August 24, 2025 – Markets were elated after the Federal Reserve Chair Jerome Powell delivered his annual address at the Kansas City Fed’s economic symposium in Jackson Hole, Wyoming, on Friday. As he spoke, risk assets surged, with stocks, bonds, and gold rallying, while the U.S. dollar declined.

The market’s near-instantaneous positive reaction implied that Chair Powell was uber dovish in his address, with some market prognosticators assuming that the Fed either abandoned its mandate of stable prices (i.e. low inflation) or provided a roadmap pointing to rapid upcoming rate cuts. Accordingly, it is worthwhile parsing the speech to determine if the market’s swift positive reaction and consensus view are reasonable, once the dust settles.

As Powell spoke to an audience of economists and policymakers on Friday, he emphasized the Fed’s dual mandate of maximum employment and stable prices via the Fed’s longer-run inflation objective of 2%. He noted the shifting balance of risks, emphasizing a recent weakening of employment data, given recent significant downward revisions, that could influence near-term interest rate decisions.

Powell described the U.S. economy as showing “resilience in a context of sweeping changes,” including higher tariffs reshaping global trade, tighter immigration policies slowing labour force growth, and potential long-term impacts from evolving tax, spending, and regulatory measures. These factors have introduced additional economic uncertainty, making it challenging to distinguish between short-term cyclical fluctuations, which the Fed’s actions can affect, and longer-term structural shifts that the central bank cannot effectively address through its monetary policy. Nevertheless, Powell indicated the belief that tariff-driven inflation would represent more of a one-off increase in prices, as opposed to fostering a consistent rise in consumer prices and inflation expectations.

Moreover, he described the current labour market as “a curious kind of balance,” with both demand for and supply of workers slowing sharply. For example, payroll growth has decelerated to just 35,000 jobs per month over the past quarter, reflecting weaker immigration-driven labour force growth and softer hiring as corporations pull back spending plans due to trade policy uncertainty. Although the unemployment rate remains at a cycle low of 4.2%, Powell warned that downside risks to employment are rising and could materialize quickly.

At the same time, U.S. GDP growth has slowed to 1.2% in the first half of 2025, compared with 2.5% in 2024, as consumer spending moderates. U.S. economic growth has decelerated compared to last year, while inflation has remained stubbornly persistent and well above target, with core PCE inflation running at 2.9% year-over-year. Constant whispers of stagflation remain, and justifiably so.

Balancing these elements, Powell noted upside risks to inflation from tariffs and downside risks to employment, creating tension in the Fed’s dual mandate. With the policy rate now 100bps closer to neutral than a year ago, although still restrictive, the Fed plans to proceed carefully. “Monetary policy is not on a preset course,” he affirmed, with decisions based solely on data, outlook, and risks.

Nevertheless, the Fed Chair made a key revelation, stating, “with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.” To translate, Powell is giving the market what it wants, which is a rate cut in September.

Markets cheered Powell’s speech, gravitating toward the interpreted commitment to a rate cut in September, prior to which some market participants had lost faith after disappointing downward revisions to payroll gains earlier this month.

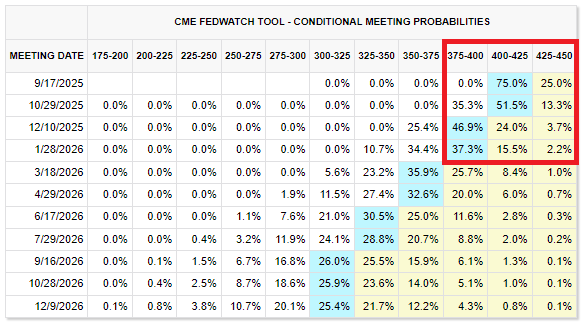

Curiously, the bullish intra-day market reaction stands in contrast to market expectations of a rate cut, which did not change markedly, as implied by 30-Day Fed Funds futures prices. With a 75% probability of a 25bps rate cut next month, as well as a second cut by year end, current market-based probabilities remained consistent with prior consensus expectations from several weeks ago. All that Powell’s speech provided is confirmation of consensus expectations. Granted, markets like certainty, and Powell’s commitment to a September cut may have caught some bears off guard.

Source: CME Group FedWatch

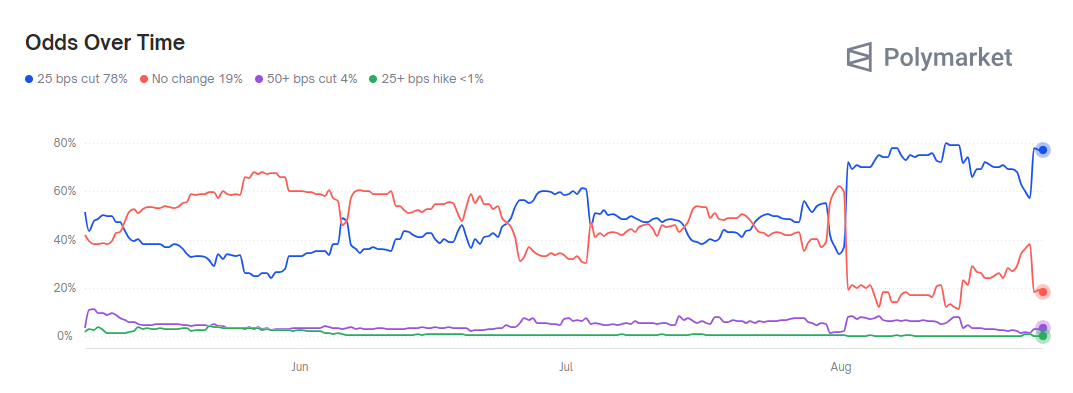

In the betting, err, prediction, markets, speculators took the odds of a 25bps rate cut next month back to 78%, right where they were a mere two weeks ago. Views of a jumbo 50bps rate cut in September appear to be off the table.

While it is debatable whether the market’s bullish reaction to Powell’s speech was the right one, for fun, we ran the monologue through a couple of large language models to discern their “opinion”. Here is what they said (emphasis added):

- ChatGPT: “On balance, the speech leaned neutral to slightly bearish for risk assets in the near term: Neutral, because Powell didn’t introduce any hawkish surprises and signalled careful flexibility. Slightly bearish, because he highlighted rising downside employment risks without offering reassurance of imminent easing, and he admitted inflation pressures from tariffs could linger. Equity markets, which thrive on a “Fed put,” may view this as less supportive than hoped. Bond markets, however, might interpret the return to flexible inflation targeting and removal of ELB language as constructive for policy credibility.”

- Grok: “Powell’s speech is neutral to slightly bearish for risk assets. The Fed’s data-dependent, balanced approach avoids immediate dovish relief (like signalling rate cuts), and the acknowledgment of inflation risks from tariffs and employment vulnerabilities introduces caution. While the stable labour market and anchored expectations prevent a fully bearish outlook, the lack of clear easing signals and economic slowdown indicators tilt the scales slightly against risk assets in the near term. Markets will likely focus on upcoming data (e.g., August jobs report, PCE inflation) to gauge the Fed’s next moves.”

Interestingly, the above AI models have a more bearish interpretation of Powell’s speech compared to market participants and strategists. Signs of a hallucination? Perhaps. By which side, time will tell.

After the Ka-Powell speech, the stock market remains in a somewhat precarious position, with a lot of good news priced in. Stock market valuations remain relatively high, meanwhile, frothy speculative activity abounds.

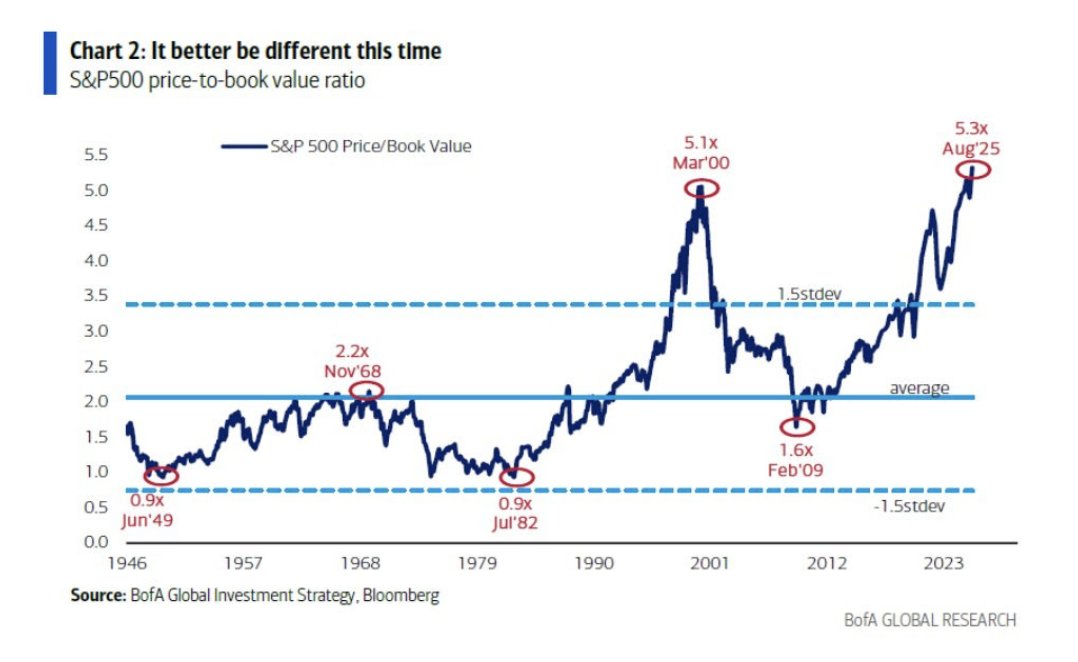

Currently, the S&P 500 trades at 5.3x book value, a record high valuation that even exceeds the 2000 tech bubble peak. Based on historical data and valuation models, buying the S&P 500 at 5.3x book value implies expected 10-year annualized nominal returns of between 3% and 5%, below the long-term average of approximately 10%.

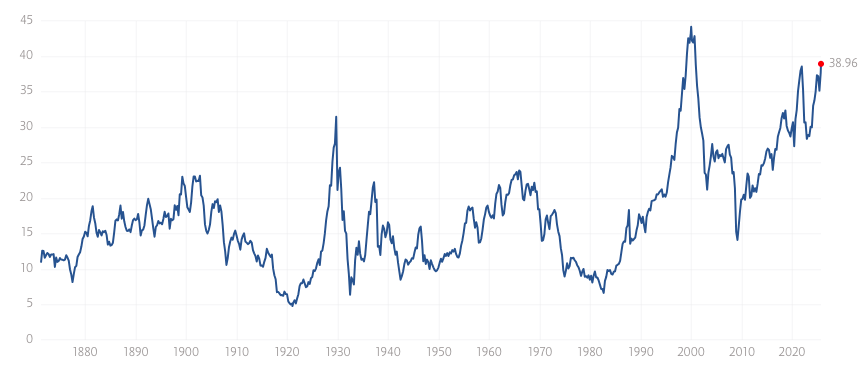

The S&P 500’s Shiller PE recently reached 39x, exceeding the peak reached during the early 2021 meme and junk stock bubbles. Although, it is still 5-turns below the peak of 44x hit in the 1999-2000 internet bubble. Based on historical data from periods when the Shiller CAPE exceeded 35x (primarily in the late 1990s), subsequent 5-year annualized total returns for the S&P 500 averaged approximately 1% to 3%, with high variability including some negative outcomes.

Source: https://www.multpl.com/

In addition, the S&P 500’s forward earnings multiple recently reached 23x, matching its peak this century achieved in early 2021. Historical data indicates that the current high forward earnings multiple often leads to muted returns, with investor returns over the subsequent three to five years averaging 3% to 6%.

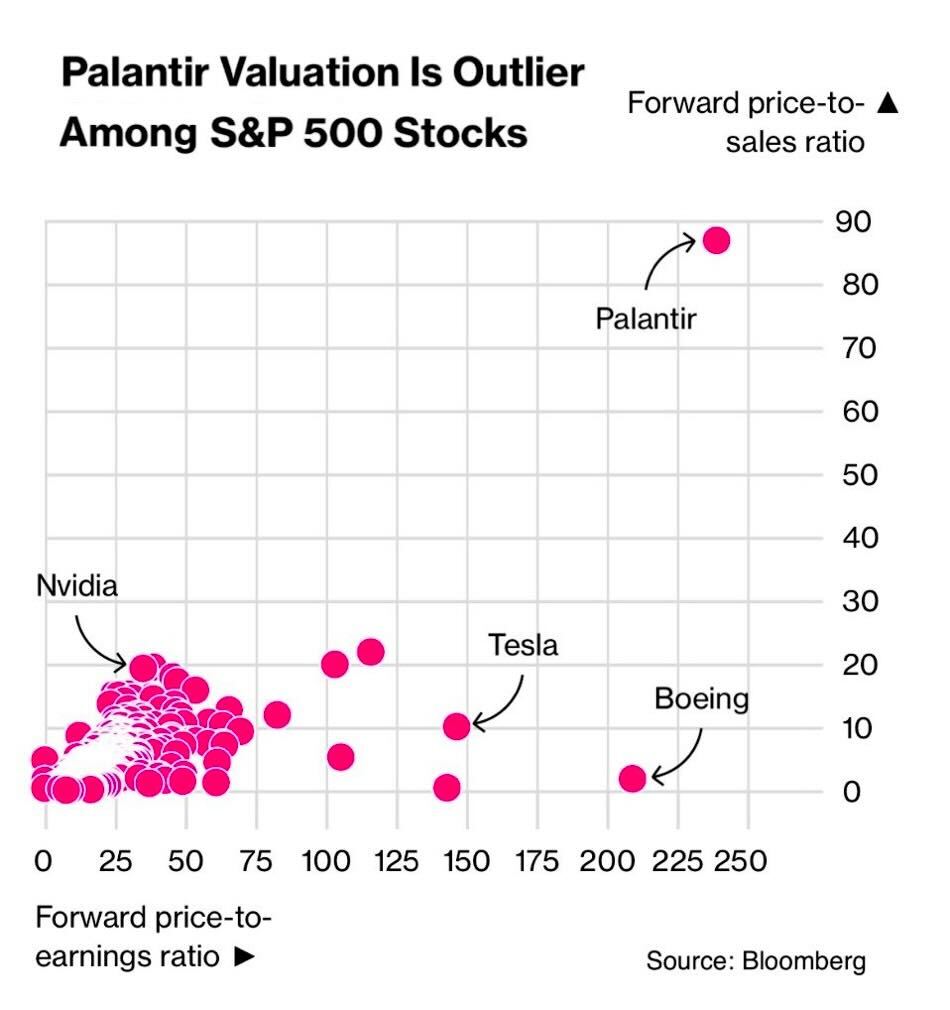

Pockets of extreme speculative activity are proliferating. A retail stock investor favourite, Palantir, trades at a jaw-dropping 88x forecast sales, a valuation that is light years away from any of its large-cap peers. Meanwhile, company insiders are aggressively selling the stock.

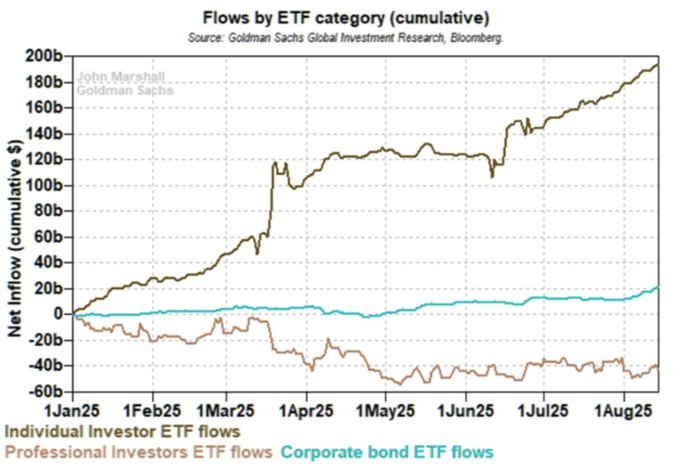

Retail investors represent a large contingent of stock market activity. While there are certain popular retail (cult?) story stocks, many retail investors attain market exposure primarily via ETFs. Year-to-date, as institutional investors have sold a cumulative $40 billion of ETFs, retail investors have bought nearly $200 billion.

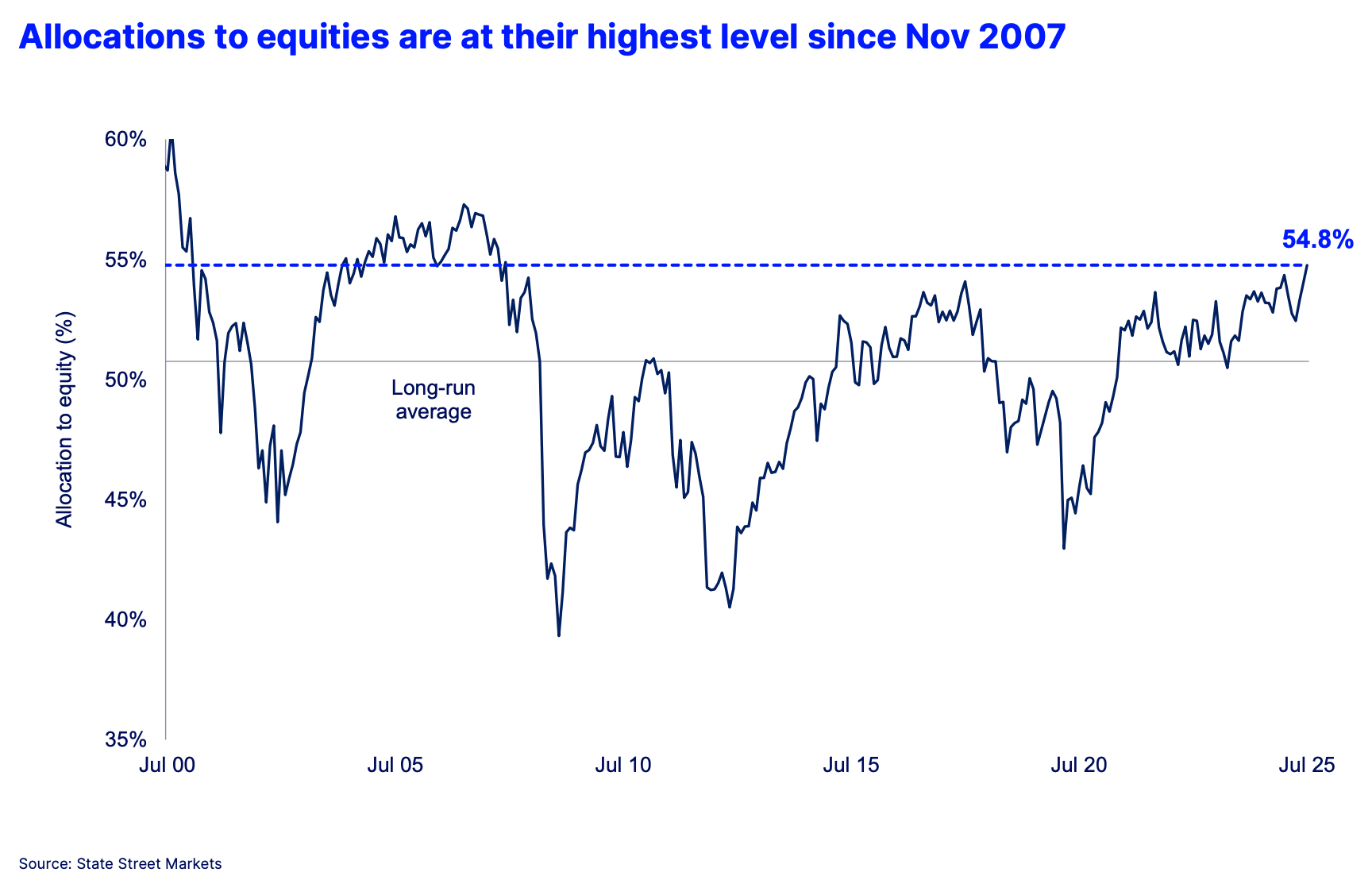

Despite, or perhaps due to, recent stock market fund flows and valuations, aggregate equity allocations remain at their highest level since 2007. It appears that investor caution is in a bear market, with many market participants going “all-in”, valuation risks and pockets of froth in the market be damned.

Whether recent political pressure got to him, the Fed Chair delivered the Ka-Powell rate cut guidance that investors were seeking during his influential Jackson Hole speech. Whether this positive sentiment and market bullishness remain is to be seen, as the Fed will continue to be data-dependent, although with an arguably dovish tilt. Meanwhile, stock market valuations remain dangerously high, and speculation abounds.

Given the tremendous amount of optimism and speculative activity priced into equity markets, conservative allocators may want to consider taking a hedged equity approach. To help facilitate idea generation, we highlight one top-decile stock that is forecast to outperform and one bottom-decile stock that is predicted to underperform in this month’s AlphaRank Top Stocks.

OUTPERFORM: OceanaGold Corp (TSX: OGC) is a gold, copper, and silver mining company based in Canada and Australia. It operates four mines across the U.S. the Philippines, and New Zealand. With a valuation of just 4.4x EBITDA and a return on capital of 39%, OGC presents a combination of an attractive valuation in an expensive market along with strong economics and robust cash flow. In addition, it recently beat quarterly expectations handily, rising 10.3% after releasing its second quarter results, which showcased a record quarterly profit. With a bullish tailwind in a rising price of gold, along with an AlphaRank score of 99.7/100, we expect OGC shares to outperform. Disclosure: Long OGC shares in the Accelerate Canadian Long Short Equity Fund (TSX: ATSX).

UNDERPERFORM: Cogent Communications Holdings Inc (NASDAQ: CCOI) is a U.S.-based internet service provider that specializes in offering high-speed, low-cost bandwidth and colocation services to businesses, carriers, and ISPs across a global fiber-optic network. CCOI presents multiple red flags, including weak earnings and cash flow pressure, a heavy debt load, looming credit risks, and a stretched valuation at 10.6x EBITDA. In addition, a recent quarterly miss sent shares plummeting -30.2%. The fact that insiders are selling and that short interest remains elevated further supports the bearish thesis. With an AlphaRank score of 1.7/100, we expect the shares to underperform. Disclosure: Short CCOI shares in the Accelerate Absolute Return Fund (TSX:HDGE).

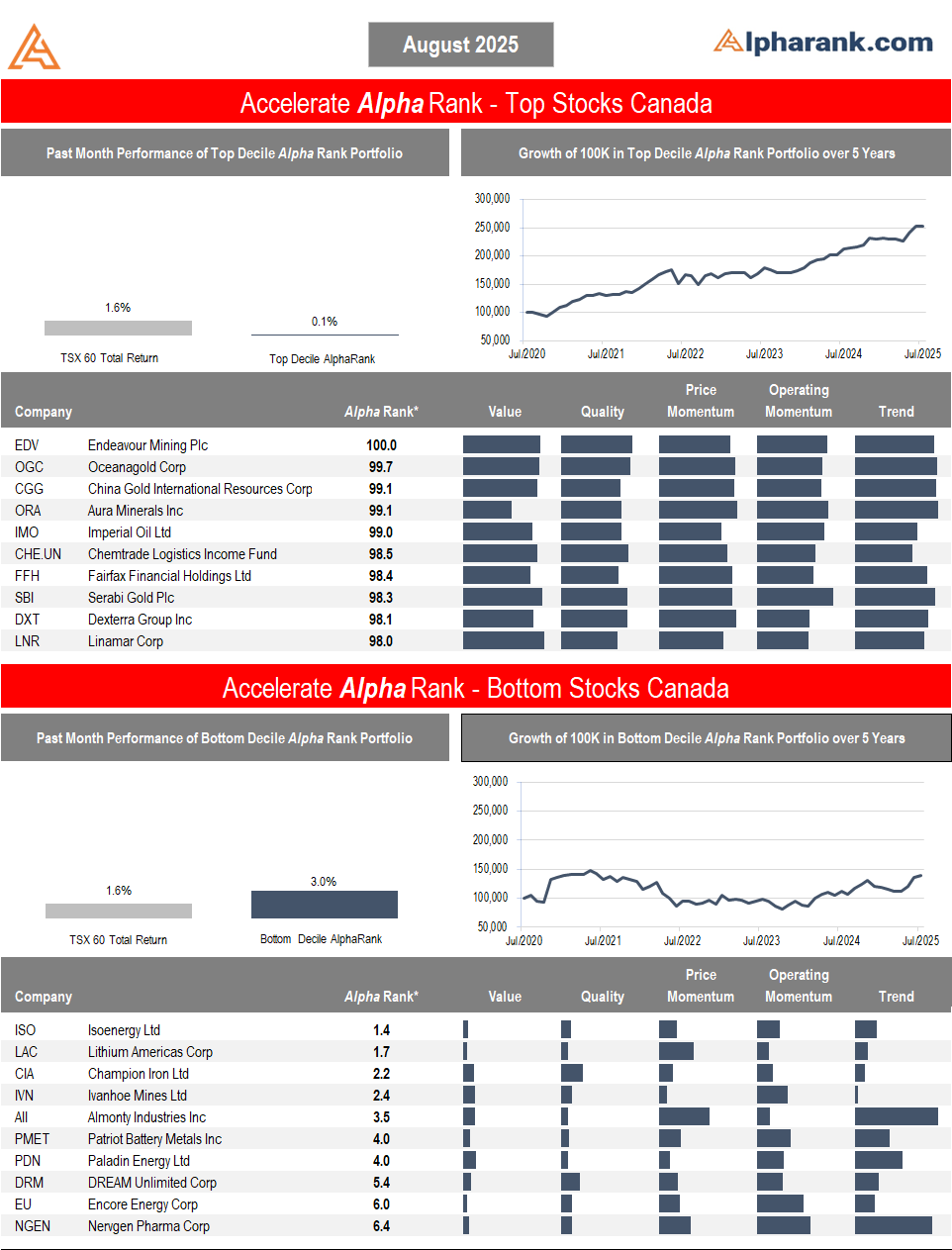

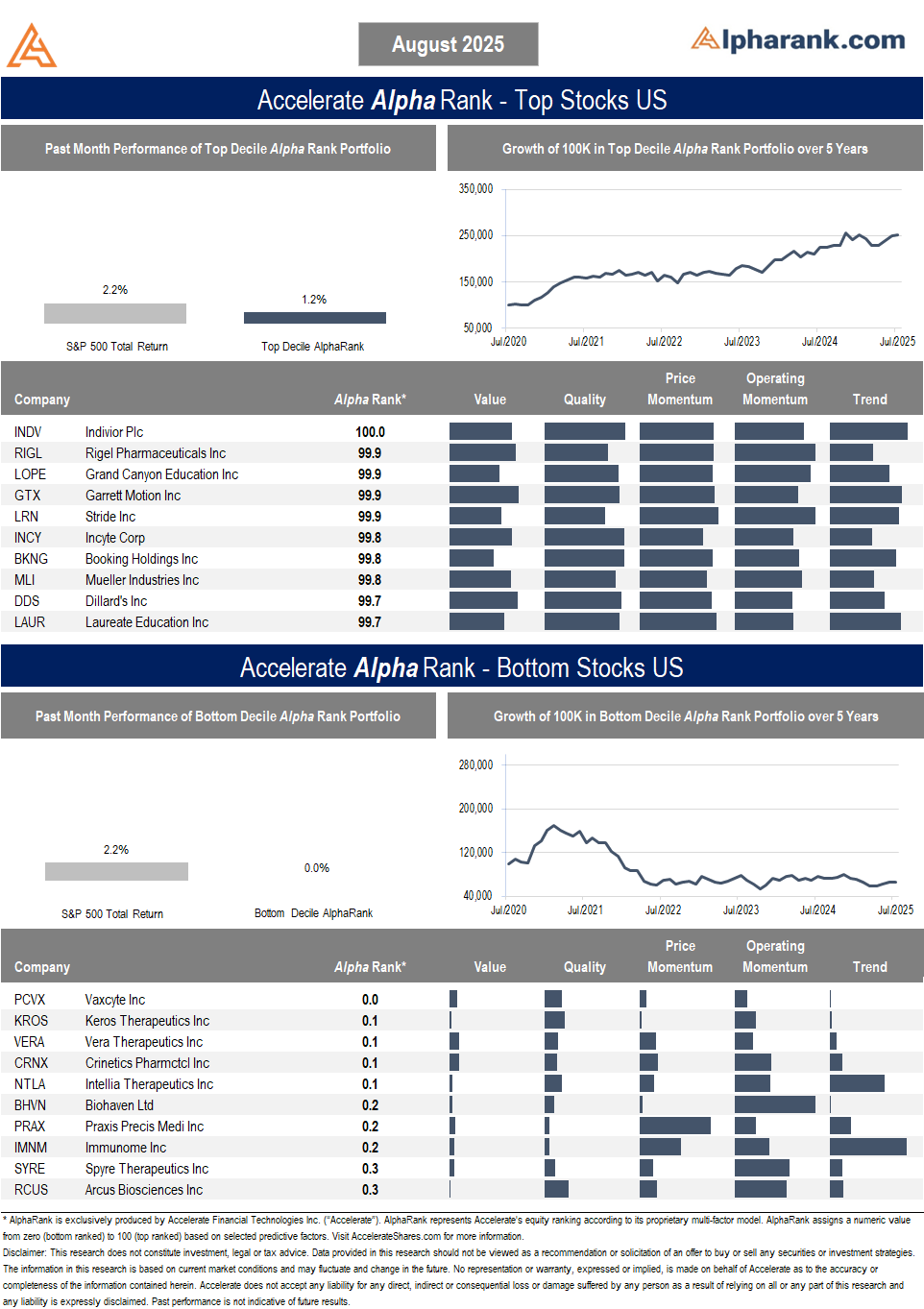

The AlphaRank Top and Bottom stock portfolios exhibited mixed relative performance last month:

- In Canada, the top-ranked AlphaRank portfolio of stocks returned 0.1%, trailing the benchmark’s 1.6% return, while the bottom-ranked portfolio of Canadian equities gained 3.0%. The long-short portfolio (top minus bottom ranked stocks) fell by -2.9%, as the bottom-ranked stocks outperformed the top-ranked securities. Over the past five years, the top decile AlphaRank portfolio has gained more than 150%, while the bottom-ranked portfolio has risen approximately 40%.

- In the U.S., the top-decile-ranked equities returned 1.2%, underperforming the S&P 500’s 2.2% return. Meanwhile, the bottom-ranked stocks were flat with a 0.0% return, leading to a 1.2% return for the top decile minus the bottom decile long-short portfolio. Over the past five years, the top-ranked U.S. equities have gained more than 150%, while the bottom-ranked portfolio has declined by -34%.

AlphaRank Top Stocks represents Accelerate’s predictive equity ranking powered by proven drivers of return. Stocks with the highest AlphaRank are expected to outperform, while stocks with the lowest AlphaRank are anticipated to underperform. AlphaRank assigns a numeric value to each security, ranging from 0 (bottom-ranked) to 100 (top-ranked), based on selected predictive factors. All Canadian and U.S. stocks priced above $1.50 per share and with a market capitalization exceeding $100 million are evaluated. In both the Accelerate Absolute Return Fund (TSX: HDGE) and the Accelerate Canadian Long Short Equity Fund (TSX: ATSX), Accelerate funds may be long many top-ranked stocks and short many bottom-ranked stocks. See AccelerateShares.com for more information.