August 16, 2025 – “I like the stock,” Keith Gill proclaimed, as he defended himself in a virtual hearing in front of the House Committee on Financial Services.

The time was February 2021, the peak of the meme stock craze, and Gill, aka Roaring Kitty, was in the limelight as the ringleader of the retail investor movement.

Meme stocks, which are publicly traded shares whose price and trading volume are driven more by online popularity, social media hype, and retail investor enthusiasm rather than by the company’s underlying fundamentals such as earnings, revenue, or business outlook, became a cultural phenomenon during the post-Covid bull market that commenced in 2020 and ran into 2021. During this period, primarily unsophisticated amateur investors gathered in online chatrooms such as Reddit’s WallStreetBets forum, engaging in coordinated buying of heavily-shorted, low-quality stocks.

Many veterans of the investment business would recognize meme stocks by another moniker.

Source: R/WallStreetBets

Hollywood even made a movie out of the phenomenon. Dumb Money, the 2023 American biographical comedy-drama film, dramatized the meteoric rise of purportedly dying video game retailer GameStop’s stock during the early 2021 short squeeze and its impact on Wall Street elites.

This meme stock craze made Gill, among other retailer speculators, millions of dollars by aggressively buying bullish call options on GameStop, as well as other heavily shorted stocks. The phenomenon highlighted the power of retail investor coordination and social sentiment in markets. In addition, it turned the decades-old hypothesis that market participants are rational actors seeking to maximize risk-adjusted returns on its head. In particular, meme stock traders made it clear that they were not necessarily buying securities to maximize their expected return on investment. Instead, they were making lottery-like bets, knowing that the odds were deeply stacked against them buying low-quality stocks, but betting anyway, inspired by a Roaring Kitty-like payday. From a fundamental perspective, most of the meme stocks represented struggling businesses experiencing long-term secular decline.

Many of the most popular meme stocks, such as Bed Bath & Beyond and AMC, have either gone bankrupt or seen their share prices drop by -99% from their peak. However, GameStop managed to use its meme stock popularity to raise billions of dollars of capital through an enormous at-the-market equity issuance program, transforming itself into a bitcoin treasury company years later.

In any event, it appeared that the 2022 equity bear market killed meme stocks, along with the retail investor portfolios that participated in the market manipulation – ahem, coordinated buying – of these securities. As quickly as they became popular, their momentum reversed, causing speculators to lose conviction and momentum to shift in the opposite direction. Meme stocks were dead.

Or so we thought.

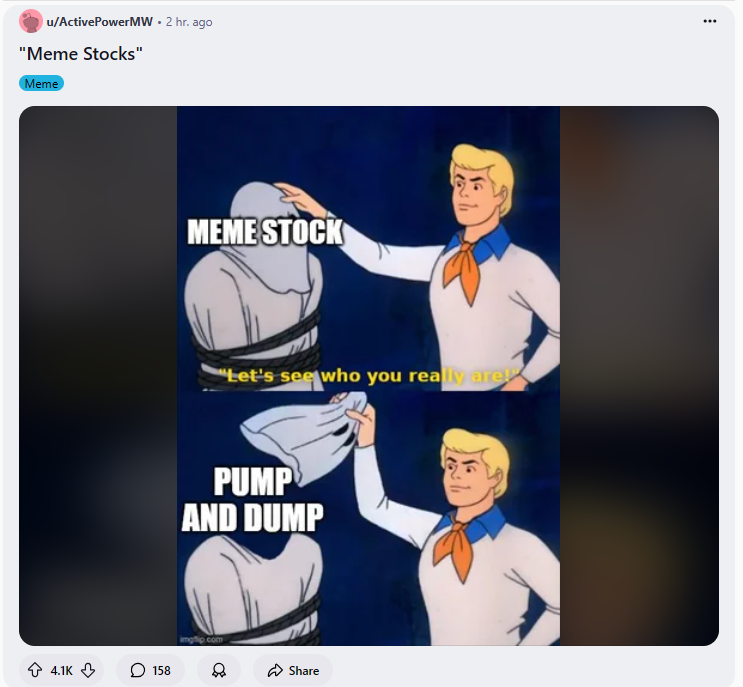

Last month became a blast from the past, as heavily shorted stocks surged by double-digits and trounced the market averages.

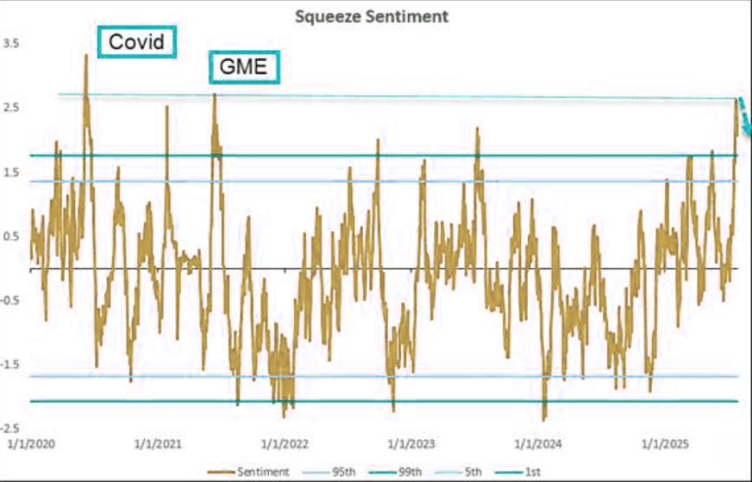

Reddit forums were once again alive with highly speculative and aggressive trading activity, primarily from unsophisticated investors using tremendous amounts of leverage (primarily via call options). Last month, the JPMorgan Squeeze Sentiment Indicator hit its highest level since early 2021.

Source: JPMorgan

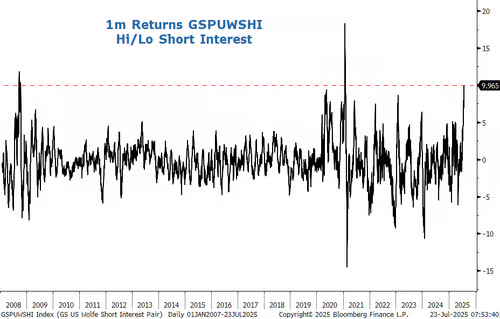

Stocks with the highest short interest, which have historically produced the poorest returns, outperformed shares with the lowest short interest by 10%. This dynamic marked the greatest outperformance of high short interest stocks since early 2021, when the last meme stock craze reached its peak.

However, meme stocks 2.0 did not feature GameStop or AMC. Short sellers, as well as speculators, learned their lesson on those names. The new short squeeze candidates included low-priced shares and penny stocks such as Opendoor and Krispy Kreme.

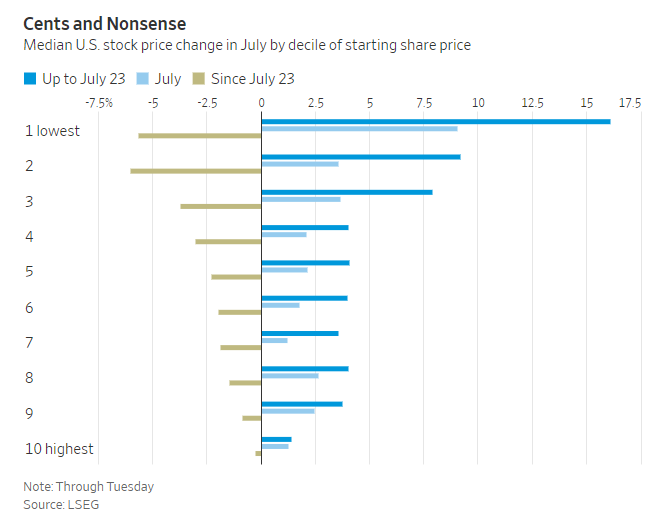

In addition to high short interest, one characteristic shared by the best performing stocks last month was a low price. The tenth of the market with the lowest share price at the start of July had a median gain of 16% by July 23rd, when the new meme stocks peaked, while the tenth with the highest share price rose only 1.4%. The starting share price was by far the best predictor of performance for stocks in July – and the lower, the better.

Moreover, low-quality stocks have been leading the market. Of the 33 stocks in the Russell 3000 that have seen their share price triple since April’s market bottom, only six have generated positive net income over the past year.

The Goldman Sachs Speculative Trading Indicator reached its highest level since the dot-com and pandemic market bubbles, driven by heavy trading in unprofitable, penny, and high multiple stocks. Elevated risk appetite and extreme positive investor sentiment was focused in the Magnificent 7 names, digital assets, and quantum computing. Call option activity has surged to its highest level since 2021. Meanwhile, IPO issuance has recently hit a multi-year high. Goldman’s retail favourite stock basket has skyrocketed 50% since April.

Currently, Goldman’s Speculative Trading Indicator sits at an 88th percentile ranking, with data going back to 1990.

Source: Goldman Sachs

One enduring characteristic of meme stocks that we learned in 2021 is that these short squeezes are ephemeral. They are like a game of musical chairs – eventually the music stops and the game ends.

The meme stock 2.0 phenomenon seems to be fading away nearly as quickly as it emerged. As is typically the case, the second bubble, similar to an aftershock post-earthquake, is smaller than the first. Heavily shorted and retail-favoured stocks have traded off since peaking during the third week of July. Hopefully, lessons were once again learned.

Nevertheless, meme stock short squeezes serve as a reminder to diversify and carefully manage risk, particularly when engaging in short selling or hedging. Whether a third coming of the meme stock phenomenon occurs is anyone’s guess. Regardless, it serves investors (both long and short) well to carefully monitor the zeitgeist, regularly checking in on WallStreetBets to see whether another bubble is percolating.

Accelerate manages five alternative investment solutions, each with a specific mandate:

- Accelerate Arbitrage Fund (TSX: ARB): Merger Arbitrage

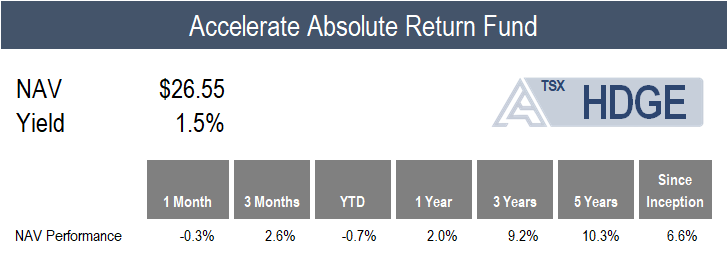

- Accelerate Absolute Return Fund (TSX: HDGE): Absolute Return

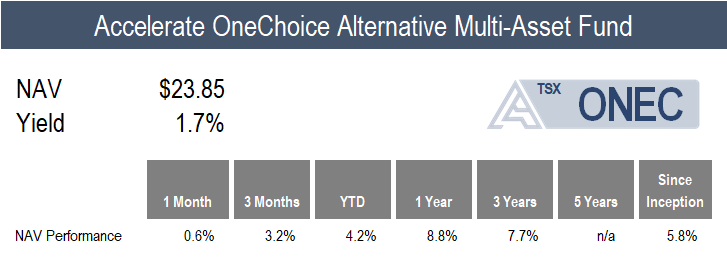

- Accelerate OneChoice Alternative Multi-Asset Fund (TSX: ONEC): Multi-Asset

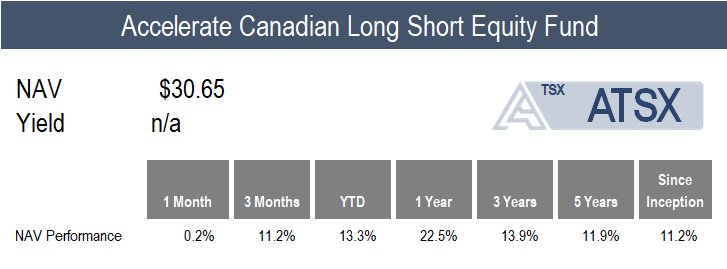

- Accelerate Canadian Long Short Equity Fund (TSX: ATSX): Long Short Equity

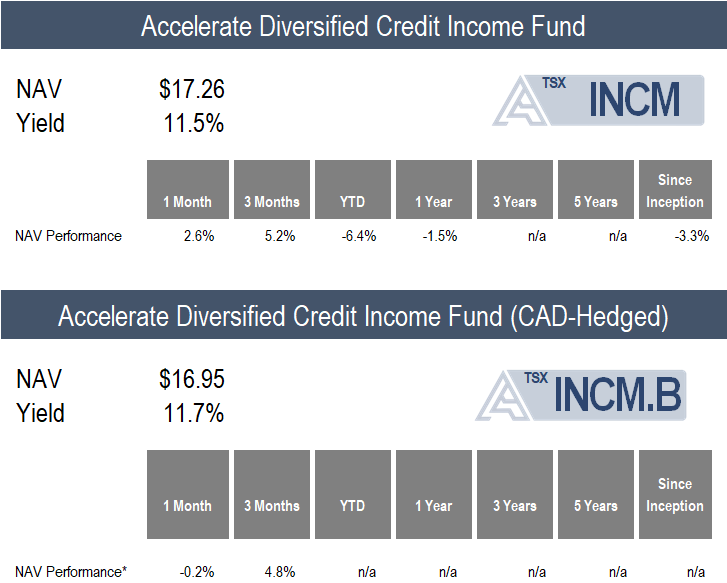

- Accelerate Diversified Credit Income Fund (TSX: INCM): Private Credit

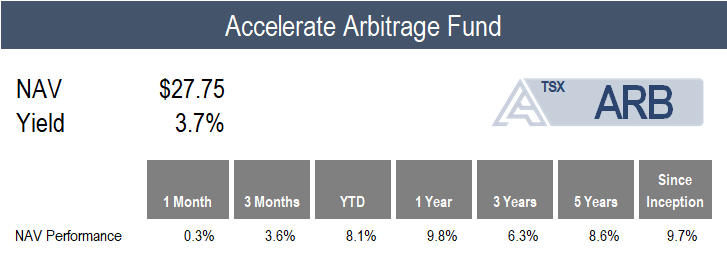

ARB gained 0.3% in July, compared to 0.8% for the benchmark S&P Merger Arbitrage Index Total Return. Year-to-date, the Fund is up 8.1%, while the benchmark has returned 4.9%.

There have been no summer doldrums in the merger arbitrage market. An extremely active month for transaction announcements has forced dealmakers to cancel their holiday plans. Twenty five public corporate mergers were announced in North America last month, worth an aggregate of $182 billion. Notable deals stuck include Union Pacific’s $85.0 billion railway merger with Norfolk Southern, Palo Alto Networks’ $24.3 billion acquisition of identity tech company CyberArk, and Baker Hughes’ $13.6 billion takeover of manufacturing company Chart Industries. Of the twenty five announced mergers, ARB invested in four.

ARB was able to monetize a significant number of investments as ten of the Fund’s merger investments closed in July.

The SPAC market remained active, with thirteen IPOs, worth a total of $2.2 billion during the month. Of these IPOs, ARB invested in eight.

Currently, ARB is allocated 70% to SPAC arbitrage and 30% to merger arbitrage (18% to strategic M&A and 12% to leveraged buyouts), with 155% gross exposure (141.8% long and -13.2% short).

We are pleased to announce that ARB has been shortlisted for the Hedgeweek® US Awards Emerging Performance of the Year: Event Driven Fund of the Year.

HDGE declined -0.3% in a challenging month for short positions and hedged portfolios.

The meme stock phenomenon, which appeared to have peaked during the third week of July, was centered on the lowest quality securities. During the month, the Goldman Sachs Most Shorted basket surged 9.4%. Meanwhile, the long-short hedge fund proxy, defined as the GS Hedge Fund VIP basket – the GS Most Shorted basket, fell -7.4%.

The various risk models within HDGE, created during the first meme stock craze during 2020 and focused on the short portfolio, helped mitigate a significant portion of the damage to the Fund’s returns. In any event, it was another challenging month for performance amid a frustrating year for hedged strategies.

The Fund’s top three contributors to monthly performance include long positions in Trican Well Service and InterDigital, and a short position in NeoGenomics. The top three detractors include short positions in Impinj and Cleveland-Cliffs, along with a long position in Charter Communications.

ONEC returned 0.6% in a fairly low volatility month for alternative asset classes, in which all but one of the Fund’s alternative strategy allocations returned less than +/- 1%.

Leading the pack was private credit, which bounced back with a 2.6% gain. The allocations that generated a positive return of less than 1% include leveraged loans, infrastructure, long short equity, merger arbitrage, commodities, and gold.

Conversely, the allocations that generated a negative return of between 0% and -1% include risk parity, real estate, absolute return, and managed futures.

ATSX generated a 0.2% return, compared to the benchmark S&P/TSX 60’s 1.6% gain in July.

A challenging environment for portfolio shorts was also prevalent in Canada, as nearly every Canadian long-short factor portfolio experienced a negative return last month. Overvalued stocks outperformed undervalued stocks by 1.0%, low quality stocks outperformed high quality by 3.2%, and stocks with negative historical momentum outperformed those with positive momentum by 2.1%.

The Fund’s top three contributors to monthly performance include short positions in Teck Resources, Tourmaline Oil, and Aecon Group. The top three detractors include short positions in Rogers Communications and WELL Health Technologies, along with a long position in Wesdome Gold Mines.

We are pleased to announce that ATSX has been shortlisted for the Hedgeweek® US Awards Emerging Performance of the Year: Equity Long/Short Hedge Fund.

The July performance of INCM was primarily due to the USD appreciating, as the CAD-hedged series of the Fund was roughly flat.

During the month, the Fund’s private credit holdings experienced an average NAV discount widening from -7.2% to -8.4%. This spread widening was offset by the Fund’s underlying portfolio yield of 11.9%.

Second quarter results disclosures for the Fund’s private credit holdings recently began, with the Fund’s largest allocation, Ares (ARCC), releasing its Q2 financial performance before month’s end. ARCC once again disclosed industry-leading results, with a quarterly total return of 2.8% (11.3% annualized), driven by its 2.4% quarterly distribution yield along with a 0.4% increase in NAV. Credit conditions remain relatively good, with no underlying trends indicating pockets of weakness. The remainder of the Fund’s private credit holdings released Q2 results in the first two weeks of August, which will be detailed in Accelerate’s upcoming quarterly private credit monitor. Given these results, we believe the widespread private credit NAV discounts are unjustified, as the market’s fears of a significant number of credit defaults due to economic volatility last quarter did not come to fruition.

Currently, INCM is allocated to twenty private credit pools, representing 5,005 loans and investments, of which 86.0% are senior secured and 92.7% are floating rate. The underlying Fund’s private credit pools trade at an average -8.4% discount to the value of their loans.

Have questions about Accelerate’s investment strategies? Click below to book a call with me:

-Julian

Disclaimer: This distribution does not constitute investment, legal or tax advice. Data provided in this distribution should not be viewed as a recommendation or solicitation of an offer to buy or sell any securities or investment strategies. The information in this distribution is based on current market conditions and may fluctuate and change in the future. No representation or warranty, expressed or implied, is made on behalf of Accelerate Financial Technologies Inc. (“Accelerate”) as to the accuracy or completeness of the information contained herein. Accelerate does not accept any liability for any direct, indirect or consequential loss or damage suffered by any person as a result of relying on all or any part of this research and any liability is expressly disclaimed. Past performance is not indicative of future results. Visit www.AccelerateShares.com for more information.