July 13, 2024 – While investors’ attention has been recently focused on themes such as artificial intelligence plays (notably GPU supplier Nvidia) and GLP-1 providers (such as Ozempic maker Novo Nordisk), one of the oldest and most reliable investments has been mostly ignored despite its bull market and recent all-time high in price.

Historically, gold has served as an attractive investment over both the short and long term. The precious metal is up 24.2% over the past year and has gained 71.4% over the past five, sitting right around a new all-time high.

Source: Google Finance

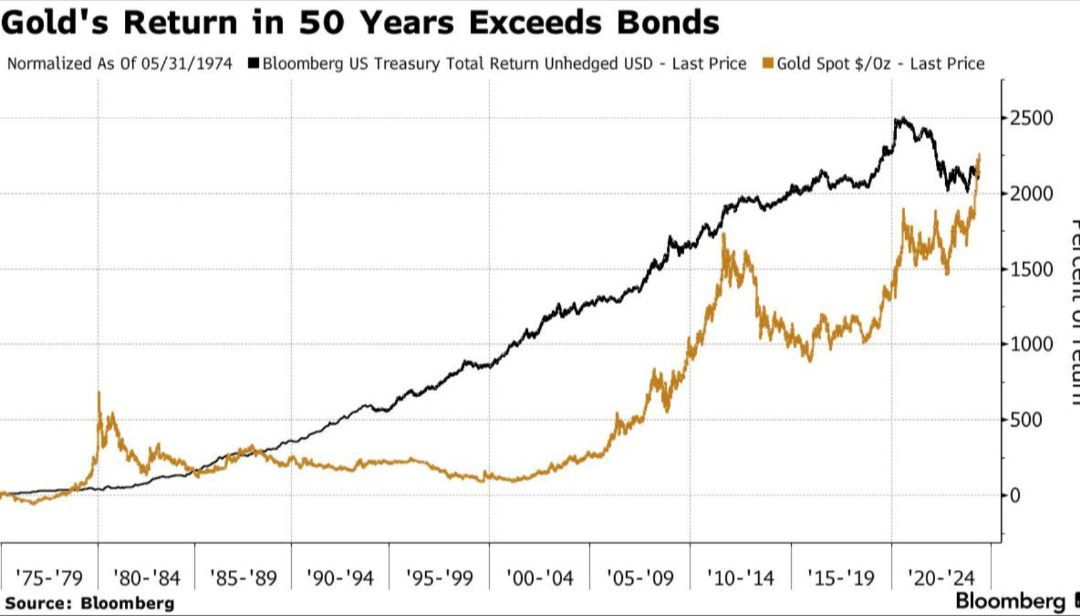

And it is not just gold’s recent performance that is worthwhile mentioning. While it has had its ups and downs throughout the last several decades, it is notable that during the previous 50 years, an investment in the yellow metal outperformed Treasury bonds.

Gold bugs and doomsday preppers may wax poetic regarding the positive characteristics of gold, but the yellow metal’s use as a portfolio diversifier goes far beyond any conspiracy theories.

Gold has been valued as an asset for thousands of years, with its origins dating back to ancient civilizations.

Around 1500 BC, the Egyptians began using gold as a currency and store of value. Over time, this practice spread to other civilizations, such as the Greeks and Romans, who also used gold coins for trade. Gold’s aesthetics and scarcity made it an ideal medium for transactions and a store of value across different cultures.

During the Roman Empire, gold coins were widespread, and gold was used as a standard for economic exchange and a symbol of wealth and power.

In the 19th century, many countries adopted the gold standard, where the value of a country’s currency was directly linked to a specific amount of gold. This system provided a stable basis for international trade and investment. However, it was eventually abandoned in the 20th century due to economic complexities.

After the gold standard was abandoned, gold retained its allure as a safe-haven asset among allocators. Investors turned to gold during times of economic uncertainty and inflation, viewing it as a reliable store of value. Gold investment evolved from holding physical gold (bars, coins, or jewelry) to more investor-friendly forms such as gold ETFs.

In modern asset allocation, gold is often included in diversified portfolios to mitigate risk and enhance risk-adjusted returns. Historically, gold has exhibited low or negative correlation to traditional asset classes like stocks and bonds, making it valuable as a portfolio diversifier to increase returns while reducing risk.

For example, over the past ten years, the traditional equity portfolio diversifier, bonds, have had a 0.44 correlation with stocks. Comparably, gold has had a 0.15 correlation with stocks over the same period. Regarding the effectiveness of portfolio diversifiers, the lower the correlation with stocks, the better.

While equity-centric investors typically eschew gold, given its lack of cash flows and inability to be valued within a discounted cash-flow model framework, we encourage allocators to maintain an open mind regarding non-productive assets such as gold (in addition to others, including commodities, art, bitcoin, etc).

One does not have to be a gold bug to appreciate its place in a diversified investment portfolio. One only needs to look at the numbers to justify allocating to the precious metal.

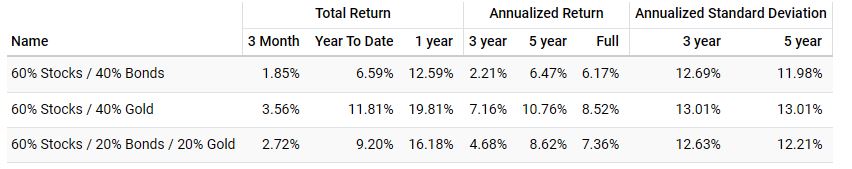

Over the past 10 years, adding gold to the traditional stock and bond portfolio has resulted in higher returns without increasing risk.

Source: Portfolio Visualizer

Adding gold to a 60/40 stock and bond portfolio (a 60/20/20 allocation, as seen below) has added 1-2% of incremental return per year without increasing volatility.

Source: Portfolio Visualizer

Although bonds have had a rough go of it over the past five or so years, with yields steadily rising (although still sitting below long-term averages), the outlook for bonds is still not attractive.

The U.S. government deficit is forecasted to hit nearly $2 trillion this year, representing approximately 7% of GDP. The supply of Treasury bonds in the market is expected to increase markedly, as the U.S. debt rapidly grows, fueled by record budget deficits. In addition, forecast deficit spending by other governments will lead to record sovereign bond issuance, further pressuring the bond market with additional supply.

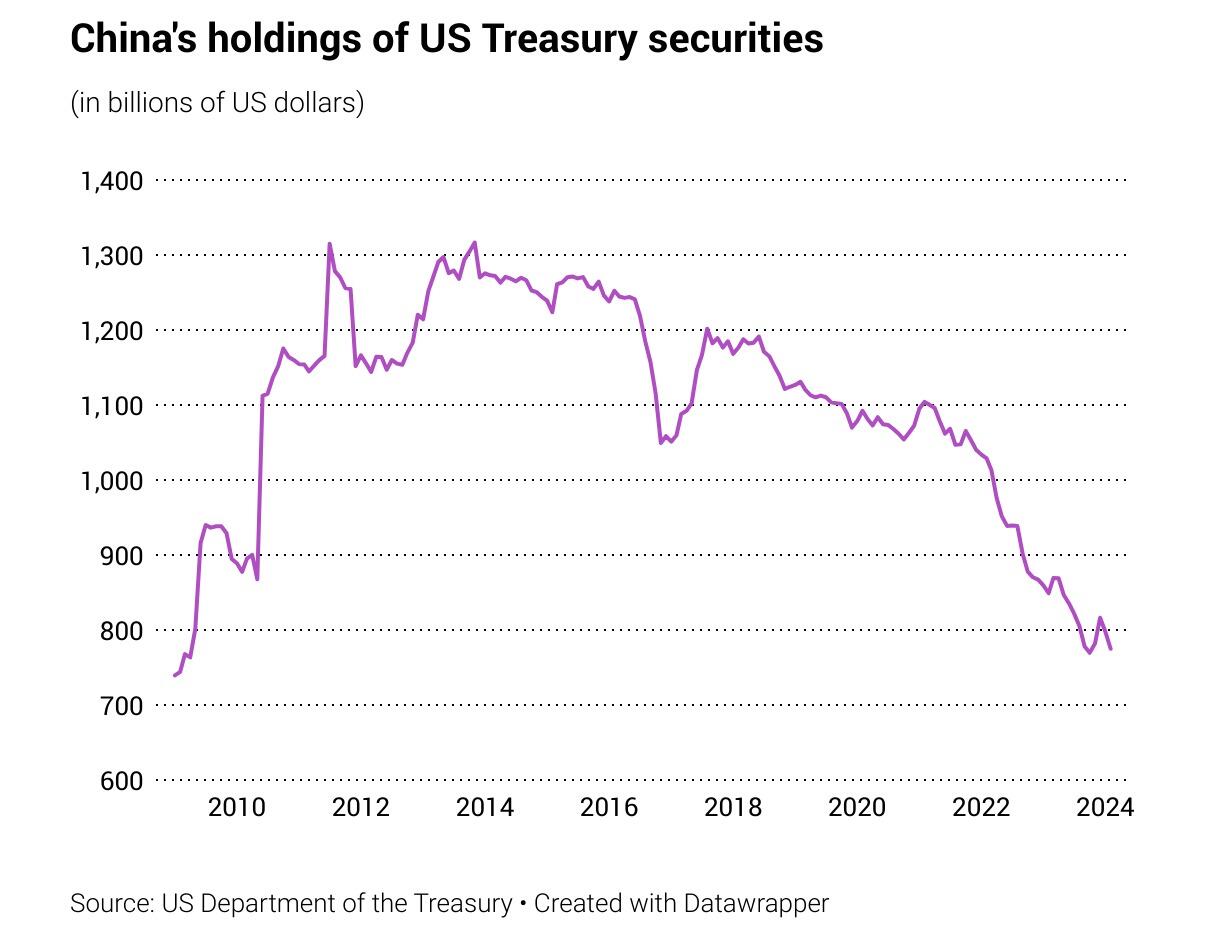

In addition, China, one of the largest historical purchasers of U.S. Treasury securities, is dramatically reducing its holdings.

With demand for Treasury bonds from one of the largest historical purchases falling markedly, combined with a rapidly increasing supply of Treasury bonds issued to fund increasingly massive deficits, headwinds remain for bond investors.

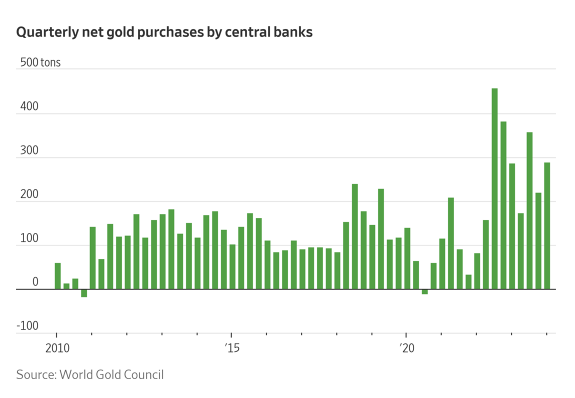

In contrast, the outlook for gold remains bright. As countries such as China reduce their holdings of U.S. Treasury bonds, they are increasingly buying gold. Central bank net purchases of gold have surged over the past two years, and are expected to continue.

Over thousands of years, gold’s journey from a symbol of divine and royal power to a central component of modern investment portfolios reflects its enduring value. As economies evolved over the centuries, so did the methods of investing in gold, expanding from physical holdings to sophisticated financial instruments, maintaining its role as a crucial element for wealth preservation and portfolio diversification.

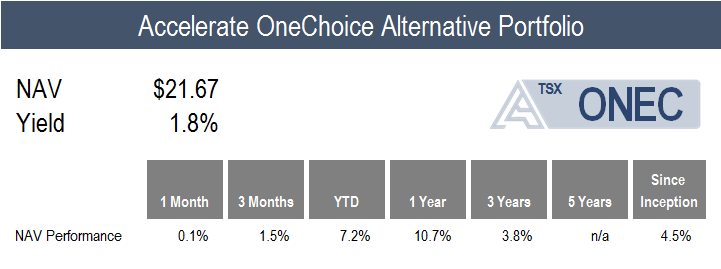

Given its diversification benefits, as exhibited by its low correlation, along with additive portfolio performance, we generally advise a small allocation (of about 2-10%) to gold in investment portfolios. The Accelerate OneChoice Alternative Portfolio ETF (TSX: ONEC) maintains a 10% allocation to gold.

Accelerate manages five alternative investment solutions, each with a specific mandate:

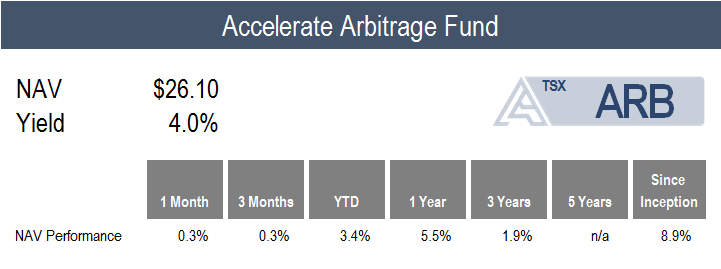

- Accelerate Arbitrage Fund (TSX: ARB): Merger Arbitrage

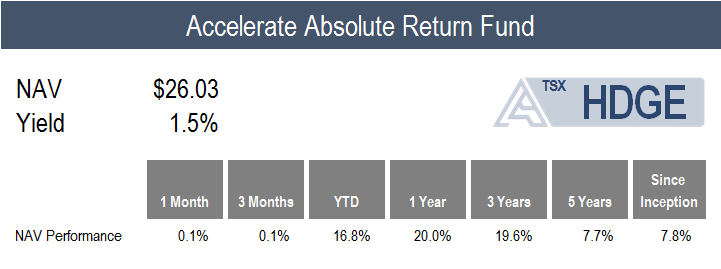

- Accelerate Absolute Return Fund (TSX: HDGE): Absolute Return

- Accelerate OneChoice Alternative Portfolio ETF (TSX: ONEC): Multi-strategy

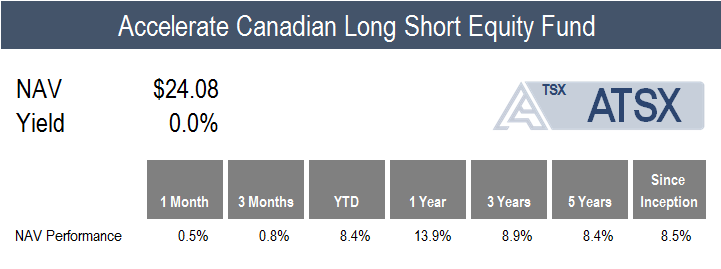

- Accelerate Canadian Long Short Equity Fund (TSX: ATSX): Canadian Long Short Equity

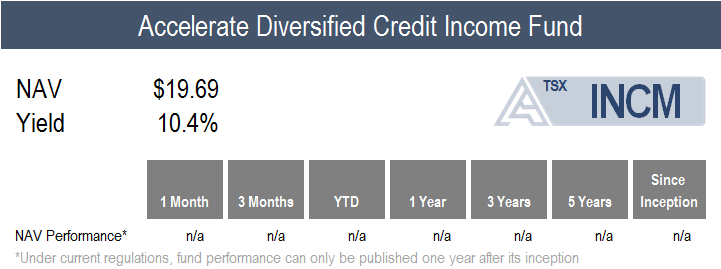

- Accelerate Diversified Credit Income Fund (TSX: INCM): Private Credit

ARB gained 0.3% in June while its benchmark, the S&P Merger Arbitrage Index, increased by 0.9%.

The Fund remained busy in North American merger arbitrage. Four new transactions were announced in Canada, with the Fund participating in three. There was a $5 billion blockbuster Canadian bank deal, as National Bank announced the acquisition of Canadian Western Bank (CWB). There are two ways of participating in this merger arbitrage, either through the plain-vanilla Canadian Western Bank stock (while shorting National Bank), or through the subscription receipts issued to finance the deal. The Fund gained exposure to the arbitrage through the subscription receipts, as they appear to offer a better risk-adjusted return compared to the CWB shares.

In the U.S., nine new deals were announced, representing $21.6 billion of aggregate transaction value. The Fund participated in just one new U.S. merger arbitrage investment. In June, thirteen deals closed in North America (including two subscription receipts), with the Fund crystalizing gains on Fusion Pharmaceuticals, Deciphera Pharmaceuticals, Snap One Holdings, AdTheorent, Model N, HireRight, and Apartment Income REIT, along with the Saturn Oil & Gas subscription receipts.

SPAC activity is picking up, with seven IPOs, totalling $1.15 billion, coming to the market last month. The Fund participated in five of these IPOs, deploying approximately 10% of the ARB portfolio.

Currently, ARB has a gross exposure of 148.9% (139.5% long and -9.3% short), with 41% allocated to merger arbitrage and 59% to SPAC arbitrage.

June was another “squeezy” month, with social media meme stock promoter Roaring Kitty reemerging (in what appears to be a trend of planned stock promotions). Nonetheless, HDGE eked out a 0.1% return for the month.

While shorts generally started the month higher, buoyed by a brief speculative fervor in meme stocks, the phenomena only lasted a handful of trading sessions. Throughout the rest of the month, long-short factor portfolios performed reasonably well, with each market-neutral factor portfolio generating positive performance. Interestingly, all top and bottom decile factor portfolios had negative returns in June. However, bottom-ranked portfolios fell by more than the top-ranked, causing the long-short portfolios to notch gains. Accordingly, HDGE’s short portfolio contributed to the Fund’s positive monthly performance.

ONEC nudged higher by 0.1% in a mixed month for alternative asset classes.

Performance was led by the global macro bucket, with the managed futures allocation leading the pack with a 2.0% gain, followed by risk parity at 1.0%.

The hedge fund allocations also contributed positively, with absolute return, directional long short equity, and arbitrage all generating positive returns of less than 1.0%.

The performance of the real assets allocation was mixed, with real estate increasing by 1.0%, while the infrastructure portfolio fell -1.0%.

Lastly, the inflation protection and credit allocations struggled during the month, as gold and commodities dropped by -0.8% and -1.2%, respectively, while leveraged loans and private credit fell by -0.6% in aggregate.

ATSX was up by 0.5% in June, while its benchmark, the TSX 60, fell by -1.8%. Over the first six months of the year, ATSX is up 8.4%, compared to 4.9% for the TSX 60.

Canadian long-short factor portfolios were positive on average during the month. The long-short value and quality portfolios surged by 9.4% and 8.8%, respectively, as overvalued and low-quality stocks plunged while undervalued and high-quality securities registered modest increases. Conversely, the market-neutral price momentum, operating momentum, and trend portfolios had mixed performance.

While ATSX is structured as 150 long and 50 short, it was able to generate positive returns while its benchmark declined because the Fund’s short positions contributed to the majority of the positive monthly result.

INCM is allocated to 21 liquid private credit vehicles, via listed BDCs. The top 5 holdings include FS KKR Capital, Blue Owl Capital, Ares Capital, Goldman Sachs, and Golub Capital. The Fund’s portfolio currently yields 11.0%, and its holdings are on average trading in line with their underlying net asset value.

The current INCM portfolio provides exposure to 4,536 loans, of which 84.9% are senior secured and 91.8% are floating rate in nature, mainly priced off of the benchmark Secured Overnight Financing Rate (SOFR). On July 1st, SOFR reached 5.4%, a record high (the benchmark rate was created in 2017). The higher SOFR goes, the more the INCM portfolio yields.

Have questions about Accelerate’s investment strategies? Click below to book a call with me:

-Julian

Disclaimer: This distribution does not constitute investment, legal or tax advice. Data provided in this distribution should not be viewed as a recommendation or solicitation of an offer to buy or sell any securities or investment strategies. The information in this distribution is based on current market conditions and may fluctuate and change in the future. No representation or warranty, expressed or implied, is made on behalf of Accelerate Financial Technologies Inc. (“Accelerate”) as to the accuracy or completeness of the information contained herein. Accelerate does not accept any liability for any direct, indirect or consequential loss or damage suffered by any person as a result of relying on all or any part of this research and any liability is expressly disclaimed. Past performance is not indicative of future results. Visit www.AccelerateShares.com for more information.