December 19, 2025 – The Dancing Plague of 1518 is a strange historical example of mass hysteria, a phenomenon in which a group of people experience similar symptoms but with no identifiable fundamental cause, that unfolded in the summer of that year in the Holy Roman Empire.

In July 1518, a woman known as Frau Troffea walked into a street and began to dance. She allegedly danced for days. For inexplicable reasons, within a week, dozens of others had joined her, and within a month, the crowd of dancers had grown to hundreds. It was said that they danced until they collapsed from exhaustion, stroke, or heart attack. No one knew what drove the people’s desire to dance, and therefore no one understood how to stop it. However, by early September of that year, the dancing outbreak began to subside. Historians now believe the episode was a stress-induced psychosis caused by the extreme famine and disease present in the region at the time.

Today, the Dancing Plague of 1518 is often cited as one of the earliest recorded cases of mass hysteria.

At its core, mass hysteria begins with ambiguity or uncertainty. Something unusual happens, such as a rumour or an unexplained event, to catalyze the hysteria. When people are under stress and dealing with incomplete information, they look to others for cues on how to interpret what they are experiencing. As humans are deeply social learners, in uncertain environments, they unconsciously outsource judgment to the group. If enough people appear alarmed, the alarm itself becomes evidence. It is a self-fulfilling prophecy.

Ultimately, mass hysterias occur under a unique cocktail of stress, uncertainty, and misunderstanding.

As it turns out, there are few areas in modern society where stress, uncertainty, and misunderstanding collide more violently than in the capital markets. And therefore, it is unsurprising that markets often feature their own mass hysteria, in which unexplainable crowd behaviour feeds on itself in a feedback loop causing price volatility that is not justified by underlying fundamentals.

A classic Wall Street cartoon perfectly captures the bewildering, unpredictable volatility of investor behaviour under stress and misinformation. Such is “the madness of crowds”.

Source: Kevin Kallaugher

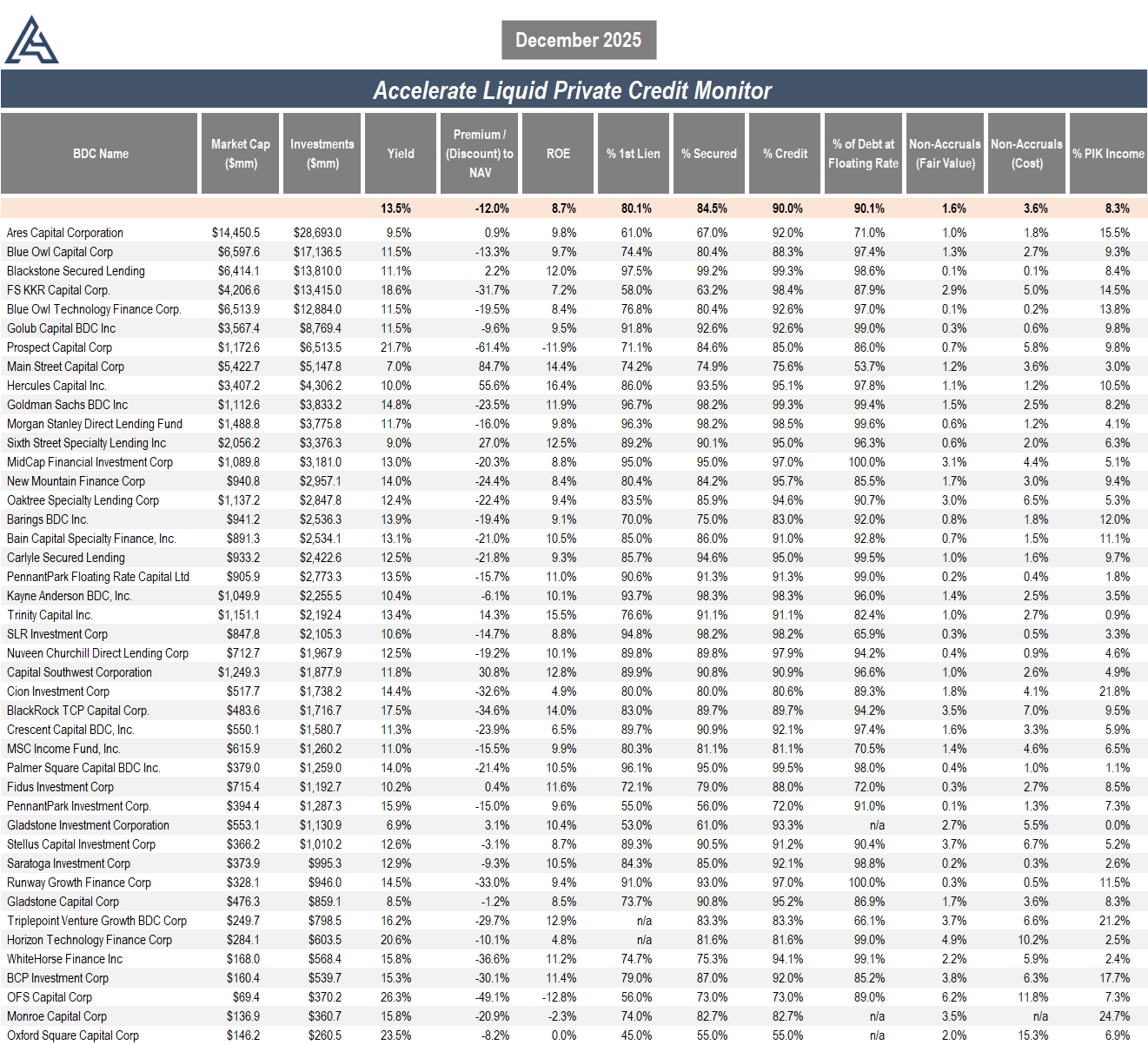

Within the private credit market, the third quarter featured a unique mix of negative headlines, credit catalysts, rumours, and media commentary that created a mild collective panic and social contagion, causing the prices of liquid private credit vehicles (primarily listed business development companies (BDCs)) to trade down significantly.

In September, two negative credit events made front-page news. Tricolor Holdings, a subprime auto lender, filed for Chapter 7 bankruptcy (liquidation) on September 10th. First Brands Group, an auto parts manufacturer, filed for Chapter 11 bankruptcy (restructuring) on September 28th.

Besides both filing for creditor protection last quarter and operating in the automotive sector, Tricolor and First Brands have two things in common:

- Alleged fraud – Both companies are believed to have engaged in double-pledging collateral – using the same assets to borrow money from multiple lenders. Both appear to involve criminal mismanagement and are not necessarily reflective of broader credit issues.

- Not private credit – Tricolor and First Brands did not borrow from the private credit market (as defined by sponsor-backed direct lending). These companies tapped the broadly syndicated loan, bank, and asset-backed finance markets. Neither were sponsor-backed (private equity owned), and traditional direct lenders were not involved with the companies. Nevertheless, that did not stop the media from having a heyday, falsely reporting that the First Brands and Tricolor bankruptcies directly affected the private credit market.

Source: CNBC, The Guardian, Forbes, Accelerate

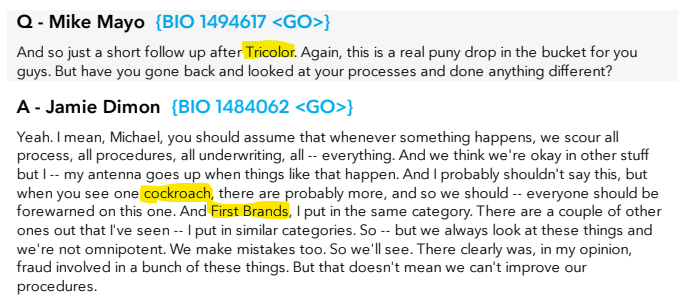

To make matters worse, on JP Morgan’s third quarter conference call, CEO Jamie Dimon discussed the current credit events at Tricolor and First Brands, stating “When you see one cockroach, there are probably more.” The media loved that, and for whatever reason, took the comments and misapplied them to the private credit market, as opposed to the BSL and ABS markets that were actually affected. JP Morgan lost $170 million lending to Tricolor.

Nevertheless, if you listen to Jamie Dimon’s comments on the conference call, the “cockroaches” he mentioned specifically referred to Tricolor and First Brands. He never mentions private credit. It is a head-scratcher as to why the media misconstrued his comments. Moreover, JP Morgan is one of private credit’s largest financiers, and the firm’s CFO was defending private credit loans on the same conference call (which the media failed to mention).

Source: JP Morgan, Bloomberg

To make matters worse, the Fed cut rates by 25bps on September 17th. Given that private credit is primarily a floating rate exposure, its yield varies with the fed funds rate. As the Fed cuts rates, the yield on private credit should decline in unison (all else equal). While proponents of the efficient market hypothesis would believe that rate cuts would have been priced into the private credit market, some market prognosticators believe that the rate cut (and the realization that floating rate loan yields would decline) gave private credit investors another reason to click the sell button. This argument ignores the fact that declining interest rates lead to better credit conditions for underlying borrowers, as interest coverage ratios improve.

Nevertheless, BDC prices declined precipitously in September, with top-tier private credit funds trading down by more than -10%.

Source: Bloomberg, Accelerate

To combat the market’s fear and the media’s assault on the asset class, the two largest listed BDCs went on the offensive, outright dismissing the market’s concerns on private credit and addressing the misguided consternation stemming from recent bankruptcies in the syndicated loan market asset-backed finance markets:

- Blue Owl Capital: The bankruptcies of Tricolor Holdings and First Brands Group is an “odd kind of fear-mongering. We’re not seeing rising defaults, we’re not seeing companies struggling.”

- Ares Capital: “We’ve been a little surprised by the First Brands, Tricolor selloff and buzz because when we look at our credit portfolios, we actually see pretty healthy portfolios relative to almost any metric that you can look at.”

The charm offensive was ineffective, and BDCs ended the third quarter in the doldrums, suffering from widespread double-digit NAV discounts, reflecting the market’s fears of defaults as high as 20% (which would be the highest on record by far).

In making a judgement regarding whether the recent negative price action and bearish sentiment were justified, it is worthwhile for investors to closely examine the fundamental performance of private credit loan books. Given the negative expectations, third quarter results from the BDC market were among the most anticipated in recent memory.

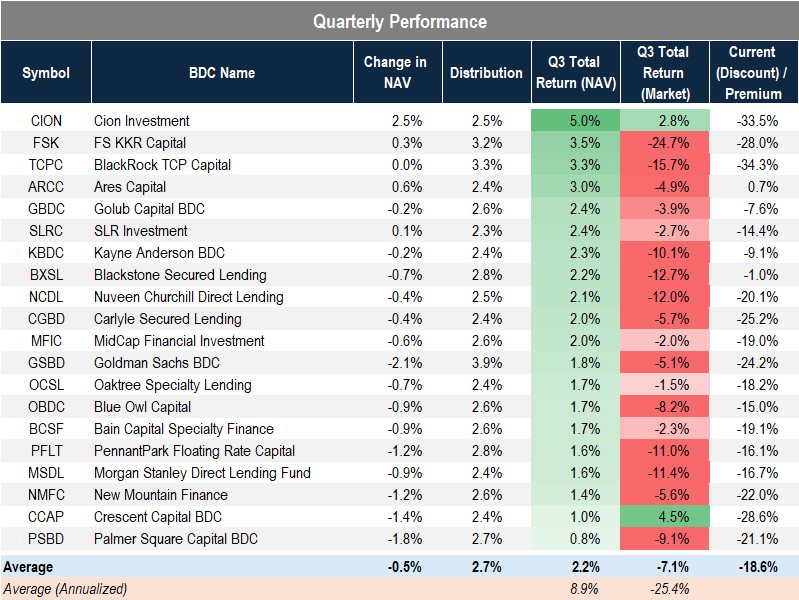

Third quarter private credit performance did not disappoint (unless you were bearish). In contrast to market expectations, BDCs reported their best results of the year. In our coverage universe of twenty leading BDCs, they generated an average 2.2% quarterly total return (or 8.9% annualized), resulting from an average -0.5% NAV loss combined with an average 2.7% distribution. If a private credit investor was informed of an 8.9% annualized return, they would likely be pleased (as this falls within the realm of typical private credit return expectations).

However, fundamental performance was only half the story. Make no mistake – the market action was ugly in Q3. In contrast, the listed BDCs under coverage delivered a -7.1% total return for the quarter (or -25.4% annualized), as a result of adding the yield to the nearly -10% average price decline. The difference between mark-to-model (+2.2%) and mark-to-market (-7.1%) of these loan portfolios is equivalent to “great” versus “terrible” for the same assets.

Consequently, most BDCs now trade at significant discounts to NAV, with some trading below 70 cents on the dollar.

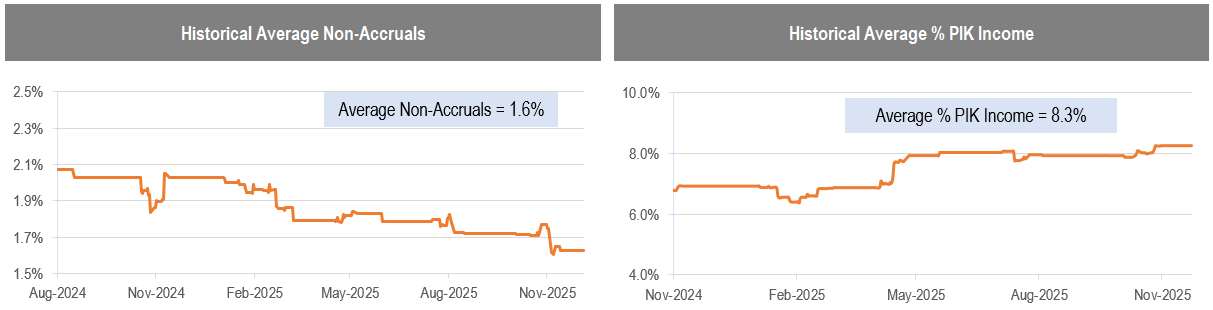

Moreover, it is useful to examine the trends in non-accruals and payment-in-kind payment rates as coincident or leading indictors of broad credit performance.

In Q3, average non-accruals declined by 10bps to 1.6%, while average % PIK income increased 30bps to 8.3%, indicating relatively stable credit conditions.

Source: Accelerate, Company filings

Although fundamental performance was relatively good in the third quarter, credit issues are unavoidable given the sub-investment grade nature of the asset class (particularly given that the listed BDC market comprises of more than 7,000 loans, with most yielding above 10%).

While the Tricolor and First Brands bankruptcies were unfairly attributed to the private credit industry, even though these were bank-led deals, there were at least two credit issues that stung private credit funds recently:

- Renovo, a home improvement company that had been recapitalized by its private equity owner in the second quarter, failed suddenly, and BlackRock and Apollo’s (through its MidCap Financial subsidiary) private credit funds took 100% losses on it. Renovo’s private equity sponsor was Audax Group. This position represented 0.7% and 0.25% of BlackRock TCP Capital and MidCap Financial Investment loan portfolios, respectively.

- The sponsor of Production Resource Group (which was previously restructured a couple of years ago), TJC, handed the keys to the company to its lenders, Ares and KKR. The investment was on non-accrual for these funds in Q3 but will be flipped into an equity position in Q4.

Renovo is in Chapter 7 liquidation, so it is a complete loss. Production Resource Group is still a going concern, so theoretically, there is a chance of recovery, but only time will tell.

While defaults will always exist in sub-investment grade credit generally, and private credit specifically, it is helpful to separate the signal from the noise. Much of the consternation in the third quarter around the First Brands and Tricolor bankruptcies, which contributed to negative sentiment and poor market performance in liquid private credit, turned out to be misplaced. As the market prepared for a raft of defaults in Q3, BDCs showcased their best quarterly fundamental results of the year.

Furthermore, the outlook for private credit deployment is improving markedly, based on two market dynamics:

- Record merger and acquisition activity – This year has seen record M&A activity, particularly in the fourth quarter, as discussed in our recent memo, The Return of the Megadeal. Direct lending deployment is primarily driven by private equity activity, and there have been enormous buyouts announced recently. This year, private credit has funded an estimated 75% of private equity buyouts. Rising buyout activity increases the demand for financing and allows direct lenders to put money to work.

- Fund flows – Widespread NAV discounts across the listed BDC space indicates that allocators are fleeing liquid private credit. It is only a matter of time before we see a similar dynamic in the unlisted BDC sector. With less supply of capital in the asset class, competition is reduced, which may result in higher loan spreads.

Whether one attributes the divergence between fundamental performance and price performance in private credit last quarter to mass hysteria or a simple misunderstanding combined with a “sell now and ask questions later” dynamic, private credit market fundamentals remained solid amid a cloud of negative sentiment in the third quarter. In addition, given recent market dynamics, the outlook for private credit is improving, offering investors a unique combination of attractive valuations and improving fundamentals.

For those who want a deeper dive into recent dynamics of the asset class, Accelerate portfolio managers conducted several management interviews with private credit leaders after third quarter results on the Absolute Return Podcast:

- #261 – Beyond the Headlines: The Outlook for Private Credit with Kayne Anderson BDC President Frank Karl

- #262 – Syndicated Loans and Private Credit with Palmer Square Capital BDC’s President Matt Bloomfield

- #263 – A Strategic Lens on the Private Credit Environment with Barings BDC’s President Matt Freund

Each individual merger is assigned a risk rating:

- AA – a merger arbitrage rated ‘AA’ has the highest rating assigned by AlphaRank. The merger has the highest probability of closing.

- A – a merger arbitrage rated ‘A’ differs from the highest-rated mergers only by a small degree. The merger has a very high probability of closing.

- BBB – a merger arbitrage rated ‘BBB’ is of investment grade and has a high probability of closing.

- BB – a merger arbitrage rated ‘BB’ is somewhat speculative in nature and has a greater than 90% probability of closing.

- B – a merger arbitrage rated ‘B’ is speculative in nature and has a greater than 85% probability of closing.

- CCC – a merger arbitrage rated ‘CCC’ is very speculative in nature. The merger is subject to certain conditions that may not be satisfied.

- NR – a merger-rated NR is trading either at a premium to the implied consideration or a discount to the unaffected price.

The AlphaRank merger analytics database is utilized in running the Accelerate Arbitrage Fund (TSX: ARB), which may have positions in some of the securities mentioned.