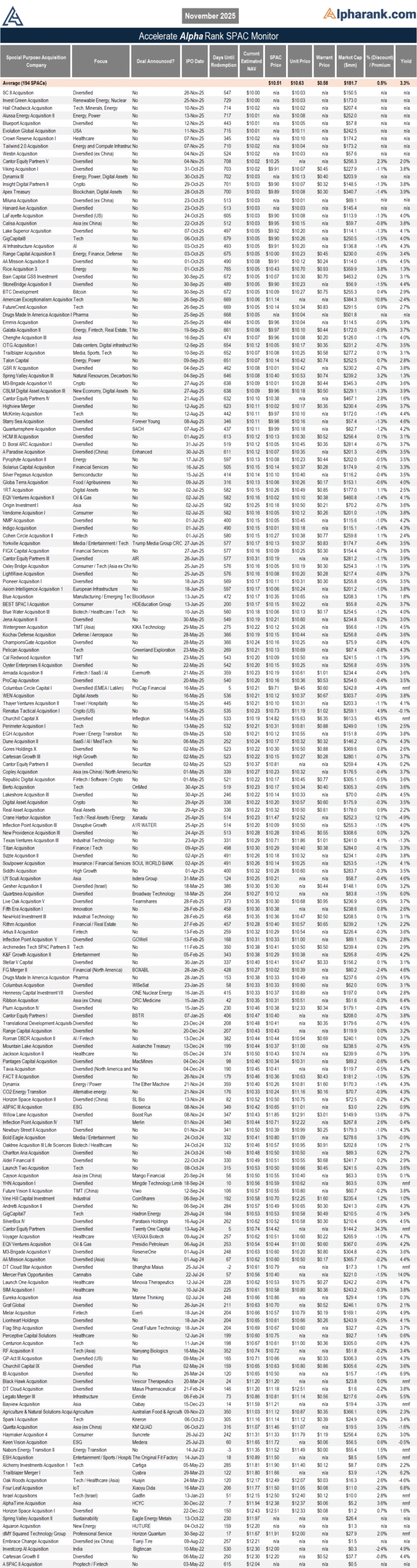

The AlphaRank.com Merger Monitor below represents Accelerate’s proprietary analytics database on all announced liquid U.S. mergers. The AlphaRank Merger Arbitrage Effective Yield represents the average annualized returns of all outstanding merger arbitrage spreads and is typically viewed as an alternative to fixed income yield.

Each individual merger is assigned a risk rating:

Each individual merger is assigned a risk rating:

- AA – a merger arbitrage rated ‘AA’ has the highest rating assigned by AlphaRank. The merger has the highest probability of closing.

- A – a merger arbitrage rated ‘A’ differs from the highest-rated mergers only by a small degree. The merger has a very high probability of closing.

- BBB – a merger arbitrage rated ‘BBB’ is of investment grade and has a high probability of closing.

- BB – a merger arbitrage rated ‘BB’ is somewhat speculative in nature and has a greater than 90% probability of closing.

- B – a merger arbitrage rated ‘B’ is speculative in nature and has a greater than 85% probability of closing.

- CCC – a merger arbitrage rated ‘CCC’ is very speculative in nature. The merger is subject to certain conditions that may not be satisfied.

- NR – a merger-rated NR is trading either at a premium to the implied consideration or a discount to the unaffected price.

The AlphaRank merger analytics database is utilized in running the Accelerate Arbitrage Fund (TSX: ARB), which may have positions in some of the securities mentioned.