Accelerate Canadian Long Short Equity Fund

Equity Plus.

The Accelerate Canadian Long Short Equity Fund (TSX: ATSX) is a directional long-short equity hedge fund that seeks to provide upside market exposure while limiting downside participation.

About the Fund

The Accelerate Canadian Long Short Equity Fund (TSX: ATSX) is a quantitative 150-50 long-short equity hedge fund that seeks to outperform the S&P/TSX 60.

Investment Objectives

-

-

- Outperform the broad Canadian equity index

- Provide volatility in-line with the broad Canadian equity index

-

ATSX TRADING DATA

MEDIA

SUBSCRIBE TO OUR DISTRIBUTION LIST TO STAY UPDATED ON HDGE

QUICK FACTS

Type:

Directional long short equity

Structure:

Alternative ETF

Date Started:

May 10, 2019

Management Fee:

0.00%

Performance Fee:

1/2 of outperformance above S&P/ TSX 60 Total Return

Investment Manager:

Accelerate Financial Technologies Inc.

Distribution:

n/a

Exchange:

TSX

Currency:

CAD

Risk Rating:

Medium

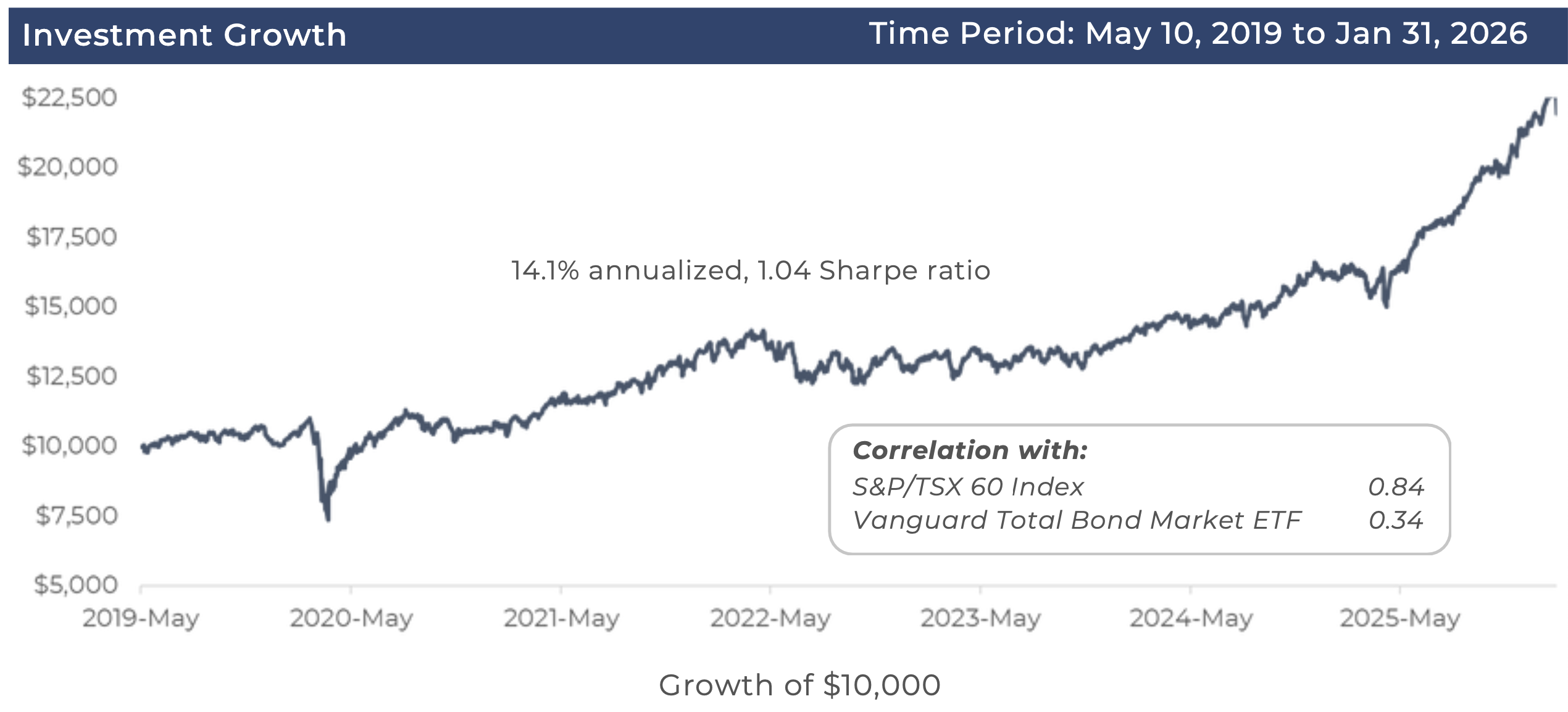

Track Record

Investment Process

Performance as of 2026-Jan-31

| 1 Month | 3 Months | YTD | 1 Year | 3 Years | 5 Years | Since Inception | ||

|---|---|---|---|---|---|---|---|---|

| ATSX | 1.2% | 11.5% | 1.2% | 41.0% | 22.1% | 18.5% | 14.1% |

Fund Characteristics as of 2026-Jan-31

| Long | Short | |

|---|---|---|

| Number of Securities | 43 | 40 |

| Average Market Cap ($mm) | $40,661 | $15,790 |

| Median Market Cap ($mm) | $14,698 | $4,131 |

| Beta | 1.0 | 1.2 |

| EBITDA/EV | 10.6% | 5.5% |

| FCF/EV | 6.0% | -1.1% |

| Trailing Return | 56.8% | 6.2% |

| Pct of 52 Week High | 97.0% | 75.4% |

| Return on Capital | 17.2% | 3.3% |

| Gross Profits/Assets | 5.7% | 2.7% |

| 50 DMA to 200 DMA | 120.0% | 106.5% |

| EPS Revision | 0.8% | 2.6% |

| Change In Shares | -1.9% | 2.7% |

| Earnings Abnormal Return | 3.7% | -3.2% |

Sector Weightings as of 2026-Jan-31

| Long | Short | |

|---|---|---|

| Communication Services | 3.5% | -2.3% |

| Consumer Discretionary | 20.9% | -1.2% |

| Consumer Staples | 10.5% | 0.0% |

| Energy | 14.0% | -11.5% |

| Financials | 31.5% | -3.4% |

| Health Care | 3.5% | -1.2% |

| Industrials | 21.0% | -10.4% |

| Information Technology | 0.0% | -1.2% |

| Materials | 45.4% | -9.2% |

| Real Estate | 0.0% | -3.4% |

| Utilities | 0.0% | -2.3% |

Top Holdings as of 2026-Jan-31

| Long Security Name | Weight | |

|---|---|---|

| Fairfax Financial Holdings Ltd | 3.6% | |

| Bombardier Inc | 3.5% | |

| Royal Bank of Canada | 3.5% | |

| Toromont Industries Ltd | 3.5% | |

| Canadian Imperial Bank of Commerce | 3.5% | |

| Finning International Inc | 3.5% | |

| Endeavour Mining PLC | 3.5% | |

| Great-West Lifeco Inc | 3.5% | |

| Linamar Corp | 3.5% | |

| Canadian Tire Corp Ltd | 3.5% | |

| Loblaw Cos Ltd | 3.5% | |

| Imperial Oil Ltd | 3.5% | |

| IAMGOLD Corp | 3.5% | |

| Badger Infrastructure Solution | 3.5% | |

| Fortuna Mining Corp | 3.5% | |

| Barrick Mining Corp | 3.5% | |

| Extendicare Inc | 3.5% | |

| Magna International Inc | 3.5% | |

| Manulife Financial Corp | 3.5% | |

| Saputo Inc | 3.5% | |

| OceanaGold Corp | 3.5% | |

| Surge Energy Inc | 3.5% | |

| Orla Mining Ltd | 3.5% | |

| Chemtrade Logistics Income Fund | 3.5% | |

| Chorus Aviation Inc | 3.5% | |

| Gildan Activewear Inc | 3.5% | |

| Enerflex Ltd | 3.5% | |

| Wesdome Gold Mines Ltd | 3.5% | |

| Suncor Energy Inc | 3.5% | |

| Kinross Gold Corp | 3.5% | |

| Centerra Gold Inc | 3.5% | |

| Toronto-Dominion Bank/The | 3.5% | |

| George Weston Ltd | 3.5% | |

| Stantec Inc | 3.5% | |

| Eldorado Gold Corp | 3.5% | |

| Aritzia Inc | 3.5% | |

| Quebecor Inc | 3.5% | |

| Stella-Jones Inc | 3.5% | |

| Power Corp of Canada | 3.5% | |

| iA Financial Corp Inc | 3.5% | |

| BRP Inc | 3.5% | |

| Wheaton Precious Metals Corp | 3.5% | |

| Bank of Montreal | 3.5% |

DISCLAIMER: This information on this web page does not constitute investment, legal or tax advice. Performance is inclusive of reinvested distributions. Past performance is not indicative of future results. Any data provided on this web page should not be viewed as a recommendation or solicitation of an offer to buy or sell any securities or investment strategies. The information on this web page is based on market conditions and may fluctuate and change without notice. Accelerate does not accept any liability for any direct, indirect or consequential loss or damage suffered by any person as a result of relying on all or any part of this website and any liability is expressly disclaimed.