September 6, 2025 – “It was the best of times, it was the worst of times,” goes the famous opening line of Charles Dickens’ classic 1859 novel, A Tale of Two Cities.

The tale unfolds in London and Paris during the late 18th century, contrasting the relative stability of England with the chaos and violence of revolutionary France. Dickens uses this “tale of two cities” to highlight stark differences in social order and the harsh consequences of inequality.

The novel’s contrast between the calm and tranquil lives of those in London and those of the volatile and uncertain environment of Paris provides a deft analogy for the divergence between the fundamental performance of private market direct lending and the public market price action of private credit funds during the second quarter.

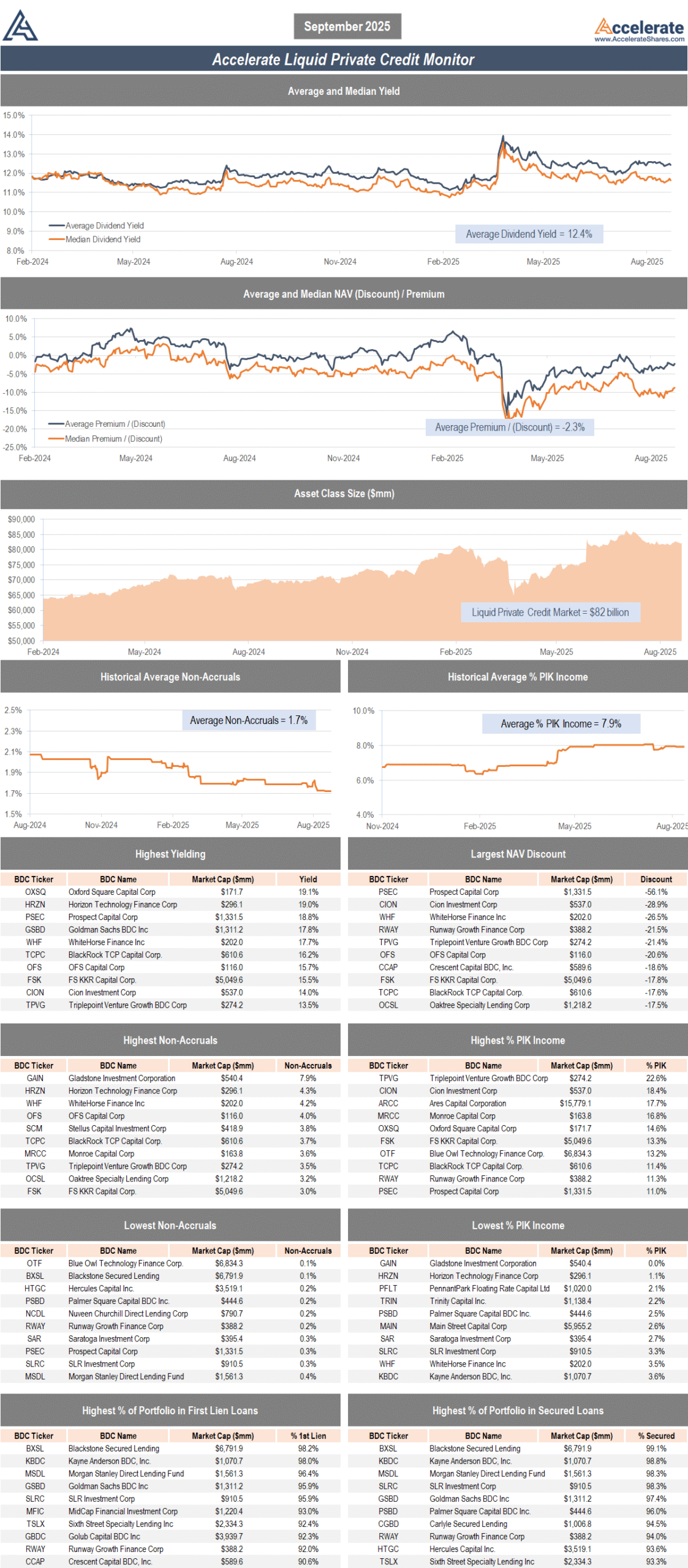

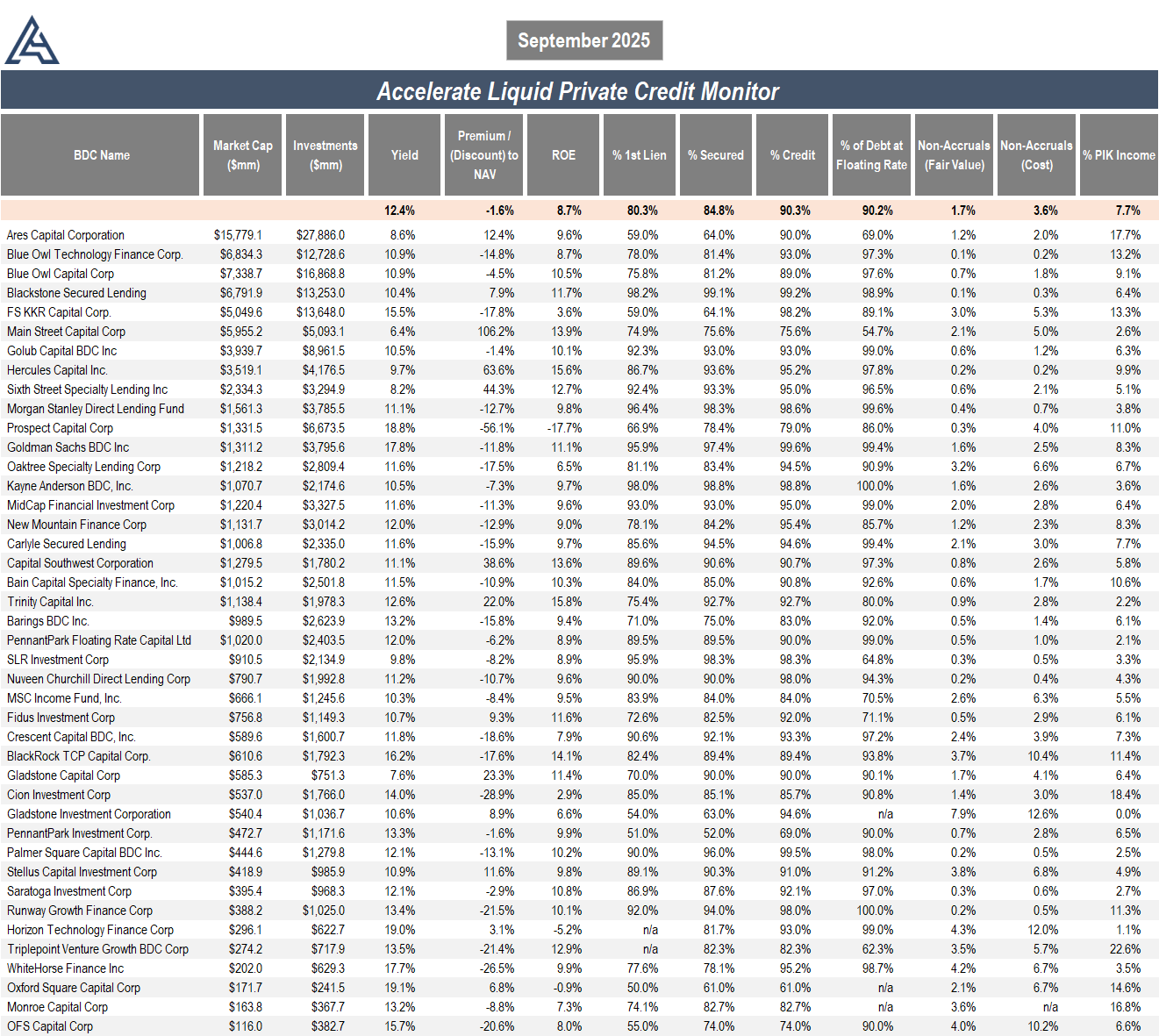

It was not quite the best of times for fundamental private credit performance in Q2, but it was pretty good. The current environment is beneficial for investors in senior secured floating rate direct loans. First, credit conditions are relatively stable, with no underlying trends indicating pockets of weakness. Second, base rates remain high and direct lending spreads have been consistent over the past 18 months, resulting in average private credit yields above 11%.

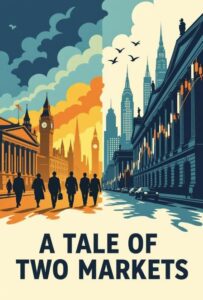

Of the 20 liquid private credit funds held in the Accelerate Diversified Credit Income Fund (TSX: INCM), on average, they reported a 1.7% total return for the second quarter (6.8% annualized), consisting of a -1.0% decline in net asset value (NAV) and 2.7% of distributions. The -1.0% NAV decline was driven primarily by idiosyncratic losses at BlackRock TCP Capital and FS KKR Capital. BlackRock TCP’s NAV losses were driven largely by markdowns on previously restructured portfolio companies, including SellerX, Khoros, InMoment, and Homerenew Buyer. FS KKR’s NAV losses were driven by company specific issues affecting four portfolio companies, including Production Resource Group, 48Forty Solutions, Kellermeyer Bergensons Services, and Worldwise. Conversely, Ares Capital and Blackstone Secured Lending continue to lead the industry with top-tier, consistent results, while Oaktree Specialty Lending is demonstrating early signs of a turnaround in its loan book with the first increase in NAV in several quarters.

While a 1.7% quarterly total return, or 6.8% on an annualized basis, was slightly below the long-term expected returns of 7% to 11% in private credit, fundamental performance in a highly volatile quarter (particularly the month of April when markets crashed) is relatively decent. Moreover, Q2’s total return increased 70bps over Q1’s 1.0% total return.

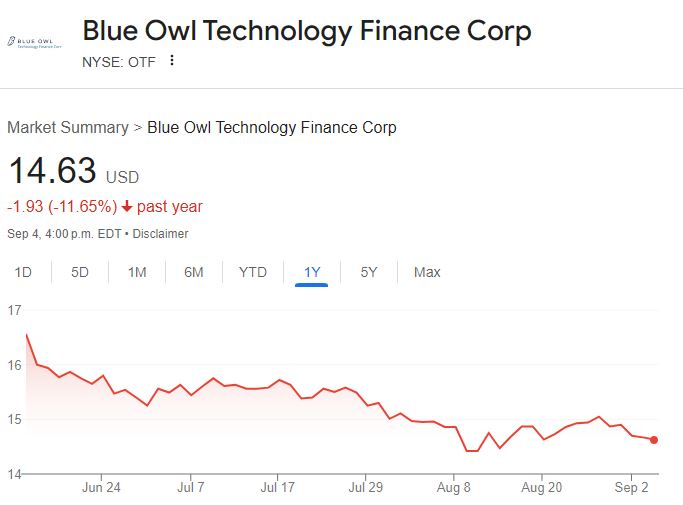

In contrast, while Dickens would not quite describe liquid private credit market performance in the second quarter as the worst of times (there have been worse!), it was not pretty. After the liberation day tariffs were announced and market volatility surged, the liquid private credit market turned from the tranquil and peaceful environment of late 18th century London to the chaotic volatility of revolutionary France. The average of the liquid private credit funds listed below generated a -2.6% quarterly total return (-10.2% annualized) based on market values plus dividends, a stunning contrast to the positive fundamental performance of 6.8% annualized of the underlying loan portfolios over the same period.

Source: Accelerate, Bloomberg

While loan portfolios held up well in Q2, providing a positive total return for investors (despite a handful of idiosyncratic credit issues), private credit fund prices traded down significantly due to market volatility, resulting in widespread NAV discounts. Currently, there are many high-quality private credit funds that focus on senior secured sponsor backed loans, trading at double-digit NAV discounts. While many risk assets fully recovered from April’s market panic, many top-notch liquid private credit funds remain stuck near their 52-week lows.

Source: Bloomberg

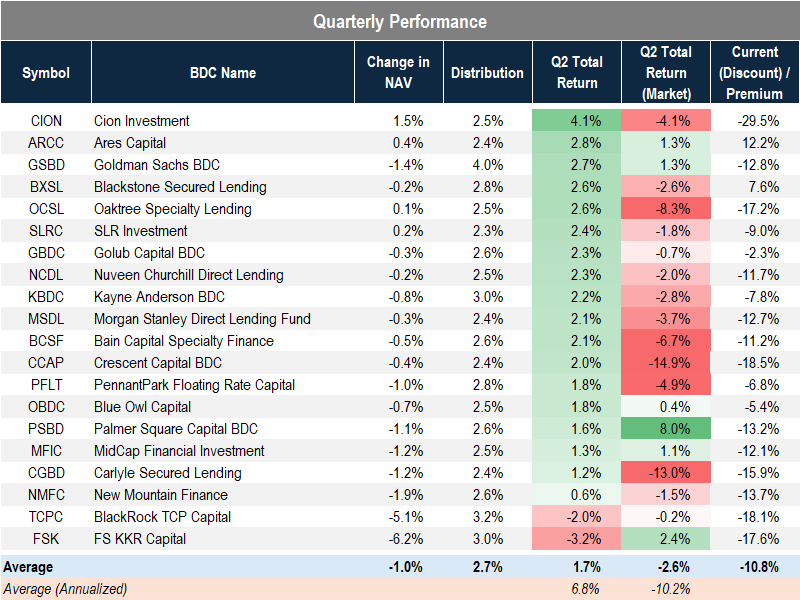

Nevertheless, the lines between the illiquid and liquid private credit markets continue to blur. While BDCs are the vehicle of choice for alternative asset managers to structure private credit funds, the majority of those that offer a top-20 unlisted (also known as “semi-liquid”) BDC also have a liquid fund that trades as a publicly-listed BDC.

Source: Accelerate, Raymond James

The interesting dynamic – call it the “Tale of Two Markets” – is that the unlisted BDCs allow investors to buy and sell at NAV (100 cents on the dollar), meanwhile, listed BDCs trade at the current market price, which can vary widely from NAV depending on market sentiment.

In the current market environment, particularly post Q2, NAV discounts are prevalent the liquid private credit market.

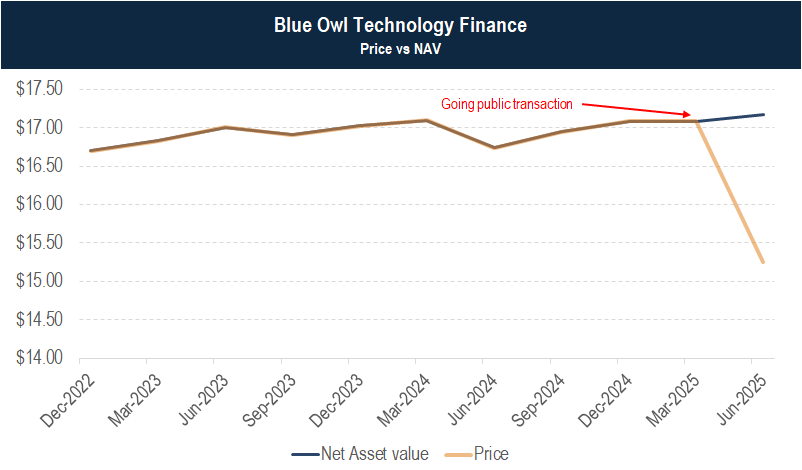

One listed fund, Blue Owl Technology Finance (NYSE: OTF), exemplifies this dynamic. Initially formed in 2018, OTF was a successful unlisted private credit fund that had grown to $13 billion in assets under management on the back of a successful direct lending strategy along with its merger with Blue Owl Technology Finance II, which was consummated earlier this year.

In June, Blue Owl Technology Finance moved from the illiquid (private) to the liquid (public) markets, listing on the NYSE under the symbol OTF via a direct listing.

Unfortunately, the timing of OTF’s direct listing could not have been worse. Making its public market debut in a liquid private credit market mired in poor sentiment, OTF shares quickly traded to a significant discount compared to its $17.17 NAV. In fact, within two months of public market trading, OTF traded to a -15% NAV discount.

Source: Google Finance

The fact that OTF traded to 85 cents on the dollar, after several years of good results showcased by NAV stability and a consistent dividend, in its brief history as a liquid fund, the public markets have not been kind. Note that OTF grew for years in the private market as allocators subscribed to the fund at 100 cents on the dollar.

Source: Accelerate, Company filings

Nonetheless, while it can be a head scratcher why some private credit funds find consistent buyers in the private markets at 100 cents on the dollar, but then struggle to find a bid in the liquid market (while lower-quality liquid private credit funds trade at justifiable discounts), both investors and the funds themselves can capitalize on this tale of two markets.

First, investors can capitalize on this discrepancy by allocating from the illiquid to the liquid markets when NAV discounts widen. Allocators can monitor listed BDC prices to see how they compare to those of unlisted brethren, dynamically allocating between the two markets, depending on sentiment and fund flows.

Second, private credit managers can capitalize on listed fund volatility by repurchasing shares at a discount, and conversely, issuing shares at a premium. Both of these activities are accretive to NAV per share of their listed funds, a value-creating tactic that is unavailable to unlisted private funds (as these subscribe and redeem at 100 cents on the dollar). During the second quarter, many liquid private credit funds took this approach and repurchased shares at a discount to NAV, including Golub Capital, New Mountain Finance, Nuveen Churchill Direct Lending, Cion Investment, Morgan Stanley Direct Lending Fund, and Goldman Sachs BDC.

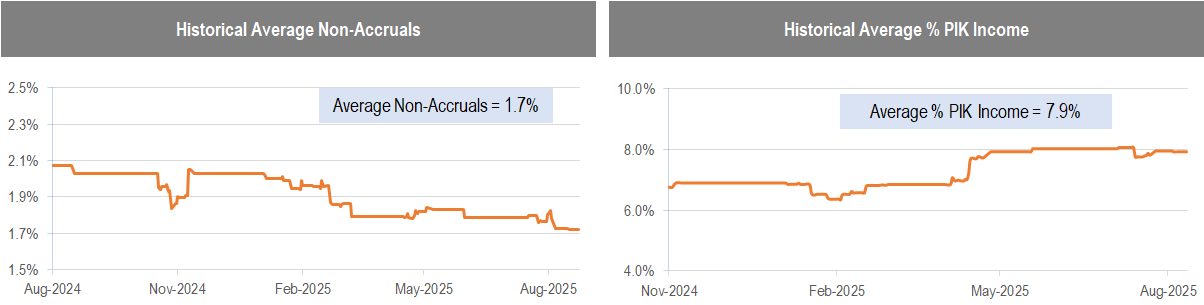

Non-accruals and PIK (payment-in-kind) income are like two sides of the same coin when it comes to reading the health of a private credit portfolio. When a loan goes on non-accrual, it means the borrower has stopped paying interest or principal as scheduled. A rising level of non-accruals can signal borrower stress and deteriorating credit quality. It is one of the cleanest indicators of realized underperformance because it reflects actual payment failure. Meanwhile, PIK allows borrowers to pay interest in kind (by issuing more debt) instead of in cash. While lenders can keep loans current on paper, a spike in PIK income usually means borrowers are conserving cash because they are strained. Persistent or elevated PIK levels can be an early warning that today’s “performing” loans may become tomorrow’s non-accruals.

Together, non-accruals and PIK give a fuller picture of average loan performance: non-accruals show the credit losses, while PIK income reveals latent borrower stress. Tracking them over time lets investors gauge portfolio quality trends and anticipate potential declines in cash yield or NAV.

In the second quarter, average non-accruals in the liquid private credit universe declined slightly, from 1.8% to 1.7%, while average PIK income remained stable at around 8%.

Source: Accelerate, Company reports

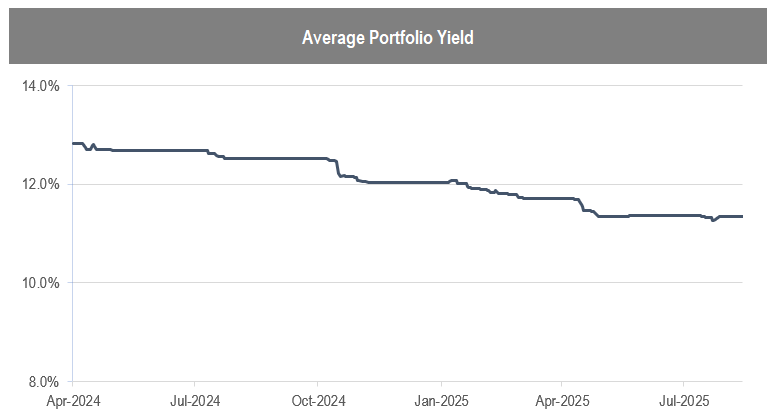

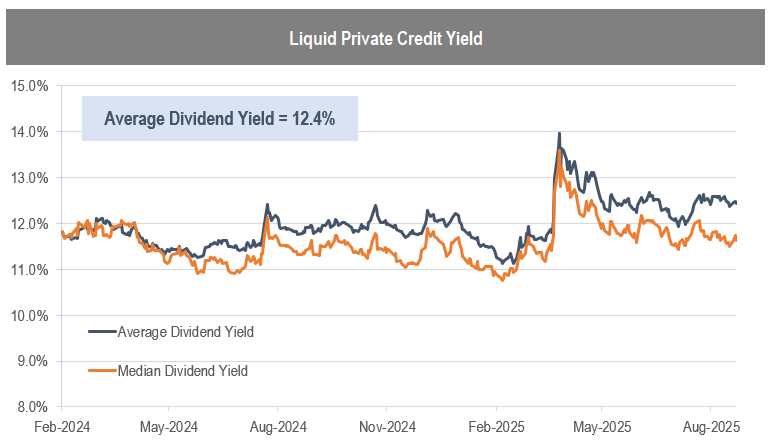

Over the past eighteen months, the average loan portfolio yield has fallen from 12.8% to 11.3%. This 150bps decline in yield was caused by a 100bps drop in base rates (as the Fed cut interest rates), along with 50bps of spread tightening.

Source: Accelerate, Company reports

Meanwhile, in contrast to declining portfolio yields, the yield of the average listed BDC has actually increased, as the decline in underlying loan portfolio yield was more than offset by price declines caused by widening NAV discounts.

Source: Accelerate

As for where we go from here, we expect listed BDC dividend yields to decline for two reasons.

First, we expect prices to recover and NAV discounts to shrink, on average, given that the underlying fundamental performance appears better than what the market is ascribing. As prices increase, yields fall, all else being equal. Historically, widespread NAV discounts have proven ephemeral, as every past correction has been followed by a subsequent recovery in which the BDC market traded back in line with NAV.

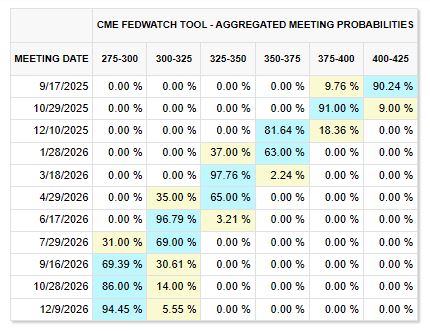

Second, Federal Reserve rate cuts appear to be in the cards. Given that the private credit market consists primarily of floating rate loans, as base rates decline, direct lending yields are expected to fall in tandem. That said, historically, spreads have widened during rate cut cycles, which would cause private credit loan yields to fall more slowly than the fed funds rate.

As it stands, the market is pricing in five rate cuts over the next year, including three rate cuts through the remainder of 2025.

Source: CME Fedwatch

While the Tale of Two Markets unfolds, and the tranquil perceived lack of volatility in the illiquid private credit market contrasts with the poor sentiment and volatility-driven NAV discounts of the liquid private credit market, the asset class continues to perform well fundamentally, while offering some of the highest yields available to investors.

As base rates are expected to decline, contemporaneously reducing private credit yields, an opportunity exists in the liquid private credit markets for allocators to experience enhanced total returns from underlying yields combined with potential capital appreciation as NAV discounts shrink. It could prove to be timely for enterprising investors – as Dickens wrote, “There is prodigious strength in sorrow and despair.”

Each individual merger is assigned a risk rating:

- AA – a merger arbitrage rated ‘AA’ has the highest rating assigned by AlphaRank. The merger has the highest probability of closing.

- A – a merger arbitrage rated ‘A’ differs from the highest-rated mergers only by a small degree. The merger has a very high probability of closing.

- BBB – a merger arbitrage rated ‘BBB’ is of investment grade and has a high probability of closing.

- BB – a merger arbitrage rated ‘BB’ is somewhat speculative in nature and has a greater than 90% probability of closing.

- B – a merger arbitrage rated ‘B’ is speculative in nature and has a greater than 85% probability of closing.

- CCC – a merger arbitrage rated ‘CCC’ is very speculative in nature. The merger is subject to certain conditions that may not be satisfied.

- NR – a merger-rated NR is trading either at a premium to the implied consideration or a discount to the unaffected price.

The AlphaRank merger analytics database is utilized in running the Accelerate Arbitrage Fund (TSX: ARB), which may have positions in some of the securities mentioned.