January 11, 2026 – The Panic of 1907 was a severe financial crisis in the United States that unfolded over three weeks in October of 1907 (what is it with October and market crashes?). At the time, the financial system nearly collapsed and had to be bailed out privately by Wall Street legend John Pierpont Morgan, who organized a coalition of fellow financiers to save the economy, as the Federal Reserve did not exist at the time.

The panic featured bank runs, failures of trust companies, and a nearly -50% decline in U.S stock prices. It was caused by three main factors:

- A recession had started that spring, and the weakening economy, along with tightening credit conditions and declining stock prices, created fragile financial conditions.

- Lightly regulated trust companies were heavily exposed to stock margin loans, making them prone to runs and margin calls when market confidence evaporated.

- The failed attempt to corner the market in United Copper Company stock by Augustus Heinze and Charles Morse served as a catalyst, triggering immediate losses for not only the speculators, but also leading to runs by depositors on the banks associated with the men. The leveraged unwind and bank run exacerbated the crash.

The Panic of 1907, and the resulting market crash, exposed the dangers of the country lacking a central bank to provide an emergency backstop to the financial system and manage market liquidity. Ultimately, the crash led to the creation of the Federal Reserve Act of 1913, creating the Fed as America’s central bank to help prevent future panics.

At its founding, the Fed had several key goals, including acting as the lender of last resort, reducing banking panics and financial contagion, and stabilizing credit conditions. Essentially, the Federal Reserve was created to provide a counter-cyclical balance in the economy and to smooth the business cycle.

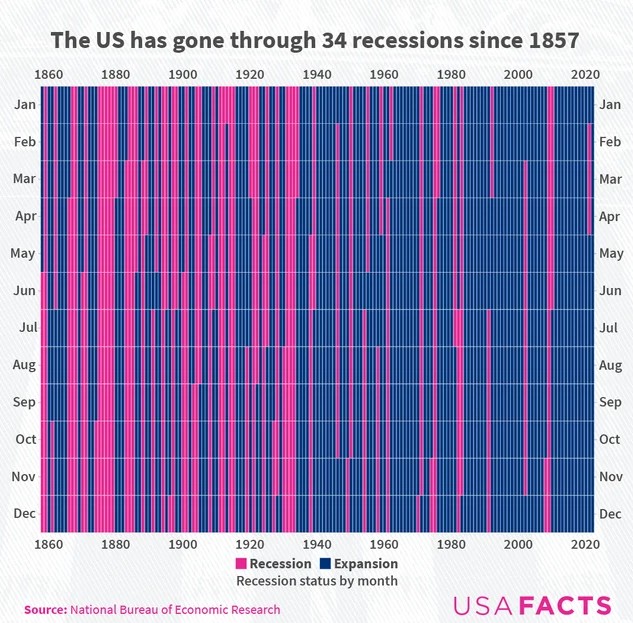

Prior to the creation of the U.S. central bank, the economy often experienced speculative booms and busts and was characterized by wild swings in the business cycle. In the 1800’s and early 1900’s, the U.S. economy would go through recessions every few years, with full-blown market panics occurring every decade or two.

However, over the past one hundred or so years, the Federal Reserve has served as a key modulator of the economy and business cycle, tightening credit conditions and pulling back on liquidity when things were going well, and stepping in to ease market conditions and make credit available when the economy was in danger.

Before the Fed, recessions were more frequent and often triggered by banking collapses. After the Fed, recessions became less frequent, although not eliminated.

That said, the Fed does not operate in a vacuum, nor is it always right. Due to the uncertainty of financial forecasts and the economy’s unpredictability and reflexive nature, running a central bank is an extremely difficult job. Central bankers are prone to policy mistakes. In addition, central banks are often under political pressure to ease financial conditions and boost the economy in order to sway voters’ favour.

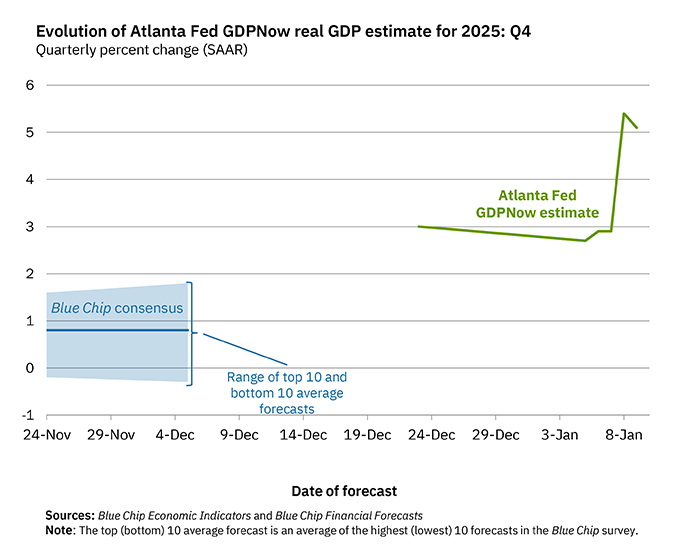

The Federal Reserve Bank of Atlanta recently released its fourth quarter 2025 annualized real GDP growth estimate, which currently sits at a blazing 5.1% (meaning the nominal GDP growth rate estimate stands at 7.8%). This current estimate of U.S. economic growth stands significantly higher than its long-term forecast real growth rate of 1.8% to 2.1%.

Source: Atlanta Fed

“Running the economy hot” means deliberately allowing demand to exceed the economy’s short term productive capacity in order to maximize employment and economic growth, even at the risk of higher inflation. These days, the powers that be are indeed running the U.S. economy hot.

However, it is not just the central bank’s easy money policy that is supporting the economy’s blistering growth rate. Stimulative fiscal policy is also helping – the U.S. is running a forecast deficit of $1.7 trillion this year, representing an unsustainable 5.5% of GDP. Historically, the current level of deficit spending happened exclusively during recessions or war. The case for running deficits during challenging economic periods, and paying down debt with a budget surplus in good times, seems to be an antiquated concept.

Moreover, with the economic growth rate far above trend, the rate of inflation higher than target for five years, and a low unemployment rate in line with “full employment”, now seems to be a good time as ever for the Fed to step in with counter-balancing measures, such as the tightening of credit and liquidity conditions.

Yet here we are – With two more interest rate cuts pencilled in for 2026, and significant budget deficits as far as the eye can see, both monetary and fiscal stimulus appear set to continue overstimulating the economy. Running the economy hot, with robust growth, low unemployment, and high inflation, presents unique risks and opportunities for investors.

First, with an approximate 8% nominal U.S. GDP growth rate and the potential for more rate cuts, the yield curve looks likely to steepen. With that, long-term bonds appear to be a poor bet, given the potential rise in long-term bond yields. A 4.2% yield on the 10-Year Treasury note seems to be insufficient to compensate investors in an environment of nearly 8% nominal GDP growth.

Conversely, several asset classes may perform well as the economy runs hot, with a high growth rate and above-target inflation. Specifically, precious metals tend to outperform during easy money environments, as do cyclical companies and commodity producers. Easy money policies tend to benefit equities and high-yield credit, at least early on in the cycle. Buoyant financial conditions often encourage deal-making, benefitting merger arbitrageurs who invest in M&A, as well as the private credit loans backing leveraged buyouts. In addition, a boom in new listings allows private equity and venture capital funds to monetize illiquid holdings, generally at favourable valuations.

That said, investors need to be cautious as a hot economy often encourages the use of leverage along with aggressive risk-taking. The better the party, the worse the next-day hangover. The more the economy is allowed to overheat, the greater the risk of adverse financial consequences once the punch bowl is taken away. The longer the overheating persists, the greater the risk of a recession or a hard landing.

With an economy running hot, early on, the conditions for investors can be quite favourable. However, late-cycle overheating and investor complacency often plants the seeds of poor future returns. Ergo, investors may do well to plan ahead and diversify portfolios in preparation for the likely hangover.

Accelerate manages five alternative investment solutions, each with a specific mandate:

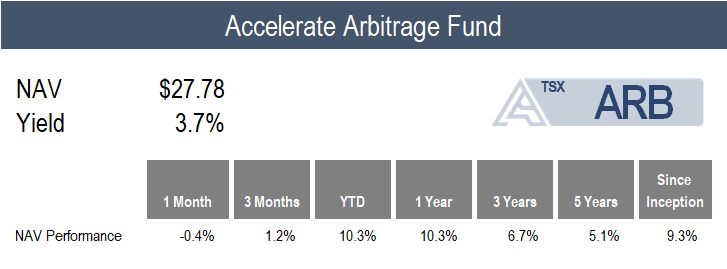

- Accelerate Arbitrage Fund (TSX: ARB): Merger Arbitrage

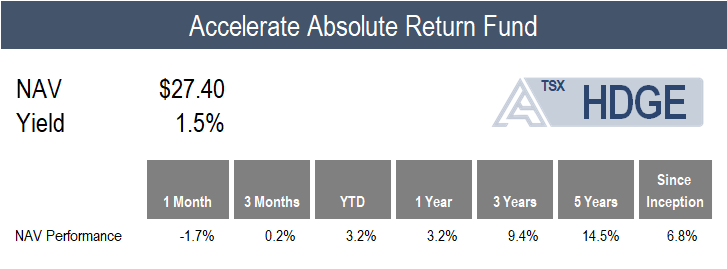

- Accelerate Absolute Return Fund (TSX: HDGE): Absolute Return

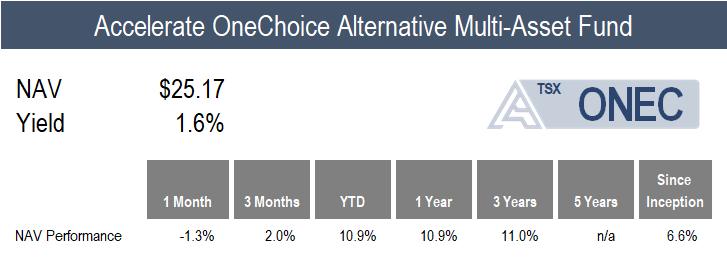

- Accelerate OneChoice Alternative Multi-Asset Fund (TSX: ONEC): Multi-Asset

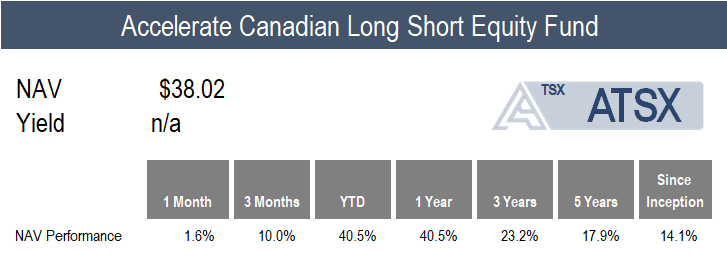

- Accelerate Canadian Long Short Equity Fund (TSX: ATSX): Long Short Equity

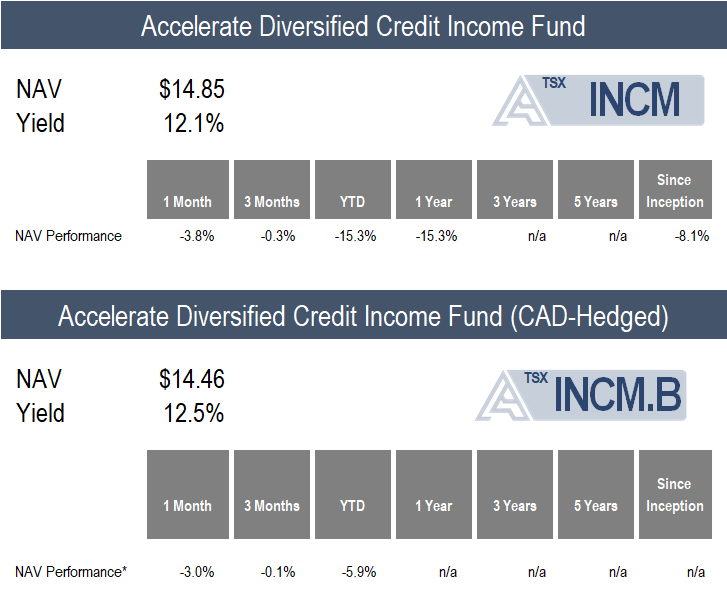

- Accelerate Diversified Credit Income Fund (TSX: INCM): Private Credit

ARB declined -0.4% in December, bringing its 2025 return to 10.3%. Notably, ARB had a trailing 12-month volatility of just 3.8%, in line with its low-risk mandate. In addition, since inception, ARB has a beta of 0.09 and a correlation with equities of 0.15 (the closer to 0.0, the better), while exhibiting a downside participation of -25.4% (negative downside participation indicates that when the equity market goes down, the Fund went up more often than not).

Several dynamics contributed to the above-target return in 2025. First, record merger and acquisition activity provided an attractive investment opportunity set with generally compelling yields. Second, upside optionality returned to the SPAC market, allowing the Fund’s SPAC arbitrage portfolio to contribute meaningfully to Fund returns. Third, a friendlier regulatory environment led to the Fund’s first year with no merger terminations (knock on wood!).

ARB is currently allocated 68% to SPAC arbitrage and 32% to merger arbitrage (consisting of 14% strategic M&A and 18% LBOs). The Fund is 168.4% long and -8.0% short (176.4% gross exposure).

HDGE declined -1.7% in a mixed month for long-short factor performance.

While the U.S. long-short value portfolio generated alpha of 5.7% in December, the long-short price momentum and trend portfolios declined by -1.9% and -2.9%, respectively.

Top Fund contributors for the month include short positions in Aspen Aerogels and Acadia Healthcare, along with a long position in Ulta Beauty. Top Fund detractors include short positions in Quanex Building Products and Neogen, as well as a long position in Imperial Oil.

ONEC declined by -1.3% over the month which featured fairly wide dispersion in alternative asset class returns.

On the positive side of the ledger, the Fund’s gold allocation gained 2.8%. Meanwhile, the Fund’s long-short equity and managed futures strategies generated returns of 1.6% and 1.0%, respectively. Lastly, the leveraged loan portfolio increased by 0.8% while risk parity remained flat.

Conversely, the primary negative performance contributors include the Fund’s allocations to private credit, infrastructure, real estate, and absolute return, which fell by -3.8%, -2.6%, -2.5%, and -1.7%, respectively. In addition, the Fund’s merger arbitrage and commodity strategies declined by less than -1.0%.

ATSX generated a 1.6% return in December, compared to the benchmark S&P/TSX 60’s 1.3% gain.

In addition to the positive market performance, Canadian long short factor portfolios generated alpha for the fund throughout the month. Specifically, undervalued Canadian stocks gained 6.2% while overvalued shares ticked up by just 0.7%, generating positive alpha of 5.5%. In contrast, the long-short quality and trend portfolios generated a monthly loss, somewhat dampening the Fund’s outperformance.

Top Fund contributors for the month include short positions in Lithium Americas and Ballard Power Systems, as well as a long position in Endeavour Mining. Top Fund detractors include short positions in Skeena Resources and Methanex, along with a long position in Imperial Oil.

INCM declined -3.8% (-3.0% on a CAD-hedged basis) for the month, driven by a widening of NAV discounts and rising yields.

Specifically, the average BDC NAV discount widened from -10.9% to -13.0% in December, while the median BDC NAV discount went from -15.3% to -16.5%. Meanwhile, the average yield ticked up 50bps to 13.8%.

2025 was a frustrating year for private credit investors, with poor returns during a bull market for most other asset classes. The primary reason for poor INCM and private credit performance was not the underlying loans, which generally performed in line with expectations, but negative sentiment, which led to significant price declines for BDCs. In particular, the average BDC started the year trading at a 0.7% premium to NAV, and ended the year at a -13.0% NAV discount. In addition, the Fund’s 100% U.S. dollar exposure was a headwind. Nevertheless, the deeply discounted prices and wide spreads within private credit may be compelling to value buyers.

Currently, INCM is allocated to 20 listed private credit funds, which hold more than 5,000 loans and investments. Of these loans, 87.3% are secured and 93.0% are floating rate, with a weighted average yield of 12.8%. INCM currently trades at a -16.6% discount to the underlying net asset value of its loan pools. In addition, the portfolio’s loans on non-accrual are 1.3%, and the portion of interest paid in kind (PIK) is 8.7%, on a weighted average basis.

Have questions about Accelerate’s investment strategies? Click below to book a call with me:

-Julian

Disclaimer: This distribution does not constitute investment, legal or tax advice. Data provided in this distribution should not be viewed as a recommendation or solicitation of an offer to buy or sell any securities or investment strategies. Please read the relevant prospectus before investing. For a summary of the risks of an investment in the Accelerate ETFs, please see the specific risks set out in the prospectus. ETFs are not guaranteed and the information in this distribution is based on current market conditions and may fluctuate and change in the future. Past performance is not indicative of future results. Decisions regarding tax, investments, and all other financial matters should be made solely with the guidance of a qualified professional. Visit www.AccelerateShares.com for more information.