July 27, 2025 – Markets have always been unpredictable in the short term. Ever since President Trump’s inauguration, uncertainty surrounding market direction, the regulatory environment, and economic policy, has been amplified.

Immediately after the U.S. election, investors initially anticipated higher economic growth and elevated inflation, along with a more conducive regulatory environment. However, what transpired over the subsequent months was a reduction in economic growth and dramatically increased regulations with the implementation of the “Liberation Day” tariff regime.

Since then, as trade deals have been struck, or at least tariff implementation has been temporarily paused, the stock market, along with investor appetite, has come roaring back.

Just as the market and economic policy environment began on shaky ground, the regulatory environment for mergers and acquisitions faced a similar initial hiccup.

By January of this year, the Department of Justice’s (DOJ) antitrust division had a temporary leader, as the Biden administration’s Assistant Attorney General for the Antitrust Division, Jonathan Kanter, had stepped down shortly after the election. Under the new Trump administration, Omeed Assefi was appointed as the DOJ’s Acting Assistant Attorney General while awaiting confirmation of Trump’s nominee, Gail Slater, who was later confirmed on March 11th.

Within weeks of the inauguration, this DOJ, whose antitrust head had been in the seat for only a few months, sued to block Hewlett Packard Enterprise’s $14 billion acquisition of Juniper Networks. Not a good start for the antitrust environment.

Shortly thereafter, the much maligned Chair of the U.S. Federal Trade Commission (FTC), Lina Khan, announced her resignation. Ms. Khan, who was notorious for her eagerness to block mergers, was no friend of investors. Thankfully, she was replaced by the presumably more deal-friendly Republican, Andrew Ferguson as Chair of the FTC.

However, the DOJ’s move to block the Hewlett Packard Enterprise merger with Juniper Networks was not the only bump in the road for merger practitioners. Approximately six weeks later, the FTC sued to block private equity firm GTCR’s $611 million acquisition of medical device coating company Surmodics, marking the first antitrust lawsuit against a public company leveraged buyout in recent history.

So much for a deal-friendly administration committed to reducing regulations.

Meanwhile, Brendan Carr, who became the Chair of the Federal Communications Commission (FCC) in January, was on a rampage against corporate DEI policies and other principles that the new administration disapproved of. In addition, Carr, whose FCC must give the nod for mergers in the media sector to close, made it fairly obvious that Paramount Global would need to resolve its lawsuit from Donald Trump stemming from Paramount’s subsidiary, CBS, and its perceived biased 60 Minutes interview with then Presidential candidate, Kamala Harris. This lawsuit remained a significant overhang on Paramount’s going private transaction, threatening the deal’s survival and timeliness.

As these adverse regulatory events unfolded during the first quarter of the Trump administration, dampening the mood of dealmakers and corporate executives, Treasury Secretary Scott Bessent went on CNBC to exclaim, “MAGA doesn’t stand for Make M&A Great Again.”

Just as merger market participants began to lose all hope, the clouds started to part. In early June, the U.S. Justice Department’s head of merger enforcement publicly stated that the antitrust watchdog would be more open to approving acquisitions under the Trump administration, in addition to negotiated settlements to avoid lawsuits – a stark contrast to the previous administration’s anti-deal rhetoric. Shortly thereafter, the DOJ entered into a settlement with Hewlett Packard Enterprise and Juniper Networks, allowing their merger to proceed after they agreed to a small divestiture and software licensing deal.

In addition, there are early indications that the FTC may be turning a page on its anti-deal, “hipster antitrust” approach pioneered by its former Chair Khan. For example, President Trump took the unprecedented (and likely illegal) step of firing the FTC’s two Democratic commissioners, leaving the commission staffed with just three Republican commissioners, who historically have been more business-friendly. More recently, rumours have emerged that GTCR and Surmodics may come to a negotiated settlement with the FTC, subject to a divestiture, to resolve the FTC’s lawsuit and allow their merger to proceed.

The regulatory environment is improving not only from U.S. antitrust authorities, but also from other watchdogs. Last month, the Committee on Foreign Investment in the United States (CFIUS) took the unprecedented step of reversing a previous decision and approving Nippon Steel’s $14.9 billion acquisition of U.S. Steel, which was previously blocked under the Biden administration. In order to obtain the Trump administration’s approval for the merger, Nippon issued the U.S. Government a “golden share” in the company, granting veto power over major strategic decisions, while also agreeing to invest $11 billion in the country. Meanwhile, the FCC recently approved Skydance Media’s $24 billion acquisition of Paramount Global after the companies paid President Trump $16 million as part of a settlement agreement to resolve a lawsuit filed by Trump over the “60 Minutes” interview with then-Vice President Kamala Harris.

These results appear to be taken straight from the pages of Trump’s 1987 bestselling book, “The Art of the Deal”.

Elsewhere, there have been additional positive regulatory results from other regulators around the globe. For example, last month, China’s State Administration for Market Regulation finally approved Synopsys’ $35 billion acquisition of Ansys, after a gruelling 18-month antitrust review. Also, the United Kingdom’s antitrust watchdog, the Competition and Markets Authority, approved SLB’s $8.1 billion acquisition of competitor ChampionX, allowing the deal to close a couple of weeks ago.

Suddenly, things are looking up for merger arbitrageurs.

The Crypto Treasury Company Phenomenon

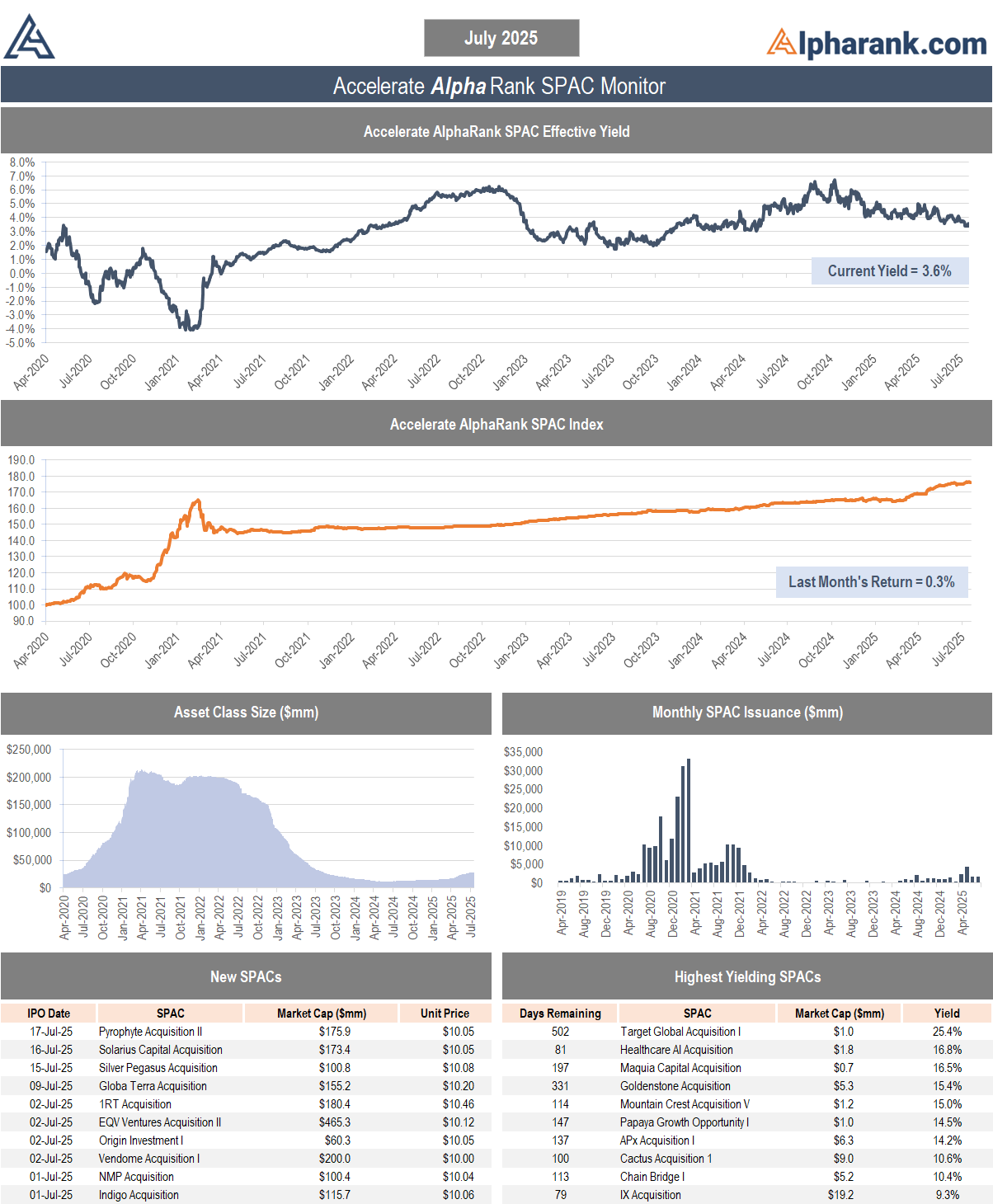

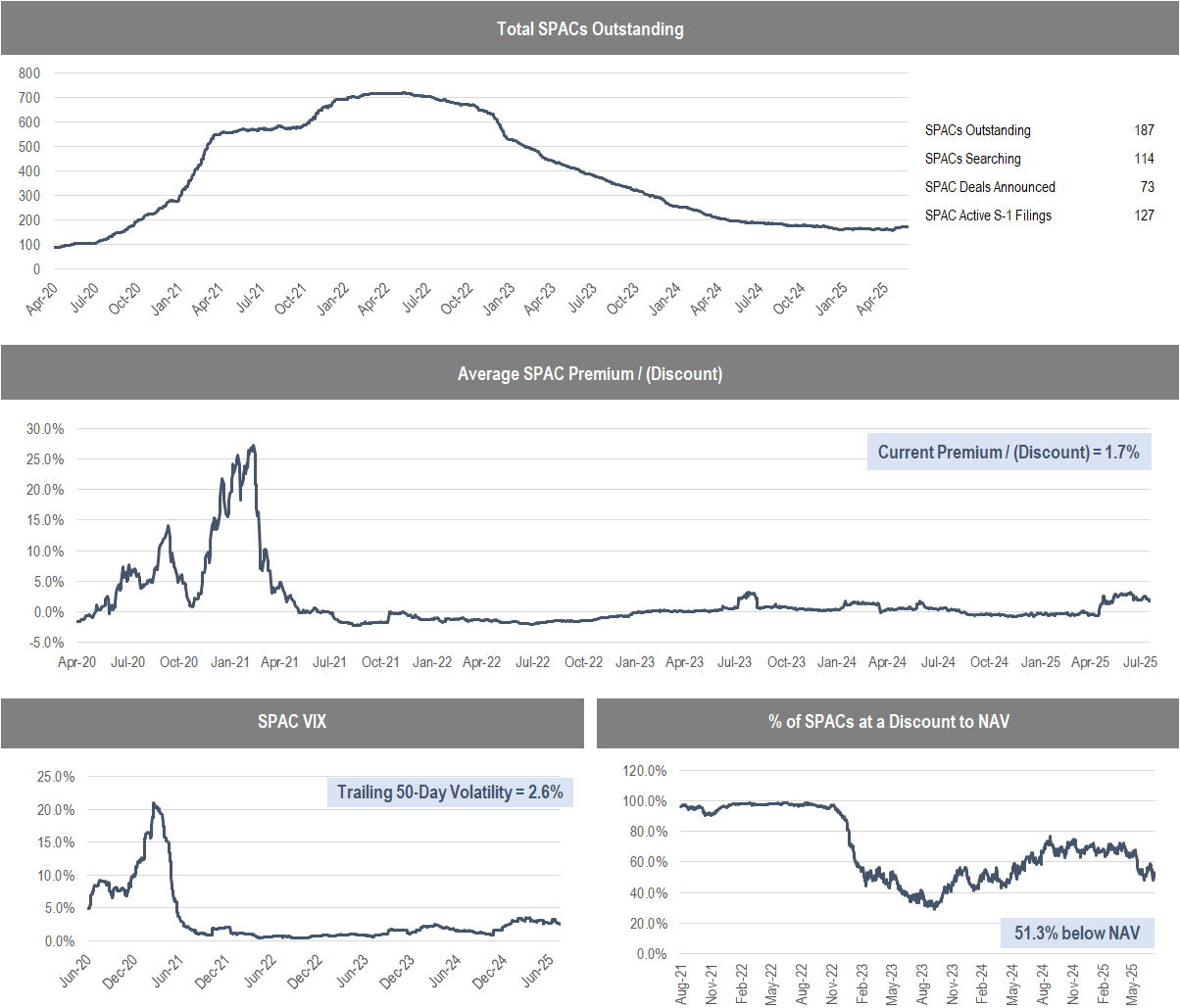

Speaking of Making M&A Great Again, the Trump administration’s favourable view toward crypto, along with the President’s vow to make the U.S. the “crypto capital of the planet”, has lit a fire under the Special Purpose Acquisition Company (SPAC) market. Specifically, SPACs have proven to be attractive merger vehicles for crypto treasury companies.

In last month’s Merger & SPAC Monitor, Dissecting the Phenomenon of Crypto Treasury Companies, we outlined the proliferation and speculative trading dynamics of these publicly-traded firms favoured by retail investors.

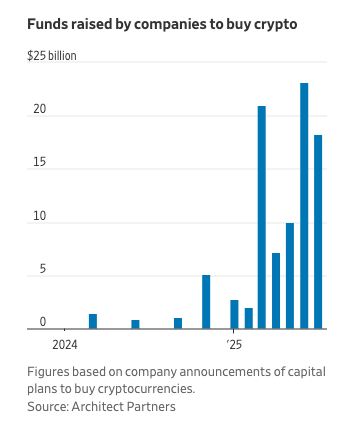

Since then, the trend of public companies raising capital to buy bitcoin and other cryptocurrencies has accelerated.

Year-to-date, nearly $86 billion has been raised by crypto treasury companies – more than double the amount of money raised by U.S. IPOs.

This dynamic has spread to the SPAC market, which accounts for a significant portion of crypto treasury company capital raising. Thus far, there have been five large crypto treasury companies that have announced a going public transaction via a SPAC, including:

- CEP: Cantor Equity Partners / Twenty One Capital – Bitcoin treasury ($3.6 billion)

- CEPO: Cantor Equity Partners I / BSTR – Bitcoin treasury ($4.8 billion)

- MBAV: M3-Brigade Acquisition V / ReserveOne – Bitcoin treasury ($1.1 billion)

- CCCM: Columbus Circle Capital I / ProCap Financial – Bitcoin treasury ($750 million)

- DYNX: Dynamix / The Ether Machine – Ether treasury ($1.6 billion)

With all of the recent positive developments within the broad merger market – has M&A been made great again? It may be too early to tell, however, things are certainly moving in the right direction. That said, with 17 public mergers worth an aggregate of $55 billion announced this month, along with 11 SPAC IPOs raising almost $2 billion, the market’s activity in July is indicating that the M&A environment is great again.

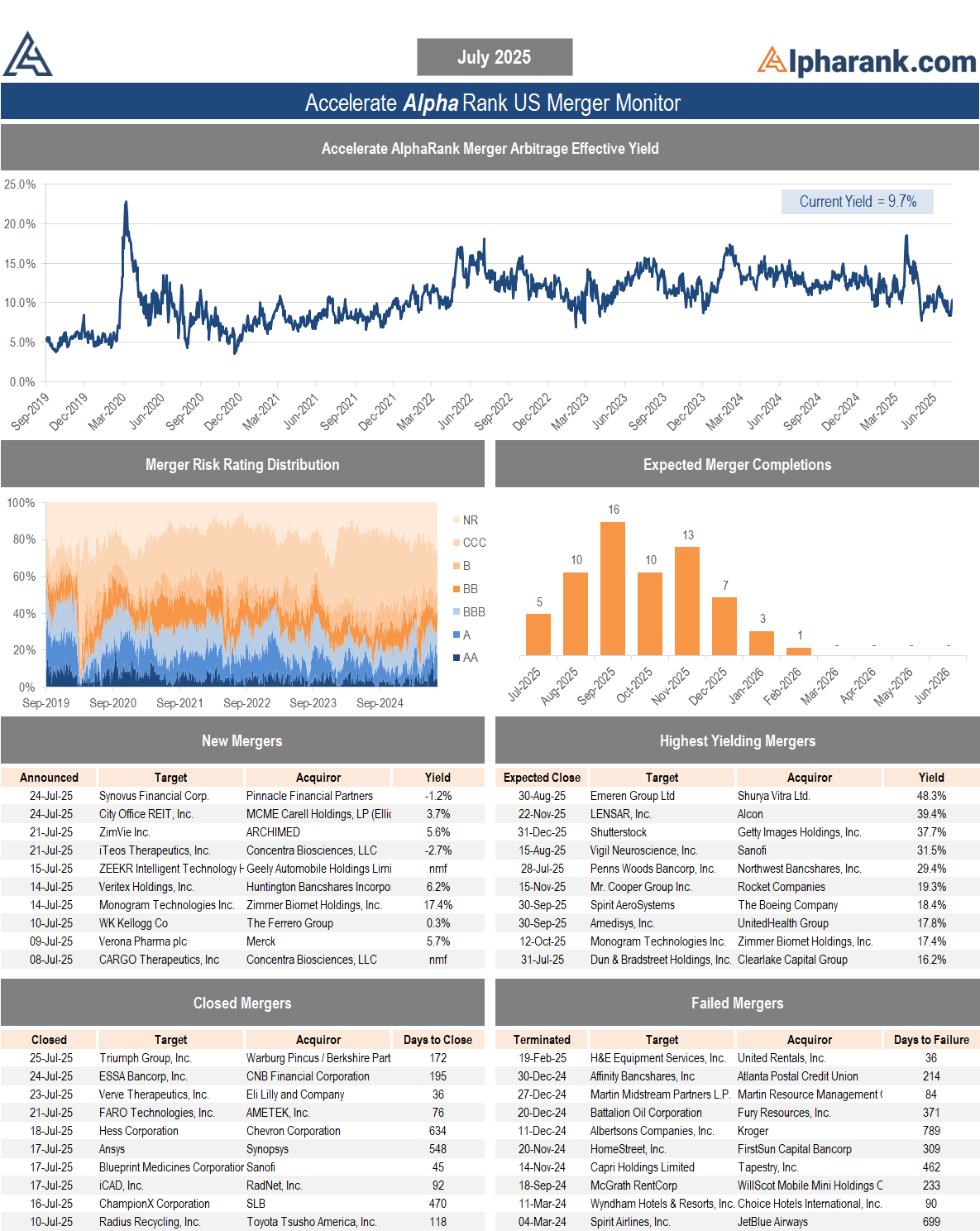

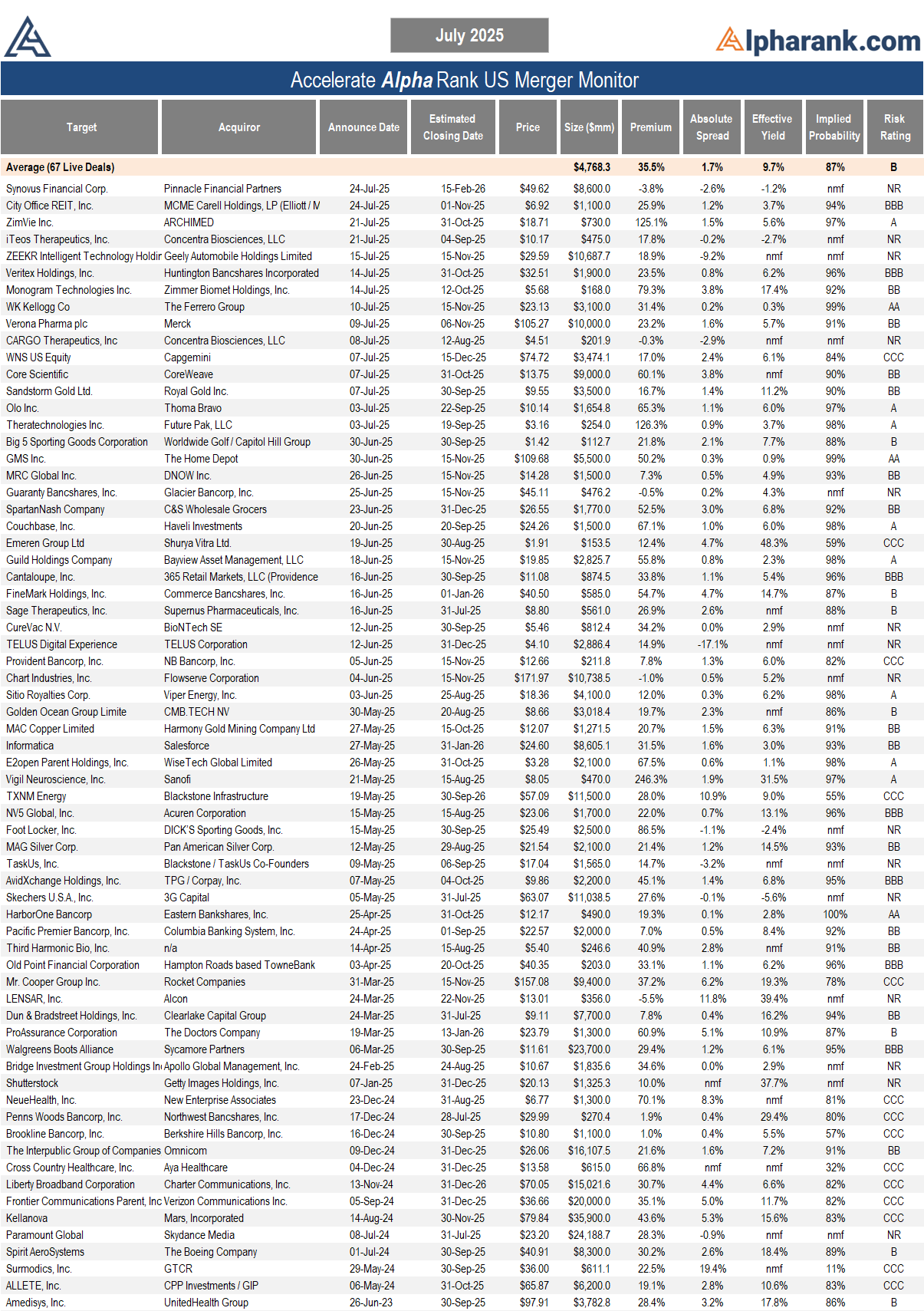

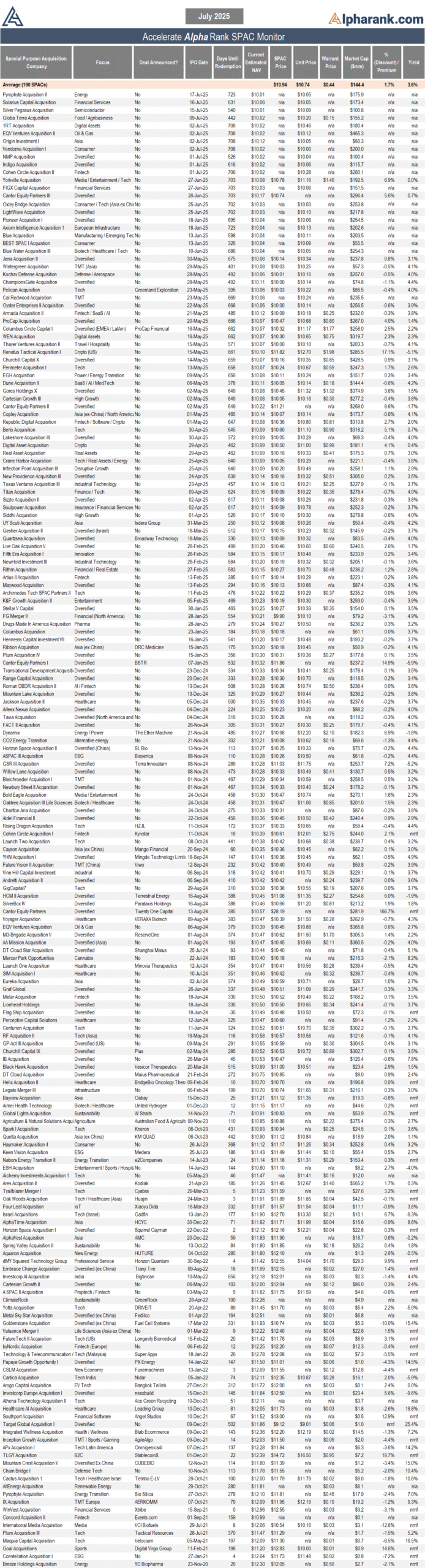

The AlphaRank.com Merger Monitor below represents Accelerate’s proprietary analytics database on all announced liquid U.S. mergers. The AlphaRank Merger Arbitrage Effective Yield represents the average annualized returns of all outstanding merger arbitrage spreads and is typically viewed as an alternative to fixed income yield.

Each individual merger is assigned a risk rating:

- AA – a merger arbitrage rated ‘AA’ has the highest rating assigned by AlphaRank. The merger has the highest probability of closing.

- A – a merger arbitrage rated ‘A’ differs from the highest-rated mergers only by a small degree. The merger has a very high probability of closing.

- BBB – a merger arbitrage rated ‘BBB’ is of investment grade and has a high probability of closing.

- BB – a merger arbitrage rated ‘BB’ is somewhat speculative in nature and has a greater than 90% probability of closing.

- B – a merger arbitrage rated ‘B’ is speculative in nature and has a greater than 85% probability of closing.

- CCC – a merger arbitrage rated ‘CCC’ is very speculative in nature. The merger is subject to certain conditions that may not be satisfied.

- NR – a merger-rated NR is trading either at a premium to the implied consideration or a discount to the unaffected price.

The AlphaRank merger analytics database is utilized in running the Accelerate Arbitrage Fund (TSX: ARB), which may have positions in some of the securities mentioned.