September 28, 2025 – “If you can walk, you can do a SPAC,” exclaimed Billionaire investor Barry Sternlicht on CNBC. “The market is a little bit crazy.”

His glib comments were made in March 2021, right near the peak of the frenzy in Special Purpose Acquisition Companies. Ironically, Sternlicht had five of his own SPACs outstanding at the time. Ultimately, the market turned, and three of his SPACs liquidated, while the other two completed mergers that later went to zero.

One of the only other promoters who was more active in the blank check market at the time was the “SPAC King”, Chamath Palihapitiya. Between 2019 and 2021, Palihapitiya launched ten SPACs. Of these, four liquidated without a deal, and six completed business combinations. Just one deal (SoFi) has generated value for shareholders, having risen 180% since its IPO. The other deals included Virgin Galactic, Akili Interactive, ProKidney, Clover Health, and Opendoor, which have all seen significant share price declines (some more than others).

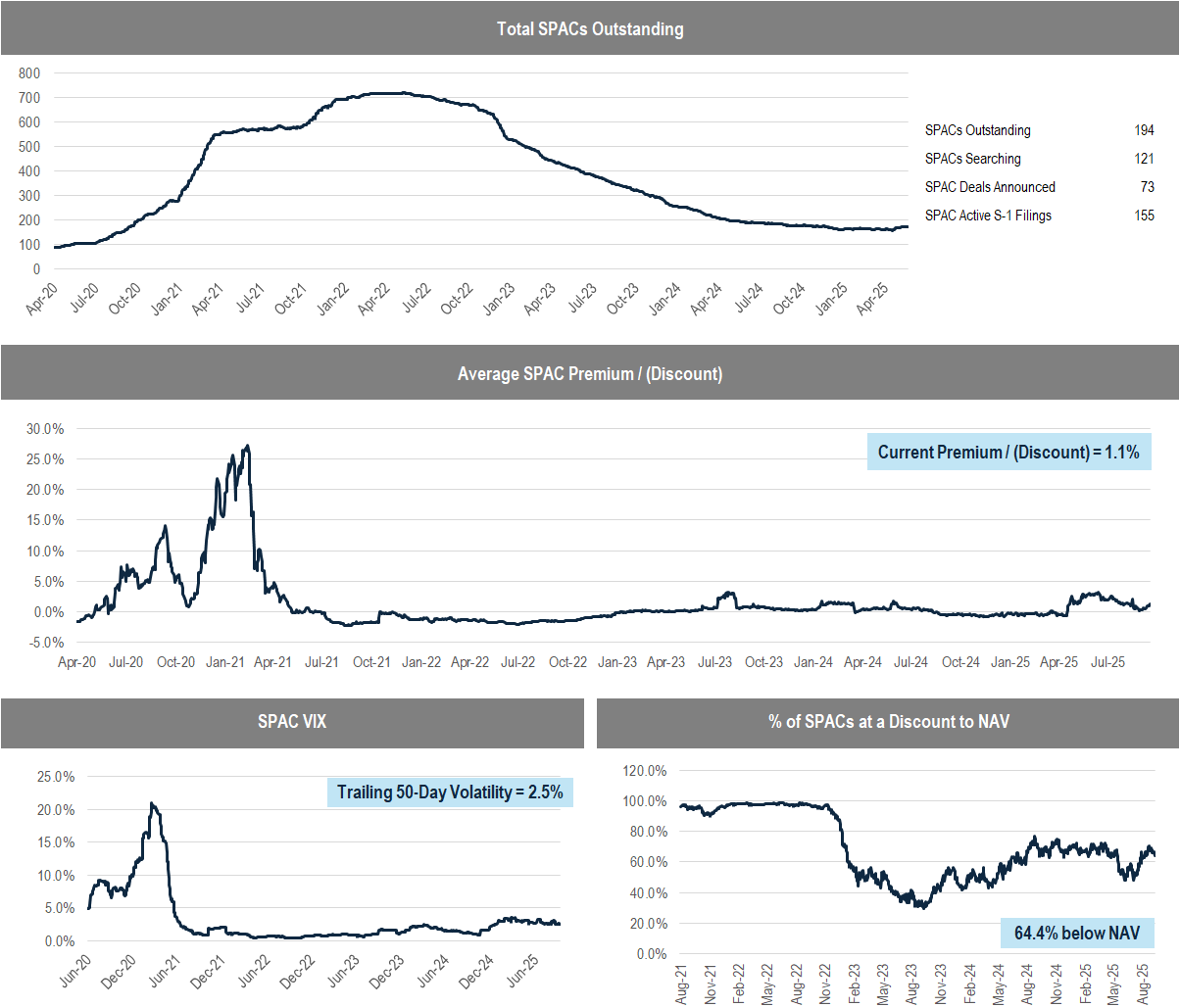

When the market went from hot to cold several years ago, business combinations became increasingly difficult to complete, and SPAC liquidations, in which investors are paid back the $10.00 IPO price plus accrued interest, increased markedly. For instance, between 2020 and 2021, there was just one SPAC that liquidated without a deal each year. In contrast, between 2022 and 2023, nearly 350 SPACs liquidated after failing to complete a merger.

Source: Accelerate

An investor getting their money back, plus interest, when a deal does not work out is not such a bad thing. That is, assuming that they bought at a reasonable price (as those participating in the IPO do).

One of the primary reasons that many unsophisticated SPAC investors got burned and lost money in 2020 and 2021 is simple: They paid prices that were too high.

At the time, pre-deal SPACs (blank check companies yet to announce a deal) were trading at enormous premiums to their net asset value (NAV), which is the cash that held in their trust account. For example, for SPACs sponsored by popular investors, such as Palihapitiya, prices reached unreasonable levels, with NAV premiums exceeding 40%. Clearly, paying $14.00 for $10.00 in cash, along with the option for an exciting merger target, would not work out well.

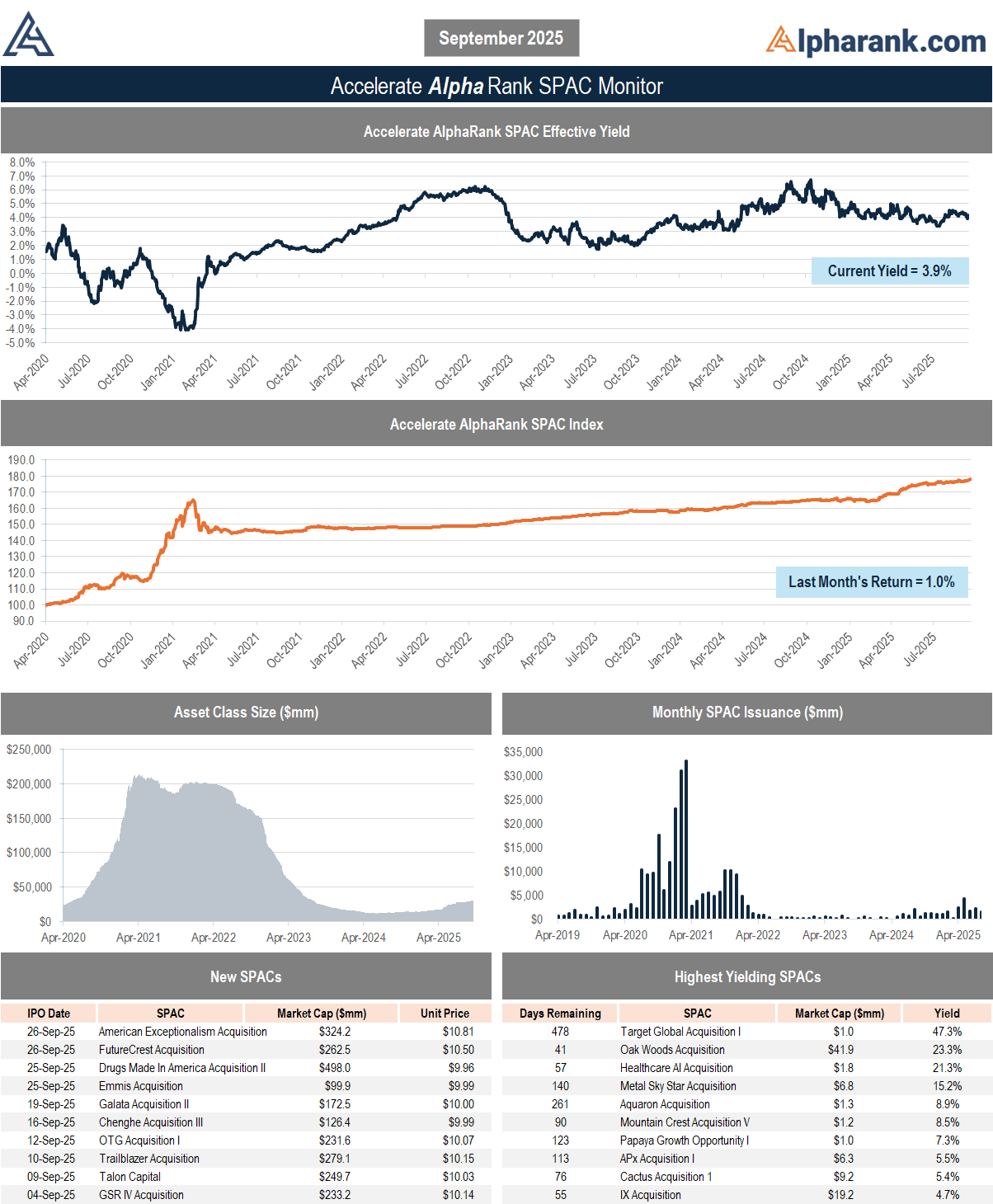

The record-high SPAC valuations, which peaked at an average 25% premium to NAV in early 2021, quickly turned to record discounts later that year as the market floundered and investors’ interest waned. Subsequently, the blank check market remained relatively boring for several years. Many wondered – would SPACs slowly die off?

Investors have short memories, and markets are cyclical. Given that human nature never changes, market historians should not be surprised that a SPAC resurgence has occurred this year.

The size of the blank check market bottomed in 2024, at a nadir of $12 billion of aggregate market capitalization. With the rebound in issuance, driven by more than $17 billion of SPAC IPOs year-to-date, the aggregate SPAC market has nearly tripled to nearly $32 billion.

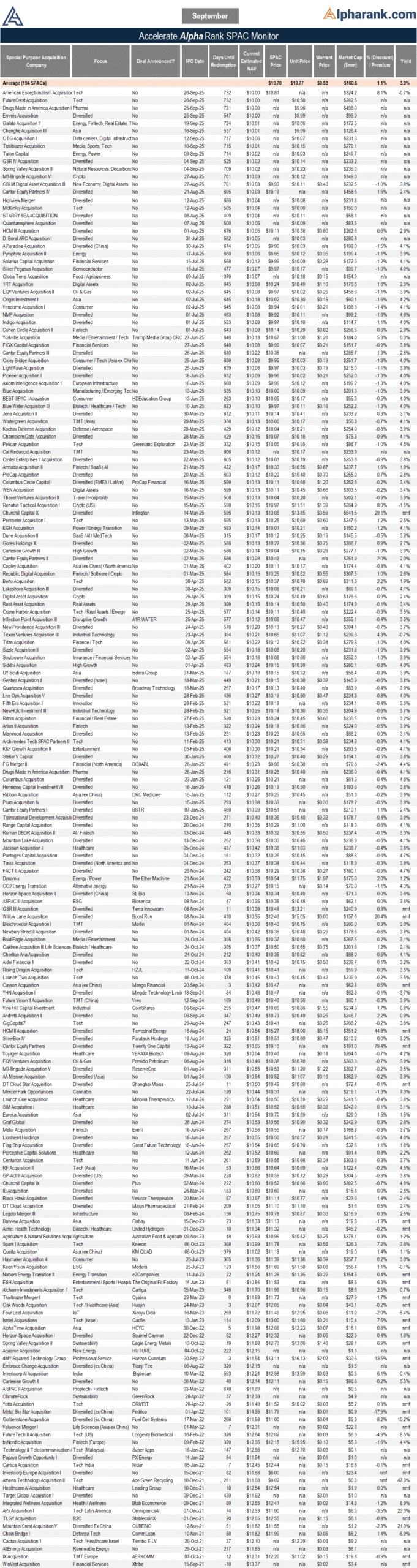

“History doesn’t repeat, but if often rhymes,” is a popular Wall Street adage. There is no better indicator that SPACs are back than Chamath Palihapitiya returning to the blank check market, which he did last week with the $300 million IPO of his American Exceptionalism Acquisition Corp (which is ironically domiciled in the Cayman Islands). In addition, another sign of a resurgence in the market is Wall Street’s perennial bull, and now crypto asset treasury company kingpin, Tom Lee, launching a SPAC IPO on the same day as Palihapitiya, with the debut of the $250 million FutureCrest Acquisition (disclosure: the Accelerate Arbitrage Fund (TSX: ARB) participated in the IPO). Unsurprisingly, both are focused on deals in hot sectors such as AI and digital assets.

As signs of SPAC market resurgence proliferate, have we gotten to the point in which Sternlicht would once again claim that the market has become “little bit crazy”, as he did in 2021?

The best indicator of blank check market froth is valuations, which ultimately drive returns for investors in the asset class. Currently, the average SPAC trades at an average 1.5% premium to NAV, a figure driven by a small handful of SPACs whose business combinations have been well-received by the market. Meanwhile, nearly two-thirds of SPACs currently trade at a discount to NAV.

In comparison, in early 2021, SPACs traded at double-digit premiums on average, with 100% of issues trading above their NAV. If a Chamath Palihapitiya or Tom Lee SPAC were launched in that environment, it would likely trade at a premium north of 50%, instead of the more modest single-digit NAV premiums they trade at today.

Source: Accelerate

Bullish signals are also proliferating in the mergers and acquisitions market. Twenty-one public North American M&A deals worth a total of nearly $85 billion were announced this month – a brisk pace in deal activity. Meanwhile, rumours of a potential largest leveraged buyout of all time circulate, with Silver Lake Capital reportedly looking to take videogame giant Electronic Arts private in a $50 billion deal.

We typically do not see these types of transactions in a bear market. The M&A machine isn’t just sputtering back to life – it’s roaring.

After several years of trepidation, driven by rising interest rates and shifting sentiment, the SPAC and M&A landscape has regained its momentum last seen in the speculative boom of 2020-2021. Capital is once again abundant, strategic buyers of active, and the market’s risk appetite (and particularly that of bullish retail investors) is steadily rising. The return of competitive bidding, copious deal flow, and robust investor participation signals more than just a cyclical uptick – it reflects a renewed confidence in market fundamentals, along with a thirst for high-growth opportunities. In short, the era of waiting is over. The return of the SPAC King was the clearest indicator. We are so back.

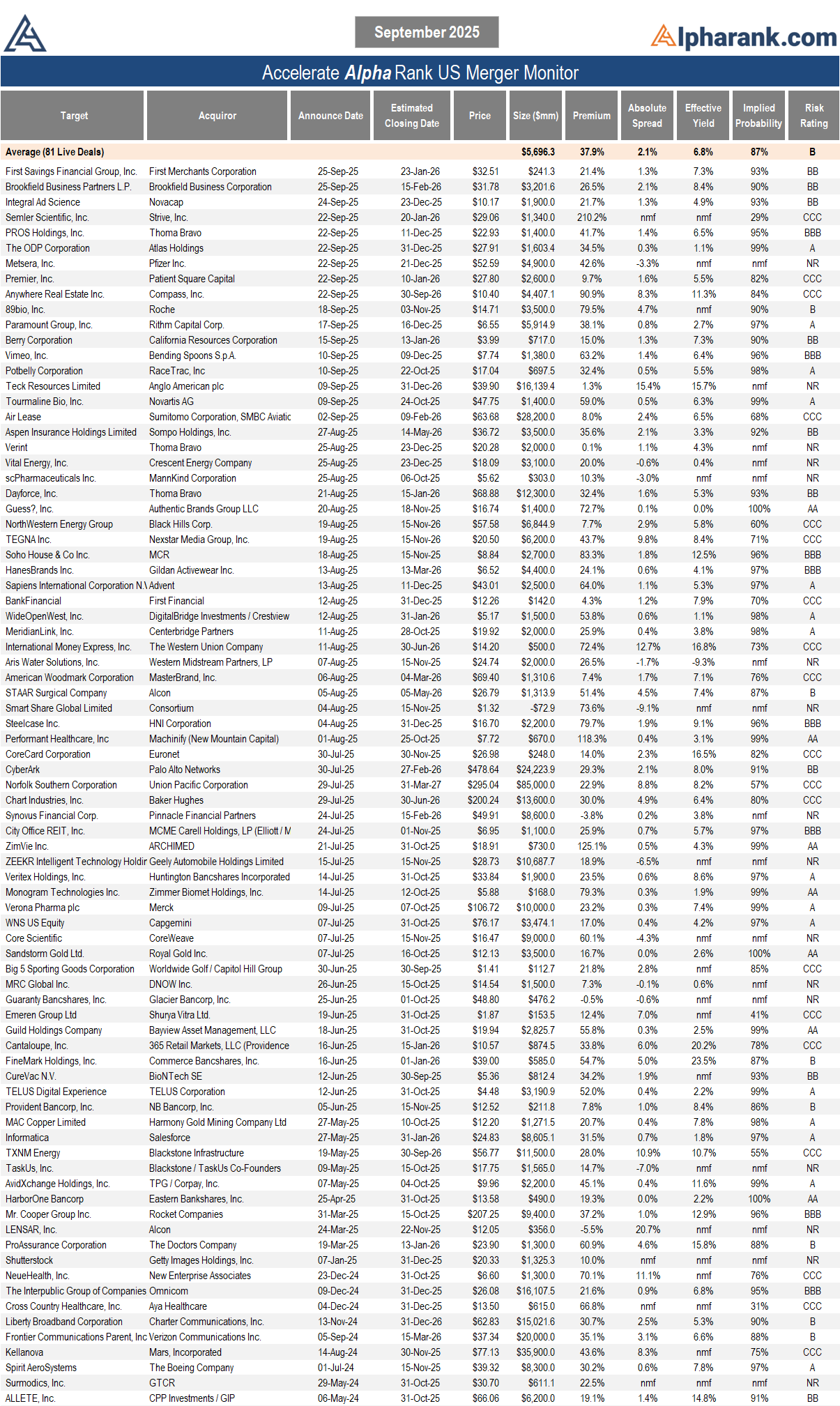

The AlphaRank.com Merger Monitor below represents Accelerate’s proprietary analytics database on all announced liquid U.S. mergers. The AlphaRank Merger Arbitrage Effective Yield represents the average annualized returns of all outstanding merger arbitrage spreads and is typically viewed as an alternative to fixed income yield.

Each individual merger is assigned a risk rating:

- AA – a merger arbitrage rated ‘AA’ has the highest rating assigned by AlphaRank. The merger has the highest probability of closing.

- A – a merger arbitrage rated ‘A’ differs from the highest-rated mergers only by a small degree. The merger has a very high probability of closing.

- BBB – a merger arbitrage rated ‘BBB’ is of investment grade and has a high probability of closing.

- BB – a merger arbitrage rated ‘BB’ is somewhat speculative in nature and has a greater than 90% probability of closing.

- B – a merger arbitrage rated ‘B’ is speculative in nature and has a greater than 85% probability of closing.

- CCC – a merger arbitrage rated ‘CCC’ is very speculative in nature. The merger is subject to certain conditions that may not be satisfied.

- NR – a merger-rated NR is trading either at a premium to the implied consideration or a discount to the unaffected price.

The AlphaRank merger analytics database is utilized in running the Accelerate Arbitrage Fund (TSX: ARB), which may have positions in some of the securities mentioned.