January 14, 2022 – While 2022 was challenging for most investors, it offered valuable learning opportunities.

Before 2022, the traditional 60/40 stock and bond portfolio worked wonders, lulling investors into a state of complacency.

Investors were apathetic about diversifying beyond just two assets due to a steady 40-year decline in interest rates, which created a golden age for the 60/40 portfolio.

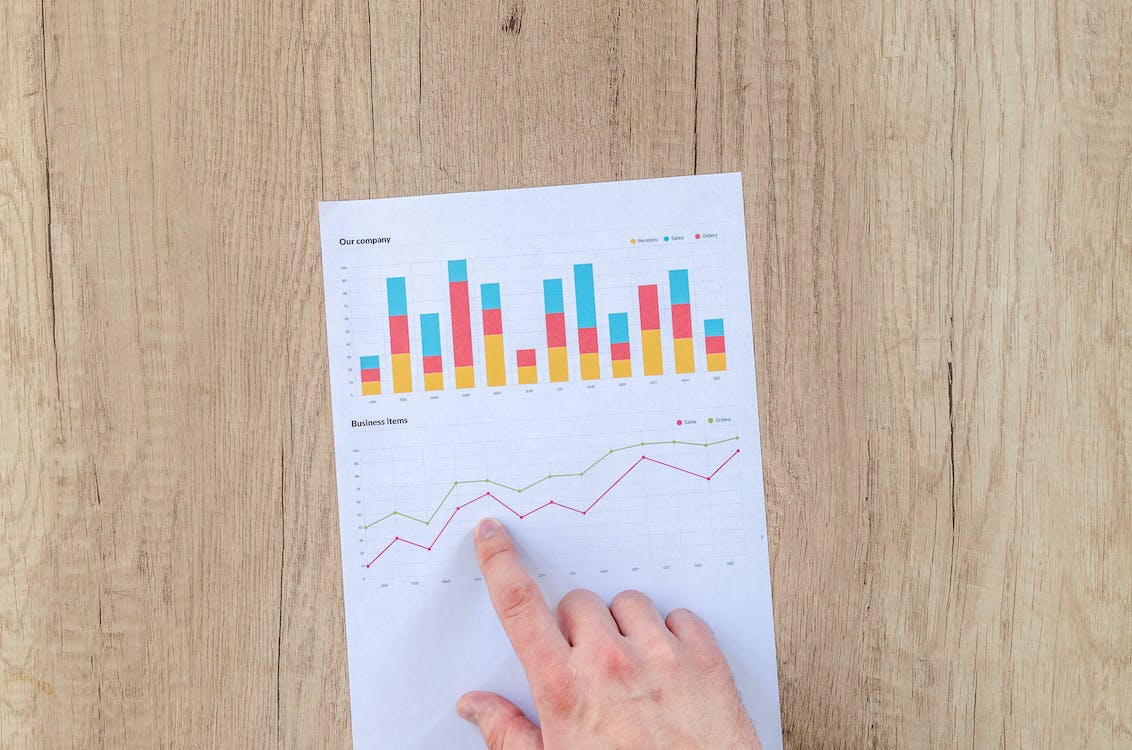

Source: CNBC, Accelerate

Source: CNBC, Accelerate

The steady decline in long-term interest rates that investors could rely on to power the consistent returns of their stock and bond portfolio ended abruptly in 2021, and its initial effects were felt in 2022.

We have long warned of the demise of the 60/40 portfolio, and 2022 was the dagger.

Before last year, interest rates had not risen materially since the early 1980s, therefore, the current generation of investors had only experienced the tailwind of falling rates.

It took last year’s performance to prove that there was an Achilles heel in the 60/40 portfolio – rising interest rates.

As this vulnerability was exposed, with the 10-year U.S. Treasury yield increasing from less than 1% at the start of the year to nearly 4% by its conclusion, the two assets in the 60/40 portfolio suffered simultaneously. Both stocks and bonds fell nearly -20% in 2022, and traditional 60/40 portfolios were left without diversifying assets to save them from significant losses.

.

Source: FT, Accelerate

Source: FT, Accelerate

Traditionally, speculative technology stocks were regarded as highly risky while Government bonds were deemed safe.

Last year, these two seemingly disparate asset classes were one and the same. The price action between long-term U.S. Treasury bonds (TLT, red line below) and the NASDAQ index (QQQ, blue line below) is indistinguishable. Both assets were driven by the same factor – rising interest rates. When assets are highly correlated, as are tech stocks and long-duration bonds, they cease to provide any diversification benefit.

Source: Accelerate, Google

Source: Accelerate, Google

On a positive note, with the advent of higher rates, investors can generate a reasonable yield in their fixed-income portfolios. Short-term T-bills, which used to generate near-zero yield, now offer returns above 4% (which is much better than nothing!).

Surging inflation has caused the bond market to finally come to its senses. As a result, one of the strangest occurrences of the zero-interest-rate-policy era of the past 15 years was the rise of the negative-yielding bond.

With inflation running hot, clocking in at a rate above 6%, it seems utterly insane that an investor would ever buy a bond with a negative yield.

However, more than $15 trillion of bonds offered a negative nominal rate of return just a handful of years ago. Thankfully, that embarrassing period (for bond investors) is over. Imagine telling your clients that you bought them investments that were guaranteed to lose money.

Source: FT, Bloomberg

Source: FT, Bloomberg

Inflation Risk

If you polled investors before 2022, how many would have made significant investment decisions based on the monthly consumer price index (CPI) change?

Zero is probably the most appropriate answer.

Now, inflation rules the roost, driving substantial market swings. Investors watch the monthly inflation readings like a hawk, and the CPI numbers are front-page news.

According to Barclays, over the past 10 years, never has the S&P been so (negatively) reactive to an economic indicator as has been the case in 2022 with the equity market’s reaction to the monthly CPI readings.

Source: Barclays, The Market Ear

Source: Barclays, The Market Ear

Pre-2020, this market dynamic likely would have been the opposite for the current generation of investors. Literally, no one cared about the monthly CPI prints. Before the pandemic, the monthly change in CPI was consistently around 0.2% (about 2% annualized) for years. Inflation was a non-factor.

Source: U.S. Bureau of Labor Statistics, Accelerate

Source: U.S. Bureau of Labor Statistics, Accelerate

The change in, and the transitory nature of, inflation is the primary driver of central banks’ interest rate policies.

Given that the Federal Reserve’s interest rate policy is the preeminent factor driving stock and bond returns in the near term, forecasting the path of rates is currently one of the top undertakings of professional investors.

A core driver of asset class returns this year will be the direction of interest rates.

Currently, there is quite a dichotomy in the market.

The market is pricing in a U.S. interest rate peak of 4.93%, followed by nearly half a percentage point of rate cuts by the end of this year.

The Fed is signaling to market participants that rates are heading above 5% and staying there all year, at least.

Source: Bianco Research

Fighting the Fed is always a risky battle. Bulls are fading the Fed’s guidance and banking on a rate cut in the back half of 2023. If the Fed holds firm, investors may be let down, then watch out below.

Recession Risk

The best recession indicator we have is the yield curve. It has correctly forecast, through a yield curve inversion, each of the past five recessions (a much better track record than any economist!).

Currently, the yield curve is at its steepest inversion in more than 40 years. This leading indicator is screaming recession.

Source: Federal Reserve Bank of St. Louis

Source: Federal Reserve Bank of St. Louis

The consensus amongst investors and economists seems to be that a recession is highly likely in 2023. However, the main question is whether the economy will feature a soft landing or will the economic slowdown be worse.

A recession brings multiple compression for equities and typically features broad-based earnings declines. A double whammy of multiple compression and earnings decline would further sink the current bear market, and certainly would not be constructive for stock market performance in the near term.

Investors should be allocated such that a recession will likely occur in 2023 and fortify their portfolios against it.

Policy Risk

While market participants focus their attention on inflation and its effect on the path of interest rates, they are dropping the ball on another major driver of asset price performance – liquidity.

Through its serial quantitative easing programmes, the Fed’s ballooning balance sheet led to the great bull market rallies of 2009 and 2020. In response to the recessions of 2008 and early 2020, the Fed flooded the system with liquidity with the goal of increasing asset prices and manifesting the wealth effect amongst consumers throughout the economy. In 2008, the Fed’s bazooka was a $1 trillion expansion of its balance sheet. In 2020, the central bank used three bazookas good for a $3 trillion balance sheet expansion, priming the pump with excess liquidity to circulate through markets and spur asset price increases.

That was then, and this is now. What the Fed giveth, the Fed taketh away.

Source: Federal Reserve, Accelerate

Source: Federal Reserve, Accelerate

With consumer price inflation raging out of the central bank’s control (remember “transitory”?), not only can they no longer justify the encouragement of asset price inflation, but they must do all that they can to reduce asset prices.

Therefore, they have begun to reverse their quantitative easing by implementing quantitative tightening (QT), removing liquidity from the system and tightening financial conditions.

QT is in full effect, and the Fed has only reduced its balance sheet by less than $0.5 trillion. In 2008, its balance sheet was around $1 trillion. By 2021, it peaked at approximately $9 trillion. What do you think happens to the market multiple when they take out $2-4 trillion of liquidity?

Think of the stock market multiple like a balloon and the Fed’s balance sheet as the air pump.

QE pumped up stocks. QT will deflate stocks.

If you’re allocated to equities, lean to value and quality, and stay far away from glamour equities as they suffer the most during tightening financial conditions.

Valuation Risk

Despite the S&P dropping nearly -20% last year, it is still trading at a lofty valuation of 29x cyclically-adjusted earnings. Compared to 10 years ago, today’s valuation of U.S. large-cap equities is 50% higher despite the 10-year Treasury yield trading 150 basis points higher. Lower rates can justify higher valuations, therefore, higher rates mean lower valuations. Compared to historical valuations of a lower interest rate era, today’s market should feature a lower multiple, not a higher one.

Source: Multipl.com

Source: Multipl.com

From a macro perspective, investors face several risks, including:

- The positive correlation between stocks and bonds as interest rates rise, significantly reducing the diversification benefits of the two assets

- Inflation lingering, and the Fed remaining steadfast in its commitment to snuffing out inflation, meaning no rate cuts in 2023 as the market is currently pricing in

- A recession leading to earnings declines, which, combined with multiple contraction, leads to another stock market correction

- A potential policy mistake from the Fed as it implements quantitative easing, sucking out liquidity which may lead to multiple contraction

- Valuation risk, specifically for U.S. large-cap equities, increasing potential downside for stock market investors

We expect the continued outperformance of non-U.S. equities over U.S equities and small/mid-cap over large-cap stocks. While bonds finally provide some decent income, they no longer provide any diversification benefit, given their positive correlation to stocks. These days, stocks and bonds represent very similar exposures.

In addition to the above, likely well-known, macro risk factors, one black swan risk is starting to bubble up from under the surface.

Private Funds = The Next Subprime?

Many investors allocate to private REITs and private credit funds because they exhibit near-zero volatility. They do not realize that these funds’ returns are generally not representative of reality and are produced by the managers, who smooth the returns to mask the risk. Generally, private offerings are far riskier and inherently more volatile than public comparables. Typically, their performance numbers are heavily smoothed (manipulated?) by the manager and are not produced by a discerning and liquid public market.

The issue with this mark-to-model accounting game played by private REITs and private debt funds is eventually, the tide goes out.

After a bear market in the underlying assets, economic reality sets in and private funds’ valuations no longer hold any bearing in reality.

As I discussed in the memo, Peekaboo, I See An Arbitrage, one cannot justify under any conditions the largest private REIT gaining about 8% in 2022 while its public comparables fell approximately -30%. They own basically the same assets!

The whole scheme falls apart when investors request their money back at inflated valuations. The sophisticated investors have capitalized on the arbitrage between the manufactured private marks and the actual public marks (more than 30% lower) by selling private funds high and buying public peers low.

The main risk is now that investors are stampeding to the exits from these artificially-high marked private vehicles, a bank run dynamic has started. It is a dynamic not dissimilar from the problems in exotic credit products leading up to the financial crisis in 2008.

Private REITs and private debt funds in 2023 are similar to subprime CDOs and MBS in 2007:

- Illiquid

- Opaque

- Underlying asset values crumbling but not yet reflected on balance sheets

- Sold as far less risky than they actually are

Investors must use the utmost caution when allocating to any of these private funds, given the powder keg of risks looming.

It would not be shocking if there were some high-profile blow-ups of private REITs and private debt funds in 2023. We are already seeing some cracks (gating, bailouts, etc).

Opportunities

One major inefficiency for investors to have on their radar is the valuation spread between value stocks and glamour stocks.

While we are approximately 18 months into a value resurgence, as stocks with attractive valuations have walloped overvalued equities, the trend is far from done.

In January 2022’s memo, The Growth Stock Bubble Popped. Here’s How To Play It, I wrote “I believe, starting in 2021, we kicked off a new multi-year run in which the growth bubble pops and value stocks come roaring back. This market dynamic may create another “golden era” for long-short equity, likely lasting several years.”

The market has reaffirmed this forecast. Moreover, we have only experienced 18 months of a likely 5-year trend. Valuations are still extreme, although off the bottom, and allow investors to enjoy a potential multi-year tailwind of value outperforming growth.

Valuation extremes provided the fuel and the Fed’s rate hikes provided the spark. Quantitative tightening will fan the flames for this trend to continue.

Source: Albert Bridge Capital

Source: Albert Bridge Capital

Diversification Pays Off

Uncorrelated alternative investments saved investor portfolios in 2022, and we continue to preach the gospel of diversification beyond just stocks and bonds.

Our goal continues to be to eradicate the 60/40 portfolio for good and help diversify portfolios beyond just two assets. 2022 was the nail in the coffin for the stock-and-bond-only portfolio. Hopefully, our message of broader diversification and asset allocation, through the use of alternative investment strategies with the goal of increasing returns while decreasing risk, one day becomes universally accepted.

We look forward to the era of 50/30/20, representing a portfolio of 50% stocks, 30% bonds, and a 20% allocation to a diversified portfolio of alternatives.

Accelerate manages five alternative ETFs, each with a specific mandate:

- Accelerate Arbitrage Fund (TSX: ARB): SPAC and merger arbitrage

- Accelerate Absolute Return Hedge Fund (TSX: HDGE): Long-short equity

- Accelerate OneChoice Alternative Portfolio ETF (TSX; ONEC): Alternatives portfolio solution

- Accelerate Enhanced Canadian Benchmark Alternative Fund (TSX: ATSX): Buffered index

- Accelerate Carbon-Negative Bitcoin ETF (TSX: ABTC): Eco-friendly bitcoin

ARB gained 0.9% in December as a record number of SPAC redemptions and liquidations were processed, closing arbitrage spreads, while merger arbitrage spreads tightened.

For the third year in a row, ARB beat its benchmark, the S&P Merger Arbitrage Index Total Return. In 2022, ARB fell -1.5% while the benchmark dropped -4.2%, leaving ARB ahead of the benchmark by 270 bps.

While we are proud to once again outperform the benchmark by a significant margin, our goal with ARB is to generate a positive return for investors every year. With respect to that goal, we failed in 2022. Most of the annual loss can be attributed to the Fund’s MER and currency hedging costs. Gross of fees, the strategy was slightly positive on the year.

Nonetheless, there are four main factors that led ARB to generate a return below our expectations:

1. SPAC warrants dropped an average of -90% in 2022. While we never buy SPAC warrants, we are allocated the securities as an equity kicker while participating in SPAC IPOs. If the Fund buys a SPAC unit at its $10.00 IPO, generally, the stock will be worth $9.80 and the warrant $0.20. The Fund’s portfolio had less than 2% of its portfolio in these “free” warrants at the start of the year. However, a -90% loss on less than 2% of the portfolio decreased the Fund’s performance by approximately 150 bps. Historically, the Fund’s strategy has been to monetize the warrant upon the completion of the SPAC merger, maximizing value for unitholders. Unfortunately, with record blank check liquidations in 2022, many of these free warrants expired worthless, reducing the return on the Fund’s SPAC IPO participation. Currently, SPAC warrants account for just 0.2% of the ARB portfolio.

2. SPAC arbitrage yields nearly doubled from 2.4% to 4.3% and merger arbitrage yields rose from 8.3% to 12.1%, widening spreads as interest rates rose. While SPACs and M&A have short durations, rising rates not only led to headwinds concerning arbitrage spreads (wider for longer), but the Fund’s borrowing cost rose as the Fed hiked rates.

3. Historically, approximately 5% of merger deals break. Conversely, on average, 5% of merger deals garner a higher bid. In 2022, an average number of M&A deals were terminated, but higher bids were not forthcoming. While we aim for a 100% accuracy rate, unfortunately, ARB did suffer one deal termination, which led to an approximate 90 bps loss for the Fund. Unfortunately, the Fund did not enjoy any increased considerations for merger targets within the portfolio. Typically, there are several bidding wars or increased bids for merger targets, which tend to offset losses from deal terminations.

Nonetheless, we start 2023 excited about the prospects for arbitrage. Specifically, SPAC arbitrage yields are approximately 4.5%, while merger arbitrage yields are above 12%. ARB currently has an underlying portfolio yield of 7.1% (unleveraged) and is fully deployed, with 75% allocated to SPAC arbitrage and 25% in merger arbitrage. The current opportunity set includes:

- 528 SPACs worth an aggregate of US$107 billion (targeting yields of 5-7%)

- 81 mergers worth US$468 billion in total (targeting yields of 7%+)

Our clients mainly use arbitrage as a fixed-income alternative. Here is ARB’s performance as compared to the Canadian bond index:

Source: Accelerate, Bloomberg

Source: Accelerate, Bloomberg

HDGE declined -2.2% in December but had a banner 2022, finishing the year up 15.3%.While most long-short factor portfolios produced positive returns in December, HDGE’s net-long weighting caused a decline in its NAV. While the U.S. multi-factor long portfolio fell -5.2%, the short portfolio dropped -12.1%. However, the 50% net weighting to shorts was insufficient to fully recover the declines from the long book.

Our clients use HDGE to hedge their equity portfolios (hence the ticker!). Historically, combining HDGE with stocks has increased annual returns by nearly 200 bps and lowered volatility by 30%, while reducing downside capture by approximately half.

Source: Accelerate, Bloomberg

Source: Accelerate, BloombergAs of year-end, HDGE’s long-short portfolio featured the following characteristics:

- Long portfolio at 4.6x EBITDA and a 10.9% free cash flow yield, short portfolio with a -7.3% cash burning rate

- Long portfolio with a 33% return on capital, short portfolio with a -12.9% loss on capital

- Long portfolio buying back 5.4% of their shares outstanding, short portfolio issuing 4.9% of shares outstanding

- Long portfolio beating expectations by 1.9%, short portfolio missing expectations by -2.6%

ONEC fell -1.4% in December as the majority of its alternative allocations decline during the month.

Positive contributions to monthly performance include gold, which rallied 3.3% and arbitrage, which gained 0.9%. The private credit allocations hung in there as the leveraged loan portfolio added 0.4% while the mortgage portfolio was flat.

Negative performers in December include risk parity, which dropped -1.9%, long-short equity, with a -2.2% return, and bitcoin, which fell -2.6%. The private asset portfolio struggled as infrastructure and real estate posted a negative monthly return of -3.1% and -3.4%, respectively. The enhanced equity strategy lost -6.1%.

Despite a disappointing overall return of -10.8% in 2022, ONEC provided necessary portfolio diversification to a traditional allocation and reduced downside volatility while outperforming both stocks and bonds.

![]()

ATSX fell -6.1% in December while its benchmark TSX 60 fell -5.4%. The Fund’s long-short overlay portfolio generated a loss of -0.7%.

In 2022, ATSX returned -5.0% while its benchmark dropped -6.2%. Over the year, the Fund’s long-short overlay portfolio not only added 120 bps of outperformance and reduced volatility and drawdowns. Risk reduction, without sacrificing upside returns, is always an appreciated feature.

Since its inception, ATSX has outperformed the benchmark while reducing volatility and lowering drawdowns.

Source: Accelerate, Bloomberg

Over time, we believe “enhanced indexing” is better accomplished by a multi-factor long-short overlay as compared to peers who utilize an options-writing overlay strategy instead. The reason why being, as shown above, the multi-factor overlay has generated alpha, and we continue to expect it to do so, while put options cost investors return.

Have questions about Accelerate’s investment strategies? Click below to book a call with me:

Disclaimer: This distribution does not constitute investment, legal or tax advice. Data provided in this distribution should not be viewed as a recommendation or solicitation of an offer to buy or sell any securities or investment strategies. The information in this distribution is based on current market conditions and may fluctuate and change in the future. No representation or warranty, expressed or implied, is made on behalf of Accelerate Financial Technologies Inc. (“Accelerate”) as to the accuracy or completeness of the information contained herein. Accelerate does not accept any liability for any direct, indirect or consequential loss or damage suffered by any person as a result of relying on all or any part of this research and any liability is expressly disclaimed. Past performance is not indicative of future results. Visit www.AccelerateShares.com for more information.