August 31, 2025 – A National Football League dynasty is defined as a team that achieves consistent and sustained success, marked by winning multiple Super Bowl championships, while having a significant impact on the league over time. When denoting a dynastic NFL team, the term legendary comes to mind.

Historically, there have been a select number of NFL dynasties, including the Green Bay Packers of the 1960s, the Pittsburgh Steelers of the 1970s, the San Francisco 49ers in 1980s and 1990s, and finally, the New England Patriots of the 2000s and 2010s.

Under legendary coach Bill Belichick and star quarterback Tom Brady, the Patriots maintained unprecedented consistency from 2001 to 2018, and the team’s 2017 Super Bowl win was one of the most memorable in NFL history. They faced the Atlanta Falcons for the championship that year, and the Patriots managed to overcome a 28-3 third-quarter deficit, pulling off the largest comeback in Super Bowl history.

A few days later, the Patriots held their championship parade, after which, Coach Belichick delivered a now-legendary speech. The brief celebratory speech was notable due to his memorable line, “No days off.”

The motto “no days off” paid homage to the Patriots’ culture of relentless preparation, discipline and consistency – basically, hard work. The phrase was quickly co-opted, spreading beyond football into fitness, business, and hustle culture.

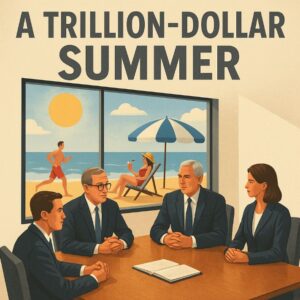

These days, investment bankers and merger arbitrageurs have been adopting the no days off mantra. Due to the near-record amount of merger and acquisition activity in the current environment, with global transaction volumes up by 30% compared to last year and exceeding the $1.0 trillion mark this summer season for the first time since a record-breaking 2021, deal makers have been cancelling vacations to stay in the office and get deals over the finish line.

So much for the dog days of summer.

This increased deal activity trend continues a robust year so far for corporate deal-making activity. Year-to-date, global transaction volumes for 2025 thus far stand at $2.7 trillion, which is more than 25% higher than the levels seen in 2024.

Union Pacific’s blockbuster $85 billion railway merger with Norfolk Southern is the summer blockbuster of the third quarter M&A slate so far. Moreover, it is not just the aggregate deal value that has been notable, it has been the sheer number of deals announced that should get deal junkies excited. Throughout July and August, fifty public M&A transactions were announced in North America, representing approximately 1.2 deals per business day, worth a total of nearly $250 billion. Before the start of each trading session this summer, more often than not, market participants have been greeted with another new deal announcement. No days off.

Deal activity continued at a rapid pace in August, with 26 public M&A deals announced in North America worth a total of more than $65 billion. The largest transaction announced was Thoma Bravo’s $12.3 billion leveraged buyout of human capital management technology company Dayforce, marking the second largest LBO of 2025 (the first being Sycamore Partners’ $23.7 billion buyout of Walgreens Boots Alliance, which was just consummated a few days ago). On top of that, MEG Energy found its white knight in oil sands giant Cenovus Energy, which struck a friendly $7.9 billion merger, cutting out hostile bidder Strathcona Resources with a bid that was not even worth more but featured a higher proportion of cash (and hence, greater certainty of value).

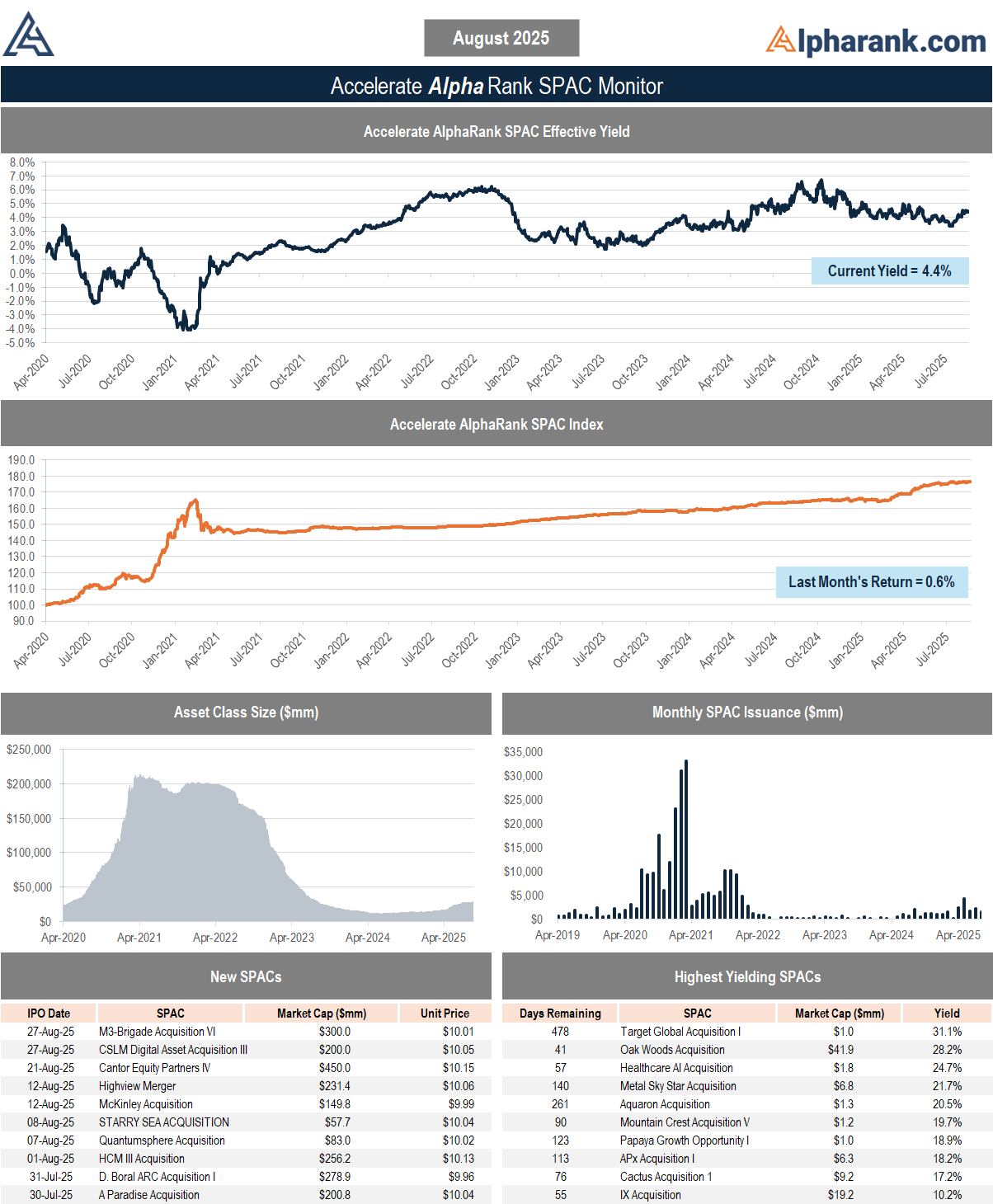

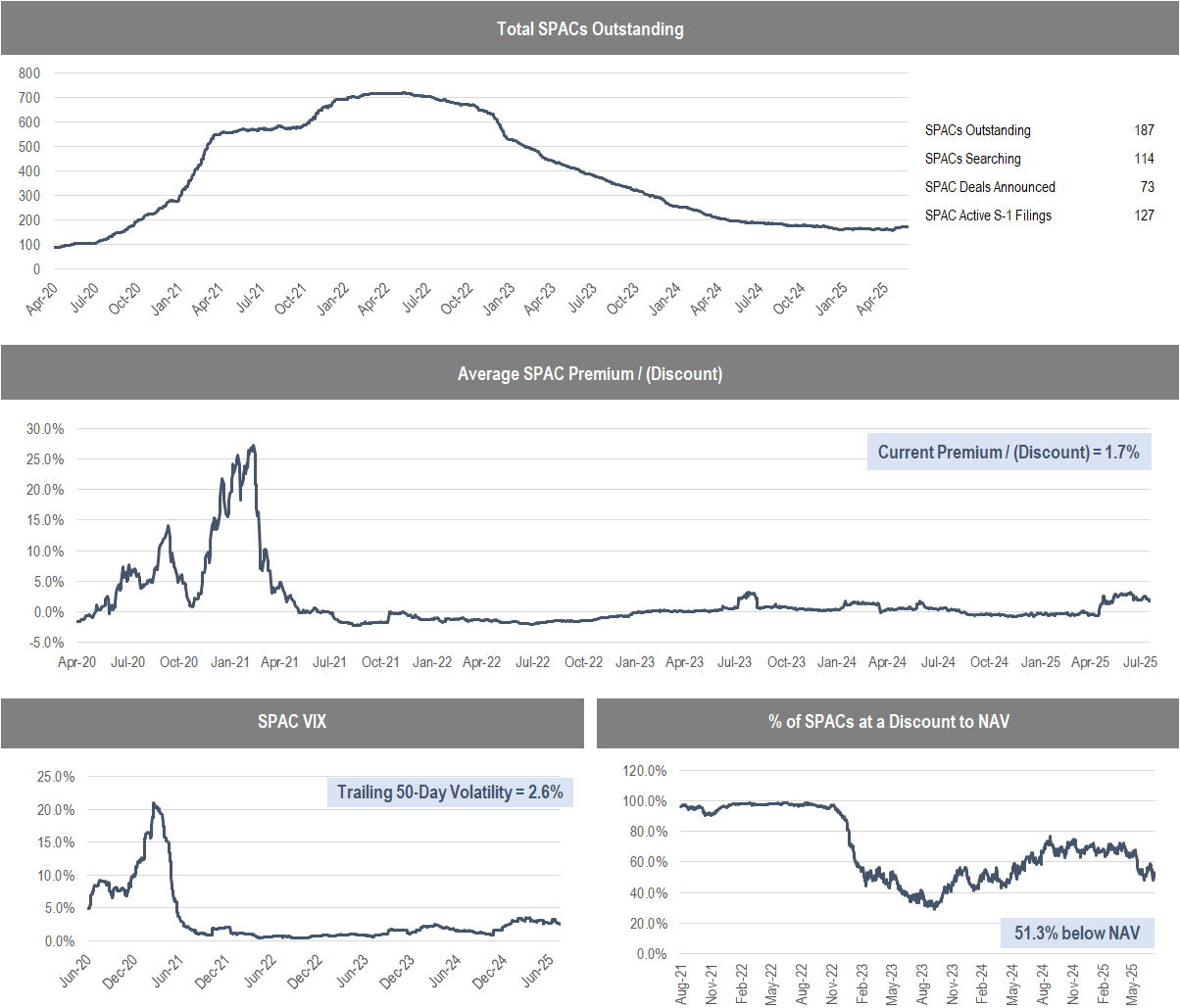

Moreover, the Special Purpose Acquisition Company market is following the lead of the M&A and IPO markets, posting activity numbers nearly reminiscent of its last bull market in 2020-2021. August brought 8 SPAC IPOs, representing $2 billion of new issuance. Moreover, six SPAC mergers were announced, worth an aggregate of nearly $12 billion. SPAC merger announcements were topped off by another, you guessed it, crypto treasury company. Yorkville Acquisition announced a $6.4 billion merger with Trump Media Group CRO Strategy, which will be focused on accumulating the native cryptocurrency token of the Cronos ecosystem. Unsurprisingly, Yorkville units traded to a 17.8% premium to NAV on the news.

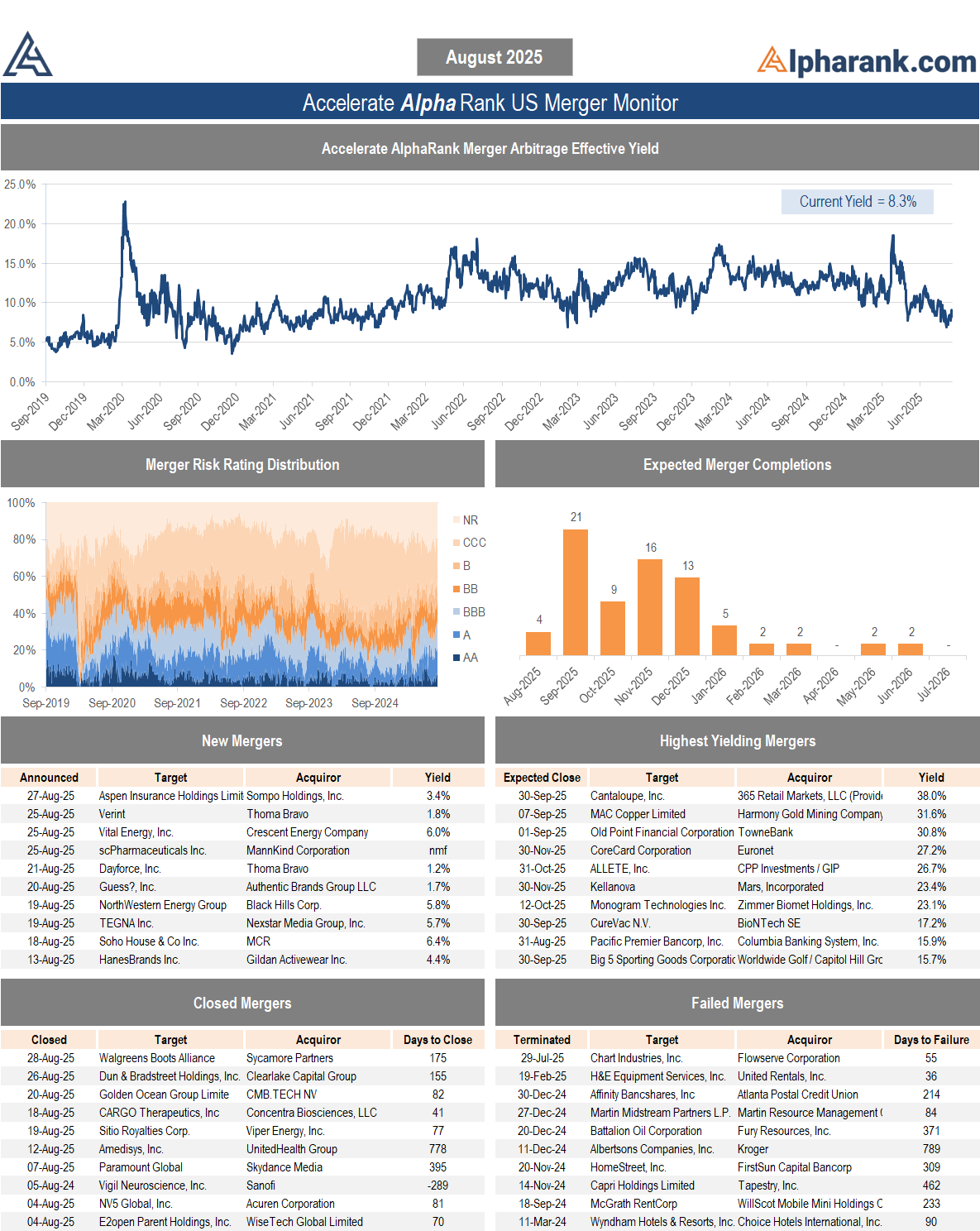

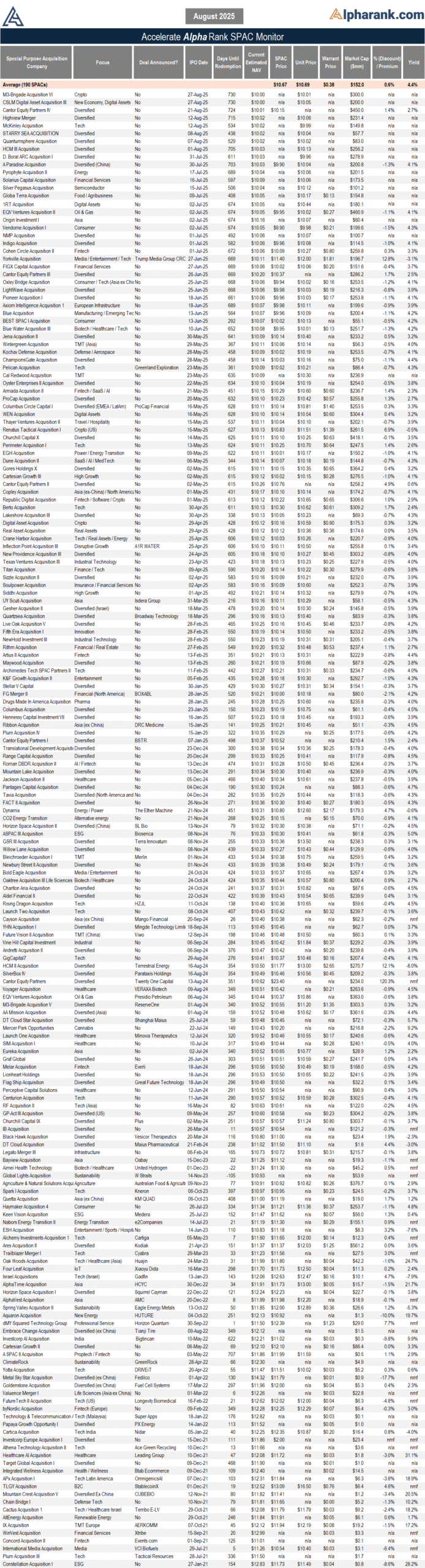

Currently, there are 96 public M&A deals outstanding worth an aggregate of more than $450 billion. Meanwhile, the average merger arbitrage investment yields 8.3%. Additionally, there are 190 SPACs currently trading worth a total of nearly $30 billion. The average SPAC arbitrage investment yields 4.3%.

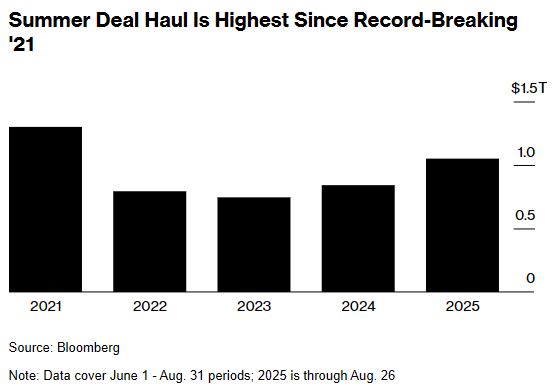

The returns of merger arbitrage investing tend to follow basic supply and demand dynamics. When the aggregate amount of mergers exceeds the supply of capital invested in merger arbitrage funds, returns to investors will likely be higher than average.

Ergo, merger arbitrage is having its best year since 2021, given that base rates are high and deal activity remains robust.

Moreover, given its consistency of returns and near-zero correlation with stocks, merger arbitrage may serve as an excellent replacement for fixed income allocations in investment portfolios.

In today’s environment of relentless deal flow, like the dynastic New England Patriots of a bygone era, merger arbitrageurs currently have a no days off attitude. While their days are spent in an office as opposed to the gym or the football field, the same demands exist: constant vigilance, discipline, and speed. Success belongs to those who can stay sharp while the M&A machine never sleeps.

The AlphaRank.com Merger Monitor below represents Accelerate’s proprietary analytics database on all announced liquid U.S. mergers. The AlphaRank Merger Arbitrage Effective Yield represents the average annualized returns of all outstanding merger arbitrage spreads and is typically viewed as an alternative to fixed income yield.

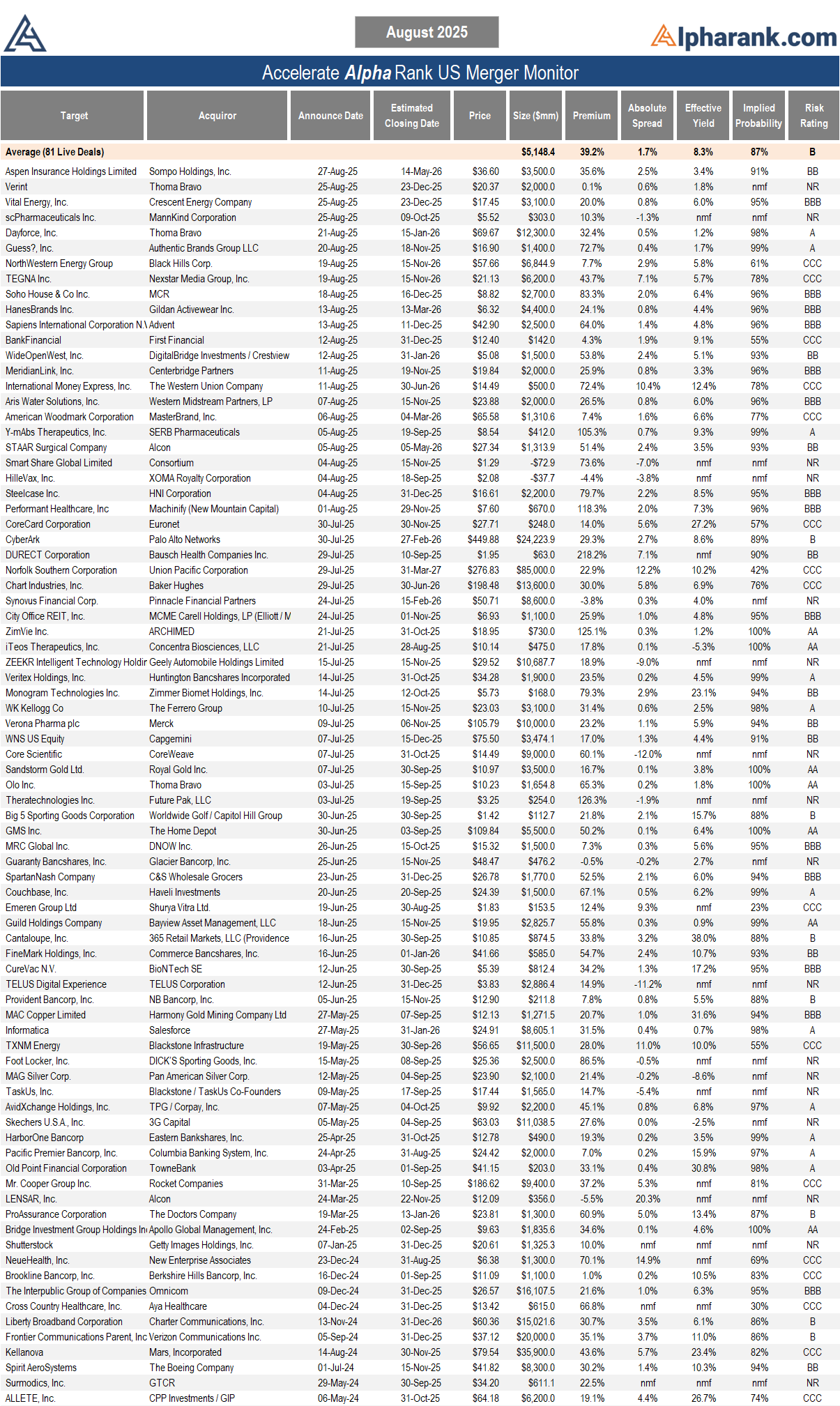

Each individual merger is assigned a risk rating:

- AA – a merger arbitrage rated ‘AA’ has the highest rating assigned by AlphaRank. The merger has the highest probability of closing.

- A – a merger arbitrage rated ‘A’ differs from the highest-rated mergers only by a small degree. The merger has a very high probability of closing.

- BBB – a merger arbitrage rated ‘BBB’ is of investment grade and has a high probability of closing.

- BB – a merger arbitrage rated ‘BB’ is somewhat speculative in nature and has a greater than 90% probability of closing.

- B – a merger arbitrage rated ‘B’ is speculative in nature and has a greater than 85% probability of closing.

- CCC – a merger arbitrage rated ‘CCC’ is very speculative in nature. The merger is subject to certain conditions that may not be satisfied.

- NR – a merger-rated NR is trading either at a premium to the implied consideration or a discount to the unaffected price.

The AlphaRank merger analytics database is utilized in running the Accelerate Arbitrage Fund (TSX: ARB), which may have positions in some of the securities mentioned.