July 8, 2020 – Risk assets continue to recover from the trauma suffered during the record-setting stock market plunge of Q1 2020.

Volatility is normalizing, with the VIX (also known as the fear index) falling below 30 by the end of June, indicative of market participants retreating from panic mode. However, all is not clear on the market front, given the pandemic continues to rage in the U.S. The uncertain economic environment caused by COVID, combined with record-high equity valuations and all-time low bond yields, has led to a dangerous mix of future potential volatility and possible drawdowns. Investors experienced this risk flare-up on June 11th, as the S&P 500 declined nearly -6% on the day and the VIX spiked above 40. Nonetheless, it appears that we are past the worst of the bear market.

Despite the largest fiscal and monetary stimulus package of all-time, only some segments of the market have fully snapped-back (such as investment grade bonds) while others remain stuck in the mud. This dichotomy has created some interesting investment opportunities for enterprising investors.

.Accelerate manages four alternative ETFs, each with a specific mandate:

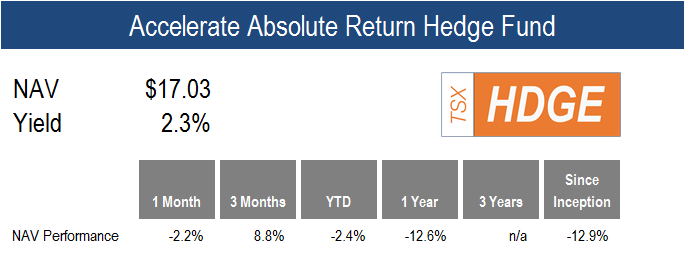

- Accelerate Absolute Return Hedge Fund (TSX: HDGE): Long-short equity

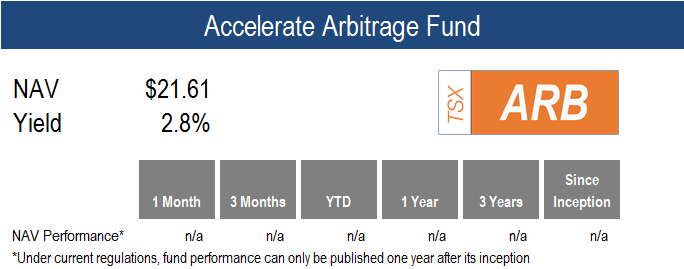

- Accelerate Arbitrage Fund (TSX: ARB): Event-driven

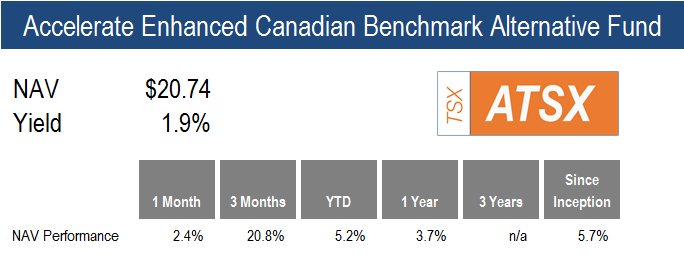

- Accelerate Enhanced Canadian Benchmark Alternative Fund (TSX: ATSX): Alpha + beta

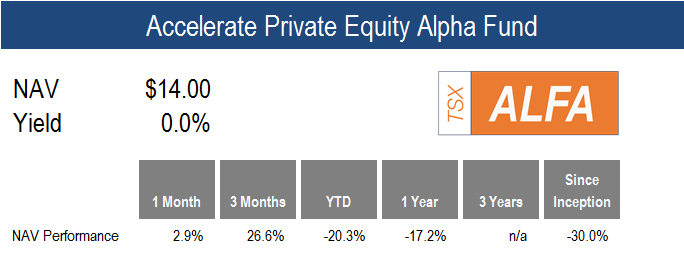

- Accelerate Private Equity Alpha Fund (TSX: ALFA): Private equity replication

Please see below for fund performance and manager commentary.

While HDGE’s 110% long portfolio more than kept up with the market’s gains last month, the fund’s approximately 50% short position suffered from early June’s rally in low-quality, beaten-down “junk” stocks. Equities with poor price momentum snapped-back, and overvalued equities continued their outperformance. The spread between the market’s cheapest stocks and its most expensive has reached a new record, exceeding that of the tech bubble in 1999 / 2000. Once this reverses and mean reversion occurs, investors who favour valuation will be rewarded on both the long and short side. But until then, the multi-factor nature of HDGE’s diversified long-short equity portfolio, including momentum and trend factors, along with stringent risk management, has protected the fund from increasingly warped valuations.

The performance of specific alternative risk premia driving HDGE’s long and short portfolios, such as value, quality, price momentum, operating momentum and trend, can be found in June’s AlphaRank Factor Performance.

After launching at $20.00 per unit during the frantic market of early April, ARB has successfully navigated an arbitrage market fraught with risk. Thus far, the fund has been able to successfully capitalize on wide arbitrage spreads in mergers and SPACs. Currently, there are two notable dynamics driving arbitrage returns:

- The market has been pricing in a higher deal break risk than has occurred. While deal breaks have been elevated in the current environment compared with historical performance, attractive merger yields have more than compensated investors for this risk.

- The market is rewarding SPAC deals. As discussed in the most recent AlphaRank SPAC Monitor, the 18 blank check companies that have announced a deal are trading at an average premium to NAV of nearly 20%. ARB’s strategy is to go long SPACs at a discount prior to announcing a deal to capitalize on this upside optionality. The fund is currently long over 30 pre-deal SPACs.

While new M&A announcements have been few-and-far-between, with June seeing a -69% year-over-year decline in announced transactions, the SPAC market remains very hot, with a record amount of new issuance. Given this dynamic, ARB has shifted more of its portfolio to capitalize on SPAC arbitrage, although emerging frothiness in that market segment warrants some caution.

The Canadian long-short overlay portfolio of ATSX added slight outperformance during June, however, the majority of the positive performance of the fund in June was due to the beta component. Given the fund’s historical performance, we expect ATSX’s outperformance to be manifested during volatile down markets, as experienced in the first quarter. Nonetheless, Canadian alternative risk premia, the systematic harvesting of factor anomalies both long and short, continues to perform beautifully, in the face of disappointing performance experienced by multi-factor long-short strategies in U.S. equities.

Despite decades of historical outperformance backing the investment thesis, small-cap value stocks are stuck in a brutal rut of underperformance. Private equity, as defined by leveraged small-cap value stocks, has borne the brunt of this pain. The ALFA fund is evidence of this, as performance has been rough in the era of large-cap growth stock dominance.

Is there a future for small, undervalued securities? Will evidence-based investing ever return? Many believe it is uncertain, given the current market’s propensity to ignore valuation and only key in on a stock’s “story”. Nonetheless, private equity is the true contrarian’s trade.

If we were to look at the only other time in history that featured a bubble in large-cap growth stocks and a bear market in small-cap value equities, the tech bubble of twenty years ago is instructive. After the market peaked in 2000, its subsequent decline tipped the economy into recession and sentiment reversed with large cap growth stocks falling deeply out of favour and small cap value equities reverting to their historical outperformance. Coming out of the bottom of the recession in 2001, private equity replication, as measured by a leveraged small-cap value portfolio, returned 50% over the following three years, tenfold the return of the S&P 500.

![]()

Have questions about Accelerate’s investment strategies? Book a call with me.

-Julian

Disclaimer: This distribution does not constitute investment, legal or tax advice. Data provided in this distribution should not be viewed as a recommendation or solicitation of an offer to buy or sell any securities or investment strategies. The information in this distribution is based on current market conditions and may fluctuate and change in the future. No representation or warranty, expressed or implied, is made on behalf of Accelerate Financial Technologies Inc. (“Accelerate”) as to the accuracy or completeness of the information contained herein. Accelerate does not accept any liability for any direct, indirect or consequential loss or damage suffered by any person as a result of relying on all or any part of this research and any liability is expressly disclaimed. Past performance is not indicative of future results. Visit www.AccelerateShares.com for more information.