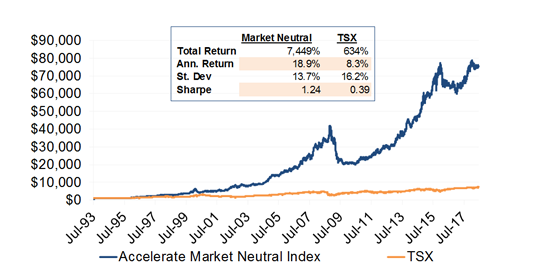

SOURCE: Bloomberg, S&P

DISCLAIMER: Results of the Accelerate Market Neutral Index are hypothetical and do not reflect investment results attained by any investor. Past performance is not indicative of future results. Performance is net of all estimated trading fees but gross of management fees. Investing involves varying degrees of risk and there can be no assurance that the future performance of any investment strategy will be profitable. This does not constitute investment advice.