September 10, 2019 – The unstoppable force paradox, a quintessential contradiction originating from the 3rd century BC, posits “What happens when an unstoppable force meets an immovable object?”

While the paradox has yet to be resolved in the realm of physics, the capital markets analogy of the unstoppable force meeting the immovable object is that the unstoppable force wins.

In 2019, the unstoppable force has been price momentum, operating momentum and trend. These three factors continue to dominate the multi-factor world with consistent outperformance. All three factors generated significant net alpha in the month of August.

The immovable object has been value and quality. These factors are immovable because they’ve done so poorly. Value and quality stocks haven’t moved even as the market has meandered higher.

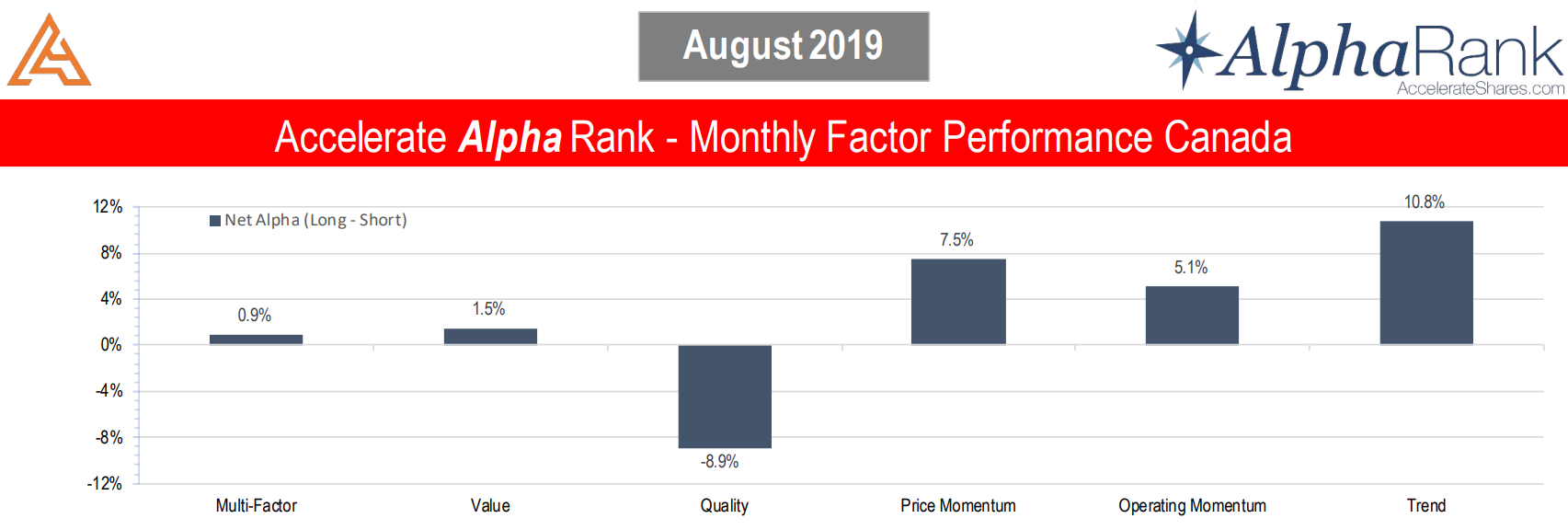

AlphaRank Canadian Stocks

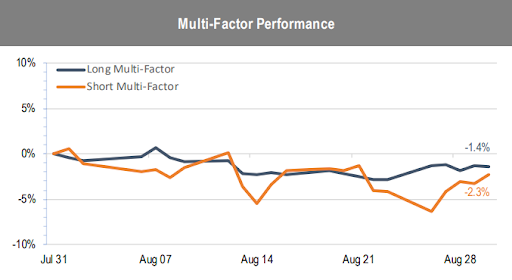

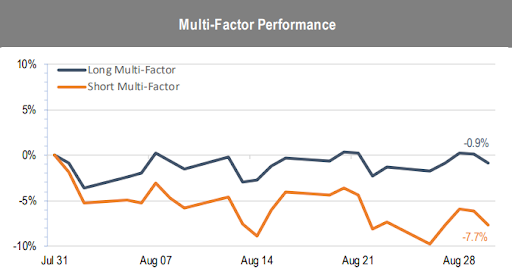

The Canadian multi-factor portfolio eked out a slight 0.9% gain in August, with the long portfolio returning -1.4% and the short portfolio dropping -2.3%. The long multi-factor portfolio underperformed the S&P/TSX Composite’s 0.4% gain in the month, but the short multi-factor more than made up for it. Alpha was generated by all factors except for quality.

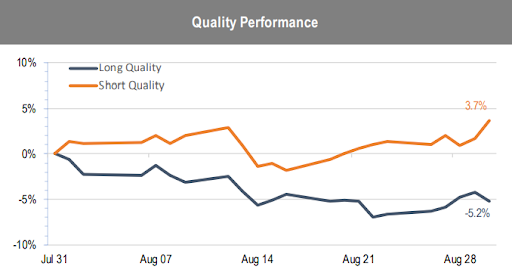

Let’s get to the bad news first. The August performance of quality stocks in Canada was just about as bad as it gets. The lowest quality stocks, those in the short quality portfolio, rallied significantly with a 3.7% gain during the month. To make matters worse, the highest quality stocks, those in the long quality portfolio, dropped -5.2%. The Canadian long-short quality portfolio dropped nearly -9% on the month.

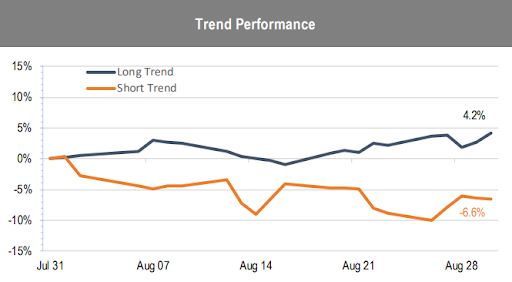

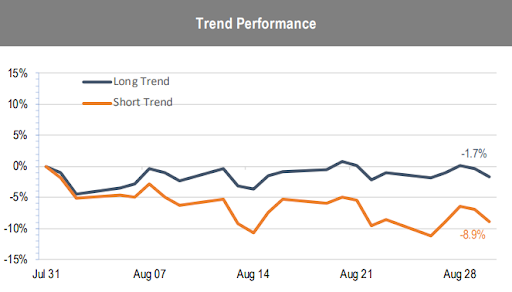

Fortunately both price momentum and trend had an equal but opposite positive performance during the month, notching long-short alpha of 7.5% and 10.8% respectively. Both long price momentum and long trend portfolios outperformed the index, notching gains of 3.0% and 4.2%, while the factors’ respective short portfolios trailed the market substantially, with declines of -4.5% and -6.6%.

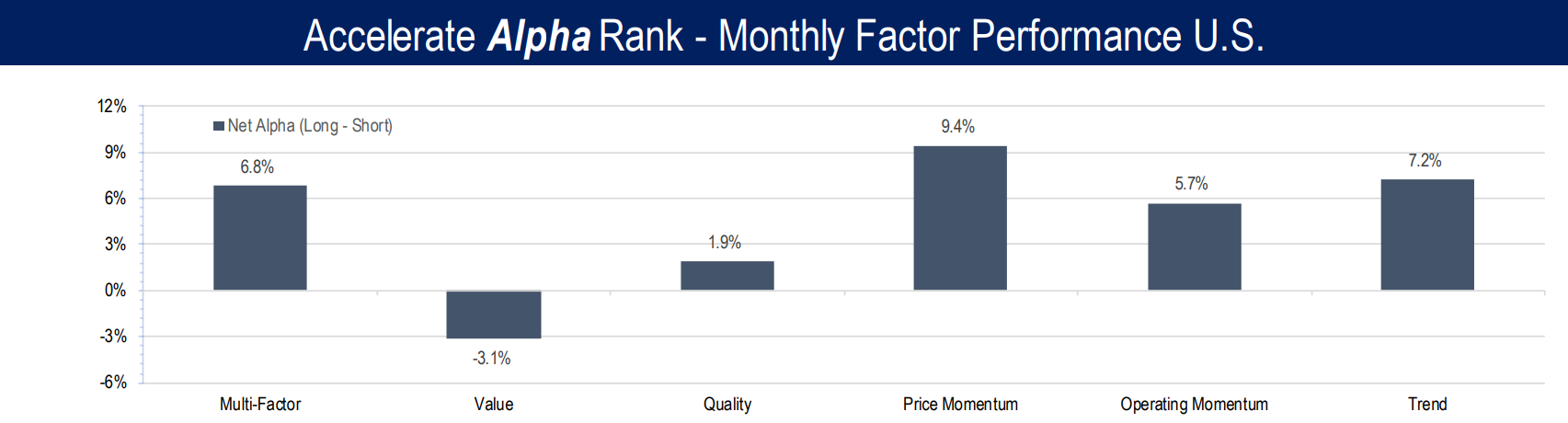

AlphaRank U.S. Stocks

The U.S multi-factor generated 6.8% alpha for the month of August, driven by the short portfolio, which dropped -7.7%. The gains from the shorts were slightly lessened by the -0.9% drop in the long multi-factor portfolio, which happened to beat the S&P 500’s -1.6% drop for the month.

The outperformance of the U.S. multi-factor portfolio was once again directed by the unstoppable force of price momentum, operating momentum and trend.

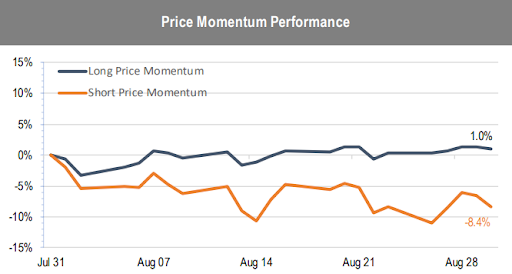

The long price momentum portfolio outperformed the market in the month with a 1.0% gain while the short portfolio dropped -8.4%. This long-short divergence led to a 9.4% net return, designating price momentum as the top performing U.S. factor.

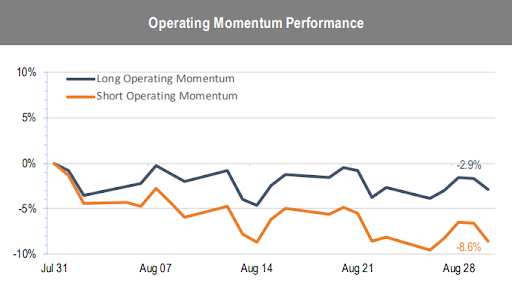

Operating momentum and trend had similar stories in August. Both long portfolios slightly underperformed the market, but both factor portfolios were redeemed by a horrid performance of the short portfolios, as each dropped nearly -9%. With short selling, a horrid performance of the short portfolio is a good thing, as we’re betting that these stocks will go down.

The immovable object, value, was once again the worst performing factor. In fact, the factor portfolio did move this month but in the wrong direction as the long value portfolio dropped significantly more than the market, falling -6.6% during August. The short value portfolio’s drop of -3.5% was insufficient to redeem the long-short value portfolio, which fell -3.1% for the month. Value remains stuck in the mud.

More of the Same

The month of August was a further showcase of what has been working this year and what has not. Year to date, the factors of price momentum, operating momentum and trend have truly been unstoppable forces with consistent outperformance while value and quality remain unmovable objects, refusing to go up.

-Julian