February 15, 2026 – “Software is eating the world” is a phrase coined by Marc Andreessen in a 2011 essay in The Wall Street Journal. In the article, Andreessen argued that software companies are taking over industries that were once dominated by traditional, asset-heavy physical businesses. In other words, every industry eventually gets disrupted by software.

Some examples of software eating the world include Netflix replacing bricks-and-mortar video stores, Amazon killing mom-and-pop retailers, Apple’s iTunes disrupting the music distribution business, and LinkedIn transforming job recruitment (anyone remember classified ads in newspapers?).

Andreessen’s thesis was based on the notion that the marginal cost of software is near zero, it scales infinitely, and it creates winner-take-most dynamics. The Software-as-a-Service (SaaS) model become one of the most attractive models in modern business because it combines recurring revenue, high gross margins, capital efficiency, scalability, and predictable growth. Due to their attractive attributes, SaaS businesses were highly favoured by both equity investors and lenders.

The “Software is eating the world” thesis worked near-perfectly for 15 years, until artificial intelligence became good enough to disrupt the software industry.

Today, a common evolution of the phrase is “AI is eating software.” Market prognosticators have become concerned that the business model has flipped to Software as a Disservice (yes, they are SaaD).

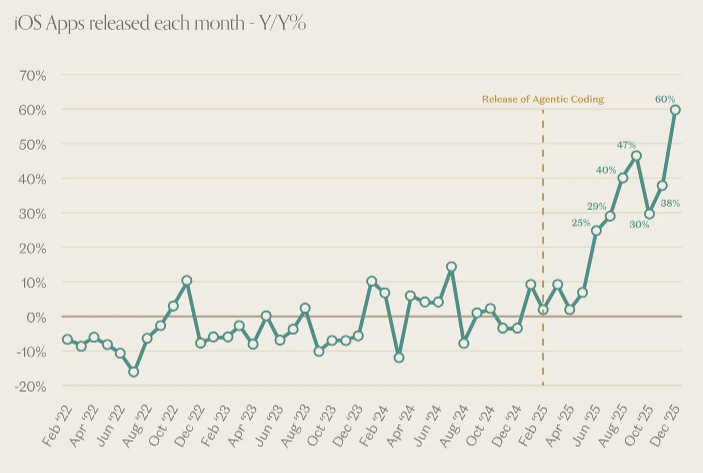

Instead of replacing physical industries, AI threatens to replace traditional software workflows with AI agents. Moreover, AI coding tools such as Anthropic’s Claude Code, which has advanced code-generation and reasoning capabilities, are leading to the collapse in the marginal cost of software creation. Now, instead of a team of developers taking months and significant capital to build an app, one developer can get the same result (or better) within days with minimal capital. In addition, agentic AI coding tools now enable non-engineers to develop functional software.

As software development barriers fall rapidly and programming becomes automated due to the rise of agentic coding, the supply of apps has begun to surge.

Source: A16Z

Now with “vibe coding”, where users create software by describing requirements in natural language to AI models rather than writing code manually, seemingly anyone can create AI agents to automate tasks. That said, I have personally burned the last two Sunday afternoons trying (unsuccessfully) to set up the viral open-source AI agent developer OpenClaw on my computer (which, after not having developed software since my engineering thesis 20 years ago, apparently supports my pursuit of a career in finance instead of software engineering).

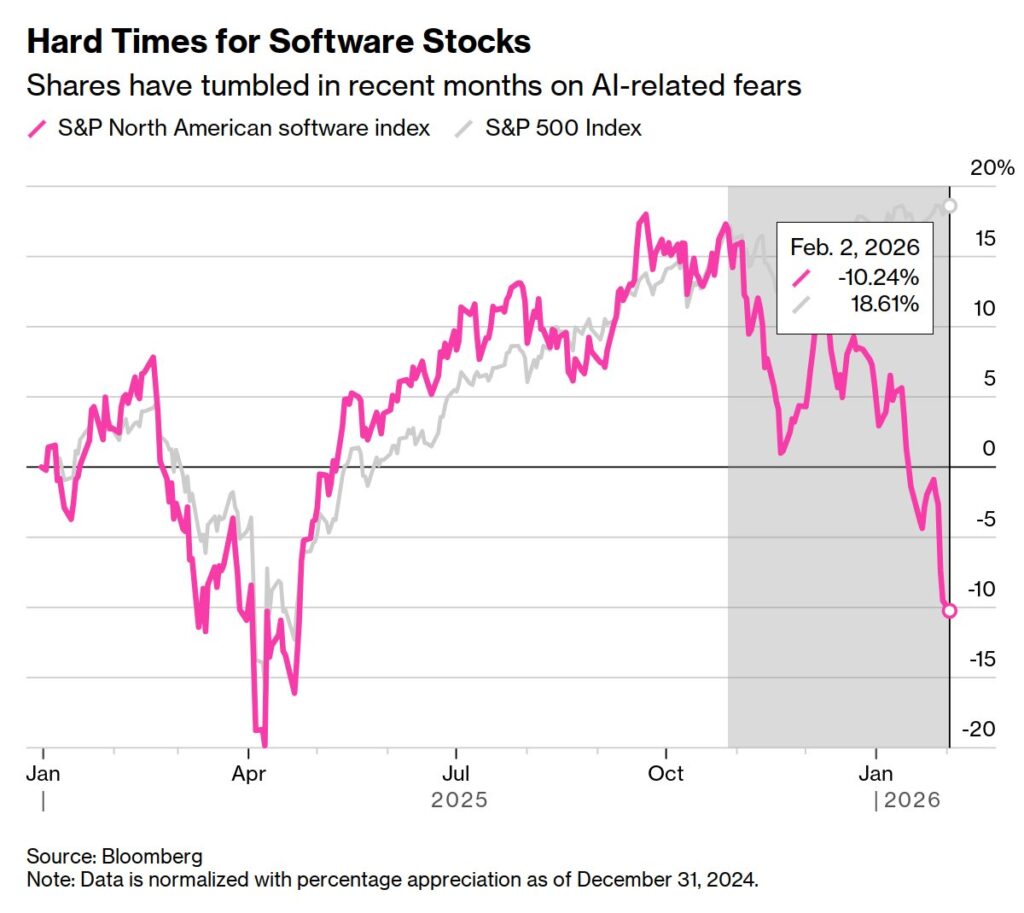

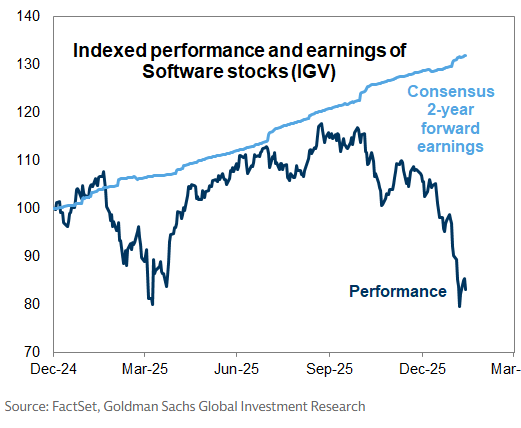

Nevertheless, market participants have expressed this fear of AI disrupting the software business by selling related securities. Software equities are now firmly in a bear market.

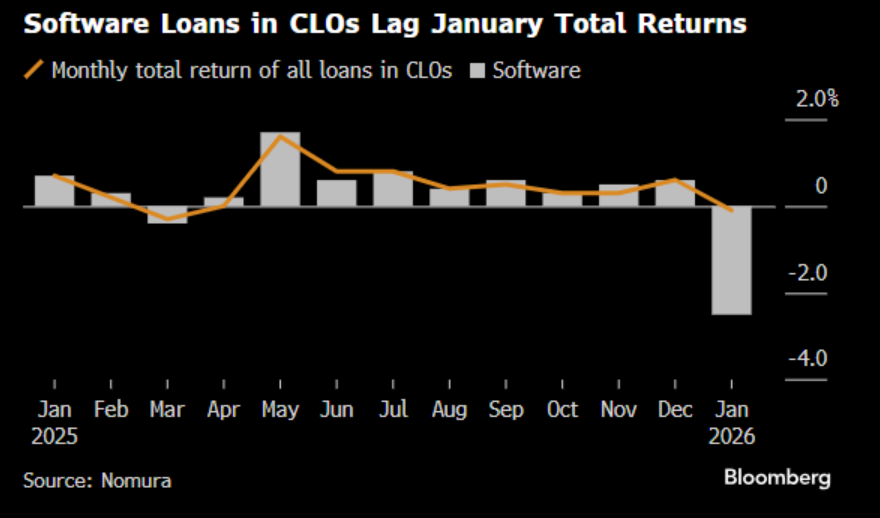

It is not only software equities that have come under pressure. Any software related credit investments have also come under pressure. For example, software loans in collateralized loan obligations (CLOs) have sold off sharply in the past few weeks.

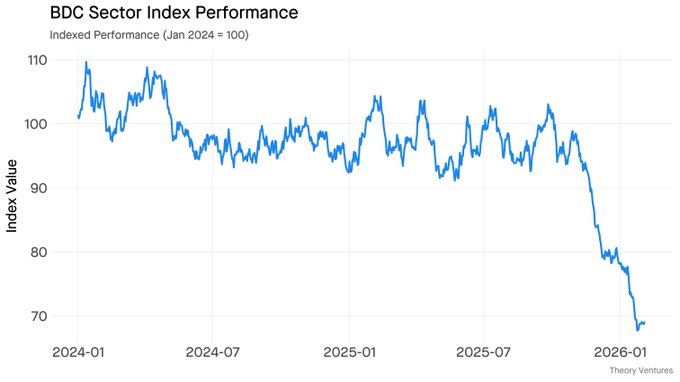

Moreover, prices of private credit funds have been hit harder than the broadly syndicated loan or CLO markets. Private credit, as represented by listed BDCs, has come under significant selling pressure in recent months, with the median BDC now trading at a -23% discount to NAV (net asset value, or the value of their underlying loans). It is estimated that software loans represent approximately 20% of all private credit loans.

At current BDC discounts, which represent the level at which private credit funds are trading below the underlying value of their loans, analysts from Raymond James note that investors are pricing BDCs as if two-thirds of their software loans will default with no recovery. Historically, private credit software loans have experienced a default rate of just 4.5% over the last ten years, which is less than half of the 10.5% rate experienced by all private credit loans.

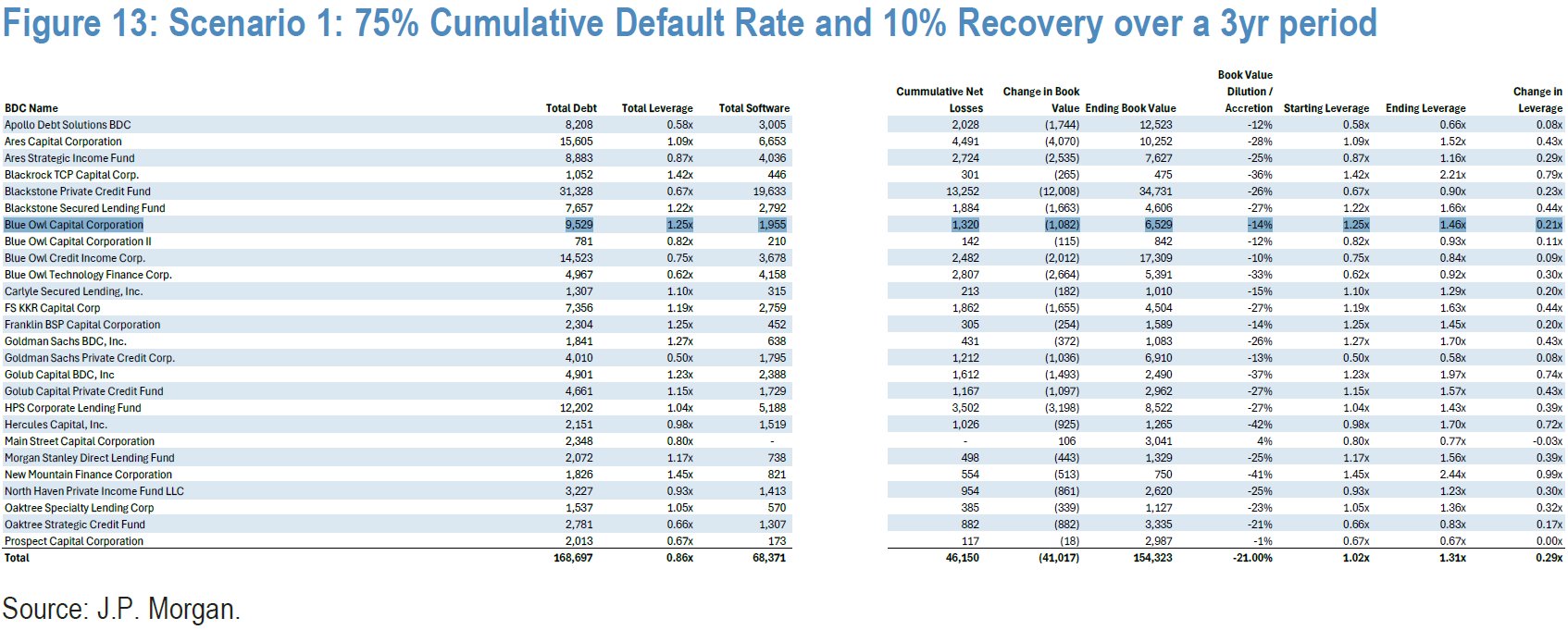

Under a draconian scenario posited by J.P. Morgan analysts, in which they assume that software loans experience a 75% cumulative default rate and a 10% recovery over a three year period, they note that this highly punitive analysis results in a total aggregate NAV decline of -21%. Meanwhile, the median BDC trades at a -23% discount to NAV.

That said, fundamentally, most software companies continue to experience attractive economics and growth rates. For example, as software stocks plunged -24% over the past three months, earnings estimates have risen by 5%. Analysts forecast that software company earnings will rise more than 30% over the next two years.

So, while software equities and credit experience significant mark-to-market pain, the underlying economics remain unchanged (at least for now). Nevertheless, the bearish sentiment is pervasive, and for now, the market expects software companies to go the way of the newspaper. My hot take:

Ultimately, the future of software products and companies requires a more balanced and nuanced view. No, not all software companies will go bankrupt and go the way of the dodo bird. That said, there has clearly been a sea change in the SaaS business. Many software firms will be negatively impacted either by an increased supply of competitors (due to reduced barriers to entry) or reduced demand for their products (as programmers or other employees are laid off and replaced by AI agents). However, many software companies will thrive by incorporating AI into their product offerings.

It was only one year ago that Google’s stock traded down sharply on fears that it would be an “AI loser” and see its search business severely disrupted by AI chatbots. Since bottoming last April, Google’s stock price has more than doubled as the market’s sentiment toward the company has done a 180 after the company found AI success with its industry-leading large language model, Gemini 3.

Robert Smith, the founder and CEO of Vista Equity Partners, one of the world’s largest software private equity firms, once famously said: “Software contracts are better than first-lien debt. You realize a company will not pay the interest payment on their first lien until after they pay their software maintenance or subscription fee. We get paid our money first. Who has the better credit? He can’t run his business without our software.”

While this thesis worked for several years, it is likely no longer valid in the age of AI. Now, revenue streams from SaaS businesses are far less certain. As for what’s next for the future of software, Nvidia’s founder and CEO Jensen Huang brought a sensible view: “There’s this notion that the software industry is in decline and will be replaced by AI. Would you use a hammer or invent a new hammer? There’s a whole bunch of software companies whose stock prices are under a lot of pressure because somehow AI is going to replace them. It is the most illogical thing in the world.”

The SaaS industry is in crisis, with many investors turning their backs on the industry. Increased uncertainty and negative investor sentiment toward software companies have caused risk premia to rise and valuation multiples to collapse. Currently, BDC prices indicate that thousands of software companies will go under.

While severe negative sentiment dominates the securities of software companies, whether equity or credit, the most likely result is that mission-critical software companies will be fine, and may even thrive, in the age of artificial intelligence. In contrast, some software companies may see their revenue growth rates decline, or even turn negative, if they do not adapt and end up getting disrupted by AI. If one thing is certain, the market has taken a “baby out with the bath water” approach to the industry, with indiscriminate and relentless selling of the sector.

With that, enterprising investors may do well by heeding Winston Churchill’s timeless advice: “Never let a good crisis go to waste”.

Accelerate manages five alternative investment solutions, each with a specific mandate:

- Accelerate Arbitrage Fund (TSX: ARB): Merger Arbitrage

- Accelerate Absolute Return Fund (TSX: HDGE): Absolute Return

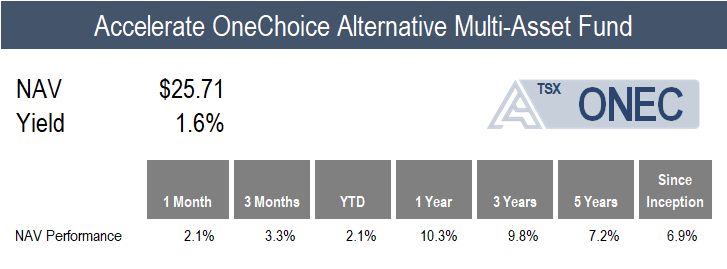

- Accelerate OneChoice Alternative Multi-Asset Fund (TSX: ONEC): Multi-Asset

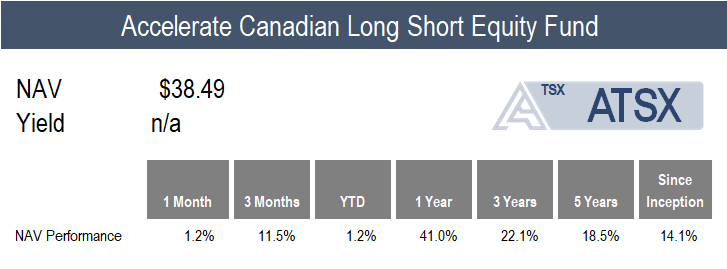

- Accelerate Canadian Long Short Equity Fund (TSX: ATSX): Long Short Equity

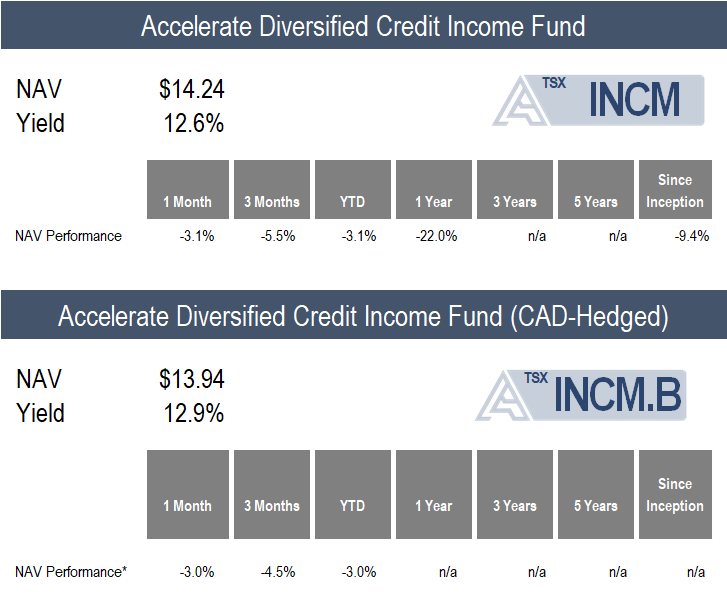

- Accelerate Diversified Credit Income Fund (TSX: INCM): Private Credit

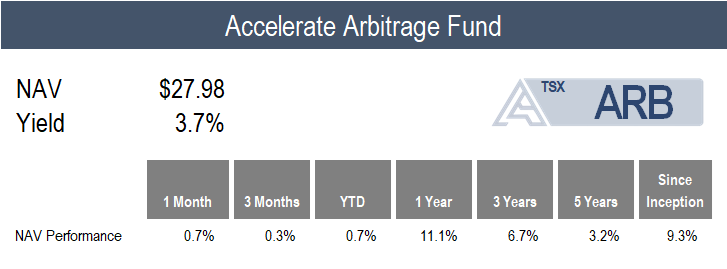

ARB gained 0.7% in January as robust deal activity continued from last year into 2026.

During the month, 13 public mergers and acquisitions were announced in North America, totalling nearly $40 billion. Of these, ARB invested in three. In addition, 24 SPAC IPOs raised a total of $5.6 billion last month and of these deals, the Fund invested in thirteen. Moreover, two of the Fund’s SPAC investments announced mergers that were well received by the market. Spring Valley Acquisition III announced a merger with General Fusion and D. Boral ARC Acquisition I announced a business combination with Exascale Labs, with the units of each rallying nearly 10% on the news.

Currently, ARB is 171.7% long and -8.4% short (180.1% gross exposure), with 65% allocated to SPAC arbitrage and 35% to merger arbitrage (with 18% in LBOs and 17% in strategic M&A).

We are pleased to announce that Accelerate has been ranked in the Top 5 (and #1 in Canada) in BarclayHedge’s Yearly performance rankings in the Merger Arbitrage category for 2025.

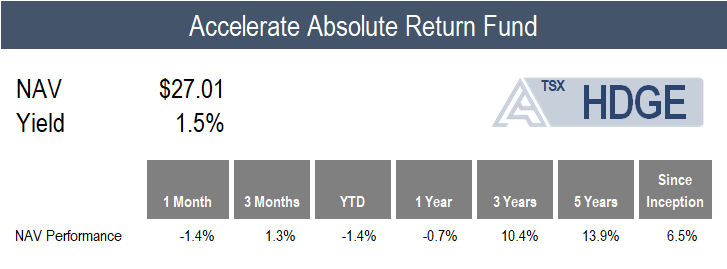

HDGE declined by -1.4% in a somewhat challenging month for short selling and hedged portfolios.

In particular, low quality and overvalued securities outperformed in January, causing the long short value and quality factor portfolios to decline by around -4.0%. In contrast, the long short price momentum and trend portfolio exhibited positive performance, with returns of 3.9% and 9.7%, helping mitigate Fund losses.

Top Fund contributors include a long position in TechnipFMC, along with short positions in PAR Technology and CBIZ. Top Fund detractors include short positions in Ichor Holdings and Camping World Holdings, as well as a long position in Pegasystems.

ONEC gained 2.1% for the first month of the year, primarily driven by its 10% allocation to gold, which surged 15.6%.

Additional positive contributors include the Fund’s allocations to risk parity, commodities, infrastructure, real estate, and managed futures, which all returned between 2.4% and 4.2%. Also, ONEC’s long short equity and merger arbitrage exposures increased by 1.2% and 0.7%, respectively. In contrast, negative contributors for the Fund include leveraged loans, absolute return, and private credit, which declined by -0.4%, -1.4%, and -3.0%, respectively.

ONEC was launched in January of 2021 as Canada’s first true multi-asset ETF. The Fund just celebrated its five-year anniversary. At inception, we aimed to provide an all-in-one alternative investment portfolio (we nicknamed it the “Yale Endowment ETF”) with the following targeted metrics: annualized returns of 6-8%, mid-to-high single digit volatility, and a beta below 0.5. The Fund has mostly met those objectives, with a 6.9% annualized return since inception, 8.2% volatility and a beta of 0.48. Moreover, since divesting its crypto exposure three years ago, ONEC’s risk-adjusted return metrics have improved.

![]()

ATSX generated a 1.2% return in January, compared to the Fund’s benchmark S&P/TSX 60’s -0.4% decline.

It was a mixed month for Canadian multi-factor performance. Although the market neutral price momentum and trend portfolios surged by more than 9%, the long short value and quality portfolios each dropped by more than -7%.

Top Fund contributors include a short position in Altus Group, along with long positions in Suncor Energy and Enerflex. Top Fund detractors include short positions in Denison Mines, NexGen Energy, and Ag Growth International.

INCM declined -3.1% (-3.0% in CAD-hedged terms) as private credit continues to face negative sentiment and widening NAV discounts for BDCs.

There is a significant focus by the media and investors on software loans, which account for approximately 20% of the loans in private credit. Specifically, the perceived threat from artificial intelligence has punished both software equities and lenders, with BDCs declining in price amid negative headlines.

While there is an estimated $300 billion of private credit loans to software companies, there is more than $500 billion of private equity capital invested in those same companies subordinated in the capital stack. The typical private credit loan to sponsor-backed software companies is at 30-40% loan-to-value. So, in order to see material impairment in software private credit loans, the private equity owners would need to see $500 billion+ of equity capital vapourized. It seems doubtful that these firms will sit idly and wait for their investments to be disrupted by AI. But even if they do, it is questionable that the private credit lenders will also do so once they get the keys handed to them. This scenario also ignores the fact that AI may be additive and accretive to software companies. In any event, an 80% impairment to all software companies due to AI, which is being priced in currently, seems like an improbable scenario, however, is presently assumed as a baseline.

Currently, INCM is allocated to 20 private credit portfolios (through listed BDCs), accounting for more than 5,000 loans and investments, of which 88.0% are senior secured and 93.7% are floating rate. The current yield on the INCM portfolio is 13.5%, and it trades at a -22% discount to its net asset value.

Have questions about Accelerate’s investment strategies? Click below to book a call with me:

-Julian

Disclaimer: This distribution does not constitute investment, legal or tax advice. Data provided in this distribution should not be viewed as a recommendation or solicitation of an offer to buy or sell any securities or investment strategies. Please read the relevant prospectus before investing. For a summary of the risks of an investment in the Accelerate ETFs, please see the specific risks set out in the prospectus. ETFs are not guaranteed and the information in this distribution is based on current market conditions and may fluctuate and change in the future. Past performance is not indicative of future results. Decisions regarding tax, investments, and all other financial matters should be made solely with the guidance of a qualified professional. Visit www.AccelerateShares.com for more information.