About the Fund

The Accelerate Private Equity Alpha Fund (TSX: ALFA) is designed to provide investors with private equity-like investment returns through a diversified long-short portfolio of equity and derivative securities.

Investment Objectives

- Replicate private equity returns

- Target 12% – 18% annualized returns

- Hold leveraged long positions

- Hedge leveraged portion of portfolio

- Provide uncorrelated returns

ALFA TRADING DATA

WEBCAST

QUICK FACTS

Type:

Private equity replication

Structure:

Alternative ETF

Date Started:

May 10, 2019

Management Fee:

0.00%

Performance Fee:

15% of outperformance over high water mark

Investment Manager:

Accelerate Financial Technologies Inc.

Distribution Frequency:

None

Exchange:

TSX

Currency:

CAD

Risk Rating:

Medium-High

Reference Portfolio Performance

Accelerate Private Equity Alpha Fund

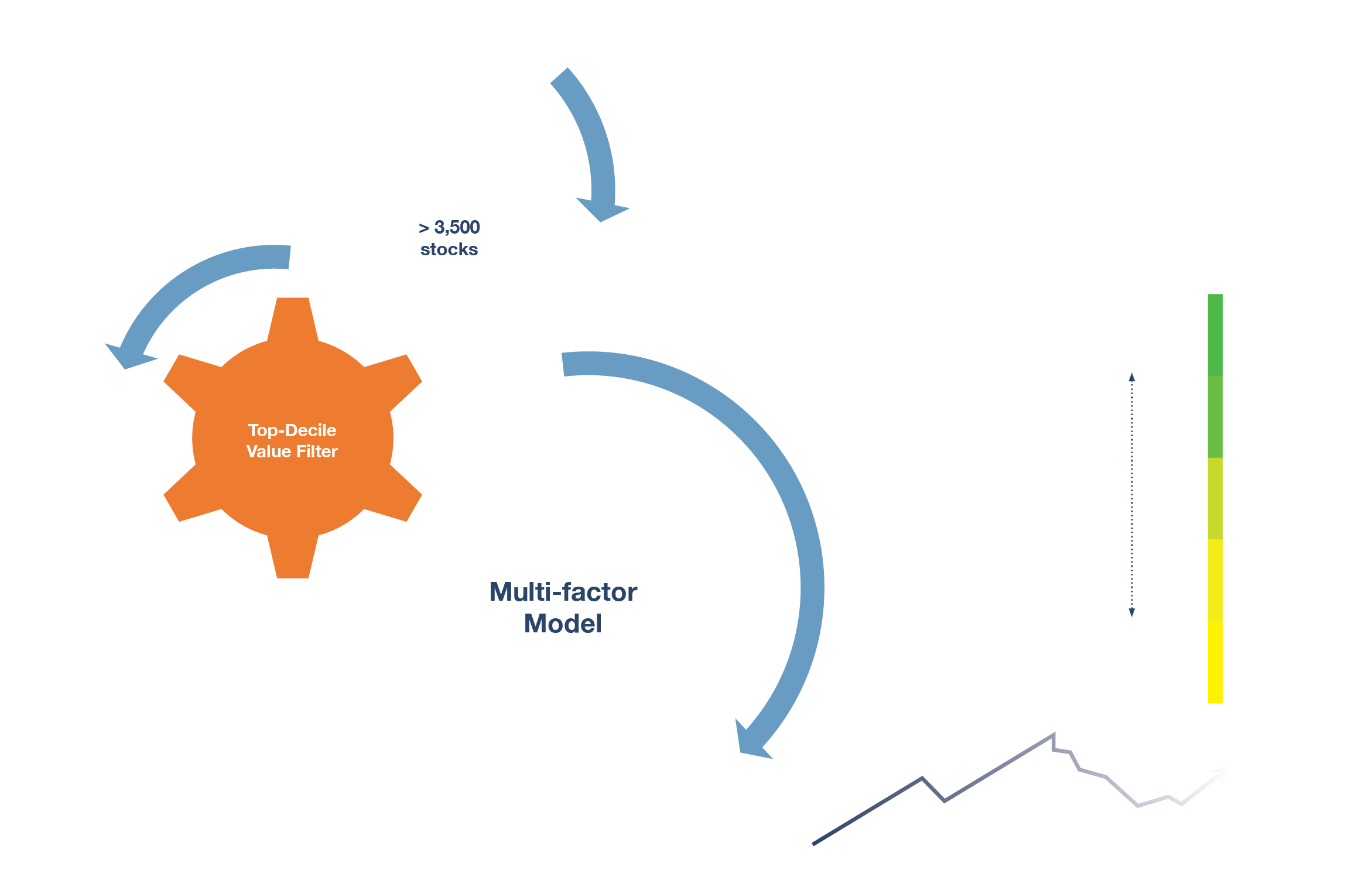

Investment Process

- Debt Paydown

- Return on Capital

- Gross Profit/Assets

- Change in Total Assets

The Fund goes long a leveraged portfolio of the highest expected return stocks selected from the multi-factor model while hedging the leveraged portion of the long portfolio by going short a broad U.S. equities index. The portfolio is balanced on a monthly basis.

Performance as of 2024-Mar-31

| 1 Month | 3 Months | YTD | 1 Year | 3 Years | Since Inception | ||

|---|---|---|---|---|---|---|---|

| ALFA | n/a | n/a | n/a | n/a | n/a | n/a |

Fund Characteristics as of 2024-Mar-31

| Long | Short | |

|---|---|---|

| Number of Securities | 0 | 1 |

| Average Market Cap ($mm) | $1,637 | $65,992 |

| Beta | 1.1 | 1.0 |

| EBITDA/EV | 13.3% | 5.9% |

| Gross Profits/Assets | 9.6% | 6.7% |

| Change in Debt | -21.6% | 5.8% |

| Return on Capital | 12.0% | 16.4% |

| Change in Assets | -1.6% | 5.0% |

Sector Weightings as of 2024-Mar-31

| Long | Short | |

|---|---|---|

| Communication Services | 0.0% | -3.1% |

| Consumer Discretionary | 0.0% | -3.2% |

| Consumer Staples | 0.0% | -1.9% |

| Energy | 0.0% | -0.6% |

| Financials | 0.0% | -2.9% |

| Health Care | 0.0% | -3.8% |

| Industrials | 0.0% | -2.4% |

| Information Technology | 0.0% | -7.7% |

| Materials | 0.0% | -0.7% |

| Real Estate | 0.0% | -0.7% |

| Utilities | 0.0% | -0.8% |

| Equity Exposure | 0.0% | -27.9% |