March 30, 2025 – Entering 2025, dealmakers were feeling jubilant and preparing to uncork their proverbial champagne bottles in anticipation of a boom in merger and acquisition activity. The previous four years had been somewhat underwhelming for tie-ups and takeovers, given the unfriendly deal environment fostered by the Biden administration.

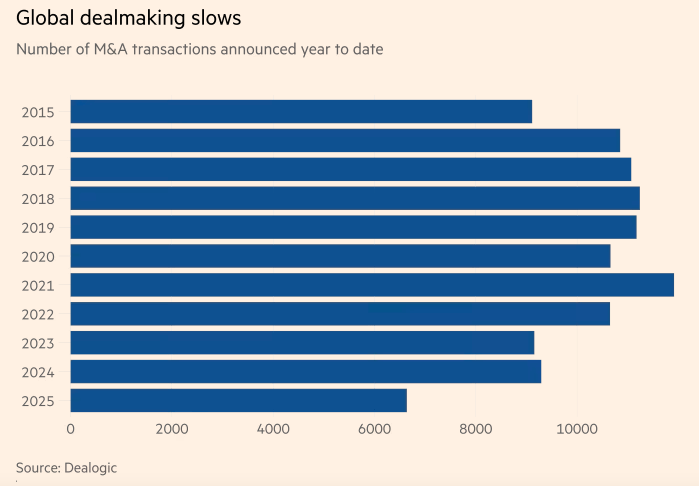

As the first quarter came and went, deal activity has been disappointing. There have been approximately 6,600 deals announced globally so far this year, a decline of nearly -30% compared to this period last year. The number of M&A transactions announced year-to-date is the lowest in over a decade.

Those deal junkies anticipating a booming environment have been thoroughly discouraged thus far this year. The lack of announced M&A transactions begs the question – what’s behind the 2025 deal slowdown?

The answer should surprise no one. Economic and policy uncertainty creates an unfriendly environment for M&A activity because it undermines the confidence needed for corporations and private equity firms to pursue transactions. When the outlook for interest rates and economic policy is highly volatile, which is a fair classification of the current environment, bid-ask spreads between buyers and sellers will widen. Acquirors may fear overpaying in an acquisition if there is a sudden economic decline post-closing. At the same time, targets may be uninterested in accepting discounted valuations to account for the uncertain economic environment.

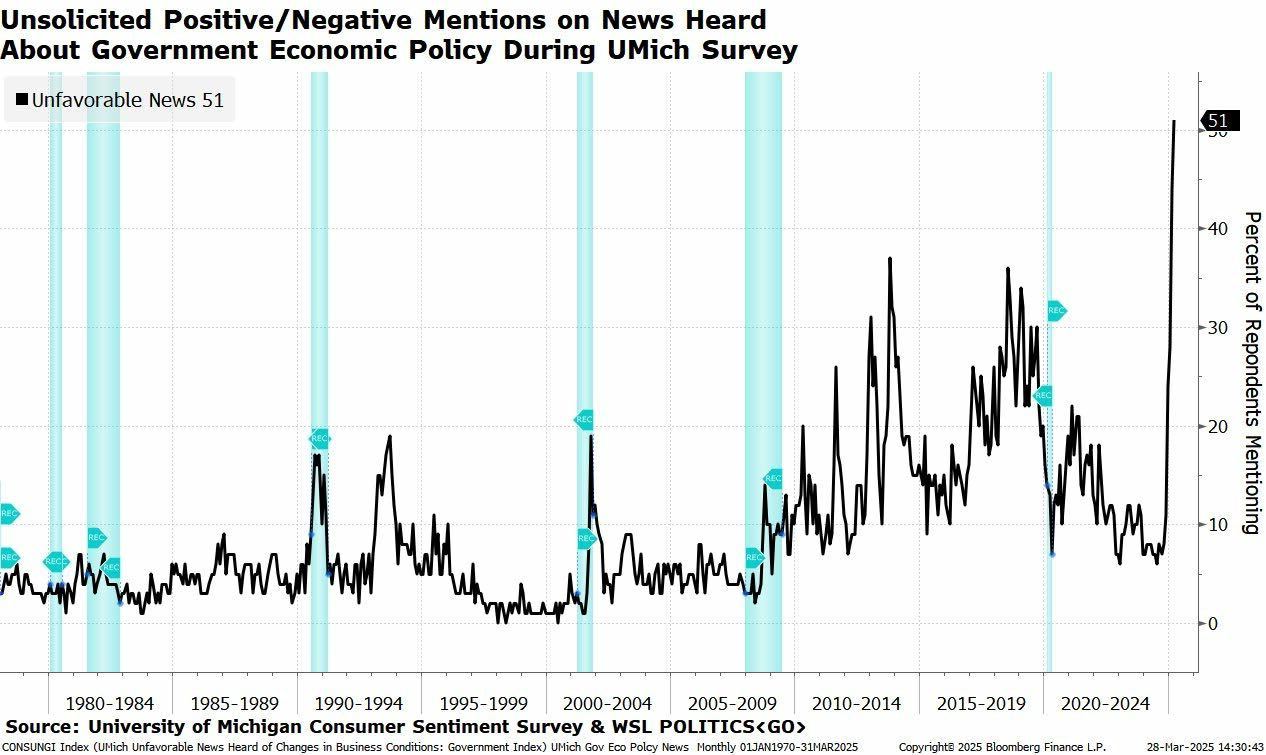

The University of Michigan Consumer Sentiment Survey is a monthly assessment that measures U.S. consumers’ attitudes toward the economy and business conditions. The survey serves as a useful tool for understanding and forecasting consumer behaviour and its implications for the broader economy.

The latest survey pinpoints the dynamic plaguing current business conditions. The attitude toward U.S. government economic policy has never been more negative, with unfavourable mentions surging last month. Market participants are highly concerned about economic policy uncertainty.

It is not just the lack of predictability around economic policy that is giving dealmakers pause. The Trump administration’s approach to antitrust regulation is still very much up in the air.

As recently as last quarter, merger practitioners expected more of a laissez faire approach to antitrust regulation after four challenging years of harsh anti-deal sentiment from the antitrust cops, the Federal Trade Commission (FTC) and the Department of Justice (DOJ). A friendlier approach to merger regulation was expected to help unleash a surge in deal activity.

However, given two recent antitrust actions, that thesis is coming into question. First, the DOJ sued to block Hewlett Packard Enterprise’s $14.3 billion acquisition of Juniper Networks in January. Then, the FTC sued to stop GTCR’s $611 million acquisition of Surmodics earlier this month, which would be the first merger challenge of a private equity buyout of a public company. In a “normal” antitrust regulatory regime, both of these deals would have arguably received a nod from the regulators. Despite the Trump administration’s promise to cut government bloat and reduce regulatory red tape, the FTC and DOJ still maintain vestiges of the anti-deal “hipster antitrust” framework built up over the past four years. It is now unclear if and when that will change.

To throw additional uncertainty in the mix, President Trump upended the FTC and its antitrust powers by firing its two democratic commissioners on March 19th. The FTC is an independent agency, composed of five commissioners, with no more than three commissioners belonging to the same political party. During the Biden administration, the FTC had three Democratic and two Republican commissioners. Shortly after President Trump took office, the FTC’s Democratic Chair resigned, leaving two Commissioners from each political party. After the recent unprecedented move to fire the FTC’s two Democratic commissioners (with no replacements), it may be the first time since 1915 that the FTC had just two Commissioners.

It is fair to say M&A practitioners have been left scratching their heads.

M&A requires long-term planning and capital commitment, both of which are harder to justify when the future is murky. Uncertainty breeds hesitation. M&A thrives on corporate confidence, visibility, and stability. These requirements become eroded when economic policy conditions are uncertain and volatile.

Nevertheless, the deal environment is not dead, it is just underwhelming. Twelve public mergers were announced in March worth an aggregate of $56 billion, providing a sufficient deal flow for merger arbitrageurs to remain busy.

Notably, we saw two large private equity buyouts announced this month. Sycamore Partners struck a deal to acquire Walgreens Boots Alliance for $23.7 billion, while Clearlake Capital Group entered an agreement to acquire Dun & Bradstreet Holdings in a $7.7 billion leveraged buyout. Could these deals represent green shoots of a resurgent private equity buyout market? Only time will tell if additional private equity dry powder gets put to work in the coming quarters.

One additional notable event occurred in the M&A world this month. Occasionally, in a contested definitive merger agreement in which an acquiror gets cold feet regarding an acquisition, many casual merger observers ask, “Why don’t they just walk away from the deal?”.

Definitive merger agreements do not facilitate the buyer walking away. If an acquiror enters into a definitive agreement, it cannot drag its feet on approvals, and it must close the deal if all conditions have been satisfied. If not, the seller will likely sue, and a court will force the buyer to complete the acquisition under a “specific performance” clause.

This dynamic recently played out between Desktop Metal and its would be acquiror, Nano Dimension. The parties signed a definitive merger agreement in July 2024 for Nano to acquire Desktop for $5.50 cash per share, subject to adjustment. Several months later, an activist investor took control of the Nano board with the goal of wriggling out of the Desktop merger, which they viewed as a value-destructive deal. The reconstituted Nano board attempted to drag its feet on regulatory approvals (specifically, CFIUS approval, which concerns national security) and run out the shot clock, which would allow the buyer to terminate the deal if it was not completed by the termination date as stipulated in the merger agreement. Desktop saw this happening and sued in the Delaware Court of Chancery, alleging that Nano breached the merger agreement by not using reasonable best efforts to complete the transaction.

Last week, the Court ruled in favour of Desktop, finding that Nano breached the merger agreement. It granted Desktop specific performance, forcing Nano to execute a national security agreement with CFIUS (to satisfy the final remaining deal condition) and complete the merger.

Chalk one up for the sanctity of definitive merger agreements. The binding nature of merger agreements, backed by courts, grant the merging parties, along with outside participants such as merger arbitrageurs, the confidence needed to invest significant time and capital into these transactions.

Amidst great volatility regarding broad economic policy, along with uncertainty around antitrust regulation, it provides some solace to merger practitioners that the enforceability and integrity of merger agreements will be honoured and upheld.

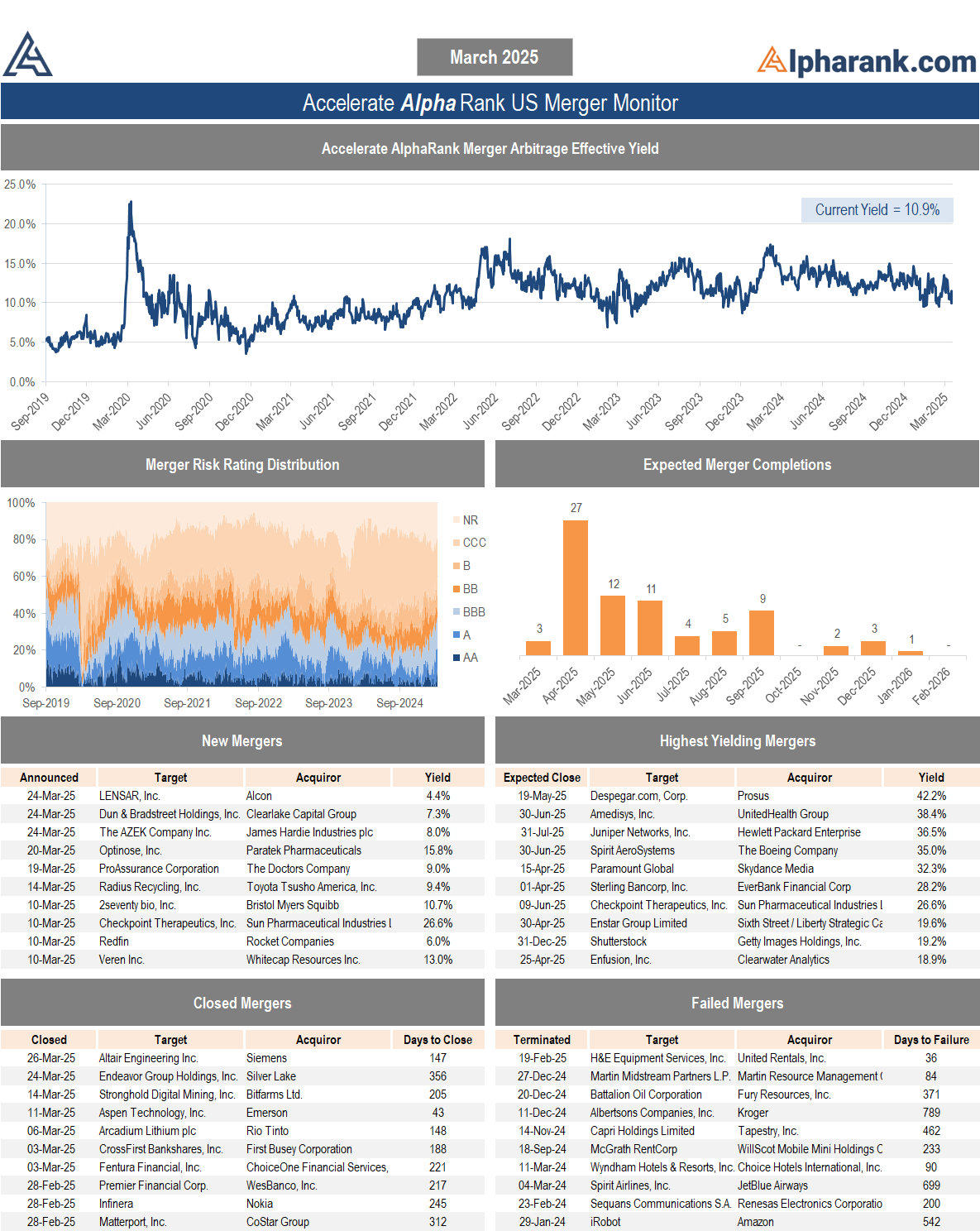

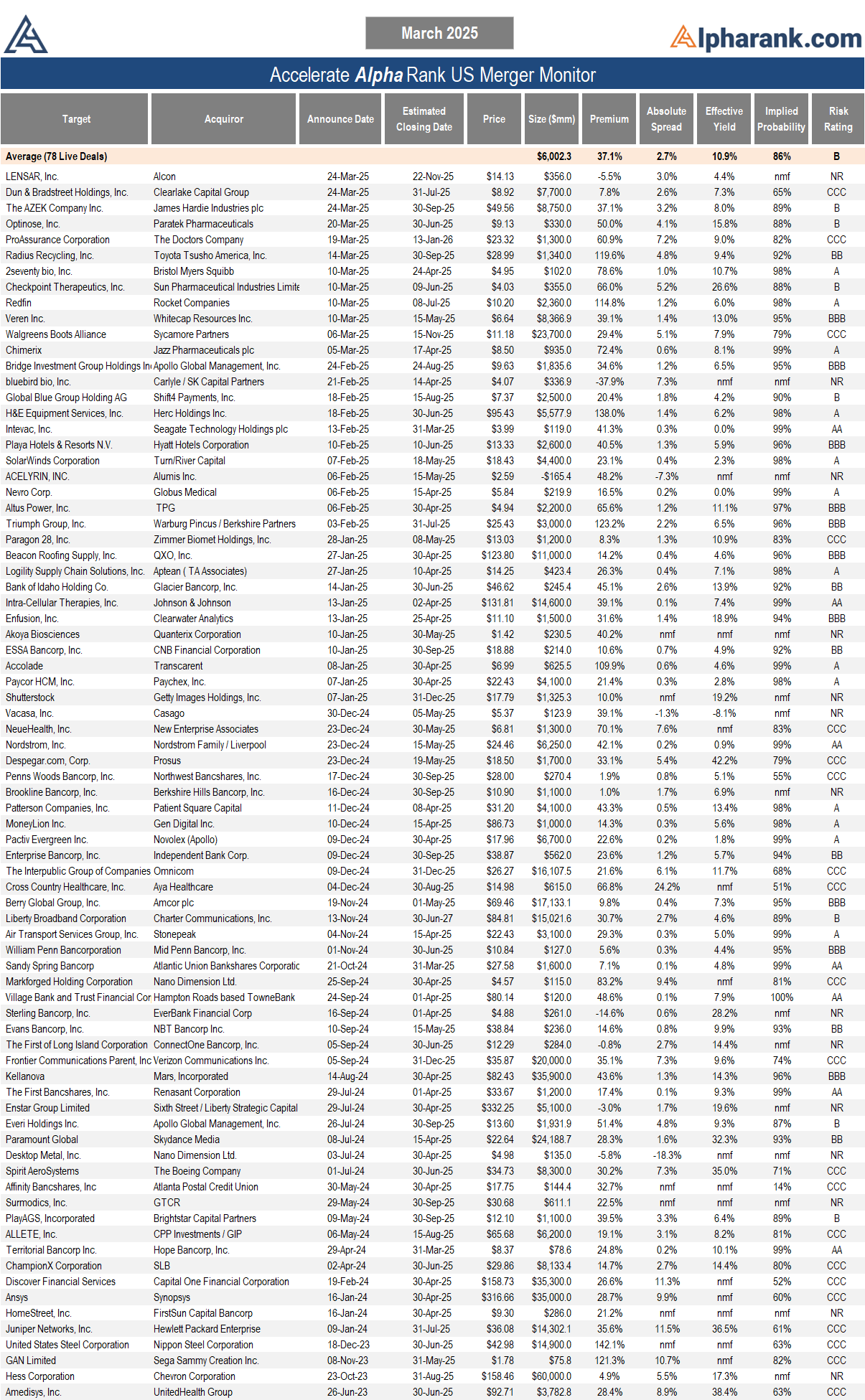

The AlphaRank.com Merger Monitor below represents Accelerate’s proprietary analytics database on all announced liquid U.S. mergers. The AlphaRank Merger Arbitrage Effective Yield represents the average annualized returns of all outstanding merger arbitrage spreads and is typically viewed as an alternative to fixed income yield.

Each individual merger is assigned a risk rating:

- AA – a merger arbitrage rated ‘AA’ has the highest rating assigned by AlphaRank. The merger has the highest probability of closing.

- A – a merger arbitrage rated ‘A’ differs from the highest-rated mergers only by a small degree. The merger has a very high probability of closing.

- BBB – a merger arbitrage rated ‘BBB’ is of investment grade and has a high probability of closing.

- BB – a merger arbitrage rated ‘BB’ is somewhat speculative in nature and has a greater than 90% probability of closing.

- B – a merger arbitrage rated ‘B’ is speculative in nature and has a greater than 85% probability of closing.

- CCC – a merger arbitrage rated ‘CCC’ is very speculative in nature. The merger is subject to certain conditions that may not be satisfied.

- NR – a merger-rated NR is trading either at a premium to the implied consideration or a discount to the unaffected price.

The AlphaRank merger analytics database is utilized in running the Accelerate Arbitrage Fund (TSX: ARB), which may have positions in some of the securities mentioned.